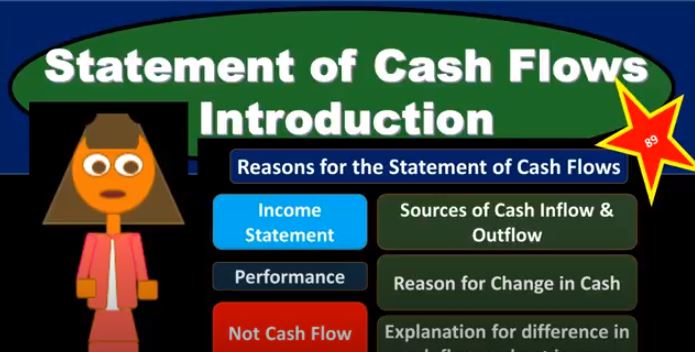

In this presentation, we will introduce the financial statement of statement of cash flows. When thinking about the statement of cash flows, we want to compare and contrast the reasons for it to what the other financial statements are providing us what information in other words, are we going to get from the statement of cash flows that’s not on the other financial statements, those being the balance sheet, the income statement, the statement of equity, we’re mainly comparing against the income statement, because the statement of cash flows going to give us some similar information. It’s going to give us information over time, what’s happening over time, unlike the balance sheet, which is going to have a point in time. So we’re still looking at at timing what is what is going on over time. That’s typically our income statement, which measures performance. The major goal of the income statement is to measure performance, how have we done how much work have we done, revenue minus expenses, revenue being recognized when we earn the work when we’ve done the job expenses when we We’ve incurred something in order to help generate in the same time period. And that’s going to be the net income. What that doesn’t do, however, is measure cash flow. And when we first learn about the income statement, that’s going to be a real big distinction we want to look at, we want to say, okay, the income statements on an accrual basis.

01:18

Why? Because that’s better for performance measurement, it’s better for us to see how much work we did. And a cash flow basis doesn’t tell us that very well. That’s why we have to use an accrual basis. However, cash flow is very important. And if we do not report it on the income statement, in terms of cash flow, then we need the statement of cash flows in order to give us that added information. So really, the statement of cash flows can be compared in a lot of ways to the income statement, it’s going to measure performance, but it’s also going to measure other types of Cash Flows outside of things that we would think about as income statement type of activities. But it’s going to be a timing statement, and it’s going to give us those cash flows. So it’s going to tell us the sources of cash inflows. Now, of course, note that as we work in the company, any type of business, most things are going to go through cash any cycle, whether it be a payable cycle, or a revenue cycle is going to deal with cash at some point within the process. So cash flow is going to be important. And we want to know what the sources of the cash flow are. Hopefully, a lot of it will be from revenue from customers that we’re going to have to cash flow, but we could have other sources of revenues, including loans or investments from the owners. We want to know the sources of the outflows. What are we spending cash on? Typically, we would think expenses inventory, but possibly paying down loans and other types of things that the cash is going out for. And then, of course, the reasons for change in cash. Because when we look at the financial statements, we’re oftentimes going to look at, you know, what’s the bottom line on the income statement, what’s our net income, and we’re going to look at the balance sheet and Then we’re gonna look at cash, what’s changing the cat? Do we have enough cash for us to, you know, continue with the operations Do we have more than enough cash and possibly we can give out a dividend or draw some money out for personal use. So, this change in cash, not the same thing as net income. However, very important statement of cash flow will give us that information so that we can have the best of both worlds. We can have the income statement given us performance data, and we can have the statement of cash flows giving us the cash flow data. This is going to be really important.

03:34

It’s something that whenever we first start learning, the accrual basis often comes to mind when we learn the accrual basis. And we learned that we’re going to have the income statement reporting revenue when it’s earned, not necessarily when we get the cash and expenses when they’re incurred. Not actually when we pay them, then we often start thinking, well, that’s going to distort things in terms of cash flow, because we may be recognizing revenue before we get cash and so we often win Learning the accrual basis are asking these questions in terms of what about cash flow isn’t that important, I need to know what the actual cash flow is. And by doing the statement of cash flows, we get the best of both worlds because the income statement will measure better the actual performance on an accrual basis, that’s a better measurement of what we’re actually doing. And the cash flow statement will give us those cash flows. And tell us where the resources of cash are, where the cash is coming from, where the cash is going, what the tat change in cash is due to. So in order to do this, we first then need to think about what is cash. Now clearly, when we think about a company, most of time, it’s gonna be the checking account off with a savings account. But there could be other types of accounts because we may have more than just one checking account. We may have multiple checking accounts, we’d have to include all the checking accounts, in terms of what cash is going to be. And then we’ve got cash equivalents.

04:53

We could have some things that are going to be highly liquid, very close to cash that may be included in Cash as well. So short term highly liquid investments, things that can be converted into cash very quickly, possibly would then be cash equivalents and included in our statement of cash flows, easily convertible into cash things are going to be changed to cash very easily close to maturity so that the market value is not affected by interest rate changes. So, if something is really close to maturity, then we’re going to say okay, it’s pretty close to cash because it’s right next to the maturity and therefore we’re going to include it in cash on the balance sheet, and we’re going to be using it within the statement of cash flows to look at the change in cash.