Hello, in this presentation, we’re going to be talking about the accounting cycle or the accounting process, that process that the accounting department will go through on a systematic basis over and over and over again, typically thought of as a monthly process. Although it could be thought of as a yearly process or some other process in terms of the amount of time that will pass. But these are going to be the steps that we’ll be going through in terms of the accounting process, always keeping in mind that in goal of financial accounting, which are the financial statements, some texts will have more steps than five as we have here. Some texts will have less than five steps. But the goal here is to really have a broad picture big picture, so that when we think about the accounting process, we can break down that that big picture view, five is a pretty good number for us to be able to memorize and keep in our mind if we have more than that, it can start to kind of muddy the picture.

Author: Bob Steele CPA - Accounting Instruction, Help & How To

Statement of Cash Flow Indirect Method Change In Inventory

In this presentation, we will continue putting together our statement of cash flows using the indirect method. Now taking a look at the change in inventory, we’re going to be using our materials here with a comparative balance sheet, the income statement and some added information, working primarily at this time from a worksheet that was made from the comparative balance sheet. So here is our worksheet. Here’s what we have. So far, we basically have a comparative balance sheet in a trial balance type format, where we have the current year, the prior year, and then the difference. Our goal is to find a home for all of these differences are in number that we’re looking for, is basically the 61 900 change in cash. So we’ve gone through this, from top to bottom, we’re working through basically the operating cash flows from operating First, the indirect method. So we started off with the net income, then we made our adjustments. And then now we’re going through basically The accounts receivable to inventory. Now once we get into the current assets, we’re going to group those into this change in current assets under the cash flows from operations. Once we know the theme here on what’s going to happen with these current assets, it’s it’s always going to be the same.

Statement of Cash Flow Indirect Method Change In Accounts Receivable

In this presentation, we will continue putting together the statement of cash flows using the indirect method focusing here on the change in accounts receivable. The information will be a comparative balance sheet, the income statement and some added information we will be focusing in on a worksheet that was composed from the comparative balance sheet. So here is our worksheet. So our worksheet that we can pay that we made from the comparative balance sheet, current period, prior period change. So we have all of our balances here for the current period, the prior period and the change, we have put in this change. And this is really the column that we are focusing in on we’re trying to get to this change in cash by finding a home for all other changes. Once we find a home for all other changes. We will get to this change in cash the bottom line here 61,900. The major thing we’re looking for is right here. We’ve already taken a look at the change in the retained earnings. And the change in the accumulated depreciation. Now we’re going to look at the changes in current assets and current liabilities.

Statement of Cash Flow Indirect Method Adjustments to Reconcile Net Income to Net Cash Provided

In this presentation, we will continue putting together a statement of cash flows using the indirect method focusing in on adjustments to reconcile net income to net cash provided by operating activities. So this is going to be the information we will be using, we have the comparative balance sheet, the income statement added information, we took this comparative balance sheet to create our worksheet. So here is our worksheet for two time periods. This is the difference we’re basically looking to find a home for all of these differences we have done so with cash, and we’ve done so with a difference in retained earnings. So here’s cash, here’s net income, the difference in retained earnings, we will have to adjust net income shortly or at the end of the problem. We’ll we’ll take a look at that we’ll make an adjustment for it. We’re going to now find the difference for all the rest of these. Also note that of course cash is going to be the change in cash will be our bottom line. Never we’re going to recalculate this But it’s nice to know where we are ending up at. So this is kind of like even though it’s at the top of our worksheet, that’s where we want to end up by finding a home for everything else. So now we’re going to take a look at the adjustments to reconcile net income to net cash provided by operating activities. So these are going to be those types of things that we look at the income statement, and we’re going to say that these are non cash activities, meaning income is calculated as revenue minus expenses. And the cash flow.

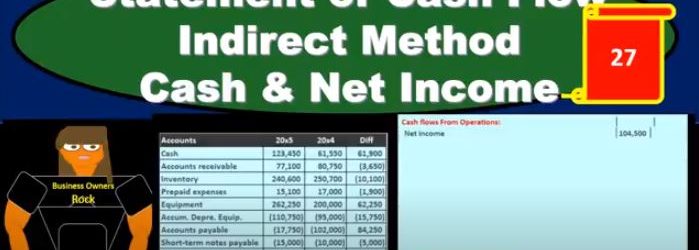

Statement of Cash Flow Indirect Method Cash & Net Income

This presentation, we will start to construct the statement of cash flows using the indirect method focusing in on cash and net income. This is going to be the resources we will have, we’ll have that comparative balance sheet, the income statement, and we’re gonna have some added information. In order to construct the statement of cash flows, we’re mainly going to be working with a worksheet that we’ve put together from a comparative balance sheet. That’s where we will start. So we’re going to find a home, this is going to be our worksheet. We have the two periods. So we have the current year, we’ve got the prior year, and we’ve got the difference between those activities. Now our goal here is to basically just find a home for every component on this difference section. So that’s going to be our home. Why? Well, we can first start thinking about cash. What are we going to do with cash? That’s the main thing. This is a statement of cash flows here. So where are we going to put cash? that’s actually going to start at the bottom, we’re going to say that’s going to be our in numbers. In number we know it’s going to be cached. Now, we’re going to recalculate it. But it’s useful for us to just know and we might just want to put there, hey, that’s where we’re going to end up. That’s where we are looking to get. And now what we really want is the change.

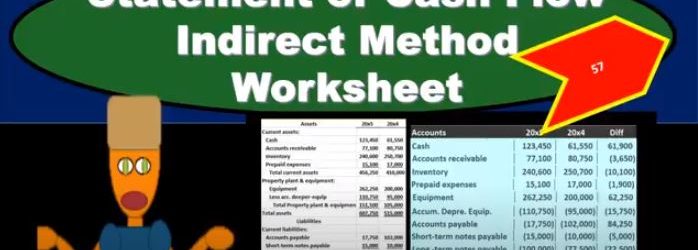

Statement of Cash Flow Indirect Method Worksheet

In this presentation, we will put together a worksheet that will then be used to create the statement of cash flows using the indirect method. To do this, we’re going to use our resources which will include a comparative balance sheet, and income statement and added information. Remember that in practice, we’re typically going to have a comparative balance sheet RS here being for the current year 2005 and 2000. x for the prior year. So we need a comparative to time periods in order to create our worksheet. This will be the primary components that we’ll use to create our worksheet. We will need the income statement when I’m creating the statement of cash flows mainly to check up on some of the differences that we will have in our worksheet. And then in a book problem will typically be told some other things related to for example, purchases of or sales of equipment, borrowings, if we had any cash dividends or any dividends at all, this is added information we would Need. In practice, of course, we would just be checking on these things by looking at the difference and going back to the GL. And just taking a look at those differences in order to determine if we have any added information that needs to be adjusted on our statement of cash flows.

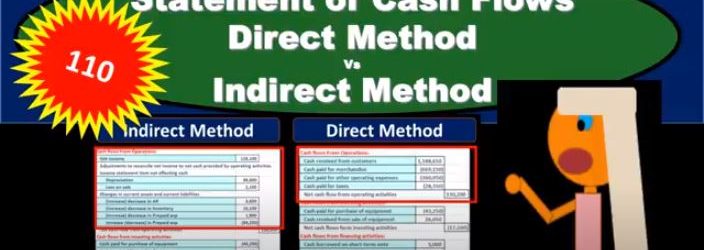

Statement of Cash Flows Direct Method Vs Indirect Method

In this presentation, we will compare and contrast the direct method versus the indirect method for the statement of cash flows. It’s important to note that when we’re comparing the direct and indirect methods, we’re really only talking about the top part, the operating activities portion of the statement of cash flows. In other words, the investing activities and financing activities and in result will remain the same, we’re going to end up with the same result, which of course, will be the Indian cash that we can tie out to the balance sheet. And we’ll have the change of cash here, which is really kind of the what we’re looking for in the statement of cash flows. What’s going to differ is the operating activities, why are they going to differ? Why would we have the operating activities differ? Remember that the operating activities have to do with kind of the income statement you can think of it basically as the income statement being reformatted to a cash flow statement versus an accrual statement. So the income statement that we use is on an accrual basis, and we recognize that Revenue when it’s earned rather than when cash is received expenses when expenses are incurred rather than when cash is paid, that’s gonna be on an accrual basis.

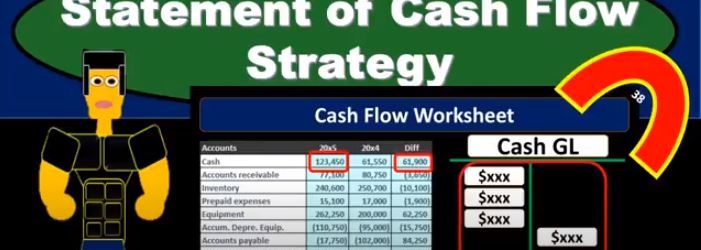

Statement of Cash Flow Strategy

In this presentation, we will take a look at strategies for thinking about the statement of cash flows and how we will approach the statement of cash flows. When considering the statement of cash flows, we typically look at a worksheet or put together a worksheet such as this for my comparative balance sheet, that given the balance sheet accounts for the current year and the prior year or the current period, and the prior period, and then giving us the difference between those accounts. So we have the cash, we’ve got the accounts receivable inventory, we’re representing this in debits and credits. So this is in essence going to be a post closing trial balance one with just the balance sheet accounts, the debits represented with positive and the credits represented with negative numbers in this worksheet, so the debits minus the credits equals zero for the current year, the prior year. And then if we take the difference between all the accounts, and we were to add them up, then that’s going to equal zero as well. This will be the worksheet that we’re thinking about. Now. When can In the statement of cash flows, we can think about the statement of cash flows in a few different ways. We know that this, of course, is the change in cash, this is the time period in the current time period, the prior year, in this case, the prior period, the difference between those two is the difference in cash.

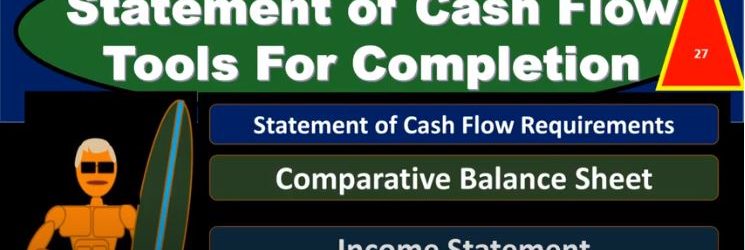

Statement of Cash Flow Tools For Completion

This presentation we will take a look at the tools needed in order to complete a statement of cash flows. to complete a statement of cash flows, we are typically going to need a comparative balance sheet that’s going to include a balance sheet from the prior period, whether that be the prior month or the prior year and a balance sheet from the current period, then we’re going to have to have an income statement. And then we’ll need some additional information in a book problem, it’ll typically give us some additional additional information often having to do with things like worth an equipment purchases, whether equipment purchases or equipment sales, were their investments in the company where their sales of stocks, what were the dividends within the company. In practice, of course, we would have to just know and recognize those types of areas where we might need more detail. And we would get that additional information with General Ledger we’d go into the general ledger, look at that added information. Now once we have this information, our major component we’re going to use is going to be the comparative balance sheet. That’s where we will start. So that comparative balance sheet is going to be used to make a worksheet such as this.

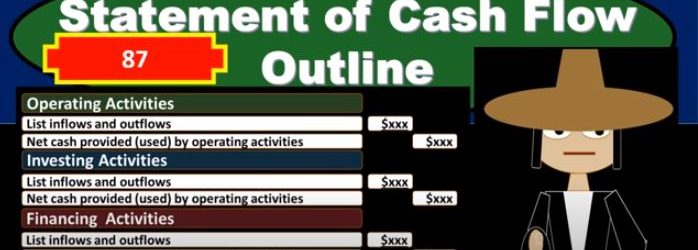

Statement of Cash Flow Outline

In this presentation, we will take a look at a basic outline for a statement of cash flows. In order to do this, we first want to give an idea of how the statement of cash flows will be generated. So we can think about these components of the statement of cash flows and where they come from. Typically, we will have a worksheet such as this that we will use in order to generate the statement of cash flows. That statement of cash flows, having three major components, operating activities, investing activities, and financing activities. Our goal here is going to be to fill out these three components and typically we will use a worksheet such as this on the left. The worksheet is just basically a comparative balance sheet that we have here that we’ve reformatted from a balance sheet to just a trial balance type format, a debit and credit type format. So you can see that we have our balance sheet accounts, and we are imbalanced by having the debits the positive and the credits be negative or debits. Minus the credits equaling zero, given it’s an indication that this period, the current period that we are working on, is in balance, the prior period, same thing. So we have two points in time for to balance sheet points the prior year, or period the prior year in this case and the current year. And then we just took the difference between these two columns. And if we have something that’s in balance, here, the debits minus the credits equals zero, something that’s in balance here, the debits minus the credits equals zero. And then we take the difference of each line item in these columns. And some of those differences, it too must add up to zero. So in essence, what we’re going to do in order to create the statement of cash flows is find a home for all these differences. And that’ll give us a cash flow, a concept of the cash flow statement. We’ll get into more detail on how to do that when we create the cash flow statement. But as we look at the outline, keep that in mind. So here’s going to be the basic outline for the state. cash flows, we’re going to have the operating activities. That’s going to include a list of inflows and outflows from the operating activities. And then we’re going to have the net cash provided by the operating activities. Now, this list of inflows and outflows for the operating activity will be the most extensive list because the operating activities are in relation to you can think of it as similar to the income statement.