In this presentation, we will continue on to part two of our bank reconciliation for the second month of operations, this time focusing on the decreases to the checks to the withdrawals from the bank account. Let’s get into it with Intuit QuickBooks Online. Here we are in our get great guitars file, we’re first going to be opening up some reports. So we’re going to go down to the reports on the bottom left, we’re going to be opening it up first, the balance sheet report, let’s open up the balance sheet report. And we’re going to be changing the dates up top. So I’m going to change the dates up top of the two months of operations that we’ve had thus far. That’s going to be a 1012020 229 to zero.

00:43

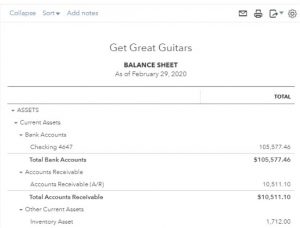

We’re going to go ahead and run that report. And I’m going to duplicate this report. I’m going to right click on the tab up top and duplicate it. I’m going to make this a little bit larger so we can see it recording our objective is going to be to be reconciling as of February 20. 99 the checking account the one to five 577 46, which is on our books to what is on the bank statement, which is 1058 1154. And we have started this reconciliation process, checking off the deposits in the reconciliation process. Now moving on to the checks, let’s go back on over to the QuickBooks, we’re going to go back to the first tab, hold down Control and scroll down a big back to that 100.

01:27

So we don’t mess anything up. QuickBooks doesn’t do anything funny. And then we’re going to go to the accounting, we’re going to go down to the reconciled, we’re going to resume the reconciliation which we had started last time. I’m going to bring it back up to 110% here because I think it can handle that without doing anything crazy. And then we have we’re on all over here. Last time we looked at deposits This time, we’re going to be looking at the payments so we’re going to go through the payments. Note the payments are often a little bit more difficult, a little bit more challenging, because they’re going to be in order often. times by date. But the dates remember on the bank statement aren’t always as clear because you’re going to have a lot more lag.

02:06

If you are dealing with checks between the date that we put the information in the system and the date they were deposited. And depending on the vendor, they could be, you know, different vendors will take a lot more lag to put that information into the system then others for dealing with electronic transfers, then it should be more straightforward. And there should be less lag on it. So you could try searching by check number, if you write a lot of checks, can be useful to write checks because the check numbers should then show up and you can sort by check numbers, if you so choose. Our strategy is always going to be to be going from the bank statement to the bank reconciliation. Why? Because if it’s on the bank statement, it should be on our books. If it’s not, we probably made a mistake.

02:49

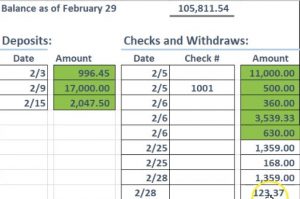

We probably need to adjust something. If it’s on the books, but it’s not on the bank statement. It may be okay because it may be an outstanding item. Those are the things we’re looking for. Now also note that with these checks when we reconciled Last time, we had these checks these checks in our This is my bank reconciliation for January, these checks that were written in January, that didn’t clear in January, they weren’t on the January bank statement, we would expect to see them this time to clear on February, we would expect to see these in the February bank statement. Let’s see if that is indeed the case. We’re looking for that you know that 360, that 500, that’ll that 11,000.

03:27

So you know, there’s the 360, the 11,500 looks like those are clearing here. So let’s go. Let’s go through these we got the 11,000. I’m going to select this item I’m going to minimize and we’re going to go to the 11,000. Here it is their note again, it’s not in the same order, as it is on the bank statement. That’s okay. Also note that this one was written in January, so it was written in January didn’t clear this is when it was written. It didn’t clear the bank statement until February. And that’s why we had to that’s why we have to do this process. So So You know, it cleared in February, it didn’t clear in January. All right, next one’s going to be the 500. And then if we go back over, here’s the 500.

04:08

Now that one has an actual check number, so notice I’m kind of checking off by basically number, which can be a little risky, because you can light up the, you know, duplicate numbers, if you have another verification, such as the check number here, or sometimes if it’s electronic transfers, they’ll have the payee on the bank statement, which will give you another verification that you’re picking up the right number and not some other, you know, duplicated number.

04:29

So there’s the 105 on the check number to give us that more verification. There’s the 360 here is the 360. So that looks good. I opened it up on accident. Here’s the 360. That looks good. Then, I’m going to right click on this and green it. Then we got the 353933. So here’s the 353933. So Adam Hamilton, that looks good. So let’s go ahead and green that one. Here’s this 6306 Three Oh, here’s the 630. And I’m going to check that one off. And again, if there are electronic transfers, you may have more detail on the bank statement to give you a little bit more verification that their checks, then of course, you have the check number. Then we have the 1359. So the 1359. Here’s the 1359.

05:19

Going to go back over here and green that one off, green it off. Then we have the 168. So the 168 here’s the 168. That looks good. And then go back over and make that one green. Here’s the 1359. So I’m going to go back over here. Do we have a 1359? We do. Here’s one down here. Chase. That looks good. Go back over and green that one off. And then we’ve got the 1233712337 do we see a 12337? I don’t see one.

05:52

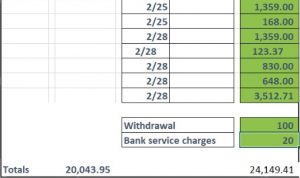

So that’s a problem. I’m going to skip that one for now. I’m going to go back over and Sarah That’s funny. I’m gonna I got the 838 30 So 830, do we see an 830? I don’t see that one. And then I’m going to go back over here, we have a 648 648. We have a 648 here. And then I’m going to go back to our account, I’m going to say, Okay, I see that one. And then we have a 351271. So we got a 351271. I see that one. So that looks good. So I’m going to go back over here and Sarah, I don’t see these two on there.

06:30

So either, if that’s the case, either there’s an amount that was on in our books, like one of these amounts on our books, possibly was input with the wrong number in it, right? Possibly, we put it into the data input with the wrong number in it, or it’s something that didn’t get input into the system at all. So one of those two are typically going to be the case. Now if we’re talking about if it was a check, then if we’re talking about these two as being checks, we can then go look at the clear We can actually get the clear checks and look at the actual cleared checks. And that could give us an idea of course of the vendor, and whether or not we have entered it into our system or not.

07:10

If it’s an electronic transfer, then like we say, we should be able to look into it and get more detail about the vendor because oftentimes, the bank will provide us more detail in terms of the transaction related to an electronic transfer, like a vendor name, or some type of number like that. Now, we also have these two amounts down here, the withdrawals and the bank charges, which of course aren’t on our system, and the withdrawals are going to be cast that was taken out, the bank charges are going to be the bank charges that we weren’t aware of.

07:38

So I’m going to say that we need to add then these four items, these four items need to be in our system, I’m going to say that they’re not in our system here. And now we’re going to have to basically go in there and add them. So we’re going to go back into QuickBooks and say all right, and let’s, I’m going to go out of here. I’m going to go into our accounting and we want to go to Part of accounts, we’re going to go back into the chart of accounts, I’m going to be picking up the checking accounts. So I’m going to hold down Control, scroll down a bit, we’re back at 100%. So it’s not doing that funny thing it was doing for a second there, we’re going to go into the register related to the checking account. And we’re going to add these transactions.

08:18

So I’m going to select the drop down up top, if I select the drop down, we’re going to record these as expense items. That’s the form we’re going to use. So it’s going to be an expense that we were going to will put into the register. And I’m going to put these in there as of these dates, so to 28. So I’m going to say oh to 28 to zero, and then the payee, which we would have to look at the clear track check or the electronic transfer to see what that would be. I’m going to say this one went to a vendor for window repairs, which I’m going to say was easy. Easy window repairs. That’s going to be the company name I’m going to add that I’m going to save that vendor and say tab, and tab, and I’m going to put this into this is going to be for the 1312 337. So 123 point three, seven. And I’m going to put that into a repairs and maintenance type of account. Let’s see if we have that in the expenses.

09:20

If I go down through the expenses, we’re looking for repairs and maintenance. There it is, repairs and maintenance will select that item. And then I’m going to say save. And so that’s that one. Let’s do the next one, which was on the 28th as well. I’m going to use the same vendor easy window repairs. And that’s going to be for the 830. So I’m going to put 830. And once again, that’s going to go to the repairs and maintenance. So I’m going to add those two and those should show up on the reconciliation now. Now I’m going to add the with drawls so withdrawals for 100, I’m going to say this happened on the 29th. We’re going to I’m going to say that this was a withdraw, it’s going to be a payment for 100.

10:11

Now this time, I’m going to ask the owner Hey, owner, you know, we’re doing your bookkeeping here. Is this a withdrawal that’s going to be on an expense like it was last time miscellaneous? Or was it for personal use? Now this time, we’re going to assume what if he says it’s for personal use. Now, this is a personal use type of draw, then we don’t want it on the income statement, we need to put it to some type of equity account needs to go into some type of equity account. Let’s see if QuickBooks has an appropriate equity account.

10:37

So if I scroll through these, I’m looking for the equity we have capital. That’s the main equity we could put up there. We don’t want to put it into the opening balance equity, that’s not a use. That’s not what you usually use. It’s kind of a plug account. Owners investment that’s the money going in, and owners pay and personal expenses. So this sounds like the drawls account that they’re using. So we’re going to put it into the owners paint personally. expenses. Remember, the key is it’s an equity account, therefore not going to be on the income statement. So that’s what we’re going to use this time.

11:07

Last time, he said he used it for personal use. So we put it on miscellaneous expense, this time, we’re going to put it into this equity account. So I’m going to say Save and Close, or, or just save. And then we got one more for the bank fees. So the bank fees were this time this month, we’re $20. So I’m going to put $20 and that’s going to be the bank service charges, bank charges and fees, something like that. And then we’ll go ahead and save that one. All right. Now let’s go back to the bank reconciliation, see if we can wrap it up.

11:40

I’m going to go into the to our hamburger hoping up the hamburger and then we’re going to go down to accounting. And we will then go into the reconcile. And then I’ll close the hamburger and let’s scroll back down a bit. I’m at 90 that’s too far down hundred Then I’m at resume, let’s resume the reconciliation. I would like to resume the reconciliation, bring it back up to 110. If I can go a little slow here, something’s wrong with it. And we’re going to go to the payments.

12:16

Now I’m going to see if I can find that 123 37 that we have added. So there it is 123 point three, seven, so we can green off this one. We’re going to green it, and then there’s the 830, the 830. There’s the 830 we’ve added now so that looks good. And I’m going to green that one off. And then we have the hundred down here, the 100 which we have added. There’s the 100. So we’ll green that one off. And there’s the 20. So there’s the 20. And so there we have that so you could you could see how this and that brings us back down to zero nice little green check that makes us feel secure.

12:58

Everything has been accomplished as it should have. And so that’s, you know, you could see how you’d basically need to fix anything. If it’s on the bank statement, not on our books, it’s probably not the case that those, you know, those checks were wrong. But it could give us an indication if you know, something happened, like a charge that we didn’t facilitate, we’d want to look into it, or something like that. That’s another kind of reason you want to do the bank reconciliation.

13:21

So then if I go back over here, these are the items that are outstanding. So we have a few of them. This one’s on the 27th. But it went to the sales tax went to the government. So it could have taken them a while to you know, to do to process that one. So, and then we have this one going to the Internal Revenue Service, same story. And then we have down here, you know, these ones are on the 29th. So would make sense if you know that they might still be outstanding.

13:48

So it doesn’t look too unusual that they’re outstanding, but again, we can check them how because we’re reconciling as of the end of February, therefore, that we’re probably doing this sometime in March. We can go check our bank statement and see if these have cleared in the month of March. So next time we’re going to finish the bank reconciliation up here. Then we’re going to take a look at the reconciliation report, which will recall these differences it’ll it’ll print out these differences as the differences between the bank balance and the book balance.