In this presentation, we will take a look at the sales journal for a service company. We’ll use the sales journal in a manual system or a system we do by hand. When we make sales. However, it’s a little bit more complicated than that because if sales journal really means sales that we make on account, meaning we’re not receiving cash at the point in time we make the sale. If we do receive cash at the point in time we make sale even though we have sales being recorded or revenue accounts being recorded. It should be going into the cash receipts journal, because that’s the journal we use whenever we get cash. So the better term for this journal may be something like accounts receivable, or more specifically, sales made on accounts or sales and accounts receivable, but it’s typically called the sales journal. So don’t let that confuse you.

00:49

Make sure that if a sale happens for cash, we don’t record it to the sales journal but recorded to the proper journal the cash receipts journal and this journal then is the most specific are pretty much the most specific type of journal we have meaning, we really can do this with just one column because it is so specific, it’s when we make a sale on account. And we will use this one column to record both sides of the transaction, a debit to accounts receivable and a credit to sales. In our case, it’s going to be revenue or income, we’re going to keep the term sales because that’s just the typical term used when having a sales journal. This is going to be very useful, because it will save time when recording a lot of sales. If we’re in a company that has a lot of sales during the day, but we don’t have an automated system, then recording the sales journal will allow us to do this very quickly throughout the day and then sum them up at the end of the day. If we do have an automated system, it’s still useful to know what the sales journal does for a few different reasons.

01:50

One, it’s good to be able to know what the sales journal will look like so that we can generate those reports when we are using automated system. In other words, we may want a report in an automated system similar to a sales journal. Another reason is just that we want or the second reason is that we want to see how different accounting systems will work so that we know the similarities and the differences. We know what needs to be in place and what can be adjusted, that then helps us to understand any system. So if we look at the sales journal, we’re going to have the sales journal First, we’re going to record all the sales throughout the time period, then we will sum those up and make one general journal entry of that being the component that saves time instead. In other words of having a separate journal entry for each transaction within the sales journal. We will record one transaction at the end of the time period.

02:45

At the end of in our case, the month, the time period could be a week or a day. In our case it will be for a month, then we’re going to take that general journal we’ll post it to the general ledger. Use that General Ledger then to create subsidiary ledger as well. Note that the subsidiary ledger is going to be something that will be breaking out the accounts receivable the account we will be dealing with, often with the sales journal every time with the sales journal. And that shows us how much people owe us how much people owe us or customers owe us. We need to say that not just by the total, but also by who owes us the money. And that will be done here in the subsidiary ledger. And that’s why it’s needed along with the general ledger. Then we’ll have the trial balance and we’ll take the the general ledger and generate the trial balance with it. So let’s look take a look at some transactions. We’re going to say first, we had the sales and the sales are all going to be the same.

03:42

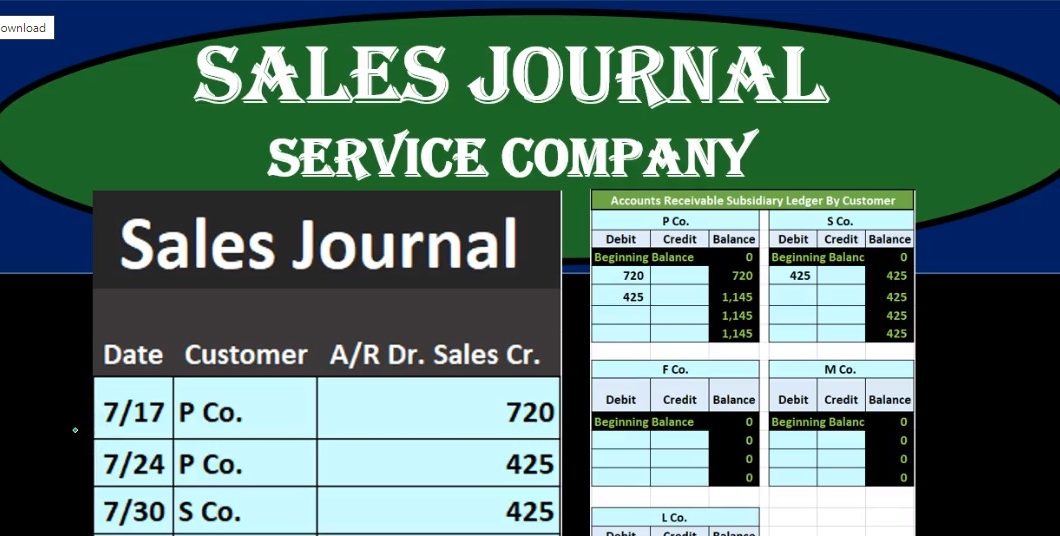

We’ll just list these out here. So on 717 p company made a sale 720. And you can kind of imagine just writing these out, this would just be if we were doing a manual system and we were making sales throughout the day. We will just be writing this out in our sales journal. And this one number then recording For Sale for in this case the service company therefore not having to deal with the inventory items just increase in accounts receivable and increasing sales, the revenue account the income account being sales, then we’re going to record this as we go to the accounts receivable subsidiary ledger, note we are not doing is recording this to the general ledger or making a general journal entry. We will do that at the end of the time period when we sum everything up and then record one general journal and record that then to the general ledger, where we are going to record it to the subsidiary ledger recording who owes us the money as we go because we need to know more than just what is owed to us. We need to know who owes us the money so that we can then collect on it.

04:43

So we’re going to give this 722 p company. Here’s the subsidiary ledger, these are our customers not very imaginative names, but those are the customers that we are going to receive money from 720 at this point, this will not match at this time. What’s on the agenda. ledger or trial balance, not until we finished the process, add everything up, do the Indian journal entry and record it to the general ledger. Next, we’re going to say that we have the same process on 724. And again, we’ll just list these out. So this is going to be P company as well for 425. So 425 for p company made another sale, this is just going to be the normal process. We’re just going to make sales as we go recording those sales in the accounts receivable ledger and then posting them not to the general ledger, but to the subsidiary ledger as we go, in this case, the 425 here, we’re just getting this going to be the same transactions every time we have the sales journal 730 no variation here except for the company that customers we have as company this time. And we’re going to say that we sold 425 to s company, then we’ll just record that for 25.

05:55

Once again to the subsidiary ledger, not to the general ledger, not to the ends. So we’re going to record that to the subsidiary ledger. This is going to be the normal transactions note that if anything varies if anything is different than a sale on account a sale other than just debiting accounts receivable and crediting sales, it will not go in the sales journal, most likely the ones most similar to that which we would think would go here would be a sale made for cash because that would be what sales right? But not a sale on account. Therefore not going into the sales journal which really is an accounts receivable type journal, the sales on account type journal. So next we’re going to have on 730 another one m company we made a sale and we’re gonna say that was for 500 that we made this sale for, then we’re just gonna sum this up. So all these transactions all the same type of transactions. If we sum up the entire sales journal 720 plus 425 plus 425 plus two 500 gives us the 2017.

06:54

We also want to record this 502 m company in the subsidiary ledger once again, not too The general ledger we are recording to the subsidiary ledger. Now note that this sales journal can be very long depending on the type of company that we have. We just have a few transactions here to demonstrate the process. We might be doing this even on a daily basis or weekly basis and have a lot of sales depending on the type of company this then saving a lot of time when that is the case. Next, we’re going to take this entry and just make our journal entry we’re going to debit the accounts receivable and credit sales. So that’s going to be our journal entry here we’re going to put that in the general journal. We’ll just debit accounts receivable for the total amount of it and credit sales. Now in our case, we’re dealing with a service company, we still call it a sales journal because that’s the typical name for it.

07:44

But when we put it to the general ledger, we’re probably going to call it something like revenue or income or fees earned when talking about a service company. We will talk about a company that deals with inventory where the typical term will be sales for the revenue and income account. Note that it House receivable has a debit balance, we’re increasing it by doing the same thing to it another debit because this represents the money owed to us by customers, then we credit the revenue account because revenue has a credit balance, it typically only goes up in the credit direction, therefore we do the same thing to it. Another credit will then make the general journal the general ledger. So here’s the accounts receivable being debited accounts receivable general ledger account going from zero up by that debit of 2070 to 2070, then we’ve got the credit here in revenue, here’s our revenue, General Ledger going from zero up by 2070 credit amount to that 2070 then we’re going to use this of course to help generate the trial balance.

08:43

So our trial balance we’ve got 2017 here in the accounts receivable matching up to the 2070 on the trial balance 2017 revenue matching up to the 2017 on the trial balance. We can see that the total here then being that 2070 representing just the net income Come here, while the total here being meaning that the debits equal the credits, and we just have the 2017 at this time in the net income of revenue minus expenses this be an income, not a loss