In this presentation, we will take a look at a sales journal for a merchandising company. When recording transactions related to a sales journal, we will be recording transactions for sales into the sales journal those been journal entries that are typically used when we have a system done by hand rather than an automated system. So a sales journal will be used. Typically when we’re having more of a manual system. It is good to know this for a automated system as well. Because the automated system one might want to run reports that are similar to the sales journal and to it’s good to know different types of formats for the accounting process to know what’s the same and what is different. So that that will better help us to understand any type of system we are using.

00:46

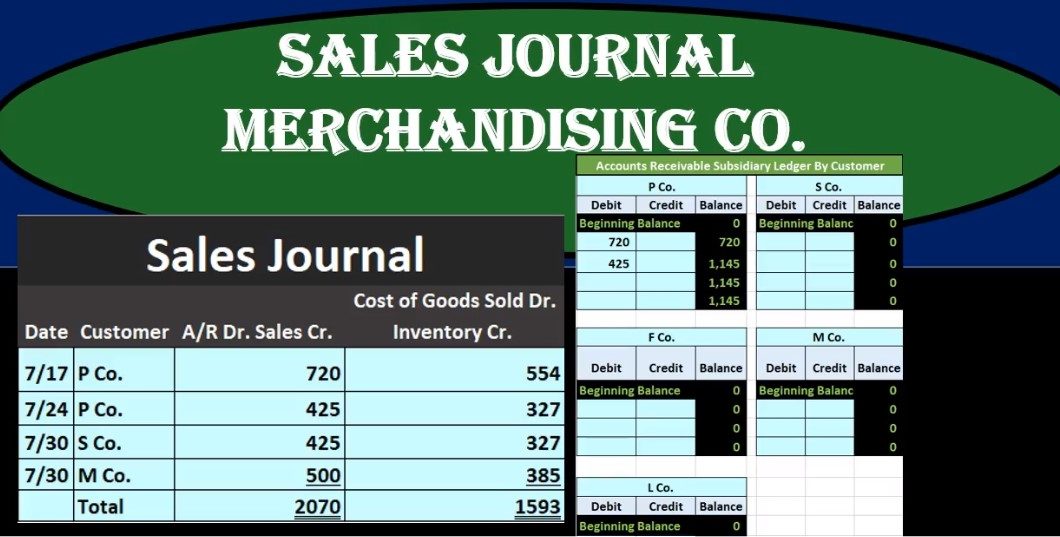

Remember that the sales journal is typically looking at sales type of transactions, but more specifically, it’s looking for sales transactions on accounts or transactions that are dealing with sales that were made revenue being recorded. But cash not being received. Instead, we will be debiting accounts receivable. It’s a very specific type of journal, in that we always have the same transaction. So we’re gonna have the debit to accounts receivable and the credit to sales. Now if we sell inventory, then we could have another column here on every transaction, which will record the second component of the sales type transaction when we sell inventory, that being the decrease in the inventory, credit to inventory, and the related expense of selling that inventory in order to help generate revenue that going to cost of goods sold. When we record the sales journal, we’re going to enter these data in during the month, it’s going to save us a lot of time because we’re going to enter a one line item per transaction. Rather than having four line items for a for a normal journal entry each time we record something, then recording that to the general ledger, then making trial balance for it.

01:58

Then at the end month we’ll sum up these columns. And we’ll make the journal entry making a one journal entry instead of a journal entry every time we make a sale note, we will be doing this in our case for a month, we could be doing it for a day or a week, we will do it for a month and then sum up at the end of that time period, and then make that one journal entry at the end of the time period. Then, we’ll record this journal entry for the entire month’s worth of data to the general journal, the general ledger accounts this just the one account but to the general ledger accounts, and then we will generate or see the effect on the trial balance of our information. So note that the information that we record in the sales journal will not report be reported in the financial statements or the trial balance until the end of the month. So we’re going to record the sales they’re all going to be the same so we’ll just list out the sales here. This journal works best when we have a lot of similar types of sales.

02:58

So when if we have a lot of transactions during The day we make the same type of inventory sales or selling the same type of thing, then the sales journal works well. So on 717, we’re going to say customer p company, sales 720 cost 554. So notice how much shorter this this journal would be in the journal entry. If we wrote this out in a journal entry, we would have to debit accounts receivable, credit sales, that being similar to a service company type of transaction for the sale, and then debit cost of goods sold and credit inventory for the cost of the goods sold, reducing the inventory and recorded the related expense for it. Here, we just have one line item to do that. We are not going to be posting this to the general ledger, but we will we will at the end once we sum everything up for the entire time period. But as we go, we’re going to post to the accounts receivable subsidiary ledger, because we’re going to have to do this a line by line no matter what so we might as well do it as we go.

03:59

So we’re We’re going to say that this 720 are we sold it to P company, here’s p company here in our subsidiary ledger. So we’re going to say it goes up by 720 to 720. Next transaction and this will all be pretty repetitive, this will be the same transaction, and it will sum it up at the end. So we’ll just do a few of these p company again we’re going to sell for 125 cost then is going to be 327. So the sales price that we’re we have for 25 it cost us 327. Once again, this representing a debit to accounts receivable credit to sales or revenue or income, and this representing a debit to cost of goods sold and credit to inventory which is these two numbers, then we’re going to record that not to the general ledger, but to the subsidiary ledger for the for 25 owed, and that’s going to be for p company bringing the balance up from 720 by 425 to 1145. Next transaction on three on 730 s company we sold for 125. Again, cost also once again 327. Same transaction here, just a new vendor, we’re going to post the new customer. We’re going to post this not to the general ledger, but to the subsidiary ledger, we will be posting to the general ledger at the end once we sum up this column of numbers. So we’ll post this over here to s company in the accounts receivable subsidiary ledger bringing the zero balance up by 425 to 425.

05:30

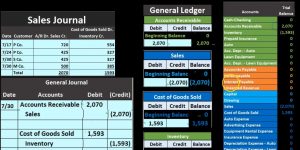

Next, we have the same icon for m company, we’re going to skip this one just to total it up here. So 730 m company 503 85. And then we’re just gonna sum this, this columns up. So we got the two columns. And note, we only have a couple transactions here. But even in some companies, even if we did this on on a day by day basis, depending on what we’re selling, the quantity that we sell, we could have a lot of transactions even if we just do the sales journal daily or Weekly. In this case we got it monthly. So we’re gonna take the 720 plus the 425 plus 425 plus the 500 gives us the 2070. For the sales and the accounts receivable on the other side, we got the 550 for the 327, the 327 and 385, giving us the 1005 93. If we record this transaction, we’ll record it just as the sales journal tells us to debit accounts receivable credit in sales. That’s been our typical merchandising type transaction when we sell merchandise, we debit the accounts receivable, we credit the sales, sales is revenue, accounts receivable is an asset assets go up with a debit balance, we’re gonna do the same thing to it in order to make it go up another debit. Sales is a is a revenue account, revenue or income has a credit balance.

06:48

We’re gonna make it go up by doing the same thing to it another credit. Then we’ll do the second component as if there’s two separate journal entries here. This is typically the way we see this when we are doing this by hand, because it helps us to visualize the sales and AR portion and the cost of goods sold and inventory portion. If you see it in a computer system or some textbooks may have the two debits on top and record this all in one transaction since it is taking place at the same time. So this is going to be a debit or to cost of goods sold a credit to inventory. I typically think of the inventory first because when constructing the journal entry, inventory is something tangible I can visually imagine it going down. And therefore I know it’s a debit balance account. So we’re going to make it go down doing the opposite thing to it. And then we’ll debit the cost of goods sold. It being an expense type of expense, and the expenses only go up in the debit direction we will increase the expense making net income go down. So here’s our journal entry for the month. We will be recording based on this data we recorded during the month. Then we’ll record that to the general ledger. So we’ll just look at the accounts that will be affected here.

08:00

The general ledger accounts receivable we’ll start with this accounts receivable 2070 taken accounts receivable from zero by 2070 to 2070. Then we’ve got the sales taking the sales from zero up by 2072 to 200 to 2070. And then we’re going to the cost of goods sold. It has a zero starting balance, we’re bringing it up by 1001 93 to 1001 593 1005 93. And then we have the inventory and it’s going to negative zero going down negative. Now the reason it’s negative here is because we are recording this end result in the sales journal before doing the purchases journal. And since they’re all happening at the end of the month, then if we just record one before the other once we record the other we should of course have a debit balance after we record all journals as of the end of the month. So let’s we’ll flip back to a debit. Once that happens, then we can see that information on the trial balance. So here’s the 2070. Here. Here it is on the trial balance. Here’s 2070 in sales on the general ledger, here it is on the trial balance. Here’s the 1005 93 cost of goods sold on the general ledger. Here’s the 1005 93 cost of goods sold on the trial balance. Here’s the 1005 93 of inventory, General Ledger negative balance, and here it is on the trial balance.

09:31

Note that we also want to compare the subsidiary ledger note what we’re looking at is the accounts receivable account is what we’re working with primarily are a lot of in the purchases or the sales journal. The sales journal could really be called the accounts receivable or sales and accounts receivable or sales on accounts journal. This number here represents how much money is owed to the company but it doesn’t tell us who owes us the money. The detail in the general ledger tells us that dates that it happened. And because we’re using a sales journal, that’s really only given us a limited information to we’d have to go back to the sales journal to see the dates of the sales within that time period. But either one, it doesn’t tell us who owes us the money. For that we need a subsidiary ledger. And so we recorded the subsidiary ledger as we go. Note that if we added all the accounts up for p company 1001 45 for s company 425 for intercompany 500. That adds up to 2070. Which of course matches what’s on the general ledger and what’s on the trial balance.