Advanced financial accounting. In this presentation we will discuss push down accounting as it relates to parent subsidiary relationships controlling interest interest over 51%, where we have consolidation accounting taking place, we’re going to be applying pushdown accounting to it, get ready to account with advanced financial accounting. So the concept of pushdown accounting will take place when we have the parent subsidiary type of relationship and we have a situation where the purchase price when the parent purchased the subsidiary, the purchase price was more than the book value of the subsidiary, which could complicate of course the consolidation process as we’ve talked about in prior presentations. So we have a couple different options that we could do.

We could say, Okay, let’s do push down accounting. And you can imagine a situation for example, where let’s say the parent purchase 100% of the stock of the subsidiary, and we talked about some of the complications that would be involved in in the consolidation. process because we basically want to revalue during the consolidation process. Well, you could say, Well, hey, why doesn’t the parent and that situation simply make the subsidiary revalue to fair market value? That would be the you know, that would make the consolidation process the easy thing to do. And that would be basically the pushdown accounting. So pushdown accounting would say, hey, look, there’s a controlling interest now or the parent, let’s imagine a situation where we have 100% control parent owning the subsidiary in that case. And if we have to do this kind of consolidation thing, every time we do we do the consolidation financial statements, then why don’t we just revalue once and for all the valuations on the subsidiary. And then when we do the consolidation, it’ll be easier. So that’ll be kind of like the concept of pushdown accounting or we do the non pushdown accounting, where I account for the added value separately. In other words, what would happen there is the parents would make the purchase as we talked about in the past, put it on the books and the equity method based on the fair value. value. The subsidiary would be just moving along just like they normally would, because there’s been no real change to the chart of accounts on the subsidiary, we haven’t revalued anything because the thing that was purchased was the stocks, right? And so the book, the subsidiary books will be pushing forward. And then we’d have to make those adjustments for it during the consolidation process, and whatnot. So pushdown accounting, adjust subsidiary assets and liability accounts to fair value based on the acquisition price. So this would make sense again, if you think about a full purchase, it would it would be the easiest to see right? If you say, Okay, now we saved the parent company purchased 100% of the stocks of the subsidiary for a price higher than the book value. Why don’t we just revalue the book value based on that, you know, kind of fair market transaction at that point, making the consolidation easier, so we don’t have to make kind of an adjustment every time we make the consolidation. Because note, when we do the consolidation entries, we can make the adjustments they’re not too difficult. But remember, the consolidation adjustments don’t actually get like, unlike adjusting entries, which are done at the end of the period, they are actually recorded typically or revert or they’re recorded and then reversed maybe, but they’re typically recorded or included in the books. You know, once you make the adjusting entries at the year end period adjusting entries, these are similar you can think of it as a similar process, we did the adjusting entries for we’re going to think of the process as being will do the adjusting entries for p parents adjusting entries for S will have the trial balances which would be the in books, we will then consolidate them together and you can then think of these these elimination or consolidation entries, kind of like more adjusting entries right, where you’re adjusting now the consolidated entity to what they need to be so that we can make the financial statements from that consolidated information. However, unlike adjusting entries, these adjustments aren’t recorded on either p or SS books.

03:55

Therefore, we have to repeat them. You know every time we do the consolidation process and account for anything Kind of adjustments as we go. So that can be, you know, somewhat tedious, it would be nice if we can eliminate, you know, make that process easier. And the pushdown accounting has potential to do so record goodwill on the books of the subsidiary. So if we were to do that, you would think okay, how would we do that logistically? Well, we do the same kind of calculation, we thought about when we think about the calculation price, the price that P paid for the stocks of s, and we would apply it out to the book value to the readjustment to the fair value of the assets and liabilities, and the difference would be going to Goodwill. And then you would think you would just record those on SS books, including the including the goodwill at that point in time, because it’s been recognized due to basically a market transaction, and then record the recapture capital for the difference. So then you might ask, well, where would the other side go? Right? You’d be revaluing things, meaning you’d be debiting if you were increasing assets debiting if you’re increasing the goodwill, where’s the credit going to go on SS books. It should Go to capital somewhere because it’s part of equity. And so it’s not retained earnings. It’s not really you know, no more stock was issued. So, they got the capital account called revaluation capital. So, we call it revaluation capital which means just what it would expect, meaning the net value assets minus liabilities have now been revalued due to basically a purchase in essence taking place, which you know kind of reveals the the goodwill that is there and the real market value that we have now identified based on market transaction, the net assets then being changed the equity section in other words with this equity account, revaluation of capital, non pushdown accounting is the case that we’ve been talking about where we have the two individuals p would be recording their investment on the fair value, the purchase price of the stock, that would be the parent and the subsidiary would do nothing, right.

05:56

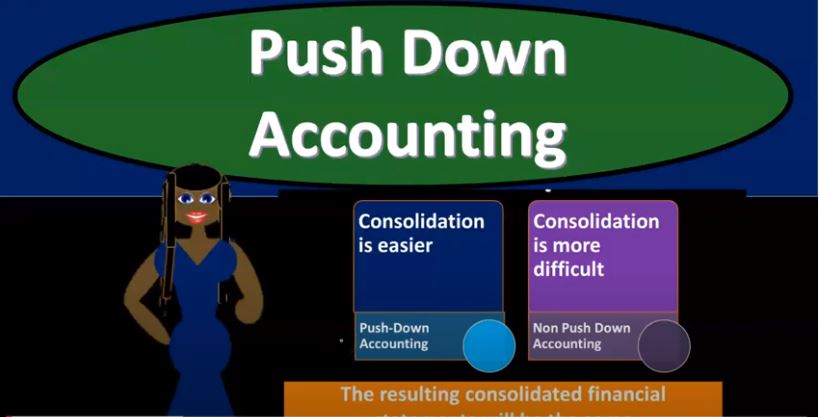

They would just keep their books and just keep going forward, you know, as they would and then you’d have to take care of this. So you’d have no adjustment to the subsidiary, then the subsidiary would just be marching along like they normally do, the only thing that has changed is the ownership the stock who owns the stock, and then you got to make the fair value adjustments and record goodwill in the in the cancellation process for In other words, you would then have to every time you do the consolidation, financials, combined p parent and subsidiary together. And when you do that, remember, you’re really looking like the people that are interested, the investors, they’re the people using the financial statements interested in the consolidated financial statements will have an interest in the parent, right that because they’re usually going to be the parent shareholders or the creditors of the parent. So that means within the consolidation, it would make sense that you’re that then you would want to consolidate and make this thing to be adjusted to what the parent is recording this thing at, which is basically a fair value. So that means every time you do the consolidation, you’d have to take the subsidiaries books, which is Still marching along at book value and revalue it to that point in time that the actual purchase took place. Every time you do the consolidation options when parent pays more than book value of the subsidiaries net assets, so more than the book value, and this is typically going to be the case, right where if you have the parent is paying for the stocks of the subsidiary getting a controlling interest, and let’s say they buy 100% again, and they pay more than the book value the net assets, that’s typically, you know, that’s typically going to be the case either due to the revaluation of the net assets being higher and or goodwill being involved. So we have the push down accounting, where we have the consolidation process is a lot easier. That’s the point.

07:47

So we can either say, if we can do push down accounting, we could say okay, let’s do push down accounting. Let’s fix the either books or just the books of the subsidiary, even though nothing has changed. Other than the only Ownership of them, we’re going to adjust the books. Why? Because it’s going to make the consolidation process a lot easier to do. And then non push down again, accounting, in general will be kind of what you would almost expect to happen to the subsidiary because again, nothing has changed really there, you know, just the stock was purchased. So you would think the books would just keep rolling on forward, that would be a kind of a normal process, but it makes the consolidation more difficult. Because within the consolidation rules, you typically need to revalue during the consolidation process, and that’s typically going to be more difficult. So if you can’t apply pushdown accounting, usually once supplied, that would be good going forward because if you could do that, then the consolidation of that you’re going to be doing going forward should be easier to do. Note that the resulting consolidated financial statements will be the same. So if you look at the end result of the consolidated financial statements, they’ll be the same. What will differ is is the books of s right the books of S will now have been changed. So when they so to basically a fair value, we’ll see you’ll see that change happening there, but the end result for the consolidation will be the same. Hopefully the idea of the pushdown accounting is that the main focus is on the consolidated financial statements and not necessarily as much on the individual, although there is focus on the individuals as well, especially for if there’s a non majority interest. But considering that then you would think this pushdown accounting would be easier, given the fact that the consolidation process will hopefully be easier both methods showing or resulting in the same result for the consolidated financial statements.