Corporate Finance PowerPoint presentation. In this presentation, we will discuss financial management goals Get ready, it’s time to take your chance with corporate finance, financial management goals. Now, as we’re thinking about the financial management goals, we’re thinking about corporate finance, we’re typically thinking about a corporate structure. So management, how does management fit into the structure of a corporation, the owners of the corporation are going to be the shareholders of the corporation. So if you think about a large corporation, then you’re thinking, well, the shareholders shares are trading all the time, possibly on an exchange for a large corporation.

Posts with the shareholders tag

Finance Topics & Activities 115

Corporate finance a PowerPoint presentation. In this presentation, we will discuss finance topics and activities going over some of the historical emphasis in the field of finance to get some context of where we’re coming from and where the current emphasis is. And we’ll be in corporate finance, get ready, it’s time to take your chance with corporate finance, finance topics and activities, we’re going to go over some of the emphasis in corporate finance in the past up into the present day to get some focus in on in context of what we will be talking about within corporate finance. So in the 1930s, what’s the emphasis in corporate finance in the 1930s, we have capital preservation.

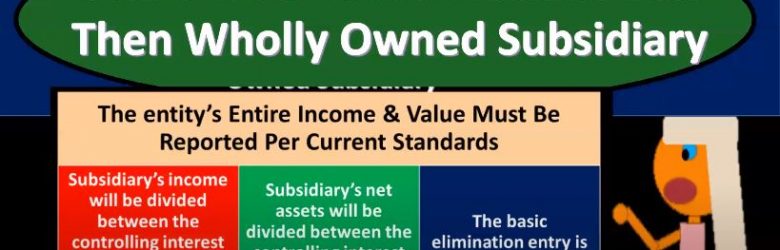

Consolidation Calculations Less Then Wholly Owned Subsidiary

Advanced financial accounting. In this presentation we’re going to talk about consolidation calculations for less than wholly owned subsidiaries. So we have a parent subsidiary relationship, we’re going to be looking at the consolidation process to put the financial statements of the parents and the subsidiaries as if they are one entity, but we don’t have a wholly owned subsidiary. In other words, the parent does not own 100% of the subsidiary. How do we do the consolidation? in bad case, consolidation calculations less than wholly owned subsidiaries, that entities entire income and value must be reported per the current standards? So in other words, once again, we might think, well, on the income statement, maybe we would just report the part of the subsidiary that belongs to or is controlled by the parent, but that’s not typically the case. That’s not the case under generally accepted accounting principles.

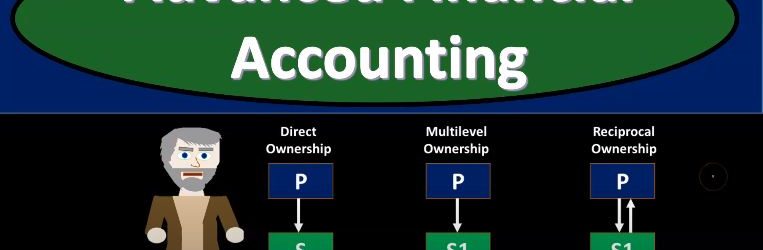

Consolidation When there is Complex Ownership Structure

Advanced financial accounting PowerPoint presentation. In this presentation we’re going to discuss a consolidation that when there is a complex ownership structure, so more complex ownership structure comparing the direct ownership, which is what we’ve normally been dealing with, with structures such as multi level ownership and reciprocal ownership, get ready to account with advanced financial accounting. Normally, when we think about our consolidation structure, we’re dealing with a direct ownership situation which looks like this direct ownership type of situation, it gets more complex. Of course, if we have more complex type of ownership structures, such as a multiple multi level ownership structure where we have a parent owning a subsidiary, that basically we have an indirect ownership, let’s say in another subsidiaries, that’s going to be more complex for us to deal with or if we have a situation where we have reciprocal ownership, where the parent has ownership a controlling interest in s, but as also has some ownership in p, right. We’ve been dealing with basically P parent company owning portion of S. So if we talk about direct ownership we’re talking about the parent has, as has controlling interest in every subsidiary. So that’s going to be of course, this situation.

Subsidiary Sells Additional Shares to Nonaffiliate

Advanced financial accounting PowerPoint presentation. In this presentation we will discuss a consolidation process where we have a parent subsidiary relationship and the subsidiary sells additional shares to a non affiliate. So we have the subsidiary selling shares not to the parent, but to a non affiliate what will be the effect on the consolidation process? Get ready to account with advanced financial accounting. We are talking about a situation here where the subsidiary is selling more stock or additional stock to someone outside of the organization, someone who is not affiliated not to the parent or some other subsidiary, what will be the effect in the consolidation process? It’s going to increase the total stockholders equity of the consolidated entity by the amount received by the subsidiary in the sale. That of course would make sense because if you imagine the transaction taking place, then if they got cash for it, for example, cash would be going up the other side going to the equity so it’s going to be increasing the total stockholders equity will increase total shares outstanding for the subsidiary reducing the percent ownership of the parent company. So if the subsidiary then issues more shares and they didn’t go to the parent, then that means there’s going to be more shares outstanding. That means the shares that the parent owns will go down, therefore, their percentage ownership will typically go down. In that case, we’ll increase the amount assigned to the non controlling interest.

Internal Business Expansion

In this presentation, we’ll take a closer look at internal business expansion, get ready to act because it’s time to account with advanced financial accounting. In our previous presentation, we talked about the types of expansion that a company can take. And we broke those out into the general categories of internal expansion and external expansion. The internal expansion, meaning we have a corporation or a company that needs to expand wants to do so internally might result in other divisions or might result in a creation of a subsidiary, the external expansion meaning we have two entities that are separate and somehow come together, which still could result in something like a parent subsidiary type relationship, or some type of division. So we’re going to be considered here the internal ideas the internal concept or internal expansion. So we have one organization, the organization wants to grow and expand possibly into a different sections or segments are different industry, and therefore they’re going to expand in some way shape. shape or form. Typically, we’re thinking of the creation in this case of a subsidiary type of relationship, in which case, they might create a separate legal entity. And that would be the giving of the assets and possibly liabilities to a separate legal entity that would be created. In other words, the parents company, setting up a subsidiary in some way, shape or form. And then given the subsidiary some assets and the liabilities that were formerly the parents organization, and then having a parent subsidiary type relationship with that subsidiary unit, us from an accounting standpoint, then having to think about how are we going to account for that with regards to financial accounting with that parent subsidiary type of relationships. So types of business entities that could be involved with this, we could have a subsidiary company and that’s the one you’d probably most be considering.