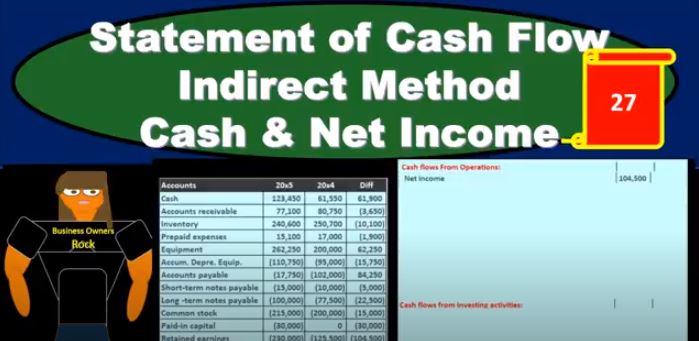

This presentation, we will start to construct the statement of cash flows using the indirect method focusing in on cash and net income. This is going to be the resources we will have, we’ll have that comparative balance sheet, the income statement, and we’re gonna have some added information. In order to construct the statement of cash flows, we’re mainly going to be working with a worksheet that we’ve put together from a comparative balance sheet. That’s where we will start. So we’re going to find a home, this is going to be our worksheet. We have the two periods. So we have the current year, we’ve got the prior year, and we’ve got the difference between those activities. Now our goal here is to basically just find a home for every component on this difference section. So that’s going to be our home. Why? Well, we can first start thinking about cash. What are we going to do with cash? That’s the main thing. This is a statement of cash flows here. So where are we going to put cash? that’s actually going to start at the bottom, we’re going to say that’s going to be our in numbers. In number we know it’s going to be cached. Now, we’re going to recalculate it. But it’s useful for us to just know and we might just want to put there, hey, that’s where we’re going to end up. That’s where we are looking to get. And now what we really want is the change.

01:14

However, the difference is 61 900, because that’s the activity. That’s what’s happening over time. So we can we get there with the statement of cash flows by basically having the increase in cash with an increase or decrease whatever it happens to be, it happens to be an increase for this activity because cash went up, but it could be a decrease, but whatever it will be, we have here, that’s the change we’re looking for. Now, this would be all we would really need to tie out to our worksheet. But, of course, we want to tie it out to the balance sheet, we want the statement of cash flows to tie out to the balance sheet. So that’s why these last two numbers on the statement of cash flows are really just to kind of get us to the balance sheet number so that we don’t have to like tie out this change to the change in the comparative Balance Sheet, like we could stop here and provide comparative balance sheet and people would have to know the tie out to make sure everything works, they could take the difference between cash and see that this is the change in cash. But it’s easier for us to show everybody that it works by having the ending cash at the end of the current year.

02:20

So to do that, we’re going to take the change. And then we’re going to we’re going to add to it, the beginning cash to get the cash at the end of the year. This is the amount on the balance sheet. But this is really the amount of change that we’re looking for here. That’s going to give us the activity. Now that of course is represented here on our differences within our worksheet, that’s going to be our major difference. Now we’re going to calculate it not by just taking this difference here as we did here, we just took that difference and said that’s where we want to end up. But we’re going to do that by taking every other place and finding a home port. So we’re going to recalculate this number, but it’s useful to see where we start. So notice What we did in this worksheet, we’re taking each account. And we have like basically a post closing trial balance for the current period and the prior period. And then we took the difference between each of them. And we could see that it’s in a debit and credit type format. And the debits equal the credits represented by this green zero, meaning debits minus the credits equals zero. That’s what this means here. And therefore, if we find a home for everything except the cash difference, then we’ll end up with the cash difference.

03:34

So that’s going to be what we are looking for him, that’ll be the end point, this 61,900. So we will recalculate that by finding a home for everything else. Now the place where we start to do that is going to be the change typically in that in retained earnings, which we call net income. that’s usually where we start an if statement of cash flows. Now there’s there’s a couple different ways we could do this. We could just go line line and say where does each Where do each of these belong? Or we can try to do what typically most people do is really start with the cash flow from operating, and then go down from there. So that’s what we will start with here, we’re gonna say the net income, then is typically going to be this change in retained earnings. Now, note that this isn’t quite right, and we’re going to recognize that right now we’re going to say that doesn’t happen to equal, what net income is this change in retained earnings doesn’t equal what net income is, but it’s part of it. And I’m going to argue that the goal right now is going to be for us to go through this entire thing and find a home for all of these changes. without breaking them up, there’s going to be added information that we know that happens to deal with dividends here that’s going to be broken out. So that’s why this doesn’t exactly equal net income.

04:49

But rather than getting all complicated and starting to break all these out into multiple components of this change, it’s easier for us to find a home For all of these changes, first, get to the correct number 61,900 the change in cash after finding a home for all of these numbers, and then go back and say, okay, are any of these numbers? Do we have to break it out and give us more detail? So what we’re going to do is actually start here with 104 thousand 500, recognizing that that’s not net income, but that we’ll have to go back and break that out so that we don’t complicate things in the beginning. So how do we know that that 104 thousand 500 isn’t net income? Well, if we look at the income statement, we can see that the income statement is the 158 100. So we would clearly look at the income statement say that’s not that that’s not the difference, but we’re not going to take the difference from the income statement. Because that doesn’t work with our worksheet right. Our worksheet is here to find a home for all the changes. If we put together this worksheet, and then we start with a net income that’s not on the worksheet. Then it’s going to, it’s going to be difficult for us to get to a place of reconciling. So what we have to do if we did start with net income, and what and what the net income actually was here, we would then have to record the two components, we’d have to break out net income.

06:17

And we’ll do that later. So what will happen is, of course, we’ll take a look at this doesn’t match what’s on the income statement. So we’ll say, okay, what’s the difference? To do that, we’ll go into the detail for retained earnings and say what else is happening what’s in the GL, or in our case, what’s in the added material, and there’s going to be in our case dividends. So dividends are something that’s going to that’s going to change retained earnings, so we’ll have to break that out into its separate line items so that this change, then we’ll end up representing two line items. Again, I’m not going to do that now, because I’d rather not complicate things. I’d rather just find a home for all of these first, recognizing that it will need more complication, but doing that in a systematic process. After we found a home for all these first