Corporate finance a PowerPoint presentation. In this presentation, we will discuss finance topics and activities going over some of the historical emphasis in the field of finance to get some context of where we’re coming from and where the current emphasis is. And we’ll be in corporate finance, get ready, it’s time to take your chance with corporate finance, finance topics and activities, we’re going to go over some of the emphasis in corporate finance in the past up into the present day to get some focus in on in context of what we will be talking about within corporate finance. So in the 1930s, what’s the emphasis in corporate finance in the 1930s, we have capital preservation.

00:41

Now, when you hear the word capital, it can be used in different contexts to mean kind of slightly different types of things, you can kind of think of it as assets in this, in this case, we’re talking about how would capital be generated for a company, either through equity or debt, typically, either equity being like the owner put capital in the company or revenue was generated within it, or debt, meaning some kind of financing, like a loan within the company, if you have the capital within the company, if we have assets within the company, then the preservation is going to be a kind of formation where we’re concerned about the deterioration of the capital, it going down in value, we’re trying to preserve the value that is there, notice that we’re thinking about the 1930s, which we’re talking about the Great Depression happening within the 1930s. Therefore, that’s going to tend towards people to be more conservative, that they don’t they don’t, they don’t want what they have to be to lose what they have, right. So the focus then being more on the preservation of the capital not having to deteriorate, we have liquidity maintenance.

01:41

So when you’re thinking about the concept of liquidity, you’re thinking about the concept of typically we’re thinking about assets, how liquid are the assets? Meaning, how useful are they? Or how can how much how easily can they be consumed or used within the business, for example, you can think of cash as the most liquid asset, that’s the point of cash, because we can use it in order to pay off debts and have other obligations be paid off with it. And other and we really list will start to list as we start to look at our balance sheet, other assets in accordance with how liquid those assets are, if you compare, compare and contrast something like cash, do property, plant and equipment, meaning like buildings and equipment, those are less liquid, they’re not very liquid at all, because you can’t pay off your liabilities with them. Those are useful for generation of revenue in the future, you need them, but they’re not going to be very liquid assets. So you need liquid assets to pay off the current liability.

02:37

So liquidity maintenance, we have the trouble corporations reorganization. So reorganization of troubled corporations is a focus here again, we’re in the Great Depression of the 1930s. So you can see why that would be a focus, and then the process of bankruptcy again, focus in on the process of bankruptcy and restructuring. In that time period, you could see why that would be a focus. So you’re going to end up with in the 1930s a more kind of conservative focus at that point in time for capital preservation preserving what is there not letting it you know, deteriorate, liquidity, maintenance, making sure you have enough, you know, liquidity to pay off your debts, because obviously, if things are going down, if there’s a depression going on, that’s going to be a point of concern, reorganization, and bankruptcy, bankruptcy processing got to be current topics or important topics for the 1930s 1950s, finance became more analytical. So we have a focus then on long term, property, plant and equipment. So when you’re putting money into property, plants and equipment, if you’re building a new plant, for example, then that’s going to take a lot more, you can think about that, from a very analytical standpoint, trying to project things into the future.

03:47

Notice now we’re getting here to be a little bit more future oriented now. And so we’re thinking about, instead of preserving, you know, how do you how are you, we want to put this long term capital in place, and then predict on what we’re going to do in the future. Those types of decision making processes are more difficult, because anything where the return is happening way out into the future, like if we’re building a plant, that we expect to have a return in the future, those are much more difficult for the human mind to to grasp, then if we’re talking about a return that’s happening today. So if we put something in and we’re expecting an immediate return, those are a lot more easier for us to just naturally understand, then if we’re trying to put something in place and have the return happens some place far out into the future. And obviously, there’s a lot of uncertainty in the future. And therefore we want to see if we can come up with some systematic way to make those decisions. Inventory maintenance is going to be a big factor as well. Cash maintenance, of course, and then the theory of capital structure.

04:50

When you’re thinking about capital structure, you’re thinking about basically how is the How is the company finance, how are the operations of the company financed? Typically, there’s two categories that we will We’ll talk about with that, that will be the equity and liabilities, right? There’s two ways you can basically capital or finance the company with a capital structure, through equity and through debt through liabilities, and equity. So the equity is going to be basically the owners representation of how much they have in the company to claim to the assets of the company. And that can be generated through the owner investing in the company. So the owners might put more money in, for example, issuing stock, for example, or through the generation of revenue, revenue will be generated, as well. And then the financing would be debt financing. So there’s going to be theories in terms of how much leveraging and how much debt should we have, and so on and so forth, then we have policies related to dividends.

05:45

So the concept of dividends, means the money’s going back out to the owners of the company. Now notice, when we’re thinking about corporate finance, we’re thinking about we’re usually going to be focusing in on we’ll talk about different types of business structures, including partnerships, sole proprietorships, but our focus is going to be on corporations, the corporate structure. So when you think about the corporate structure, they are owned by shareholders, and we’ll talk a little bit more about this in the future, but they’re going to be owned by the shareholders, and the shareholders will purchase the stock, and then they’re going to want to accumulate, we’re going to accumulate revenue within the company, hopefully.

06:22

And then the shareholders might want distributions just like an owner of like a sole proprietor wants to take money out of the company, in order to have to finance their personal whatever they’re going to do, personally, their lives, right, the owners of the corporation are going to want to take the money out Paul, possibly as well, depending on how you know what the purpose is of their investing in the company is the purpose to finance their their current lifestyle, in which case they’re going to need to take money out, or is it for long term growth, in which case the company might keep the money in the company in order to grow the value of the company, which will grow basically the stock price, the ownership value of the company. So those are going to be decisions that need to be made. And so there’s going to be a focus in on what are going to be the dividend policies when we have earnings in the company.

07:08

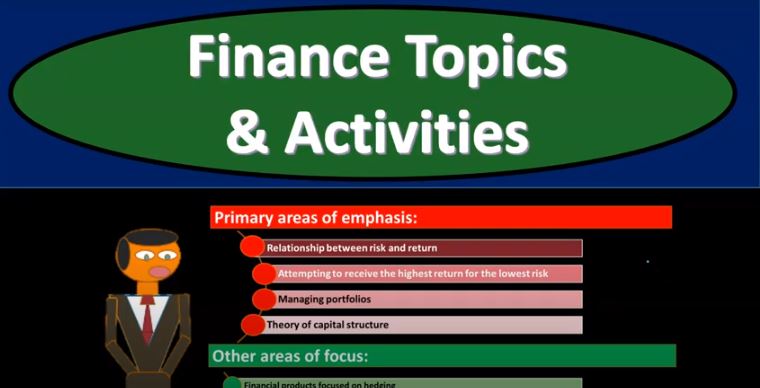

In other words, are we a growing company that we need to take those earnings and put them back into the company so that we can keep growing, which is beneficial to the shareholder, because that means the value of the stocks that they hold are increasing in value, and they could trade those stocks and have a gain if they want to, or is is the goal of the company, we’re an established company, possibly, we don’t need to the capital to keep growing, we want to just keep generating revenue, and provide that revenue to the owners in the form of dividends. So that needs to be established, then we have the finance topics, the current finance topics where we currently tend to have our focus in on with corporate finance, primary emphasis will be on the relationship between risk and return. So once again, refining really down to these concepts and understanding them better with regards to the relationship of risk and return.

08:01

So when we’re thinking about any kind of decision into the future, we’re always going to be weighing This is going to be common concepts that we will be taking a look at what’s going to be the risk versus the return on it. Typically, obviously, you know, things that have a higher return will often have more risk. And those are things that we’re going to need to be balancing, attempting to receive a higher return for a lower risk. That’s going to be our objective. Of course, as we think of you know, where we’re going to invest where we’re going to put the money of the company, we want to look we want to be comparing and contrasting options looking for the highest return for the lowest risk managing portfolios and the theory of capital structure is still going to be of course, an emphasis here. So managing the portfolio’s theory of capital structure remember capital structure being how are we financing the business are we financing it through and the two areas are through basically forms have different forms of debt that we can have different forms of equity we can have those are the two basically categories equity, and debt and you can break those further down equity can be broken down then into the owners invested in the company and or the earnings of the company.

09:10

Debt can be broken down into different debt instruments they can basically be used such as loans or bonds that can be issued as well. Then other areas of focus in the in the current times are going to be financial products focused on hedging and inflation with regard to financial decisions. So some of these some of these products that have have gotten a little bit more complex the financial products focusing in on hedging in the future, meaning we’re going to hedge some of the risk into the future with some of these financial instruments. And so those get a bit more complex. So we’d have to have an understanding of those. And there’s a lot of focus in on that in certain areas of corporate finance, and then inflation with regard to financial decisions. So we’re getting want to put a lot more emphasis in times into those long term decisions off Often times, when we have long term decisions, then we have to consider the economic factors, which will include inflation, the value of money.

10:08

And we want to make sure that we’re taking into consideration at least our best projection of what those environmental factors, including inflation will be for a long term decision making process. And decision making factors will include inflation’s effect on financial forecasts, so there’s going to be we have a lot better understanding, or at least people believe they got a lot better understanding of the concept of inflation, and basically predicting inflation, and the value of money and so forth. So anytime we’re forecasting out, which is what we’re going to be doing, oftentimes trying to focus in and look into the future in some way to make predict predictions in the future, we have to take into consider the consideration the time value of money. And that means the time value of money with consideration to other investments we can have, and the value of the dollar and the potential value of the dollar in the in the future, which relates to inflation. And then we got the capital budgeting decisions rate of return. So we will typically be thinking about the rate of return and capital and then the cost of capital. So we’re going to be considering then, you know, when we think about future decisions, the the rate of return that we’re going to be having, and we’re getting better and more systematic at saying, Okay, are we going to put our money into this project or this project, what’s gonna be the comparable benefits, and using a rate of return type of calculation will help us to make those decisions for investment purposes, finance, financial management, managing the company’s money is the primary concern for financial management activities will include allocate funds to current functions and depreciable assets.

11:54

So the allocation of the funds achieving optimal are a combination of financing options. So financing options could be like debt options, like bonds and loan type of options, for example, and then create a policy related to dividends that aligns with the company’s goals. So we talked about the dividends policies a bit in the past, that’s going to be the money that’s going from the company to the owners, do we have a dividend policy, where we’re going to have the earnings of the company, a lot of them go into the owners, or are we reinvesting those dividends into the company creating or increasing the value of the company for the owners, those are some of the options we would have with the dividend policy or some of the considerations. So financial management goal is to maximize wealth for shareholders of the company. So the goal is to maximize the wealth for the shareholders, the shareholders being the owners of the company. So remember, the corporate structure that we’re going to be mainly focusing in on means that the owners of the company are the shareholders within the company management, if it’s all if it’s a large company management’s basically acting as agents of the owner, you know, running the company, to in to increase the wealth and essence of the shareholders.

13:04

So the daily activities would include things like manage credit controls over inventory, manage a receipt, and and distribution of funds. And then periodically, we would have to deal with the the issuing of stock, the issue of bonds, capital budgeting, decisions about dividends, so we got the daily kind of activities, that would happen, of course, and then you get those periodic type of activities, including the issuance of of stock, that’s not going to happen all the time, stock is going to be the ownership within the company. So if you think about a company starting from scratch, one of the first things that would happen is you would need an investment from the owners of the company, that means you’re going to issue stock in order to receive that investment.

13:46

Once the initial company has been put in place, then you’re not going to have a lot more times where you’re going to be issuing stock that might happen periodically, stock might be trading a lot for up for a public company, but it’s not being issued from the corporation. A lot of times at that point, they’re being traded amongst other people, and then issue bonds, that’s going to be another type of financing. So that’s not going to happen all the time that you’re going to issue bonds, but you might say hey, we need to find it, we need to finance something, we need more money, we need to raise capital, we’ve decided that stock that the issuance of bonds is the best way to generate that revenue. And therefore you might issue bonds, again, periodically, capital budgeting projects, the meaning long term projects that you might be thinking about, again, not something that happens all the time. These aren’t the daily activities, but they’re big activities that need a good amount of time to consider if you’re considering to build like a plant or something like that, that you’re going to be using for a long time into the future. decisions about dividends, once again, are those decisions that you’re going to need to make periodically in alignment with your overall structure of the company. And then you’re always going to be trading off the risk and profitability that risk reward. trade off with these types of decision making processes.