QuickBooks Online 2021 add service items and enter invoices in a service job cost type system. Let’s get into it with Intuit QuickBooks Online 2021. Here we are in our get great guitars practice problem, we’re going to be opening up our financial reports go into the reports up top right clicking on it, we’re going to duplicate the tab, we’re going to do it two more times, right click once again, duplicate the tab one more time, right click once again and duplicate the tab, we’re gonna have a trial balance on the tab to the far right, then the income statement and then the balance sheet.

Posts with the give tag

Form 1099 & Expenses by Vendor Reports 4.30

QuickBooks Online 2021 form 1099. And expenses by vendor reports. Let’s get into it with Intuit QuickBooks Online 2021. Here we are in our free QuickBooks Online test drive practice file, which you could find by searching in your favorite browser. For QuickBooks Online test drive, we’re gonna be looking at our reports down below looking at a 1099 report, you could simply type in the search menu for 1099. But I’m going to locate it down here by scrolling down.

Accounts Receivable Aging Reports 4.10

QuickBooks Online 2021 accounts receivable aging reports. Let’s get into it with Intuit QuickBooks Online 2021. Here we are in our free QuickBooks Online test drive file, which you can find by searching in your favorite browser for QuickBooks Online test drive. We’re in Craig’s design and landscaping services, we’re going to go down to the reports down below.

Memorize Report 2.45

QuickBooks Online 2021. Memorize report. Let’s get into it with Intuit QuickBooks Online 2021. Here we are in our QuickBooks Online test drive file, which you can find by typing into your favorite browser QuickBooks Online test drive, we’re going to be taking a look at the memorizing of reports function. To do that, let’s go to the reports down below. And we’ll see that the normal tab that you will be on will be the standard tab, you can make the reports favorite of the reports that have already been made by putting that star next to them as we have seen, which will move them up into the Favorites area.

Expenses by Nature & Function 187

In this presentation, we will generate, analyze, print and export to Excel a report that will show the expenses both by their nature and by their function. Get ready, because here we go with aplos. Here we are in our not for profit organization dashboard. Let’s first take a look at our Excel sheet to see what our objective will be. We’re over here on tab 10. You’ll recall last time that we made the statement of activities. So the statement of activities in essence, the income statement being broken out by two columns, and a total column, those with restrictions and without restrictions. And now we’re concentrating on those expenses, which we want to break out both by nature and function, which we could do on the statement of activities.

Statement of Activities Formatting 185

https://youtu.be/S3lCOA6esqY?list=PL60SIT917rv6ERsGZxM9V_IZLVybpgfNU

In this presentation, we’re going to take a look at the formatting of a statement of activities or income statement, we’ll take a look at customizing the statement of activities and customizing it for internal use, as well as external use and then saving those customized income statements so that when we go into them into the future, it will be as easy as possible, get ready, because here we go with aplos. Here we are on our not for profit organization dashboard, we’re going to be opening up our reports, let’s go to the reports on the right hand side to do so we’re then going to go into the income statement by fund. So let’s take a look at the income statement five fund which is going to be our statement of activities report.

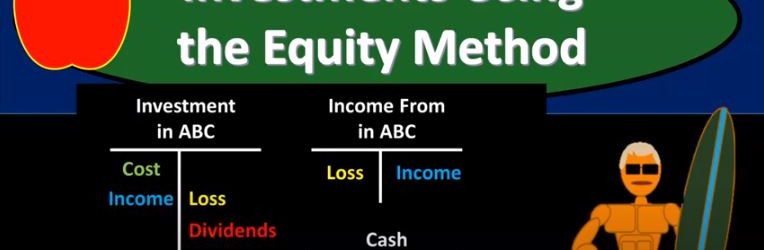

Investments Using the Equity Method

This presentation we’re going to focus in on investments using the equity method. In other words, we’re going to have a situation where we have one company that’s investing in another company, this time they have significant influence. And therefore, we will be using the equity method to account for that investment, get ready to account with advanced financial accounting. In prior presentations, we gave an overview about different accounting methods that could be used based on different levels of influence and control those general rules being that if there is 20, or zero to 20%, ownership, we use the carried value 20 to 50%, which is where we’re going to focus in on now, the equity method, idea of there being that there is now significant influence. So in other words, if we own zero to 20%, that would be kind of like you investing in a large company like apple or whatnot. We’re the assumption being, we don’t have significant influence, even though we do have a vote of what happens However, when our vote gets to be 20% Have the total, that’s kind of a shady line or not completely solid line. But that’s kind of an arbitrary line that’s been drawn, then you’re thinking, Okay, now there’s pretty much significant influence. And therefore, we’re going to use a different method equity method, then if we’re over 51%, which is a more solid line, if you have more than 51%, and you’re voting on things, and you have like more than 51%, then you pretty much win. And that would mean control for that situation typically. And then we may use a different method, such as a consolidation. So we’re going to be focusing in here on the middle method, where we have significant influence where we have that lower line that’s a little bit fuzzy that 20% arbitrarily drawn. And then if you’re over the 51%, then it’s more likely that then you do have control and may be using the consolidated method. In that case. So equity method we’re focusing in on investments using the equity method, the equity method will reflect the investors changing interest in the investi. So we’re going to try to basically reflect what’s going on on the investor side with the change investment in the investi, the company that we are investing in that company, we have a significant influence over investment is recorded at the starting purchase price.

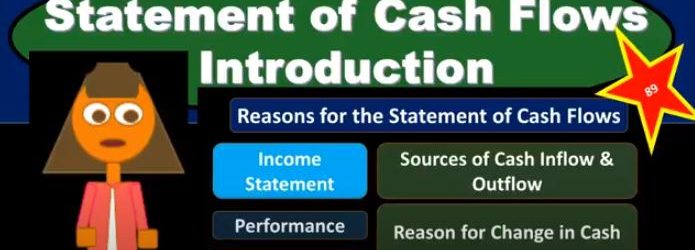

Statement of Cash Flows Introduction

In this presentation, we will introduce the financial statement of statement of cash flows. When thinking about the statement of cash flows, we want to compare and contrast the reasons for it to what the other financial statements are providing us what information in other words, are we going to get from the statement of cash flows that’s not on the other financial statements, those being the balance sheet, the income statement, the statement of equity, we’re mainly comparing against the income statement, because the statement of cash flows going to give us some similar information. It’s going to give us information over time, what’s happening over time, unlike the balance sheet, which is going to have a point in time. So we’re still looking at at timing what is what is going on over time. That’s typically our income statement, which measures performance. The major goal of the income statement is to measure performance, how have we done how much work have we done, revenue minus expenses, revenue being recognized when we earn the work when we’ve done the job expenses when we We’ve incurred something in order to help generate in the same time period. And that’s going to be the net income. What that doesn’t do, however, is measure cash flow. And when we first learn about the income statement, that’s going to be a real big distinction we want to look at, we want to say, okay, the income statements on an accrual basis.

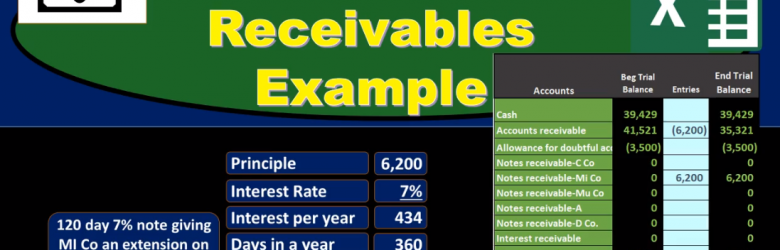

Note Receivable Example

In this presentation we will discuss notes receivable, giving some examples of journal entries related to notes receivable and a trial balance so we can see the effect and impact on the accounts as well as the effect on net income of these transactions. first transaction, we’re gonna have 120 day 7% note giving the company EMI and extension on past due AR or accounts receivable of 6200. When considering book problems and real life problems, one of our challenges is to interpret what is actually happening what is going on, which party are we in this transaction in? Therefore, how are we going to record this transaction when we’re looking at notes receivable? A common problem with notes receivable is the conversion of an accounts receivable to a notes receivable. So in this case, that’s what we have. We have an accounts receivable here that includes an amount of Due to us by this particular company in AI so these are our books, we have a receivable people owing us money for prior transactions goods or services provided in the past and they owe us in total, all customers owe us 41,521 this customer in particular owes us 6200 of this amount in the receivable that could be found not in the general ledger which would give backup of transactions by date.

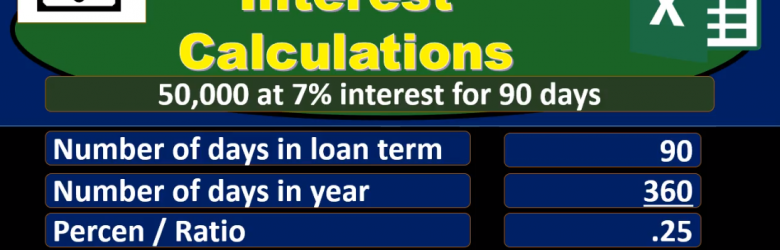

Interest Calculations

In this presentation, we will take a look at how to calculate simple interest a few different ways. As we look at this, you may ask yourself, why are we going over this a few different ways, why not just go over it one way, the best way. And let us learn that well and be able to apply it in each situation. While one way does work in most situations. In other words, we will probably learn one way have a favorite way to calculate the simple interest and apply that in every circumstance. It’s also the case that when we look at other people’s calculations or technical calculation, they may have some different form of the calculation. For example, I prefer away when I think about the calculation of simple interest to have some subtotals in the calculation and have more of a vertical type of calculation the way we would see if done in something like a calculator. If we see a type of equation in a book, then the idea there is that Have the most simple type of equation expressed in as short a way as possible. And that typically is going to be some type of formula. And that formula will often not be showing the subtotal.