QuickBooks Online 2021 that statement of cash flows. Let’s get into it with Intuit QuickBooks Online 2021. Here we are in our QuickBooks Online test drive file, which you can find by searching in your favorite browser for QuickBooks Online test drive or in Craig’s design and landscaping services, we’re going to go down to the reports down below, opening up the other report, that’s going to be a financial statement report, but not really our two favorite ones, the two favorites being the balance sheet and income statement, the other financial report being the statement of cash flows, so we’re going to be opening up the statement of cash flows, I’m going to right click on the statement of cash flows.

Posts with the worksheet tag

Vertical Analysis Profit & Loss, P&L, Income Statement 3.25

QuickBooks Online 2021 vertical analysis, profit and loss, p&l or income statement, let’s get into it with Intuit QuickBooks Online 2021. Here we are in our free QuickBooks Online practice file, which you can find by searching in your favorite browser. For QuickBooks Online test drive, we’re in the Craig’s design and landscaping services, we’re going to go down to the reports down below modifying another P and L profit loss income statement.

Custom Income Statement 3.15

QuickBooks Online 2021 Custom income statement, let’s get into it with Intuit QuickBooks Online 2021. Here we are in our free QuickBooks Online test drive file, which we can find by searching in our favorite browser for QuickBooks Online test drive. We’re in Craig’s design and landscaping services practice file, we’re going to go on down to the reports down below, we’re going to be creating a custom income statement, we’re going to build that from our standard income statement.

Balance Sheet Vertical Analyses 2.38

QuickBooks Online 2021 balance sheet vertical analysis, let’s get into it with Intuit QuickBooks Online 2021. Here we are in our free QuickBooks Online test drive practice file, which you can find by typing into your favorite browser, QuickBooks Online test drive, we’re in Craig’s design and landscaping services, we’re going to go down to the reports on the left hand side, we’re going to start off with our basic balance sheet, again, our favorite report or one of them, and then we’re going to be modifying it this time for a vertical type of analysis.

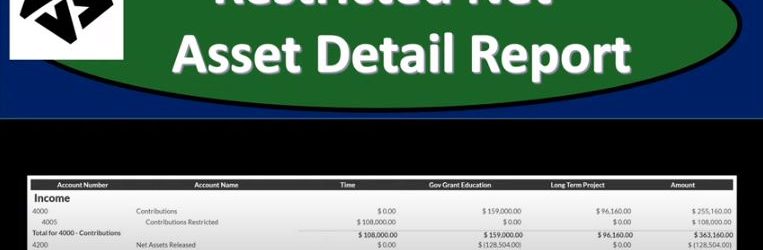

Restricted Net Asset Detail Report 190

This presentation we will generate, analyze, print and export to an Excel a restricted net asset detailed report and get ready because here we go with aplos. Here we are in our not for profit organization dashboard, let’s head on over to Excel to see what our objective will be. We’re currently in the 10th, tab, tab number 10. And last time and a few prior presentations, we’ve been creating the statement of activities, including three columns, two columns, for width restrictions, without restrictions, we then broke out the width restriction column out into the expenses by both function and by their nature.

Statement of Activities Formatting 185

https://youtu.be/S3lCOA6esqY?list=PL60SIT917rv6ERsGZxM9V_IZLVybpgfNU

In this presentation, we’re going to take a look at the formatting of a statement of activities or income statement, we’ll take a look at customizing the statement of activities and customizing it for internal use, as well as external use and then saving those customized income statements so that when we go into them into the future, it will be as easy as possible, get ready, because here we go with aplos. Here we are on our not for profit organization dashboard, we’re going to be opening up our reports, let’s go to the reports on the right hand side to do so we’re then going to go into the income statement by fund. So let’s take a look at the income statement five fund which is going to be our statement of activities report.

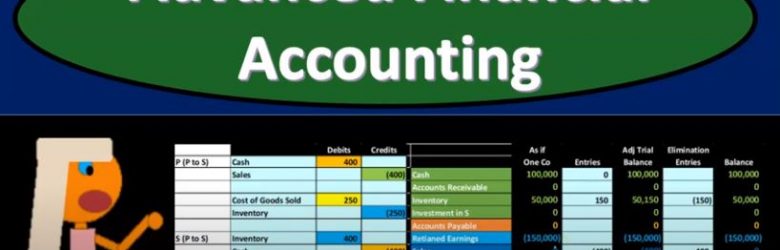

Sale From Parent to Sub Sub Has Not Resold

Advanced financial accounting PowerPoint. In this presentation we will discuss a situation where there is a sale of inventory or transfer of inventory from parent to subsidiary, the subsidiary not having yet sold the inventory. So in that sense, we have an intercompany type of transfer. When we consider the parent and subsidiary as a whole with regard to a consolidation process, the parent sold to the subsidiary the inventory, the subsidiary still holding on to that inventory has not resold it externally at this point, get ready to account with advanced financial accounting. What we want to do now is think about the transaction on p side and then on SSIS, and then what the elimination entry will be. So there’s a couple ways you can think about this, you can kind of memorize what the elimination process will be what the elimination entry will be and put together worksheets to do that elimination process kind of by just routine by just filling out the worksheet. And then you also want to analyze the worksheet and think about it in detail in terms of what is actually happening.

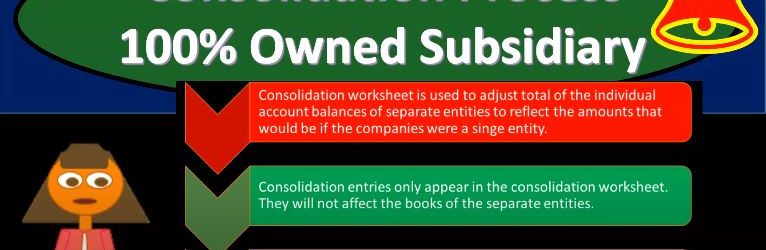

Consolidation Process 100% Owned Subsidiary

This presentation we’re going to take a look at the consolidation process for a 100% owned subsidiary. In other words, when we’re thinking about one company owning another company in advanced financial accounting, we’re usually looking at the situation and spending most of our time where we have some kind of consolidation process. So we want to Vin take the consolidation process and look at it in levels of complexity. So we’re going to start with a level of complexity, that’s going to be an easier setting where we will have 100% owned subsidiary, and then we’ll go from there and add more complications to it. Get ready to account with advanced financial accounting to ownership and control and prior presentations, we took a look at different methods based on different levels of ownership and control. We said in general, if we had zero to 20%, we use the carried value and then 20 percents kind of an arbitrary number, but if we’re over that amount, we’re really looking at the term of significant influence it for over the 20% from 20 to 50% then The assumption is that we would be using the equity method because the assumption would be if over 20% unless spoken otherwise, unless some unreal, some reason, otherwise, we would then have this significant influence and therefore be justified to use the equity method. And then if you’re over 51%, then you may have the consolidation. Now, when we think about these two methods that they carried value in the equity method, we can basically explain those as we go, you know, if you got anything from zero to 20%, then we could just basically say, yeah, then you fall into this category, let’s talk about the accounting in general.

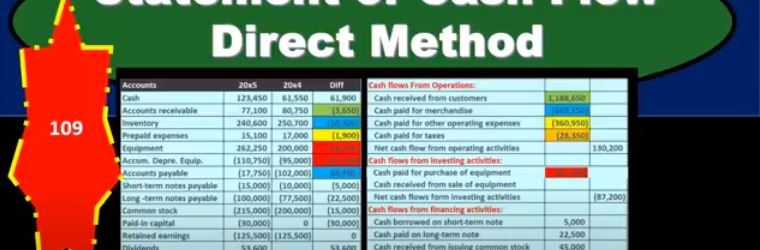

Statement of Cash Flow Direct Method

In this presentation, we will take a look at the statement of cash flows using the direct method. Here’s going to be our information we got the comparative balance sheet, the income statement and some additional information. And we will use this information to put together our worksheet which will be the primary source used to create the statement of cash flows using the direct method. This is going to be our worksheet. Now most of this worksheet will be similar to what we have done for the indirect method, in that we took the difference in the balance sheet accounts. So we’re taking the current year and the prior year, the current period, the prior period, all the balance sheet accounts, we’ve got cashed down to the retained earnings for the balance sheet accounts. But we’re also in this case going to give us the income statement accounts for the current period. So in other words, we’re going to break out the retained earnings the amount to its component parts, meaning we’ve got net income being broken out on the income statement. We’ve got sales cost of goods sold, the income statement accounts. So it’s going to be our same kind of worksheet here, we’re going to be in balance, we’ve converted it from a plus and minus format, we’ve removed all of the subtitles as we did under the indirect method.

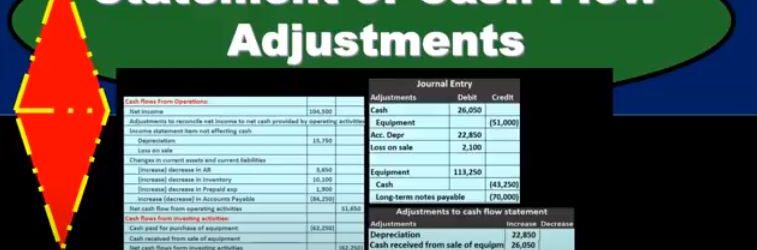

Statement of Cash Flow Adjustments

This presentation we will continue on with our statement of cash flows, we’re not going to enter the final adjustments that we will need to finalize the statement of cash flows to bring those last few numbers to the correct balances. In order to do that, we’re going to use this information we’ve got our comparative balance sheet, our income statement and additional information. We put together most of our information so far with the comparative balance sheet, which we made into a worksheet. Now we’re going to use some of these other resources, the income statement, the additional resources to make those final adjustments, those fine tunings that are needed to get those few numbers that we have left and noted into balance. And this is going to be part of the normal practice where once we get this information set up, we can then make some comparisons such as net income does it tie out, such as depreciation does it tie out on the cash flow statement to what we see here on the income statement, then we can have this other information which will be given in both problems in practice, of course, we’ll just go to the gym. General Ledger. And we’ll get this information in a book problem, we don’t want to give all the detail of a general ledger or just when we’re going over an example.