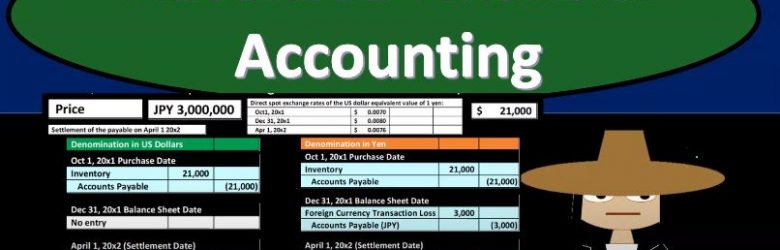

Advanced financial accounting PowerPoint presentation. In this presentation, we will discuss foreign currency transactions get ready to account with advanced financial accounting, foreign currency transactions. So remember when we’re thinking about foreign currency transactions, we’re thinking about them from the perspective of the US company in US dollar. So we’re have our currency that we’re making our financial statements in, we’re measuring all the stuff on our financial statements with the measuring tool that we need to be using, that’s going to be the US dollar, that’s going to be our standardization. And then anytime we have foreign currency transactions with something other than US dollars, then we want to see them from that perspective, right? Because when we put them on our financial statements, just like anything else, just like inventory, if we were to value units of inventory, or to value stocks and whatnot, we need to value them in terms of our measure into a which of course is the US dollar.

Foreign Currency Exchange Rates

Advanced financial accounting PowerPoint presentation. In this presentation, we’re going to discuss foreign currency exchange rates get ready to account with advanced financial accounting, foreign currency exchange rates, let’s first define foreign currency transactions. So what are from foreign currency transactions? When are we going to need to account for foreign currency transactions. So from our perspective, we’re going to be looking at this from the perspective of a US company US company that is having their books then accounted for or measured in dollars. And when you think about the foreign currency transaction, it’s just like anything else, but it can be a little bit more confusing. So you want to remember, of course, that the dollar is basically the measuring tool.

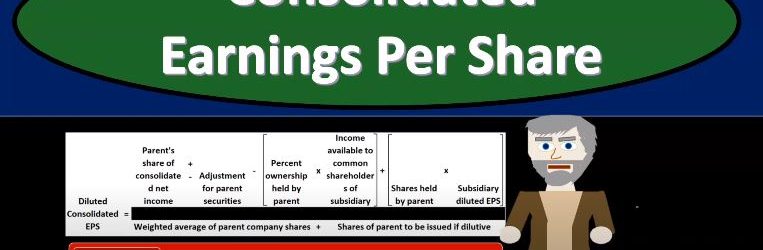

Consolidated Earnings Per Share

Advanced financial accounting PowerPoint presentation. In this presentation we will discuss consolidated earnings per share, get ready to account with advanced financial accounting, consolidated earnings per share, how do we calculate the earnings per share for a consolidated entity, the basic calculation for the earnings per share will in essence be the same as for a single Corporation. So there’s not too much difference between the consolidated earnings per share calculations and the basic earnings per share for one entity one Corporation. So the basic earnings per share is is computed by deducting income to the non controlling interest and any preferred dividend requirement of the parent from the consolidated net income. So we’re going to take the net income and then we’re going to deduct income to the non controlling the non controlling interest and any preferred dividend requirement. In other words, we’re going to take the consolidated net income and then remove or deduct income to the non controlling interest and and in preferred dividend requirement, then we’re going to take that number, the amount resulting is divided by the weighted average number of the parents common shares outstanding during the period covered. So it’s a pretty straightforward calculation for the basic earnings per share, we do have practice problems on it. However, if you want to brush up on calculating the basic earnings per share, we have that there. diluted consolidated earnings per share is going to be a more complex calculation.

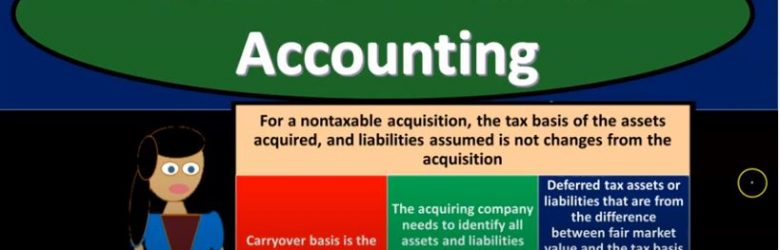

Consolidation & Income Taxes

Advanced financial accounting PowerPoint presentation. In this presentation we’ll talk about consolidation and income taxes get ready to account with advanced financial accounting. For a non taxable acquisition, the tax basis of assets acquired and liabilities assumed is not changed from the acquisition. In this case, then the carrying basis is the acquire ease basis, the acquiring company needs to identify all assets and liabilities acquired and their fair market value when the acquisition takes place, and then the deferred tax assets or liabilities that are from the difference between the fair market value and the tax basis when allocating the purchase price must be recorded by the acquiring company. So we have the tax expense allocation. When consolidated return is filed. What are we going to do with this tax expense allocation, the parent company and subsidiaries can file a consolidated income tax return or they can choose to file separate returns. So this is one of the things that we kind of have to consider here we’ve got a controlling interest that’s going to be involved. So we have two entities, one has a controlling interest and the other obviously parents subsidiary type of relationship question, then should we report just one tax return? Or should we have two tax returns, this is going to be a decision that needs to be made. But if we file one tax return, then at least 80% of its stock must be held by the parent company or another company included in the consolidation return for a subsidiary to be eligible to be included in a consolidated tax return.

Consolidation – Interim Acquisition

Advanced financial accounting PowerPoint presentation. In this presentation we will discuss consolidation and interim acquisition. In other words, we have a parent subsidiary relationship that parent owning a controlling interest over 51%. However, that controlling interest took place for a purchase of the common stock of the subsidiary that happened in the middle of the year. So prior to this, we’ve been talking about situations where we are doing consolidations for an entire year. And you may have question probably popped up in your head at some point in time as well what would happen if the purchase took place in the middle of the year now we have that mid year kind of purchase worse, especially concerned with that first year where the consolidation didn’t really happen. I mean, there wasn’t a consolidated ownership until sometime in the middle of the year, get ready to account with advanced financial accounting. So we’re talking about a situation where we have a consolidation but the consolidation happened in the middle of the years. We’re thinking about that first year, primarily What would happen? Well, if the consolidation didn’t take place in January in other words, the parent didn’t purchase the controlling interest in the subsidiary at the beginning of the year but happened at some point in the middle of the year what’s going to be the impact on the year in consolidation, which typically happens for the entire year? Well, the subsidiary is seen as being part of the consolidated entity from the time the stock is acquired, even if acquired in the middle of the year.

Consolidated Statement of Cash Flows

Advanced financial accounting PowerPoint presentation. In this presentation we will discuss consolidated Statement of Cash Flows get ready to account with advanced financial accounting, consolidated statement of cash flows. So the consolidated Statement of Cash Flows we have a parent subsidiary relationship parent owning over 51% of the subsidiary therefore, we have the consolidated financial statements which of course includes the consolidated statement of cash flows. So, when we think about the consolidated statement of cash flows, we’re basically thinking about those areas where the cash flow statement will be different from a normal cash flow statement, which is one company or one business if you want to learn more about the cash flow statement, and I do recommend looking more into the cash flow statement because it’s one area where even in public accounting, oftentimes people don’t have as good a grasp on it as they could and some people are really good at reading it but don’t really understand as much of how to put it together in a room. systematic way even if there’s going to be, or especially when there’s going to be complexities to it. So we do have a course on the statement of cash flows, which we believe puts together a nice, simple, simple way in a systematic way to go through putting the statement of cash flows in such a way that, that you can do it in a step by step process. And then if you make an error, you can go back and you should be able to find that error easily and not have to kind of start the whole thing over again.

Consolidation & Subsidiary Stock Dividends

Advanced financial accounting PowerPoint presentation. In this presentation we will discuss the consolidation process and a situation where the subsidiary issues stock dividends we have stock default dividends issued by the subsidiary what will be the effect on the consolidation process get ready to account with advanced financial accounting. We’re talking about a consolidation process where the subsidiary then issued stock dividends. So we have stock dividends are issued to all common stockholders proportionally, therefore, the relative interest of the controlling and non controlling stockholders is not changed. So that relative interest isn’t changed, so we don’t have to worry about that which is nice. The carrying amount on the parents books is also not changed. So we’re not going to have to change anything on the books of the parent with basically an adjustment to the investment account using you know, typically the equity method, which is nice stockholders equity accounts for the subsidiary do change. So we do have a change to the stock There’s equity on the subsidiary, but total stockholders equity does not. So in other words, if we take stockholders equity as a whole, there’s no change there, even though there’s changes within the stockholders equity of the subsidiary. So we’re here we’re going to say this stock dividends represent a permanent capitalization of retained earnings. That’s basically what is happening, permanent capitalization of the retained earnings.

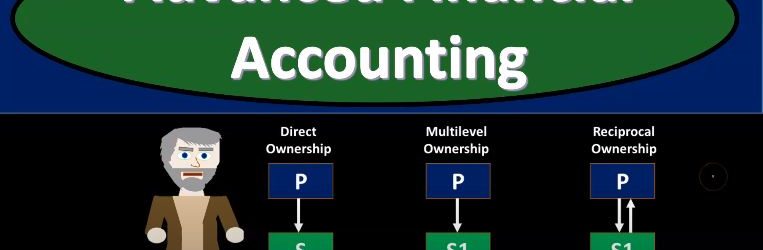

Consolidation When there is Complex Ownership Structure

Advanced financial accounting PowerPoint presentation. In this presentation we’re going to discuss a consolidation that when there is a complex ownership structure, so more complex ownership structure comparing the direct ownership, which is what we’ve normally been dealing with, with structures such as multi level ownership and reciprocal ownership, get ready to account with advanced financial accounting. Normally, when we think about our consolidation structure, we’re dealing with a direct ownership situation which looks like this direct ownership type of situation, it gets more complex. Of course, if we have more complex type of ownership structures, such as a multiple multi level ownership structure where we have a parent owning a subsidiary, that basically we have an indirect ownership, let’s say in another subsidiaries, that’s going to be more complex for us to deal with or if we have a situation where we have reciprocal ownership, where the parent has ownership a controlling interest in s, but as also has some ownership in p, right. We’ve been dealing with basically P parent company owning portion of S. So if we talk about direct ownership we’re talking about the parent has, as has controlling interest in every subsidiary. So that’s going to be of course, this situation.

Subsidiary Purchases Shares from Parent

Advanced financial accounting PowerPoint presentation. In this presentation we will discuss a consolidation process where we have a subsidiary that purchases shares from the parent. So what’s going to be the effect on the consolidation process? When we have a subsidiary that purchases shares from a parent get ready to account with advanced financial accounting. We are talking about a situation here where this subsidiary is purchasing shares from the parent what’s the effect on the consolidation process? In the past, the parent has often recognized a gain or loss on the difference between the selling price and the change in the carrying amount of its investment. So in the past, it’s often been recorded as a gain or loss on parent companies that difference as a gain or loss on the parent company’s income statement.

Subsidiary Sells Additional Shares to Parent

Advanced financial accounting PowerPoint presentation in this presentation will discuss a consolidation process where we have a parent subsidiary relationship and the subsidiary sells additional shares to the parent. So we have a situation where we have the subsidiary selling additional shares to the parent, what’s going to be the effect on the Consolidated Financial Statements get ready to account with advanced financial accounting. We’re talking about a situation here where the subsidiary is going to sell additional shares to the parent and the price is going to be equal to the book value of the existing shares. In that case, it’s going to increase the parents ownership percent, because the parent now has more stocks and no one else got more stocks. Therefore, their percent ownership is increasing. The increase in the parents investment accounts will equal the increase in the stockholders equity of the subsidiary the book value of the non controlling interest is not changed and the normal consolidation entries will be made based on the parents and new ownership percent. So obviously when we do The consolidation entries, we’re going to be basing them on the new ownership percent, that’s going to be the more simple kind of situation where we have the price equal to the book value. What if there’s a sale of additional shares to the parent at an amount of different than the book value, so we still have shares going from the subsidiary to the parent, but now the amount is different than the book value. This increases the carrying amount of the parents investment by the fair value of the consideration. So in other words, the carrying amount of the parents investment in the subsidiary is going to go up by that what was paid for it that consideration given whether that be cash at the fair value of something other than cash. At consolidation, the amount of a non controlling interest needs to be adjusted to reflect the change in its interest in the subsidiary.