In this presentation we will talk about how to set up and record a petty cash fund. Setting up a petty cash fund seems like an easy thing to do to have a minimal amount of cash that we can have expenditures for small purchases for however, it can be a little bit tricky to set up the petty cash fund and there is kind of a shortcut to recording transactions for the petty cash fund. So we’ll go over the process of setting up the petty cash fund recording the initial investment in the petty cash fund and then recording the activity from the petty cash fund. Now the objective of course in this will be to have not just the checking account where we need authorization in order to take money out of the checking account, we would typically want anything going out of the checking account to be by electronic fund transfer or by cheque so that we have a clear paper trail of what is going on the petty cash However, if we just have some small items that we need to take care of with cash and as to convenient to have small items with cash to be paid.

01:03

The petty cash fund is good to have the idea of the petty cash fund, of course, being that the small purchases we make with the petty cash are probably going to be in material in nature compared to the other purchases and therefore not affect our financials too much. And the petty cash, we’re going to try to keep it at a level that it’s small enough that if it was stolen, it wouldn’t increase the likelihood of people trying to rob us for the petty cash fund that we will have on hand and that if it was stolen, again, it would be some something that would be in material because we will have less safeguards over the petty cash given that we have cash on hand rather than the money in the bank account. So we want to keep that level of the level pretty steady at what the Katie petty cash will be able to monitor and track to some extent what is going in and out of the petty cash as we go. So we’ll talk about that by setting up a petty cash account.

02:00

We’re gonna start with a trial balance here, it’s just gonna have out some limited accounts because we’re really only working with the cash and the petty cash. And then we’ll have some expenses when we start to spend out of the petty cash here. So here’s going to be our trial balance, the debits are going to be non bracketed the credits here are going to be bracketed. The zero here indicates that if we were to add up the debits and subtract out the credits, they would be equal and therefore add up to zero. net income is now 4000 905. That’s this 10,000 of revenue, minus all the expenses to get to income, not loss, income, credit over the credit over the expenses, credit over the debits of 4000 905. Now we’re just going to set up the petty cash fund. And it’s as easy as you would think to set up a petty cash fund clearly we’re going to we’re going to in our chart of accounts, have another account called petty cash, and we will set up that account we’re going to try to pick some number that we think is a good enough number to cover those small towns.

03:00

Back to purchases, but not too high to have too much cash at any one given time. And we’re going to say that’s going to be $250. So what we’re going to do is just set up the petty cash, it’s a debit balance account, it’s going to be a cash account asset account has a debit balance, we’re going to increase it doing the same thing, another debit. And the other side will of course be coming out of the checking account. So we’re just going to move money, write a check from the checking account or take money out of the checking account and put it into the petty cash account. Therefore the checking account is going to go down to a debit balance, we’re going to the opposite thing to it a credit. So we are in essence, just adding another cash type account to our chart of accounts to our trial balance. posting this out to our little worksheet, we’re going to say that petty cash is going to go from zero up by this debit in the debit direction to 250. The cash account is going to go from this to thousand 205 down in the credit direction down in the credit direction.

04:00

To 2000 to 55. So we just lowered the cash account set up the petty cash, pretty straightforward. Next item we’re going to have and if we saw that in context, of course, then if we pull over all the other accounts, we are still in balance. We’re still at a zero balance here. no effect on net income, just in essence, bringing the cash count down, putting the money into the petty cash. Next, we’re going to say that the activity happened during the month and we need to replenish the petty cash. So at the end of the month, we’re going to say how much cash is left of the 250 we put in there. We have not been taking it out as we go. What we have done is just paid whatever petty cash out for minor purchases, and we now have $19 and 17 cents left in the petty cash at the end of time period. What we also have our receipts that we got from the petty Cash Disbursements. So anytime we spent petty cash, we went wrote it down, or we got a receipt for it. And we’re putting those into the into the safe the petty cash drawer, in order to track our petty cash.

05:10

Now we need to replenish it. Now, the quick way you might think that we would want to replenish this would be to first do a journal entry, taking everything out of petty cash, and then replenishing it with cash. But this is the kind of a tricky part, we’re going to do a bit of a shortcut, which will save us some time and the data entry. So first, we’re just going to go through and we’re going to say, Okay, what did we spend money on according to our records, any kind of receipts that we kept or any kind of thing that we wrote down to help us track what we spent money on, and we’re going to record that the debit to these expense accounts in accordance with that. So we’re going to say that there was janitorial expenses of some kind that we had to deal with, which was $70 that we spent out of petty cash. We’re going to say that there’s miscellaneous expenses. We just have a receipt Are Jordan, that’s all we wrote down, we probably should be more specific than that. But it could have been, it could have been something more specific.

06:07

And we’re just going to put it into miscellaneous expense because there’s no other account that that we want to set up for such a small item possibly, we’re going to say that then we have postage expense that we paid money for postage for 350. And again, we’re just going to pull these from the expenses, we’re going to record our journal entry. These are all debit balance accounts. So we’re going to increase them by doing the same thing to it, which is a debit, which is building our journal entry by what we find in the petty cash drawer in terms of our records for what we spent this 250 on, of which we only have $19 and 17 cents left. We’re going to say we had advertising expense of 57. That’s something we spent our petty cash on. And that’s all we have in our drawer now. So if we think about this, and we’re going to say okay, well, we had 200 Hundred and 50 in there at the beginning. And now we spent 78 minus 78 minus 63.68 minus 43.5 minus 57.15.

07:15

So according to our records, the receipts that we have, and the original amount that we had in place, you would think that we would be left with $7 and 67 cents. However, we are left with $19 and 17 cents. So we have a difference there. We can’t just put the difference of the $7 of the $7. there we’ve got it we’ve got a problem because we’re left with $19. So we’re gonna do a subtraction problem and we’re going to say okay, well, we we think we should have been left with 17 but we got 19. If we subtract out minus 19.17. Then we have a difference and over short difference of this $11 and 50 cents, a difference between what our records show starting at two 50 minus the activity that we show in accordance with our records, the difference of 1150. off, we’re going to put that difference into the cash over and short. So the cash over and short account is going to be that difference of the 1150 that we’ll need in order to be in balance.

08:19

Now, the tricky thing is that you would think that the difference here would go to the petty cash account. So in other words, if we’re saying that the petty cash only has that 1917 in it left, you would think we’d say, Okay, well, there’s 250 minus the 19.17. And that would be 230 87, that we would have to write this down by, in order to bring it to this $19 and 17 cents, and then do another journal entry, taking money out of the cash account and putting it into the petty cash account. So you could and we could do it that way. That would be a legitimate way to do it, but often we could skip those steps. And instead of writing this down to 19, and then write another check bringing it back up, which would be, you know, more journal entries, we could just put this difference just 2030 83 into the cash account. So we’re just basically going to write a check for cash of the difference that we need $230 and 83 cents to bring this account back to what’s already in our account here, we already have 250 here, this is what we need in order to bring the balance back up to that from the checking account.

09:37

So one more time in other words, we could have done this two different ways we could have said this to 230 is what we need in order to bring this balance down to zero, or in order to get in balance the debits minus the credits equals this 230 83. So after this transaction, total debits would equal total credits. We could have put this instead of to cash to the petty cash fund, bringing the balance down to the $19 and 17 cents, which would make sense and then write a note another journal entry, which would be crediting the cash account by $230 and 83. And then debiting, the petty cash by $230 and 83 to bring it back up to 250. But that’s some repetitiveness there. So most of these type of problems will just say, Hey, I’m just going to skip that extra step. And we’re not going to reduce the petty cash flow, and we’re just going to write a check out of the cash account here, apply it to all the expenses that have already been expended. And then the difference of course, will go to the cash over and short. So if we post this out, then we’re going to say that the janitorial expenses are here 400 debits going up with a debit direction to 478.

10:54

We have miscellaneous expenses are going to go from the 650 up by the 6368 To 713 68, we have the postage 4350, increasing the postage by 100 from 100 by 4350 to 143 50, then the advertising is going to increase the 300 by 5715 to 357 15. The cache over short is going to be here and now this is going to be our new account here. And it could be something that’s going to increase income or decrease income, depending on if we’re over or short on the cash. In this case, it’s actually going to increase income because we must have basically Miss wrote one of these items here that we’re in the in the petty cash we have this difference, which is going to increase the net income with a credit here, so it could be a debit, it could be a credit, it could go either way this cash over short. In other words, doesn’t have like a normal normal balance. Not always gonna have a debit normal balance, like every other type most other accounts do.

11:57

For example, expenses are all debits in And then revenues a credit balance normal balance. But but the cash over short could flip from a debit balance to a credit balance. And then we’ve got the cash is going to go down by the 230. So we’re actually writing a check, and we’re taking more money out, we’re taking 230 out, you can say we got that cash, we go to the bank and take 230 83 out, and we put it back in the drawer back in the petty cash drawer. But when we recorded it, when we record the taking of this money out, we’re going to record it to the expenses that we had already expended. And the expenses we had already expended really came out of the original $250. And that’s just going to be again a kind of shortcut that we can do to put this in more easily. Note that this transaction will of course decrease net income all the expenses are going up because that’s what we spent the petty cash on net income revenue minus expenses then going down by what we spent the petty cash on. Now if we’re back Get the 250.

13:01

If we wanted to increase the balance, if we’re saying hey, that 250 is not enough for our petty cash needs, we spend more than that in whatever the month time period, then we might want to increase that minimum balance, whatever that level is to say 450. And then of course, all we’d have to do is take out, increase the petty cash by the 200. To bring it up to 450. And write another check, take it out of the checking account. So now we’re going to we’re going to say, Hey, I don’t want to keep that level at 250, we want to keep the new level at 450. So if we post this out, then petty cash is going to go up by this 200 from 250 up by that 200 to 450. And then the cash accounts going to go down in the credit direction. So here’s the debit balance, it’s going to go down by that 200 to 1008 2417. So this is just like the original investment. If we wanted to increase or decrease the minimum balance, then we could just do that same type of transaction taken out of the checking account, put it into the petty cash account.

14:04

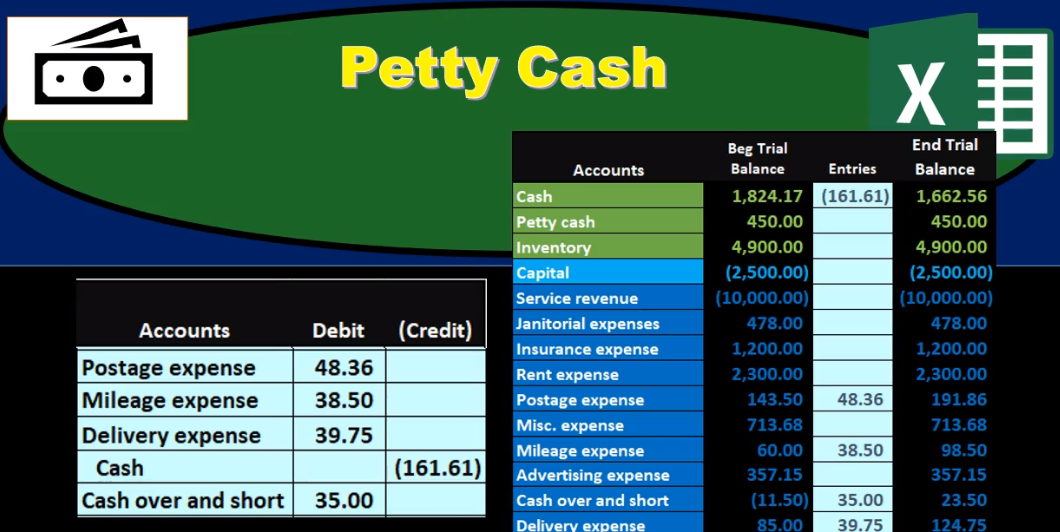

And then if we do this replenishing one more time now we’re at the 450, the minimum level, we spent a month’s worth of stuff out of petty cash again, and we’re trying to say, Okay, we have to record this information. And we’re left with if we do a count at the end of the month, $288 and 38, nine cents. So we’re gonna do this same type of calculation, we’re going to look through all the receipts that we have in the petty cash drawer for month two, and see what we can align those two in terms of expense categories. So if we look to the petty cash drawer, we’re gonna say there’s a postage expense, it’s a it’s an expense, debit balance, we’re going to increase a debit to our journal entry, we’re going to say there’s a mileage expense, so that’s an expense. We’re going to put that into a debit for our journal entry, delivery expense. So it’s an expense to debit balance, we’re going to debit to journal entry. And that’s all we have this time. So if we if we do Add this up, then we have now the 450 minus the 48.36 minus the 38.5.

15:12

Let’s do that one more time. 450 minus the 48.36 minus the 38.5 minus 230 9.75 gives us the 332 39. That’s what we would think that we had left. However, the physical count shows us that we have 208 39. The difference then 280 8.39 is $35. So we’re going to say there’s an over short then a 35, this time needing to be a debit. And then the credits going to go to cash, we’re going to reduce the cash. And we can we can know that, you know, obviously, if we add all these up, it should add up to 161 61. And if we take the difference between the 450 minus the two 88.39 that gives us that same 161 61. That’s what we need, in order to you would think, take the petty cash down to the physical count. So again, same journal entry, we could have taken the petty cash, reduced it by the 161 61. Two bring it down to what we physically counted it to be 288 39 and then done another journal entry to take money out of the checking account and put it into the petty cash account for the same amount 161 61 to bring the balance back up to the $450 however, of course, we can reduce that process the number of journal entries by instead just taking the money out of the checking account and replenishing this.

16:49

So in essence, we’re taking the money out of the checking account, we’re getting that physical cash putting it back in the petty cash drawer, but we’re never really adjusting the petty cash because we We’re writing that original for 50 off for the expenses that happened during the month. So if we post this, then we end up right where we need to be, we’ve got the post postage expense going up from a fourth 143 50 up the debit direction to the 191 86. And then we’ve got the mileage here, here’s the mileage expense going up, debit here, debit there, it’s going up in the debit direction, we’ve got the delivery expense here, going up in the debit direction as all expenses do. We got the cash over and short been a debit this time. So notice it’s going to flip and that’s what can happen with the over and short account. It could be a debit balance, it could be a credit balance, it has no real normal balance. And so it flipped this time to 2350. Now this scenario might be more familiar one we might see more often, and that the receipts that we added up, don’t add up.

18:00

To what we think the receipts should be given the physical count, meaning it looks like we’ve spent money on something and didn’t record it in here. So that is probably more typical than us writing off a receipt that didn’t didn’t go off of the petty cash. But in any case, this could flip to a credit balance or debit balance, and discount in this case, it’s going to flip back down and had a credit balance of 1150 with a $35 debit, bringing it down by the 1150 to zero and then back in the debit direction to 2350 in this account, and then the cash account is going to go from 1008 2417 down by the 161 61, which were actual which are physically writing a check for taking money out of the checking account for bringing the balance down to 1006 6256. Nothing happened to the petty cash fund even though we’re dealing with the petty cash fund, because it’s already at the balance that we want.

18:58

And instead of doing that, two steps process, we’re just going to do a one step process taking the money out of the checking account physically, taking it out of the checking account, putting it back into the drawer, the drawer only having 288 39 needing that 161 61 to get back up to the balance that we already have recorded a 450. And then we’re recording the expenses here that we had done during the month into our system. So if we see the whole thing here, here’s here’s all the accounts. Of course all of these debits to the expenses are going to decrease net income because net income is calculated as revenue has a credit balance minus all the expenses the expenses went up. So net income went from 4006 7417 income not a loss, this is income credits, beating the debits it went down by 161 61 to 4005 1256. So of course we are recording the fact that We made expenditures during the month decreasing net income