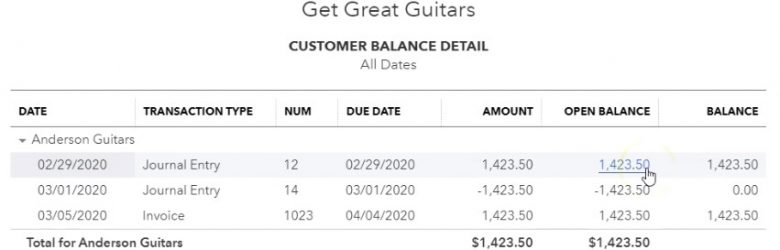

In this presentation, we’re going to take a look at an accounts receivable reversing entry. So the story goes like this, we had an invoice that was entered into the system in March after the cutoff date, we pulled it back before the cutoff date. So that income was reported correctly as of the cutoff date, which is going to be February 29. Now we’re going to do a reverse in entry, so that everything is correct and the following period in February as of the date of the original invoice. Let’s get into it with Intuit QuickBooks Online.

Posts in the QuickBooks category:

Invoice & AR Adjusting Entry Part 2 Solution 10.26

This presentation and we’re going to continue on with our adjusting entry related to an invoice that was entered into the wrong period. We laid out the problem last time. Now we’re going to enter the adjusting entry of this time. Let’s get into it with Intuit QuickBooks Online. Here we are in our get great guitars file, we’re going to open up our reports.

Accrued Interest Reversing Entry 10.25

This presentation and we’re going to enter a reversing entry related to accrued interest. Let’s get into it within two, it’s QuickBooks Online. Here we are in our get great guitars file, we’re going to go down to the reports on the left hand side, we’re going to be opening up this time the trusty trial balance, we’re going to be typing in up top to find the trial balance the trial balance, and then we’ll find it and then I’m going to open that up. Then we’re going to change the dates up top, we’re going to change the dates from Oh 1120 to 202 29 to zero.

Reversing Entry Notes Payable 10.17

In this presentation, we’re going to enter a reversing entry related to notes payable. Let’s get into it within two, it’s QuickBooks Online. Here we are in our get great guitars file, we’re going to start off by opening up our report on the left hand side favorite report balance sheet reports what we’re going to be starting off with, let’s open up that balance sheet. Let’s change the dates up top to those familiar dates we’ve been working with remember and emphasizing the cutoff date, oh 10120, the cutoff date being Oh to 29 to zero because that’s when we’re going to be entering our adjustments.

Accrued Interest Adjusting Entry 10.15

This presentation we will enter and adjusting entry related to accrued interest. Let’s get into it with Intuit QuickBooks Online. Here we are in our get great guitars file. We’re going to start off by opening up our reports. Once again, we’re going to go to the reports on the bottom left hand side, we’re opening up the trusty balance sheet or our favorite report the balance sheet, not the trustee trial balance the balance sheet up top, we’re going to go back up top, we’re going to change dates from 1012020 229 to zero, remembering that this is the cutoff date that we want to enter our adjusting entries as of we’re going to go back up top and then duplicate the tab by right clicking on it and duplicating it.

Short Term Portion Of Loan Adjusting Entry 10.11

This presentation and we’re going to break out the short term portion of a loan, this time taking a look at a loan that has both a short term and long term portion to it. Let’s get into it with QuickBooks Online. Here we are in our get great guitars file. Let’s start off by opening up our report our favorite report that being the balance sheet report. So we’re going to go into the reports we’re going to go into the balance sheet, we’re going to be changing the dates up top.

Short Term Loan Adjusting Entry 10.10

This presentation we will look into recording and adjusting entry related to a short term loan. Let’s get into it with Intuit QuickBooks Online. Here we are in our get great guitars file. Let’s first take a look at our reports our balance sheet report for this transaction that we’re going to be recording or this adjusting entry, we’re going to be opening up our favorite report that being the balance sheet report, we’re going to change the dates up top the dates from let’s make it a 1012020 229 to zero. Now, when we think about the adjusting entries, we’re always going to be thinking of them as kind of like the cutoff dates, we’re trying to make things correct as of the cutoff date, which in this case, it’s going to be the end of the second month.

Bank Reconciliation Second Month Part 3 9.17

This presentation we’ll continue on with our bank reconciliation process for the second month of operations, this time finalizing the bank reconciliation process and reviewing the bank reconciliation report. Let’s get into it with Intuit QuickBooks Online. Here we are with our get great guitars file, we’re going to start off with our reports down below. So I’m going to go to the to the reports and we’re going to go to the reports on the bottom left. Let’s open up that balance sheet report.

Bank Reconciliation Second Month Part 2 9.15

In this presentation, we will continue on to part two of our bank reconciliation for the second month of operations, this time focusing on the decreases to the checks to the withdrawals from the bank account. Let’s get into it with Intuit QuickBooks Online. Here we are in our get great guitars file, we’re first going to be opening up some reports. So we’re going to go down to the reports on the bottom left, we’re going to be opening it up first, the balance sheet report, let’s open up the balance sheet report. And we’re going to be changing the dates up top. So I’m going to change the dates up top of the two months of operations that we’ve had thus far. That’s going to be a 1012020 229 to zero.

Bank Reconciliation Second Month Part 1 9.14

This presentation we will start a bank reconciliation for the second month of operations. This will be part one we’ll be focusing in on reconciling the deposits. Let’s get into it with Intuit QuickBooks Online. Now. Here we are in get great guitars file, we’re going to open up our reports. First, let’s go on down to the reports on the bottom left. And then we’re going to first open up the balance sheet report our favorite report opening up the balance sheet. We’re now considering the second month of operations, I’m going to change the dates up top those from a one a 120 to 1230 120.