Advanced financial accounting PowerPoint presentation. In this presentation we will discuss the consolidation process and a situation where the subsidiary issues stock dividends we have stock default dividends issued by the subsidiary what will be the effect on the consolidation process get ready to account with advanced financial accounting. We’re talking about a consolidation process where the subsidiary then issued stock dividends. So we have stock dividends are issued to all common stockholders proportionally, therefore, the relative interest of the controlling and non controlling stockholders is not changed. So that relative interest isn’t changed, so we don’t have to worry about that which is nice. The carrying amount on the parents books is also not changed. So we’re not going to have to change anything on the books of the parent with basically an adjustment to the investment account using you know, typically the equity method, which is nice stockholders equity accounts for the subsidiary do change. So we do have a change to the stock There’s equity on the subsidiary, but total stockholders equity does not. So in other words, if we take stockholders equity as a whole, there’s no change there, even though there’s changes within the stockholders equity of the subsidiary. So we’re here we’re going to say this stock dividends represent a permanent capitalization of retained earnings. That’s basically what is happening, permanent capitalization of the retained earnings.

Consolidation When there is Complex Ownership Structure

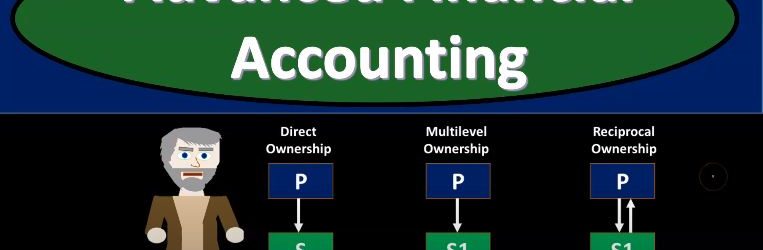

Advanced financial accounting PowerPoint presentation. In this presentation we’re going to discuss a consolidation that when there is a complex ownership structure, so more complex ownership structure comparing the direct ownership, which is what we’ve normally been dealing with, with structures such as multi level ownership and reciprocal ownership, get ready to account with advanced financial accounting. Normally, when we think about our consolidation structure, we’re dealing with a direct ownership situation which looks like this direct ownership type of situation, it gets more complex. Of course, if we have more complex type of ownership structures, such as a multiple multi level ownership structure where we have a parent owning a subsidiary, that basically we have an indirect ownership, let’s say in another subsidiaries, that’s going to be more complex for us to deal with or if we have a situation where we have reciprocal ownership, where the parent has ownership a controlling interest in s, but as also has some ownership in p, right. We’ve been dealing with basically P parent company owning portion of S. So if we talk about direct ownership we’re talking about the parent has, as has controlling interest in every subsidiary. So that’s going to be of course, this situation.

Subsidiary Purchases Shares from Parent

Advanced financial accounting PowerPoint presentation. In this presentation we will discuss a consolidation process where we have a subsidiary that purchases shares from the parent. So what’s going to be the effect on the consolidation process? When we have a subsidiary that purchases shares from a parent get ready to account with advanced financial accounting. We are talking about a situation here where this subsidiary is purchasing shares from the parent what’s the effect on the consolidation process? In the past, the parent has often recognized a gain or loss on the difference between the selling price and the change in the carrying amount of its investment. So in the past, it’s often been recorded as a gain or loss on parent companies that difference as a gain or loss on the parent company’s income statement.

Subsidiary Sells Additional Shares to Parent

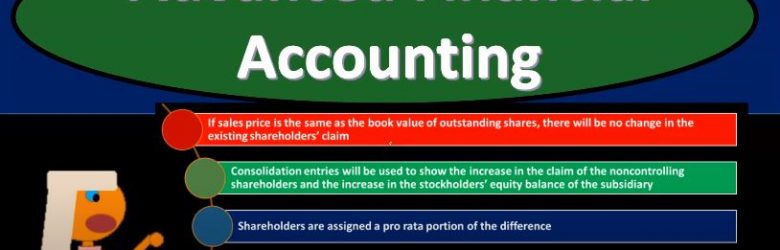

Advanced financial accounting PowerPoint presentation in this presentation will discuss a consolidation process where we have a parent subsidiary relationship and the subsidiary sells additional shares to the parent. So we have a situation where we have the subsidiary selling additional shares to the parent, what’s going to be the effect on the Consolidated Financial Statements get ready to account with advanced financial accounting. We’re talking about a situation here where the subsidiary is going to sell additional shares to the parent and the price is going to be equal to the book value of the existing shares. In that case, it’s going to increase the parents ownership percent, because the parent now has more stocks and no one else got more stocks. Therefore, their percent ownership is increasing. The increase in the parents investment accounts will equal the increase in the stockholders equity of the subsidiary the book value of the non controlling interest is not changed and the normal consolidation entries will be made based on the parents and new ownership percent. So obviously when we do The consolidation entries, we’re going to be basing them on the new ownership percent, that’s going to be the more simple kind of situation where we have the price equal to the book value. What if there’s a sale of additional shares to the parent at an amount of different than the book value, so we still have shares going from the subsidiary to the parent, but now the amount is different than the book value. This increases the carrying amount of the parents investment by the fair value of the consideration. So in other words, the carrying amount of the parents investment in the subsidiary is going to go up by that what was paid for it that consideration given whether that be cash at the fair value of something other than cash. At consolidation, the amount of a non controlling interest needs to be adjusted to reflect the change in its interest in the subsidiary.

Subsidiary Sells Additional Shares to Nonaffiliate

Advanced financial accounting PowerPoint presentation. In this presentation we will discuss a consolidation process where we have a parent subsidiary relationship and the subsidiary sells additional shares to a non affiliate. So we have the subsidiary selling shares not to the parent, but to a non affiliate what will be the effect on the consolidation process? Get ready to account with advanced financial accounting. We are talking about a situation here where the subsidiary is selling more stock or additional stock to someone outside of the organization, someone who is not affiliated not to the parent or some other subsidiary, what will be the effect in the consolidation process? It’s going to increase the total stockholders equity of the consolidated entity by the amount received by the subsidiary in the sale. That of course would make sense because if you imagine the transaction taking place, then if they got cash for it, for example, cash would be going up the other side going to the equity so it’s going to be increasing the total stockholders equity will increase total shares outstanding for the subsidiary reducing the percent ownership of the parent company. So if the subsidiary then issues more shares and they didn’t go to the parent, then that means there’s going to be more shares outstanding. That means the shares that the parent owns will go down, therefore, their percentage ownership will typically go down. In that case, we’ll increase the amount assigned to the non controlling interest.

Other Foreign Operations Issues

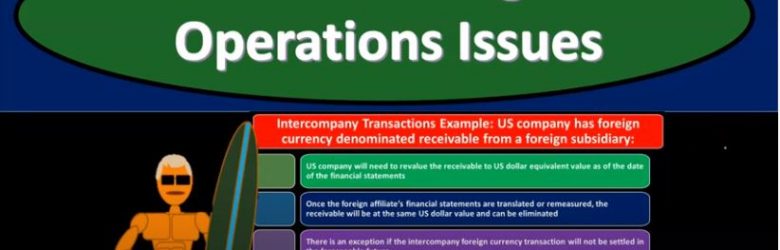

Advanced financial accounting PowerPoint presentation. In this presentation we will discuss other foreign operations issues, get ready to account with advanced financial accounting, other foreign operations issues. So we’re going to start off with an issue related to the parent company having a foreign subsidiary. Typically when that is the case, they’re going to have to consolidate. In other words, you’re going to have to get the foreign subsidiary books in some way to the US dollar and then do the consolidation process. However, you might have a situation where that wouldn’t take place under certain conditions. So, parent generally consolidates a foreign subsidiary except when certain conditions are so severe that the US company owning the foreign company may not be able to exercise the necessary level of economic control. So notice when we think about the consolidation process, we’ll typically think about, we need to consolidate the entities if there’s control right over the 51% is that going to be a general rule but the overarching concept is that there is control. Now if there are certain conditions even though it’s the ownership is over the 51%, we would think there would be control, but there are certain conditions in the foreign subsidiary that are restricting that economic control, then then they might not meet you know that condition and therefore in that situation you might not have the consolidation process. So in that situation then you might have a parent company that has basically a controlling interest you would think in terms of the stock, the stock but you’re not having a consolidation due to the due to one of these factors limiting the actual economic control. So, those include restrictions on foreign exchange in foreign country. So severe strict restrictions, there could be one of the items that would stop the basically consolidation process possibly restrictions on transfers of property in foreign country.

Remeasure Financial Statement of Foreign Subsidiary

Advanced financial accounting PowerPoint presentation. In this presentation we will discuss the remeasurement process for financial statements of a foreign subsidiary. Get ready to account with advanced financial accounting remeasurement financial statement of foreign subsidiary remeasurement overview so we’re going to go through the process of the remeasurement. As you think of the measurement process, you want to be comparing and contrasting it to the translation process. So you’re envisioning basically you got a parent company. The parent company has a subsidiary the subsidiary is a foreign subsidiary. The subsidiary then conducts their books. Typically we’re thinking in a foreign currency right, that subsidiary is conducting their books in a foreign currency. If we need to consolidate the subsidiary into the parents financial statements, the parent uses dollars to measure their books subsidiary uses a foreign currency on the bookkeeping side, how do we get them over $2 so we can do the consolidation process. two methods generally we can use a translation method or a remeasurement method, and we have to determine which method we’re going to use by determining what the functional currency is. And once we know what the functional currency is, then we can determine whether we need to use the translation method or the remeasurement method. And they’re going to be slightly different. Now note, there’s also a third kind of option where we might have to use translation and remeasurement if there was a situation where the foreign currency has the financial statements, and something other than the US dollars and then the functional currency was not the currency that their bookkeeping was in, and it’s not the US dollar.

Translate Financial Statements of Foreign Subsidiary

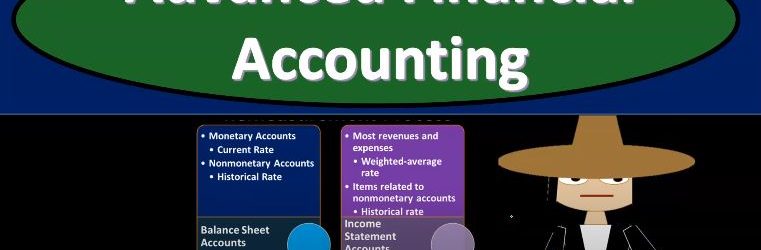

Advanced financial accounting PowerPoint presentation. In this presentation, we will discuss translate financial statements of foreign subsidiary, get ready to account with advanced financial accounting, translate financial statements of foreign subsidiary. So we’ll go through the general process of the translation process for the revenue and expenses, the average exchange rate for the period covered by the statement is the rate that is generally going to be used. And again, this would make sense, because if we’re talking about the revenue and expenses, we can’t really pick one rate, because that is a statement of how the performance did over time from beginning to the end. And therefore we need to use some kind of rate that would be representative and it wouldn’t really make sense to use the rate at the end of the timeframe but possibly some average of it. So a single material transaction is translated using the rate in effect on the translation date. So then there could be an argument that could be made we could say okay, so We’re not going to use just one rate, like at the end of the time period like we’re using on the balance sheet generally, because that would make more sense on the balance sheet because it’s reported as of a point in time. But on the income statement, yeah, it makes more sense for us to use some rate that’s kind of reflective of the timeframe. So possibly we’ll use an average rate. But what if we have this really material type of transaction that’s really large transaction, maybe in that case, we should we should deviate from just an average rate and use the rate as of that point in time or like a historical rate at that point in time. assets, liabilities and equity. So now we’re talking about the balance sheet. So for the most part on the balance sheet, you would think all right, it would make more sense then for us to be using the current exchange rate, which would be as of the date of the balance sheet date. So which says as of the end of the time period, if we’re talking for the for 1231 income statements or financial statements for the year ended 1231 then we’re talking 1231. The end of the time period is when all the balance sheet accounts are reporting as Oh, As of that point in time, and therefore, for the most part, you would think that the current exchange rate, the rate as of that point in time would work. However, you can also think that the historical exchange rate might be used for some items, some, again, some kind of large items power, possibly for the property, plant and equipment.

Translation vs Remeasurement

Advanced financial accounting PowerPoint presentation. In this presentation we will discuss translation versus remeasurement. Get ready to account with advanced financial accounting, translation versus remeasurement methods to restate to foreign entities statements to US dollar. So the most straightforward methods can be translation of foreign entities functional currency statement to US dollars. So the translation is what we’ll use the most straightforward method when the entity statement is using the functional currency. So typically, if the if the entity is using the functional currency, and we need to translate it, then we’ll simply translate it from the functional currency to the US dollars. And then there’s remeasurement of foreign entities statement into its functional currency. So remeasurement means that the entity is running their bookkeeping in a currency that is not the functional currency. Right? So then we’re going to have to re measure we’re going to use this term re measure rather than translate the To the functional currency, so after we remeasure to the functional currency, after remeasurement statements need to be translated to the reporting currency if the functional currency is not the US dollar. So in other words, if we’re assuming, in this case, in the case of the remeasurement, or let’s say, we have an entity that we’re going to be consolidating a subsidiary entity in another country, and we’re in the US and we need to basically consolidate these data together in terms of US dollars at the end of the day, if the entity is using the functional currency as as their financial statements, their bookkeeping is in the functional currency, then we can simply use the term translate it to the US dollars, which will be the parent currency that we’re talking about here. If however, the foreign entity is having their books in some currency, that is not the functional currency, then what we’re going to have to do is re measure it. We want to use remeasurement To the functional currency, we want to make remeasure at first to the functional currency rather than straight to the US dollar. So we’re going to use remeasure to the functional currency. And after we re measure to the functional currency, if the functional currency is the US dollar, then then we should be able to stop there. That’s okay. If however, the functional currency is not the US dollar, then we would have to go from the functional currency and then translate to the US dollar. So we’ll talk a little bit more about that as we go. So let’s think about translation.

Functional Currency

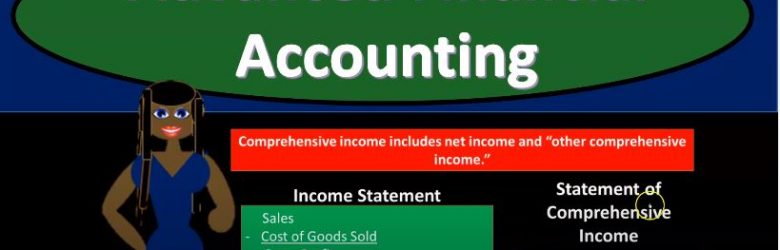

Advanced financial accounting PowerPoint presentation. In this presentation we will discuss functional currency get ready to account with advanced financial accounting, functional currency. When financial statements are restated from a foreign currency into US dollars, we must consider which exchange rate should be used to translate the foreign currency amounts to the domestic currency. So, when we translate the foreign currency to the domestic currency, we’ll have to determine what our exchange rate Are we going to be using in order to do so how will we account for translation gains and losses? So if there’s going to be a translation gain or loss, what are we going to do with that? In other words, should we put the translation gains and losses as part of the income statement reporting it on the income statement, the gains and losses that are due to the translation process exchange rates that may be used? So what kind of exchange rates might we use during this exchange process? Well, we could use the current rates probably the first thing that comes to mind you say, Hey, we got the financial status. As of the year ended of this time period, why don’t we just use the current rate. And that’s typically what we will do for the balance sheet amounts. And that typically makes sense for the balance sheet amounts, because remember, the financial statements, of course on the balance sheet represents where we are at a particular point in time. So simply converting them makes some sense on the balance sheet. But you also might think, Well, what about those things, you know, that we purchased, like fixed assets at a point in time, maybe we should use the point in time that we had the purchase took place. So you could argue on that on the balance sheet, but the current rate on the balance sheet and makes the most sense, but if you’re looking at the income statement, the current rate might not make as much sense because we’re measuring a timeframe that from a year will, let’s say, for a year’s timeframe from the beginning to the end, so maybe it doesn’t seem quite right to use simply the current rate, which would be the rate as of the end of the financial statements if we’re talking like December 31, rather than using some type of race. That would be representative of the period that would covered being January through December, we could use the historical rate, that’s gonna be the rate that exists at the time the initial transaction took place. And again, this one is often would make sense to us if we’re talking about a situation like if we bought equipment or something like that fixed assets, property, plant and equipment, large purchases that are on the books, we might say, well, maybe we should be putting those on the books at the rate that we should be using at the time, basically, the transaction took place. So maybe we would argue for the historical right there. And then we have the average rate for the period, generally a simple average for a period of time, usually the exchange rate used to measure revenues and expenses.