QuickBooks Online 2021 preferences, account and account settings. Let’s get into it with Intuit QuickBooks Online 2021. Here we are in our Google search page searching for QuickBooks Online test drive. And then we’re going to be picking QuickBooks Online test drive for Intuit, the owner of QuickBooks, we’re gonna verify that we are not a computer, or a robot, kind of the same thing, I guess, I mean, a computer can be a robot, but a robot doesn’t necessarily have to be. But in any case, we’re here on the Craig’s design and landscaping services, we want to touch in on the preferences or account settings, because when you set up a new company file, this is often one area that you’re going to zoom in on towards the beginning of the setup process.

Posts with the future tag

Break Even Analysis 510

Corporate Finance PowerPoint presentation. In this presentation, we will discuss breakeven analysis, get ready, it’s time to take your chance with corporate finance. Break Even analysis includes our fundamental tools for making projections and predictions into the future. Now note, when we think about breakeven analysis, the fundamental calculation within a breakeven analysis will be the break even point. But when we hear breakeven analysis in general, you can think of it that as a more broad kind of perspective, to use some of these tools in order to think about projections into the future. So when you hear breakeven analysis, you’re typically thinking kind of projections, budgeting, future based analysis, as opposed to some financial accounting, which is typically going to be based on the past prior performance.

Forecasting Objectives 405

Corporate Finance PowerPoint presentation. In this presentation, we will discuss forecasting objectives Get ready, it’s time to take your chance with corporate finance, forecasting objectives. When thinking about forecasting, we’re thinking about into the future, we’re thinking about kind of like a budgeting or projection type of process, we want to plan ahead making changes in strategy as needed. So we’re going to think about what we think will happen into the future. So we can strategize now, and do what we need. Now, in order to accommodate what we believe will be happening in the future. Based on our best guesses based on our forecasts, we’re going to construct a financial plan to support the growth.

Financial Statements Overview 205

Corporate Finance PowerPoint presentation. In this presentation, we will give an overview of financial statements Get ready, it’s time to take your chance with corporate finance, financial statement overview, the financial statements will be the primary tool that will be used to value the company, the financial statements are going to be generated from the company.

Financial Management Goals 125

Corporate Finance PowerPoint presentation. In this presentation, we will discuss financial management goals Get ready, it’s time to take your chance with corporate finance, financial management goals. Now, as we’re thinking about the financial management goals, we’re thinking about corporate finance, we’re typically thinking about a corporate structure. So management, how does management fit into the structure of a corporation, the owners of the corporation are going to be the shareholders of the corporation. So if you think about a large corporation, then you’re thinking, well, the shareholders shares are trading all the time, possibly on an exchange for a large corporation.

Finance Topics & Activities 115

Corporate finance a PowerPoint presentation. In this presentation, we will discuss finance topics and activities going over some of the historical emphasis in the field of finance to get some context of where we’re coming from and where the current emphasis is. And we’ll be in corporate finance, get ready, it’s time to take your chance with corporate finance, finance topics and activities, we’re going to go over some of the emphasis in corporate finance in the past up into the present day to get some focus in on in context of what we will be talking about within corporate finance. So in the 1930s, what’s the emphasis in corporate finance in the 1930s, we have capital preservation.

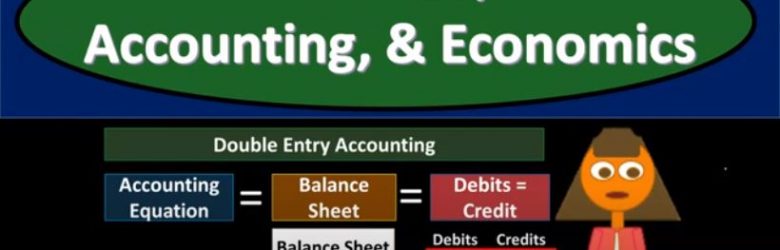

Finance, Accounting, & Economics 110

Corporate Finance PowerPoint presentation. And this presentation we will discuss the differences between finance, accounting and economics, the differences between the fields of finance, accounting and economics Get ready, it’s time to take your chance with corporate finance, there’s a lot of overlap and differences between the fields of finance, accounting and economics, what we want to do is think about those differences. And where that overlap is, as we do so we will do so from the perspective of corporate finance, because that’s the objective of our viewpoint here for this particular course.

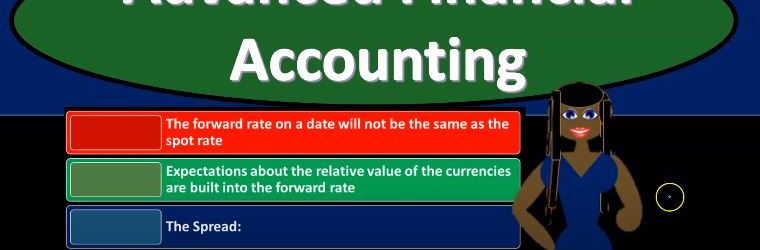

Foreign Currency Exchange Rates

Advanced financial accounting PowerPoint presentation. In this presentation, we’re going to discuss foreign currency exchange rates get ready to account with advanced financial accounting, foreign currency exchange rates, let’s first define foreign currency transactions. So what are from foreign currency transactions? When are we going to need to account for foreign currency transactions. So from our perspective, we’re going to be looking at this from the perspective of a US company US company that is having their books then accounted for or measured in dollars. And when you think about the foreign currency transaction, it’s just like anything else, but it can be a little bit more confusing. So you want to remember, of course, that the dollar is basically the measuring tool.

Forward Exchange Contracts

Advanced financial accounting a PowerPoint presentation. In this presentation, we will discuss forward exchange contracts get ready to account with advanced financial accounting, forward exchange contracts. Now we’re going to go over some of the components of the foreign exchange contracts here, we’ll go into them on a lot more detail as we work through practice problems related to the forward exchange contracts. But just to visualize the basic kind of layout of a foreign exchange contract as you think about these items, and there’ll be a lot more concrete once we look at practice problems, we’re basically have a setup where we’re going to be working with a bank or a dealer, typically a bank, and we’re going to be setting up a foreign exchange contract which is basically going to say, we have a receivable and payable on the books at this point in time and we’re either going to put the receivable or the payable that is going to be due to us or something that we will pay in foreign currency at the end of the time period. Whereas the other side the receivable or the payable, the other side that’s not in foreign currency will be in US dollars. In other words, we We will determine the amount that will that we’re talking about. And then we’ll use an exchange rate which we’ll talk a little bit more about the exchange rate that we will use to value it in today’s dollars will put either the receivable or the payable in US dollars and either the receivable or the payable and foreign dollars as of this point in time. And then as time changes, as the rate of the foreign currency changes, then that could result in the difference between, you know, what we thought the value would be, at the point in time we went into the forward contract between the US dollar and the foreign currency as that difference changes over time that could result in basically a gain or loss.

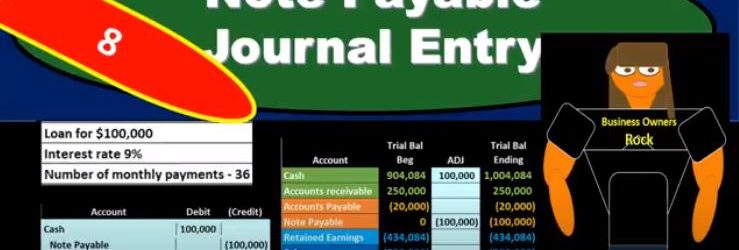

Note Payable Journal Entry

In this presentation, we will record the journal entry related to a note payable related to taking out a new loan from the bank. Here’s going to be our terms. We’re going to record that here in our general journal and then we’ll post that to our worksheet. The trial balances in order assets, liabilities, equity, income and expenses, we have the debits being non bracketed or positive and the credits being bracketed or negative debits minus the credits equaling zero net income currently at 700,000 income, not a loss, revenue minus expenses. The difficult thing in terms of a book problem, when we record the loan is typically that we have too much information and this is the difficult thing in practice as well. So once we have the terms of the loan, and we have the information, we’ve already taken the loan out, then it’s the question of well, how are we going to record this thing? How are we going to put it on the books and if we have this information here, if we have a loan for 100,000, the interest is 9%. And then the next number of payments that we’re going to have, we’re going to pay back our 36. Then how do we record this on the books? Well, first, we know that we can ask our question is cash affected? We’re going to say, Yeah, because we got a loan for 100,000. That’s why we got the loan.

01:14

So cash is a debit balance, it’s going to go up with a debit, so we’ll increase the cash. And then the other side of it is going to be something we owe back in the future. And that’s going to be note payable. And that’s as easy as it is to record the initial loan. The problem with this the thing it’s difficult in practice, and in the book question is that we’re often given, of course, the other information, like the interest in the number of payments, and possibly more information that can cloudy up the what we’re doing, and the reason these are needed, so that we calculate interest in the future, but they’re not really We don’t even need that information to record the initial loan. All we need to know is that we got cash and we owe it back in the future. And you might be asking, Well, what about the interest we owe interest in the future as well? We do, but we don’t know it yet. And that that’s the confusing thing interest, although we we will pay interest and we know exactly how much interest we’re going to pay in the future. We don’t owe it yet. Why don’t we owe it yet? Because we’re going to pay back more than 100,000. Why don’t we Why don’t we record something greater than 100,000? You might say, because we know we’re going to pay more than 100,000. And that’s because the interest is something that it’s like rent. So we’re paying rent on the use of this 100,000. And just like if we if we had a building that we rented, that we’re using for office space, we’re not even though we know we’re going to pay rent in the future. We’re not going to record the rent now. Because we haven’t incurred it until we use the building.

02:41

So the same things happening here. We know we’re going to pay interest in the future we’re no we know we’re going to pay more than 100,000 but it hasn’t happened yet. We haven’t used up we haven’t gotten the use of this hundred thousand and therefore haven’t incurred the expense of it yet. So the interest and is something we need to negotiate when making To turn off the loan, but once the loan has been made, and we’re just trying to record it, it’s not going to be in the initial recording. It will be there when we calculate the payments need and the amortization table. So the initial recording is pretty straightforward. We’re just going to say okay, cash is going to go up by 100,000. And then the notes payable is going to go up from zero in the credit direction to 100,000. So what we have here is the cash increasing the liability increasing, although we got cash, there’s no effect on net income because we haven’t incurred any expenses. We’re going to use that cash most likely to pay for expenses possibly or pay for other assets or pay off liabilities in order to help us to generate revenue in the future. But as of now, we’ve gotten we increase an asset and we increase the liability