QuickBooks Online 2021 30 day free trial setup. Let’s get into it with Intuit QuickBooks Online 2021. Here we are on the Intuit website Intuit being the owner of QuickBooks, this is the first place I would go for anything that’s going to be QuickBooks related. Because if you just do a search into your favorite browser, such as Google, it might take you to some other websites. And you want to go here first, because this is the source. These are the owners of QuickBooks. So it’s Intuit, i NTU, i t.com, that’s into it, I empty you it.com. What we’re looking for here is to set up a free 30 day trial version of the software, which we will have for a limited time, that to been 30 days.

Posts in the QuickBooks category:

QuickBooks Online 2021 Test Drive .15

QuickBooks Online 2021 Test Drive File. Let’s get into it with Intuit QuickBooks Online 2021. Now, in a prior presentation, we looked at the 30 day free trial option of QuickBooks Online offered by Intuit, the owner of QuickBooks. This time, we want to look at the other free option that is offered by Intuit, the owner of QuickBooks, that being the test drive file. Easiest way to get there is just to go to your favorite search engine, such as Google type in QuickBooks Online test drive, QuickBooks Online test drive, as I’ve done here, then we’re just going to click on this item, QuickBooks Online test drive from Intuit, Intuit, the owner of QuickBooks, it may give you a little test here to say that you’re not a robot, and I’m gonna say, yeah, I’m not a robot.

Navigation Overview .20

QuickBooks Online 2021 software navigation overview. Let’s get into it with Intuit QuickBooks Online 2021. Here we are in our Google search engine browser, we’re going to be typing in QuickBooks Online test drive to get to our QuickBooks Online at test drive that I’m going to enter into that QuickBooks Online test drive here. Here we are in our Craig’s design and landscaping services Test Drive File, we’re going to start off with a broad overview of how to get around the quickbooks online format. We’ll be doing some comparisons as we do so to the desktop version.

Bank Feeds .25

QuickBooks Online 2021 Bank feeds. Let’s get into it with Intuit QuickBooks Online 2021. Here we are online in our Google search engine. We’re typing in the QuickBooks Online test drive to get to our QuickBooks Online at Test Drive File, we’re going to be clicking on QuickBooks Online at test tribe, verifying that we are not a computer here, and then continue. Here we are in the Craig’s design and landscaping services practice file, we’re going to be touching in on the bank feeds. And the first thing we want to note is that we will be going into bank feeds in more detail, but it will be after the primary practice problem where we will focus specifically on bank feeds.

Preferences – Account & Settings 30

QuickBooks Online 2021 preferences, account and account settings. Let’s get into it with Intuit QuickBooks Online 2021. Here we are in our Google search page searching for QuickBooks Online test drive. And then we’re going to be picking QuickBooks Online test drive for Intuit, the owner of QuickBooks, we’re gonna verify that we are not a computer, or a robot, kind of the same thing, I guess, I mean, a computer can be a robot, but a robot doesn’t necessarily have to be. But in any case, we’re here on the Craig’s design and landscaping services, we want to touch in on the preferences or account settings, because when you set up a new company file, this is often one area that you’re going to zoom in on towards the beginning of the setup process.

Accounting Related to Ownership & Control

In this presentation, we will take a look at accounting methods which will relate to and depend on ownership and control, get ready to account with advanced financial accounting. Accounting related to ownership and control methods used to account for investments in common stock will depend on the extent of influence or control, the investor can exercise over the investi. So in other words, we’re gonna have different methods depending on the level of control. Now, if we’re going to use different methods, we need to have some kind of definition we need to have some lines in terms of when we’re going to apply these different methods. What does it mean to have different levels of control? And then how do we apply those in practice so we can have some kind of standardization for that.

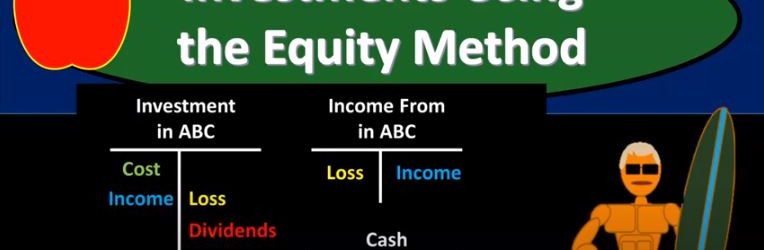

Investments Using the Equity Method

This presentation we’re going to focus in on investments using the equity method. In other words, we’re going to have a situation where we have one company that’s investing in another company, this time they have significant influence. And therefore, we will be using the equity method to account for that investment, get ready to account with advanced financial accounting. In prior presentations, we gave an overview about different accounting methods that could be used based on different levels of influence and control those general rules being that if there is 20, or zero to 20%, ownership, we use the carried value 20 to 50%, which is where we’re going to focus in on now, the equity method, idea of there being that there is now significant influence. So in other words, if we own zero to 20%, that would be kind of like you investing in a large company like apple or whatnot. We’re the assumption being, we don’t have significant influence, even though we do have a vote of what happens However, when our vote gets to be 20% Have the total, that’s kind of a shady line or not completely solid line. But that’s kind of an arbitrary line that’s been drawn, then you’re thinking, Okay, now there’s pretty much significant influence. And therefore, we’re going to use a different method equity method, then if we’re over 51%, which is a more solid line, if you have more than 51%, and you’re voting on things, and you have like more than 51%, then you pretty much win. And that would mean control for that situation typically. And then we may use a different method, such as a consolidation. So we’re going to be focusing in here on the middle method, where we have significant influence where we have that lower line that’s a little bit fuzzy that 20% arbitrarily drawn. And then if you’re over the 51%, then it’s more likely that then you do have control and may be using the consolidated method. In that case. So equity method we’re focusing in on investments using the equity method, the equity method will reflect the investors changing interest in the investi. So we’re going to try to basically reflect what’s going on on the investor side with the change investment in the investi, the company that we are investing in that company, we have a significant influence over investment is recorded at the starting purchase price.

Creating a Statement of Cash Flow-Indirect Method-Accounting%2C financial

Hello in this lecture we’re going to talk about creating a statement of cash flows using the indirect method, we will be able to define a statement of cash flows, create a statement of cash flows explain a process of creating a statement of cash flows designed to limit mistakes and define the indirect method. So what we’ll do is we’ll work through basically a problem and look through the statement of cash flows. We want to think about a few things we want to think about how to create a statement of cash flows, we want to think about a few definitions of what is a statement of cash flows, we want to kind of explain what the purpose is of a statement of cash flows and going through the process can help us to do that. Also want to point out that creating the statement of cash flows can help us with setting up a problem in such a way that we can limit the amount of mistakes that we will make. So a statement of cash flows is something that in a lot of firms, people generally often have problems to create the statement of cash flows. And it’s good practice to go in there and and create the statement of cash flows and try to create a system in which it’s easy for us to have checkpoints and see where a problem is going to happen.

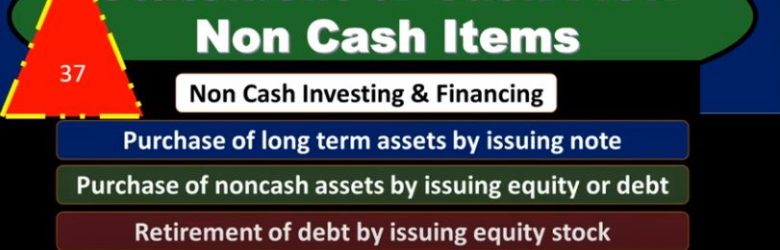

Statement of Cash Flow Non Cash Items

In this presentation, we will take a look at the statement of cash flows non cash items. First question, why would we be looking at non cash items when considering a statement of cash flows? We’re gonna go through a list of non cash items first and see if you can recognize a trend in these and why we might be linking them to a statement of cash flows discussion, then we will explain more fully on the idea of looking at non cash items when considering a statement of cash flows. So, some examples of non cash items would be the purchase of long term assets by issuing a note the purchase of non cash assets by issuing equity or debt, the retirement of debt by issuing equity stock, lease of assets in a capital lease transaction and exchange non cash asset for other non cash asset. Consider these examples and note some of the common features including the deal with investing and financing activities. and think through why we might be linking them to a statement of cash flows. We’ll go more fully through this by giving an example of the purchase of long term assets by issuing a note, an example that we can then apply out to the rest of these items. So what are we going to do with these non cash items, we’re going to report them at the bottom of the statement of cash flows or report them in a note related to the statement of cash flows. So we’re going to have to say in some format, or other, hey, look, these are some non cash items that we’re linking to, for some reason, the statement of cash flows.

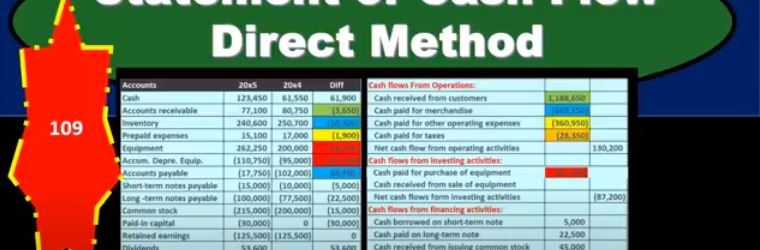

Statement of Cash Flow Direct Method

In this presentation, we will take a look at the statement of cash flows using the direct method. Here’s going to be our information we got the comparative balance sheet, the income statement and some additional information. And we will use this information to put together our worksheet which will be the primary source used to create the statement of cash flows using the direct method. This is going to be our worksheet. Now most of this worksheet will be similar to what we have done for the indirect method, in that we took the difference in the balance sheet accounts. So we’re taking the current year and the prior year, the current period, the prior period, all the balance sheet accounts, we’ve got cashed down to the retained earnings for the balance sheet accounts. But we’re also in this case going to give us the income statement accounts for the current period. So in other words, we’re going to break out the retained earnings the amount to its component parts, meaning we’ve got net income being broken out on the income statement. We’ve got sales cost of goods sold, the income statement accounts. So it’s going to be our same kind of worksheet here, we’re going to be in balance, we’ve converted it from a plus and minus format, we’ve removed all of the subtitles as we did under the indirect method.