In this presentation we will discuss the consistency principle as it relates to inventory and inventory assumptions. First, we’re going to define the consistency principle and then apply it to an assumption such as the flow assumption such as do we use something like a first out last In First Out average inventory system, the definition of consistency principle according to fundamental accounting principles, while 22nd edition is a principle that prescribes use of the same accounting method methods over time so that financial statements are comparable across periods. So, here we’re considering the assumptions that we’re making with the flow of inventory those being either first in first out last in first out or the average method typically for the cost flow assumptions, because those are assumptions.

Posts in the QuickBooks category:

Inventory Costs

In this presentation we will discuss what will be included or should be included in inventory costs. So when considering inventory cost, clearly we have the cost of the inventory which would be included. But there are other components that we want to keep aware of. And keep in mind that could be included in the cost of inventory as we record that inventory cost that purchase price or the amount in dollars of inventory on the financial statements. One is going to be Do we have to pay for the shipping costs and that typically will have to do with the terms of fo B shipping point, or fob destination is going to be a common question that is asked and a common factor in practice that we need to consider.

Inventory Methods Explained and compared FIFO LIFO 15 600

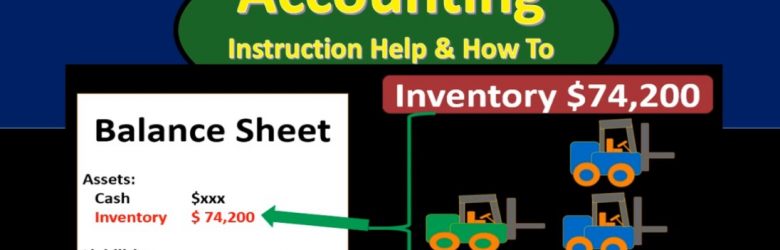

Hello in this lecture we’re going to talk about estimating inventory methods methods such as first in first out last in first out and the average method. Last time we talked about specific identification when we were selling the inventory of forklifts. We use specific identification meaning we had an ID number for each particular forklift and knew exactly which forklift we sold and the cost of that particular forklift. reason that makes sense for forklifts is because they’re relatively large, they could be distinct in nature, and they have a fairly large dollar amount in comparison to other types of inventory. If we’re selling something else, like coffee mugs over here, we may have a large amount of coffee mug they may be all completely the same.

Inventory Tracking Explained – Introduction-Specific 10 600

Hello. In this lecture we’re going to talk about the idea of tracking inventory and recording inventory, both in terms of the balance sheet as well as the income statement in the format of cost of goods sold. In our example, we’re going to be purchasing and selling forklifts, meaning we’re going to purchase forklifts from the factory and then we’re going to sell those forklifts. That means that forklifts to us will be inventory their inventory because we are purchasing the forklifts in order to resell them for the generation of revenue. That’s really going to be the definition of inventory the purchasing of something for the resale of it as opposed to if we were someone else purchasing the forklift in order to help us generate revenue in another way through the use of the forklift, in which case it would then be property plant and equipment.

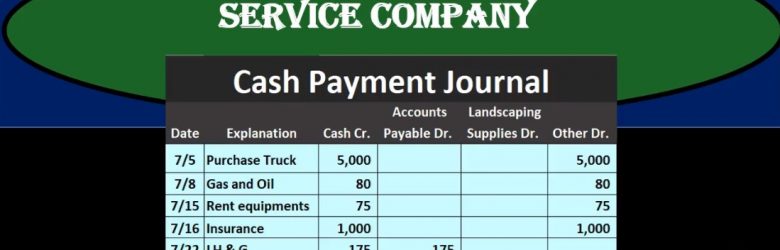

Cash Payments Journal Service Company 50

In this presentation, we will take a look at a cash payments journal for a service company, the cash payment journal we’ll be dealing with transactions where we have cash payments, that’s going to be the factor that will be the same for all transactions with cash payments meaning this column here cash payments will always be affected wish they kept cash payments journal cash payments journal will be used when using more of a manual system rather than an automated system. However, it’s good to know what the cash payments journal is, even if using an automated system because it’s possible that we or it’s very likely that we would need to run reports that will be similar in format to a cash payments journal. And it’s useful to see this format or how different types of accounting structures can be built.

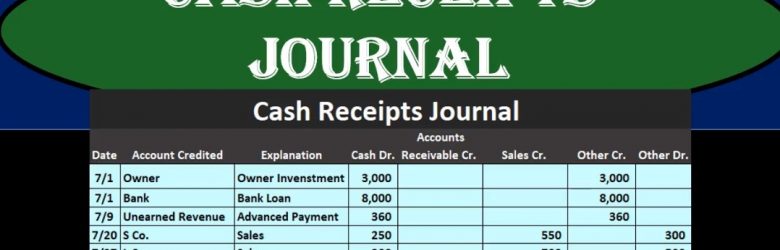

Cash Receipts Journal 40

In this presentation we will talk about the cash receipts journal. The cash receipts journal will be used when we have cash receipts when using a more of a manual system or a data input system that we will be doing by hand as opposed to an automated system. It’s still useful to know the cash receipts journal if using an automated system for a few different reasons. One is that we might want to generate reports from an automated system, similar to what we would be creating in a manual system for a cash receipts journal. And to it’s just a good idea to have different types of systems in mind, so we can see what’s the same and what is different between different accounting systems. The cash receipts journal will be used for every time we have a cash receipts. So the thing that transaction triggering a cash receipt will be when cash is being used. And we’re going to have a little bit more complex complexity in a cash receipts journal than something like a sales journal because we may be receiving cash for multiple different things.

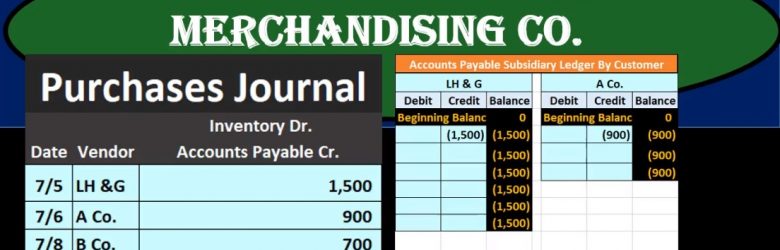

Purchase Journal Merchandising Co.

In this presentation we will take a look at the purchases journal for a merchandising company. Purchases journal will be used when we make purchases for a type of system that will typically more be more of a manual system as opposed to an automated system. However, it is useful to know this in order to have an automated system because the automated system will generate reports that will be similar to a purchase journal and because it’s good to know how different system works to know what are similar what’s different, so that we better understand whatever system we are using. The purchases journal may better be described as the purchase journal on account. So that’s going to be the major point meaning if we make purchases for something that in cash if we spent cash to make the purchase then it will not go in the purchases journal even though we made a purchase because it will go into cash payments journal. So this is really kind of a short name. The accounts payable journal might be a better name for it or the purchases journal on account, but purchases journal is typically the term that will be used.

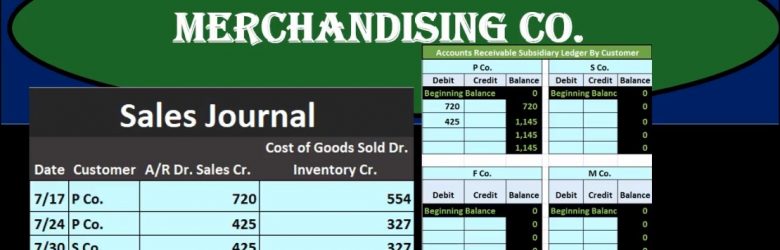

Sales Journal Merchandising Co.

In this presentation, we will take a look at a sales journal for a merchandising company. When recording transactions related to a sales journal, we will be recording transactions for sales into the sales journal those been journal entries that are typically used when we have a system done by hand rather than an automated system. So a sales journal will be used. Typically when we’re having more of a manual system. It is good to know this for a automated system as well. Because the automated system one might want to run reports that are similar to the sales journal and to it’s good to know different types of formats for the accounting process to know what’s the same and what is different. So that that will better help us to understand any type of system we are using.

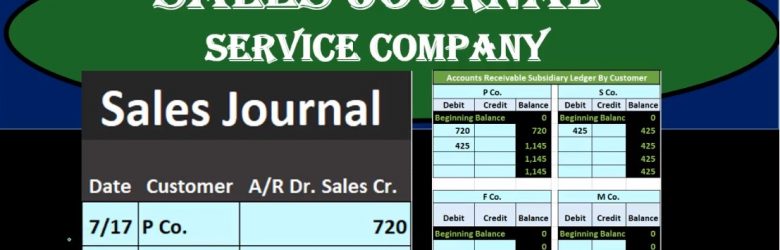

Sales Journal Service Company 10

In this presentation, we will take a look at the sales journal for a service company. We’ll use the sales journal in a manual system or a system we do by hand. When we make sales. However, it’s a little bit more complicated than that because if sales journal really means sales that we make on account, meaning we’re not receiving cash at the point in time we make the sale. If we do receive cash at the point in time we make sale even though we have sales being recorded or revenue accounts being recorded. It should be going into the cash receipts journal, because that’s the journal we use whenever we get cash. So the better term for this journal may be something like accounts receivable, or more specifically, sales made on accounts or sales and accounts receivable, but it’s typically called the sales journal. So don’t let that confuse you.

Accounts Payable AP Subsidiary Ledger 6

Hello. In this lecture we’re going to talk about the accounts payable subsidiary ledger accounts payable subsidiary ledger will be backing up the accounts payable account on the trial balance or the balance sheet. As we can see in the example here we have a balance of 1640 in accounts payable. If an owner asks the question of how much money do we owe to vendors? The answer would then be 1006 40, which we can see on the balance sheet or the trial balance. But the next question that will follow will be who do we owe that money to? And how do is it which of these vendors should we be paying? First? In order to answer that question, we may try to go to the detailed account, which is the general ledger. Typically every account is backed up by the general ledger, we can see that we have the same balance here and we can see that we have activity however, the activity is in order by date. And that’s not really helpful for us to determine who exactly we still owe at this point in time. In order to determine who we owe, we need to organize this information.