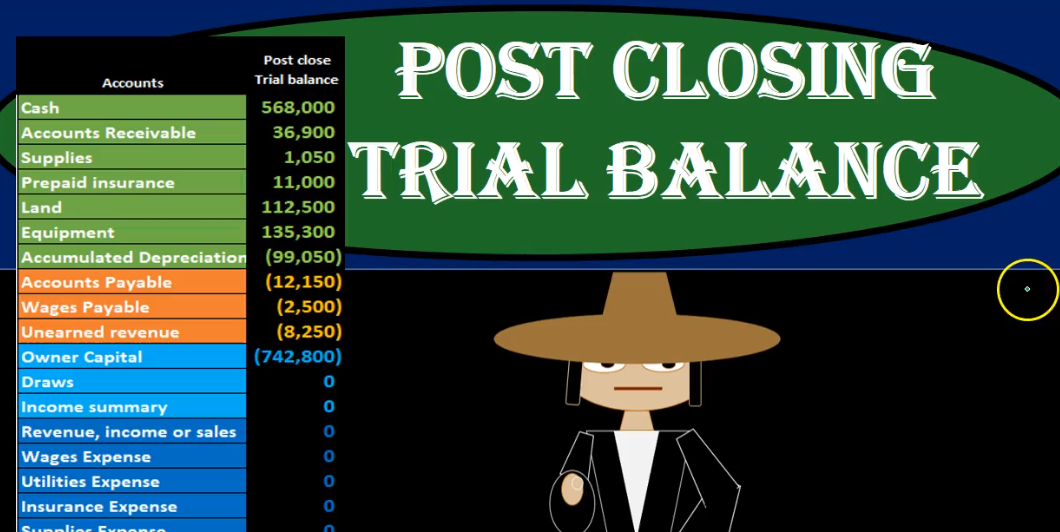

Hello in this section we will define the post closing trial balance. When seeing the post closing trial balance, it’s easiest to look at it in comparison to the adjusted trial balance and consider where we are at in the accounting cycle in the accounting process. When we see these terms such as the adjusted trial balance and post closing trial balance, as well as an unadjusted trial balance, we’re really talking about the same type of thing. We’re talking about a trial balance, meaning we’re going to have the accounts with balances in them. And we’re going to have the amounts related to them. And of course, the debits and the credits will always remain in balance. If it is a trial balance, no matter the name, whether it be just a trial balance on an adjusted trial balance and adjusted trial balance or a post closing trial balance.

00:52

We’re really talking about the time period in which the trial balance was prepared when we’re talking about these different names of the trial balance. So in order to think about that, first we want to look at the accounting cycle recall the accounting cycle in broad strokes is basically that we have the normal day to day accounting entries, that stuff that happens most of the time period throughout the month, which would be bills, invoices, checks. And then at the end of the month, we’re going to prepare the trial balance from the system to the adjusting department given it to the adjusting department, and the adjusting department will put it into the worksheet calling it an unadjusted trial balance. Then we’ll do the end of period adjusting entries.

01:36

And once those are done, we will be ending up with the adjusted trial balance. This is the one that we’re going to be working with. We typically see this in a worksheet type format, but we will enter that information back into the accounting system and have have the data there that would be the adjusted trial balance numbers within the system as well. We’re going to use this adjusted trial balance in order to create those financial status. After they have been created, we then will want to close out the temporary accounts. Now it’s important to note that this does happen automatically in most accounting software. But we need to know what the software is doing in order to see what how the reports are changing as we change date ranges. And so that’s the change once we do the closing entries will be to the post closing trial balance. So this trial balance represents the first time period of the next month that will be set up.

02:32

And this trial balance is often represented without any temporary accounts meaning these accounts down here will just be left off, given the fact that they are zero balances. But in any case, the post closing trial balance will have the same assets and then liability accounts as the adjusted trial balance but the equity account will be different. In our case, the owner’s equity because we’re talking about a sole proprietorship All the temporary accounts will then be closed out to that owners capital account. So the post closing trial balance is really kind of like cleaning up the shop at the end of the day. If we have a cafe we’re cleaning up the shop in order to set up for the morning shift. To start the whole process over again, at the end of the accounting cycle, we have done the main event that being the financial statements, and we’re basically just cleaning up the shop cleaning up the accounts so that we can do the whole thing again next month, starting on the first of next month, starting with revenue and expense accounts at zero so that we can count up from them. So the only difference between the post closing and the adjusted is that all the temporary accounts will be closed out to the owner capital and therefore, we have no net income, no revenue and expense accounts and no draws account here. And this will be our goal as we go through the closing process to achieve this post. Closing trial balance from the adjusted trial balance.