Advanced financial accounting PowerPoint presentation. In this presentation we will discuss the consolidation process when there is a preferred stock involved, get ready to account with advanced financial accounting. We’re talking about a situation here where we have preferred stock in the subsidiary and a consolidation process we’re doing the consolidation subsidiary has some preferred stock, you’ll recall that the characteristics of preferred stock generally means that in general, they have preference with regards to dividends and distribution of acids in liquidation over common shareholders. So therefore, when when a distribution happens if there’s going to be dividend distributions, for example, the preferred stockholders will typically get paid first, and we got to consider how that will be impacted or affected within our consolidation process.

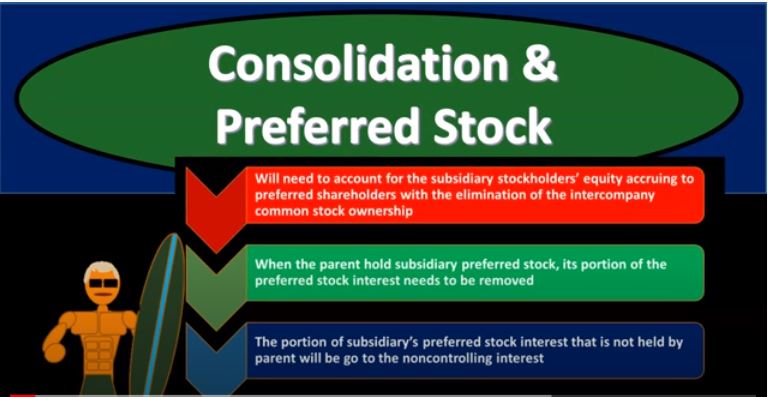

Also, when we have the liquidation process, then the preferred stockholders will typically be paid first. However, they don’t generally have the voting rights. So that means the common stockholders typically get Paid afterwards with regards to distributions and liquidation, but they have the voting rights which is a you know, a critical component. So So how does this impact the consolidation process when we do the actual consolidation, we will need to account for the subsidiary stockholders equity accruing to preferred shareholders with the elimination of the intercompany common stock ownership.

01:21

So this will be included we’ll have to take this into consideration. As we enter our consolidation or elimination entries. We will be doing a practice problem with regards to this subject. So I highly recommend taking a look at that and working through these problems and entering these transactions yourself either with the Excel worksheets or we’ll have other example problems in OneNote. When the parent holds subsidiary preferred stock, its portion of the preferred stock interest needs to be removed. So that’s when the parent holds some of the preferred stock, then its portion obviously would need to be removed it would need to be eliminated the portion of the subsidiaries preferred stock interest that is not held by the parent We’ll go to the non controlling interest