This presentation and we will enter a reversing entry related to unearned revenue. Let’s get into it with Intuit QuickBooks Online. Here we are in our get great guitars file, we’re going to be opening up our old reports down here on the bottom left, the standard reports that being the balance sheet report. First, we’re going to be changing the dates up top from 1120 to the cutoff date 1120 to 2920 February 29 2020. We’re going to run that report. Right click on the tab up top, duplicate the tab up top, go to the tab to the left, go down to the reports on the bottom open up the other favorite report bad being the P and L Profit and Loss income statement where they’re going to be changing the dates up top for it from oh one it won’t let me do it. Why isn’t it let me do it. It’s gonna be a 1012020229 to zero.

Author: Bob Steele CPA - Accounting Instruction, Help & How To

Unearned Revenue Adjusting Entry 10.45

This presentation and we will enter and adjusting entry related to unearned revenue. Let’s get into it with Intuit QuickBooks Online. Here we are in our get great guitars file. Let’s open up our reports by going to the reports on the left hand side, we’re going to be opening up our balance sheet First, the balance sheet, the favorite record, we’re going to go back up top, we’re going to be changing the dates up top that being from a 10120 to the cutoff date of Oh to 29 to zero, we’re going to run that report, we’re going to right click on the tab up top so we can duplicate that report.

Depreciation Adjusting Entry 10.45

This presentation and we’re going to enter and adjusting entry related to depreciation. Let’s get into it with Intuit QuickBooks Online. Here we are in our get great guitars file. Let’s go down and open up our reports, we’re going to go down to the reports down below, open up our favorite reports at the end the balance sheet reports, we’re going to open that one up, we’re going to be changing the dates up top going to go up top and change those dates from a one on one to zero to 1231. Let’s make it as of the cutoff date here, Ode to 29 to zero, and then run that report and duplicate the tab up top by right clicking on it and duplicating it.

Prepaid Insurance Adjusting Entry 10.40

In this presentation and we’re going to enter an adjusting entry related to insurance recording prepaid insurance and insurance expense. Let’s get into it with Intuit QuickBooks Online. Here we are in our get great guitars file, we’re going to be opening up our reports. First, we’re going to go down to the reports on the bottom left. So we’re going to be opening up our favorite report that being the balance sheet report changing the dates up top from a one on one to zero, this time to our cutoff date at Oh to 29 to zero.

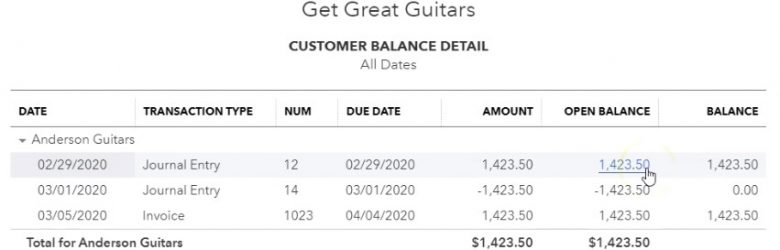

Accounts Receivable Reversing Entry 10.35

In this presentation, we’re going to take a look at an accounts receivable reversing entry. So the story goes like this, we had an invoice that was entered into the system in March after the cutoff date, we pulled it back before the cutoff date. So that income was reported correctly as of the cutoff date, which is going to be February 29. Now we’re going to do a reverse in entry, so that everything is correct and the following period in February as of the date of the original invoice. Let’s get into it with Intuit QuickBooks Online.

Invoice & AR Adjusting Entry Part 2 Solution 10.26

This presentation and we’re going to continue on with our adjusting entry related to an invoice that was entered into the wrong period. We laid out the problem last time. Now we’re going to enter the adjusting entry of this time. Let’s get into it with Intuit QuickBooks Online. Here we are in our get great guitars file, we’re going to open up our reports.

Accrued Interest Reversing Entry 10.25

This presentation and we’re going to enter a reversing entry related to accrued interest. Let’s get into it within two, it’s QuickBooks Online. Here we are in our get great guitars file, we’re going to go down to the reports on the left hand side, we’re going to be opening up this time the trusty trial balance, we’re going to be typing in up top to find the trial balance the trial balance, and then we’ll find it and then I’m going to open that up. Then we’re going to change the dates up top, we’re going to change the dates from Oh 1120 to 202 29 to zero.

Reversing Entry Notes Payable 10.17

In this presentation, we’re going to enter a reversing entry related to notes payable. Let’s get into it within two, it’s QuickBooks Online. Here we are in our get great guitars file, we’re going to start off by opening up our report on the left hand side favorite report balance sheet reports what we’re going to be starting off with, let’s open up that balance sheet. Let’s change the dates up top to those familiar dates we’ve been working with remember and emphasizing the cutoff date, oh 10120, the cutoff date being Oh to 29 to zero because that’s when we’re going to be entering our adjustments.

Accrued Interest Adjusting Entry 10.15

This presentation we will enter and adjusting entry related to accrued interest. Let’s get into it with Intuit QuickBooks Online. Here we are in our get great guitars file. We’re going to start off by opening up our reports. Once again, we’re going to go to the reports on the bottom left hand side, we’re opening up the trusty balance sheet or our favorite report the balance sheet, not the trustee trial balance the balance sheet up top, we’re going to go back up top, we’re going to change dates from 1012020 229 to zero, remembering that this is the cutoff date that we want to enter our adjusting entries as of we’re going to go back up top and then duplicate the tab by right clicking on it and duplicating it.

Short Term Portion Of Loan Adjusting Entry 10.11

This presentation and we’re going to break out the short term portion of a loan, this time taking a look at a loan that has both a short term and long term portion to it. Let’s get into it with QuickBooks Online. Here we are in our get great guitars file. Let’s start off by opening up our report our favorite report that being the balance sheet report. So we’re going to go into the reports we’re going to go into the balance sheet, we’re going to be changing the dates up top.