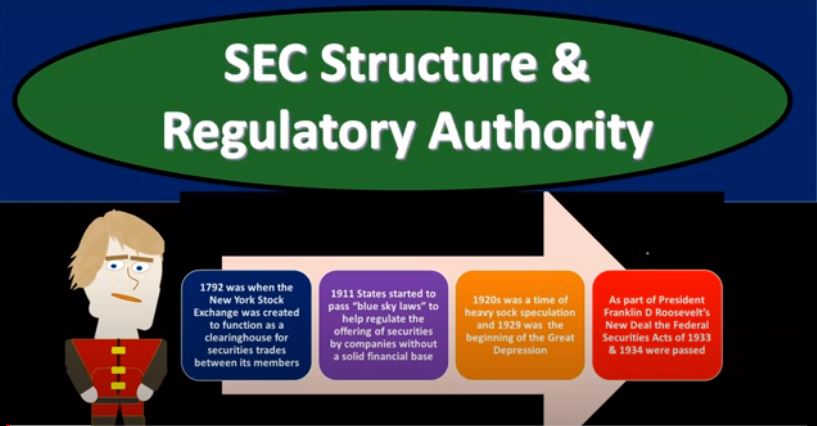

Advanced financial accounting PowerPoint presentation. In this presentation we will discuss sec structure and Regulatory Authority get ready to account with advanced financial accounting in sec structure and regulatory authority, Securities and Exchange Commission the SEC What is it? It’s an independent federal agency It was created in 1934. It’s going to regulate and it does regulate the securities markets, the SEC helps maintain an effective marketplace for companies issuing securities and for investors seeking capital investments. Now we’ll take a look at a brief history of leading up to the creation of the SEC and a little bit about the SEC itself. So if we have an understanding of the history, then it gives us a little bit better of an understanding of why the SEC does what it does today and how it how it was created or came to be. So in 1792, was when the New York Stock Exchange was created to function as a clearing house. For the securities trades between its invit its investors. So now we have the New York Stock Exchange that will function as the clearing house. But then in 1911, states started to pass, quote, blue sky laws in quotes to help regulate the offerings of securities by companies without a solid financial base. So in other words, they saw a need for regulation, now that you have the securities that are on the New York Stock Exchange and can then be offered basically, to more to the public, more people will have access to purchasing them and putting capital into the market, then there’s a lack of transparency, the people that are putting money in maybe doing it solely on speculation, and we don’t have the information to really support the claims possibly that could be made by the stocks that are that are being traded and therefore, you could have situations and did have situations where you had stocks that had no supporting you know, value or very little supporting value to them.

01:54

That could be you know, traded on even you know, without lack of information. So, you would think then the idea would be, well, if you’re going to have stocks that you’re going to be issuing, you know more on a public basis on an exchange offering to a wider swath of the public, then you should have some responsibility to be more transparent about what it is you are offering. And so that you could see a trend towards that in the 1920s was a time of heavy stock speculation and 1929 was the beginning of the Great Depression. So we had the roaring 20s. And then, of course, the Great Depression in 1929, which which lasted for, you know, 10 years or so. Right. So then we got the roaring 20s within the roaring 20s, the stock market was going in there in that time period as well. And there’s a lot of speculation that was taking place at that time, meaning people might would often do things like taking large loans out possibly, and then putting it into speculative stocks, which works as long as the stock market goes up. But if there is a crash in the stock market, then then that becomes a A huge, you know, huge problem because they’re going to be overly leveraged. So that’s going to be part of the things that took. And then in the 1920s, in 1929, there was an economic downturn, and there’s a ton of different effects that you can think about why that happened. But obviously, the stock market went down with all that happening as well. And that would drove a need for more or maybe not a need as much as a gut reaction, a human reaction that needs we had means we have to do something do do do something. Right. And so that’s going to lead to more looking for regulations that could possibly stop a future occurrence of a similar factor. So as part of the President Franklin D. Roosevelt’s New Deal, the Federal Securities Act of 1933 and 1934, were then passed. So the Securities Act of 1933 regulated the initial distribution of security, requiring companies to make full and fair disclosures. Oh, their financial affairs

04:01

prior to their securities being offered to the public public. And you would think that would be reasonable. Because again, if you’re looking at it from an economic standpoint, you want the two people that are involved in a trade, to have transparent information, the more the more information they know about the trade, the more likely you’re going to have two people come together and make a mutually good trade, which is what we would want from a market standpoint to increase basically market productivity. And to that point, up until that point, you could have misinformation and the misinformation is ultimately what any misinformation ultimately leads to less trade, because people lose trust, and therefore they don’t have an optimal market situation. So you would think if you want to put your put your stocks out there to be traded to the public, then you have to be transparent about what it is you’re selling. And if you are then you can have great benefits on that. And that’s one of the huge that was a that is a huge leading factor as to why one reason a lot of couples comes into the US it’s not it’s not just due to the fact that we have growth potential. Because third world countries have more growth potential than us, they could rise higher given the fact that they’re not being efficient with their, with their resources, possibly, but it’s because they trust, you know, the, the, what they’re putting their money into, they have faith, more faith than a lot of other places in the world. And that’s, that draws a lot of capital, even though even though the potential for huge gains might not be there as much as other areas. So that’s a huge thing. And then, the Securities Exchange Act of 1934 required companies whose stocks were traded on a stock exchange to update their financial information periodically, creating the Securities and Exchange Commission assigned the responsibility of administering both the 1933 and the 1934 x. So there’s where we got these acts coming into place. We got to see some regulation for the acts that are taking into place there. We have now, the SEC put put Then to its responsibilities, then we have the SEC has the responsibility to regulate trades of securities and to determine the types of financial disclosures that a publicly held company must make. So they’re looking for that information they’re trying to make they’re trying to make this. What they want to do is, you know, one of the goals you’re looking for on the exchange is to make that transparent situation you want to you want to make it so that people want to be able to trade they can have access to capital, and you want the people that have capital to want to do business on the exchange, how do you do that transparency, transparency, so that people can see what what they’re doing and then make make the decisions that they that they want based on adequate information to do so.

06:44

So the more you can do that, from them, the more likely on a long term basis, you’re going to be drawing more capital than other people that might make short term profits through deceit or something like that, you know, more likely if you can build the trust on a long term basis. you’ll draw more in and that’s generally part of the goal here. So the SEC rule is to ensure full and fair disclosure, the SEC does not guarantee the investment merits of any security. So notice what the, the SEC is not doing, they’re not going in and saying, we’re only going to allow securities that we think are passing, you know, this merit threat we’re gonna say these these are only going to earn you money if you put capital into them. That’s not the SEC is not trying to guarantee that you’re not gonna have a loss or anything like that. If you put capital into the into the exchange, what they what they’re trying to do is say, hey, look, if this person this is these people have to disclose what it is that they’re putting out there for you to be investing in. And that should that disclosure should be well known both sides of a trade, then it’s an A and B situation A and B trade. sec, as the third party is simply looking or the ideas that they’re simply looking to make sure that all the the trade is transparent, the information relevant The trade is is there for both parties so both parties can go into a trade that’s most beneficial for themselves. So, Securities Act release number three, three dash 879 financial statements from foreign private issuers will be accepted by the SEC without record reconciliation to us generally accepted accounting principles gap if they are prepared using IFRS as issued by the iasb.

08:33

So this is going to this this aim towards the fact that we could have different financial standards for the world and for us in particular, we’re trying to basically go towards having a same set of financial standards. So it’s going to be easier for people to to, to work to put their to put their information out there if you have different sets of standards and people have to learn different sets of standards and if you’re going to be If it’s working in different countries, then you could find yourself subject to making financial statements that are going to be in alignment with different sets of standards. So there’s been moves, then by the SEC, to try to consolidate the standards or accept standards so that we can move towards, you know, a consolidation of world standards that are similar, obviously, that when you think of standards that are going to be worldwide standards, there’s, it would be great if you had one set of standards, because then that would make it more comparable between different different countries and whatnot. So that would make it a lot easier. But then you also, of course, have the question of well, who’s in charge of those standards? And, you know, if you make the standards one way versus another way, does it benefit a certain part of the world versus another part of the world and whatnot. So there’s all a whole bunch of concerns in terms of who’s going to have control of any one particular standard. So there’s, there are pros and cons. through it. But the clear pro of having one set of standards would be that, you know, you wouldn’t have there’d be more transparency, there would be more compatibility. And you wouldn’t have companies that would need to be making two sets of books using two different standards and whatnot. So we have the Securities Act release 33 dash 831. If us issuers are allowed to use IFRS is in their filings with the SEC multinational US companies operating in several countries could use just one set of accounting, financial reporting standards for all their global operations. So that would be a huge benefit. That would save a lot of money. But again, getting there isn’t as easy as you would think. Because again, someone has control now it’s centralized, we have basically centralized in some way, you know, the standards themselves, which is a little, a little scary, because if they were then going to skew, you know, it’s all in one place, but any case, then the interview International Accounting Standards Board the iasb. And the Financial Accounting Standards Board The faz be they’ve been worked work has been done attempting to move toward a uniform set of accounting and financial reporting standards that could be used by all companies seeking financing through any of the world’s major stock markets.

11:19

So these are the two the International Accounting Standards Board the iasb and the Financial Accounting Standards boards, the FA SB were working together to basically line up their accounting standards for the most part and they were working towards that it was moving along, but then it seems to have slowed down. So, so the goal has yet to be achieved at this point in time. So the SEC organizational structure. So the organizational structure of the SEC division and Corporation Finance develops and administers the disclosure requirements for the Securities Act reviews, re registration statements and other issue oriented discussion. measures, we have the Division of Enforcement enforcement action direction. We have the Division of Investment Management charged with regulating investment in advisors and investment companies. We have the division of economic and risk analysis combines financial economic data and now analytics into core missions of the SEC and the Division of Trading and Markets in charge of regulating national securities exchanges, brokers and dealers of securities. here’s just some of the laws some of the major laws administered by the Securities Exchange Act, the SEC that you might recognize at least some of these, we have the jumpstart our business startup JOBS Act of 2012. We’ve got the Dodd Frank Wall Street Reform and Consumer Protection Act of 2010. We have the Sarbanes Oxley act of 2002 securities Investor Protection Act of 1972. The investment advisor act of 1940, the Investment Company Act 1940, and the trust indenture act of 1939 Securities and Exchange the SEC a regulatory structure. We have accounting and auditing enforcement releases a Rs. These present the result of enforcement action taken against accountants, brokers and other participants in the filing process. We have the staff accounting bulletin bulletins, as a BS permits the commission staff to make announcements on technical issues that it is concerned with as a result of reviews of the SEC filings