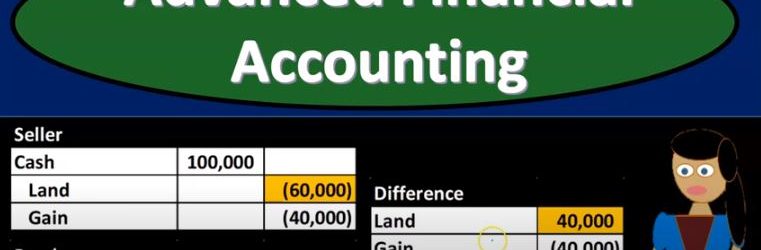

Advanced financial accounting PowerPoint presentation. In this presentation we’ll take a look at the equity method and land transfer get ready to account with advanced financial accounting, land transfer intercompany. Within the context of our consolidation, then we’re talking about situations where land is transferred from subsidiary to parent like a sale from subsidiary to parent or from parent to subsidiary. That resulting in basically an intercompany type of transaction we’re going to have to deal with with the consolidation process and possibly with the recording of the equity method by the parent as they reflect their investment in the subsidiary. We talked a little bit last time about the land transfer being similar to the inventory transfer because typically you’ll have like a gain that will be involved in it and your physical inventory that is changing hands. It does not have the added complexity as the property plant and equipment type of transfer. That would be depreciable assets with regards to accumulated appreciation and appreciation.

Posts with the parent company tag

Consolidations Less Than 100% Owned Subsidiary

Advanced financial accounting. In this presentation we’re going to discuss the consolidation process for less than 100% owned subsidiary. In other words at the end of this, we’ll be able to understand some of the major differences in the consolidation process from a company that was 100% owned. In other words, the parent owns 100% of the subsidiary and one in which the parent owns some other percent some stock share and percent other than 100%. Get ready to account with advanced financial accounting when there is a controlling interest but less than 100% owned interest in a subsidiary. In other words, the parent company owns something other than 100% of the common stock something over 51% still having a controlling interest still makes sense to do consolidated financial statements, because it’s useful to see the assets minus the liabilities, the net assets that the parent has control over, even if they don’t have claim over them. The performance based on you know, the net assets that they have control over.

Direct & Indirect Control

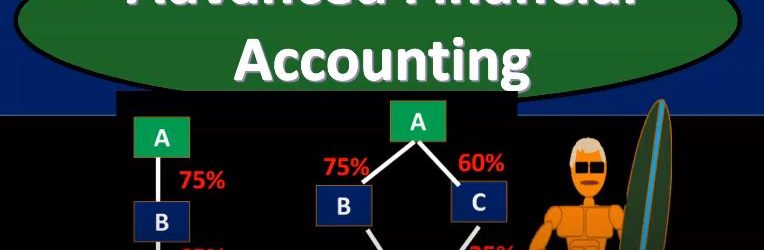

Advanced financial accounting. In this presentation we’re going to talk about the concepts of direct and indirect control. If you’re ready to account with advanced financial accounting, we want to consider these concepts within the context of financial statements and consolidation. So you’ll recall that when we have consolidated financial statements, the idea is to put two financial statements together when one company has basically control over another company that being defined typically by having more than 51% interest because if you have more than 51%, then you have basically a voting share for you to vote on anything, then of course, you would win the vote at that point in time. So let’s consider then direct control and indirect control direct control when one company has a majority of another company’s stock common stock. So that would be a situation where you got a and b, one company has a majority interest over 51% control is pretty easy to see at that point. When you start to get into indirect control. This can get more complicated things can get more confusing here. So indirect control, one company’s common stock is owned by one or more other companies that are under common control. So this can get a lot more detailed structure in terms of what is going to constitute control. So for example, if we have direct control, then you have just simply a parent subsidiary type of relationship. And, you know, the parent has more than 51% of the subsidiary, interest common stock. So and that could happen if we have to, we could still have a little bit more complexity here, where we have two subsidiaries, right. But they’re both going to be consolidated in this case, because there’s 75% over 51% direct control is parent over as one direct control over as to here because it’s over the 51%. So both of these cases would be direct control.

Consolidation for Non Wholly Owned Subsidiary

Advanced financial accounting. In this presentation we’re going to talk about a consolidation for a non wholly owned subsidiary. So in other words, we have a parent subsidiary relationship, but the parent doesn’t own 100% of the outstanding common stock of the subsidiary but something other than 100%. In other words, over 51% controlling interest less than 100% get ready to account with advanced financial accounting. Non controlling interest often will be represented NCI non controlling interest. So notice if we have a parent subsidiary relationship we’re talking about there is some controlling interest, the controlling interest is the interest that’s going to be over 51%. However, if we don’t have 100% ownership, then we have the amount that’s not in control and that of course is going to be the non controlling interest. So non controlling interest. NCI controlling interest is needed for consolidation. Obviously, if we’re going to consolidate this thing, that means typically that A parent has some controlling interest over 51% a 100% is not needed. So 100% of ownership, in other words, by one parent to the other is not necessary for a consolidation to take place control is necessary, which is typically over 51% less than 100% ownership will result in a non controlling shareholder, those other than the parent.

Usefulness of Consolidated Financial Statements

Advanced financial accounting. In this presentation we’re going to take a look at the usefulness of consolidated financial statements. In other words, consolidated financial statements taking two or more companies where there’s a parent subsidiary relationship, putting them together representing financial statements as if those entities were one entity. What are the pros and cons of using consolidated financial statements? Get ready to account with advanced financial accounting idea of consolidated financial statements? In other words, why did we come up with the consolidated financial statements? So remember, we’re talking about a situation where there’s a parent subsidiary relationship, there’s a controlling interest, we have one company that has a controlling interest in over 51 interest in the other company. And then we’ve come up with this concept of showing the Consolidated Financial Statements showing the entity the parent and the subsidiary entities of which there’s a controlling interest as if they were one entity. Why do that? So when company creates or gets controlled Another company, that’s going to be the scenario we have. So we have a parent subsidiary relationship due to that fact due to one company having control than another company. You can think of that, of course in a stock situation owning for more than 51%. The result is a parent subsidiary relationship. So if we just have the two entities, it would look something like this.

Consolidation – Interim Acquisition

Advanced financial accounting PowerPoint presentation. In this presentation we will discuss consolidation and interim acquisition. In other words, we have a parent subsidiary relationship that parent owning a controlling interest over 51%. However, that controlling interest took place for a purchase of the common stock of the subsidiary that happened in the middle of the year. So prior to this, we’ve been talking about situations where we are doing consolidations for an entire year. And you may have question probably popped up in your head at some point in time as well what would happen if the purchase took place in the middle of the year now we have that mid year kind of purchase worse, especially concerned with that first year where the consolidation didn’t really happen. I mean, there wasn’t a consolidated ownership until sometime in the middle of the year, get ready to account with advanced financial accounting. So we’re talking about a situation where we have a consolidation but the consolidation happened in the middle of the years. We’re thinking about that first year, primarily What would happen? Well, if the consolidation didn’t take place in January in other words, the parent didn’t purchase the controlling interest in the subsidiary at the beginning of the year but happened at some point in the middle of the year what’s going to be the impact on the year in consolidation, which typically happens for the entire year? Well, the subsidiary is seen as being part of the consolidated entity from the time the stock is acquired, even if acquired in the middle of the year.

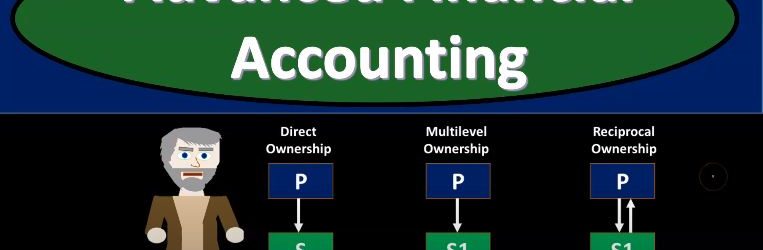

Consolidation When there is Complex Ownership Structure

Advanced financial accounting PowerPoint presentation. In this presentation we’re going to discuss a consolidation that when there is a complex ownership structure, so more complex ownership structure comparing the direct ownership, which is what we’ve normally been dealing with, with structures such as multi level ownership and reciprocal ownership, get ready to account with advanced financial accounting. Normally, when we think about our consolidation structure, we’re dealing with a direct ownership situation which looks like this direct ownership type of situation, it gets more complex. Of course, if we have more complex type of ownership structures, such as a multiple multi level ownership structure where we have a parent owning a subsidiary, that basically we have an indirect ownership, let’s say in another subsidiaries, that’s going to be more complex for us to deal with or if we have a situation where we have reciprocal ownership, where the parent has ownership a controlling interest in s, but as also has some ownership in p, right. We’ve been dealing with basically P parent company owning portion of S. So if we talk about direct ownership we’re talking about the parent has, as has controlling interest in every subsidiary. So that’s going to be of course, this situation.

Subsidiary Purchases Shares from Parent

Advanced financial accounting PowerPoint presentation. In this presentation we will discuss a consolidation process where we have a subsidiary that purchases shares from the parent. So what’s going to be the effect on the consolidation process? When we have a subsidiary that purchases shares from a parent get ready to account with advanced financial accounting. We are talking about a situation here where this subsidiary is purchasing shares from the parent what’s the effect on the consolidation process? In the past, the parent has often recognized a gain or loss on the difference between the selling price and the change in the carrying amount of its investment. So in the past, it’s often been recorded as a gain or loss on parent companies that difference as a gain or loss on the parent company’s income statement.

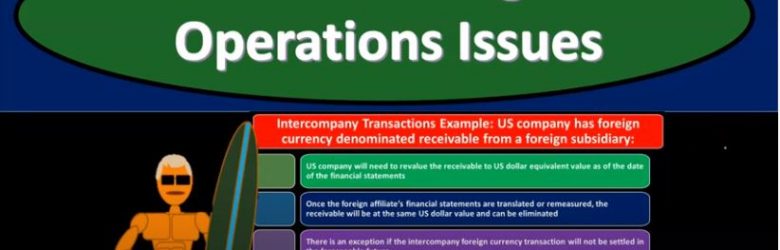

Other Foreign Operations Issues

Advanced financial accounting PowerPoint presentation. In this presentation we will discuss other foreign operations issues, get ready to account with advanced financial accounting, other foreign operations issues. So we’re going to start off with an issue related to the parent company having a foreign subsidiary. Typically when that is the case, they’re going to have to consolidate. In other words, you’re going to have to get the foreign subsidiary books in some way to the US dollar and then do the consolidation process. However, you might have a situation where that wouldn’t take place under certain conditions. So, parent generally consolidates a foreign subsidiary except when certain conditions are so severe that the US company owning the foreign company may not be able to exercise the necessary level of economic control. So notice when we think about the consolidation process, we’ll typically think about, we need to consolidate the entities if there’s control right over the 51% is that going to be a general rule but the overarching concept is that there is control. Now if there are certain conditions even though it’s the ownership is over the 51%, we would think there would be control, but there are certain conditions in the foreign subsidiary that are restricting that economic control, then then they might not meet you know that condition and therefore in that situation you might not have the consolidation process. So in that situation then you might have a parent company that has basically a controlling interest you would think in terms of the stock, the stock but you’re not having a consolidation due to the due to one of these factors limiting the actual economic control. So, those include restrictions on foreign exchange in foreign country. So severe strict restrictions, there could be one of the items that would stop the basically consolidation process possibly restrictions on transfers of property in foreign country.

Translation vs Remeasurement

Advanced financial accounting PowerPoint presentation. In this presentation we will discuss translation versus remeasurement. Get ready to account with advanced financial accounting, translation versus remeasurement methods to restate to foreign entities statements to US dollar. So the most straightforward methods can be translation of foreign entities functional currency statement to US dollars. So the translation is what we’ll use the most straightforward method when the entity statement is using the functional currency. So typically, if the if the entity is using the functional currency, and we need to translate it, then we’ll simply translate it from the functional currency to the US dollars. And then there’s remeasurement of foreign entities statement into its functional currency. So remeasurement means that the entity is running their bookkeeping in a currency that is not the functional currency. Right? So then we’re going to have to re measure we’re going to use this term re measure rather than translate the To the functional currency, so after we remeasure to the functional currency, after remeasurement statements need to be translated to the reporting currency if the functional currency is not the US dollar. So in other words, if we’re assuming, in this case, in the case of the remeasurement, or let’s say, we have an entity that we’re going to be consolidating a subsidiary entity in another country, and we’re in the US and we need to basically consolidate these data together in terms of US dollars at the end of the day, if the entity is using the functional currency as as their financial statements, their bookkeeping is in the functional currency, then we can simply use the term translate it to the US dollars, which will be the parent currency that we’re talking about here. If however, the foreign entity is having their books in some currency, that is not the functional currency, then what we’re going to have to do is re measure it. We want to use remeasurement To the functional currency, we want to make remeasure at first to the functional currency rather than straight to the US dollar. So we’re going to use remeasure to the functional currency. And after we re measure to the functional currency, if the functional currency is the US dollar, then then we should be able to stop there. That’s okay. If however, the functional currency is not the US dollar, then we would have to go from the functional currency and then translate to the US dollar. So we’ll talk a little bit more about that as we go. So let’s think about translation.