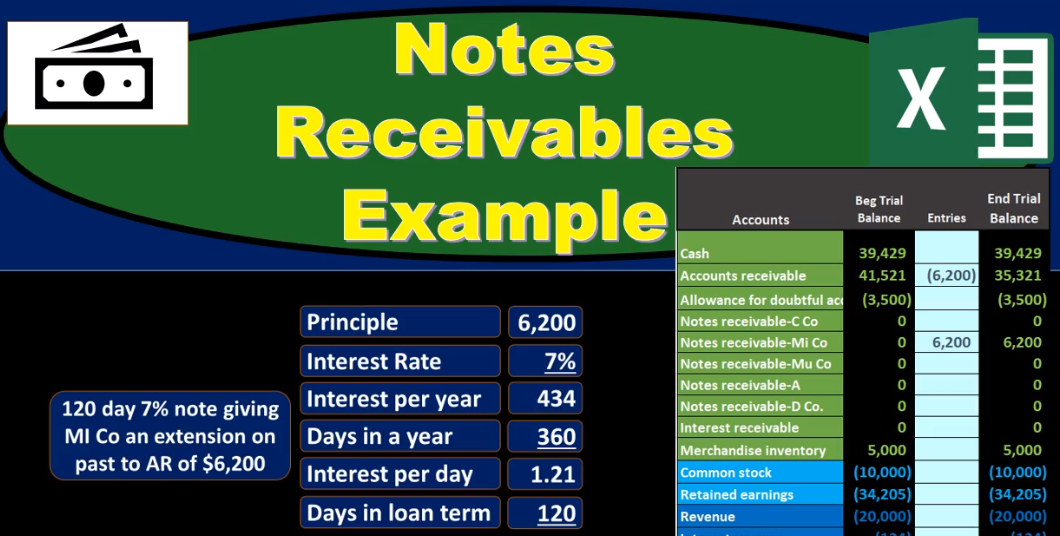

In this presentation we will discuss notes receivable, giving some examples of journal entries related to notes receivable and a trial balance so we can see the effect and impact on the accounts as well as the effect on net income of these transactions. first transaction, we’re gonna have 120 day 7% note giving the company EMI and extension on past due AR or accounts receivable of 6200. When considering book problems and real life problems, one of our challenges is to interpret what is actually happening what is going on, which party are we in this transaction in? Therefore, how are we going to record this transaction when we’re looking at notes receivable? A common problem with notes receivable is the conversion of an accounts receivable to a notes receivable. So in this case, that’s what we have. We have an accounts receivable here that includes an amount of Due to us by this particular company in AI so these are our books, we have a receivable people owing us money for prior transactions goods or services provided in the past and they owe us in total, all customers owe us 41,521 this customer in particular owes us 6200 of this amount in the receivable that could be found not in the general ledger which would give backup of transactions by date.

01:32

But in the subsidiary ledger supporting this amount giving us this number broken out by customer in this case showing that this company in my our customer owes us 6200. If we were adding up all the customer accounts in the subsidiary ledger which we only see the one here it all of them would add up to the total accounts receivable. Accounts Receivable represents sales that are made that are typically due in say 30 days. And a note receivable, on the other hand, typically has a longer time period. Interest Rate involved often has a higher dollar amount, and therefore, interest will be charged and want to have that in writing. So in this case, we’re going to say okay, it was in accounts receivable. But now we’re going to give an extension and because of the extension and the days being greater than, say 30 days, we don’t want to track it in accounts receivable, and in the subsidiary ledger, but create another account and track it in a note receivable and then charge interest on it. So we can imagine a formal document being made here for a note receivable.

02:41

And we then now having to record this. So to record this note, we don’t we don’t really need to know the 7% or the 120. All we need to know at this point in time, is that it was an accounts receivable and we’re transferring it to notes receivable. So accounts receivable has a debit balance. We need to make it go down. So we’re going to do the opposite thing to it, which is a credit decrease in the receivable. And then we’ll put it into notes receivable, which is another asset account very similar to accounts receivable. And it has a debit balance, and it’s going to go up by doing the same thing, another debit. Now note here that we’re recording the note receivable a different note receivable for each customer. So in other words, the accounts receivable we’re tracking in one account here, supporting that account with a subsidiary ledger, which then will track each customer that owes us the money with the notes receivable.

03:39

In this example, we have a different note receivable for each note outstanding and we’ll track the amount owed the principal amount owed here, as well as supporting documentation to be able to track the principal and interest that is over. It is possible however for us to track this with just one account on the trail. balance as well, and then have supporting documentation in a similar way as the subsidiary ledger for the notes receivable, which would calculate what the notes receivable due to us and the interest that would be due on those notes receivable. I kind of like to see it if we don’t have too many notes receivable in this format, so that we can check each note receivable when we make the financial statements, then of course, we’re not going to list out a bunch of different notes receivable with different customer names, we’re just going to put it together in one account called notes receivable.

04:33

If we record this out, then we can see the accounts receivable started at 41 521. It’s going to go down by this 6200. We’re recording this accounts receivable, making it go down to 35,003 2141 521 minus two credit 6200, giving us the 35,003 21. Notice here we’re representing the debits with non bracketed numbers, the credits with bracketed numbers, and therefore if we do some This up debits minus the credits equals zero, debits minus the credits equaling zero meaning debits equal the credits and we are in balance. net income is calculated as the revenue minus the expenses we don’t have. We’re not showing any right here because we’re simplifying the chart of accounts are all we have revenue accounts, revenue, interest revenue, and again here to get to the revenue, not a loss revenue, or net income 38,002 45. The second component notes receivable started at zero, it’s now going to go up in the debit direction by 6200 to 6200. We also need to track this account. This gives us total accounts receivable owed to us by all customers. We’re going to track the activity in the subsidiary ledger, for in my company, a particular customer who owed us 6200.

05:55

We credit the same credit here, similar to as we would do for the general ledger. But now breaking it out by customer, saying that they no longer owe us any money. So this 35,000 to 321 is all made up of customers other than the EMI company customer. If we look at the full transaction of all of our accounts at the end of the day, here’s where we started. Here’s our adjustments. Here’s the Indian trial balance, all that happened, one asset account goes down, one asset account goes up no effect on the accounting equation. In essence, assets went up, assets went down, no effect on equity, no effect on liabilities. You can see down here in the income statement accounts, nothing happened. No revenue went up no expenses. net income is the same after this transaction, just transferring from one account to the other account one asset account to another asset account. Why? Because this asset account will allow us to track not only what is owed to us, but then we’ll want to capture rate, the interest on it and the longer term of days, then we’re going to say, Okay, what happens at the end of this time period, we’re going to get paid both the principal and the interest.

07:11

And therefore we need to calculate what that interest will be. So the principal, that amount is 6200. The interest rate is 7% 6200 times 7% is 434, or 6200 times point oh, seven 7% point oh seven, it’s 434. Then that would be remember for an entire year, and we’re going to need to break this down to the time period we’re talking about, which is only 120 days. There’s a few ways to do this. We’ll talk more about different ways to do this in a later presentation. But here, what we’re going to do is break it out into an amount per day, and then multiply times 120 days, which I think is one of the most intuitive ways to do this. And makes sense to Many people, so we’re going to say the 434 divided by 360 days is $1 and 21 cents. So what does that mean? Where did we get the number of days at 360, we’re going to say 12 months, times 3360. There’s really 365. But we’re gonna round it for simplification purposes.

08:21

For simple interest calculations, we’re going to take the 434 divided by the 360, meaning 434 interest for an entire year divided by 360 days is about $1 21 cents, we have to deal with rounding, that’s okay. For each day, so then we’re going to take that 121 multiplied by the number of days in the loan 120 days to give us the 145. Now again, remember that if we take the 121 times 120 is something slightly different here. Then if we took the rounded number 434 divided by 360 gives us really 120 point 555 times 120. And that gives us still something slightly different, we’re rounding to the nearest dollar. So just be careful of rounding, it’s always going to be an issue. Even if we go to the penny, it’s still gonna have rounding issues because we’re off by, you know, less than a penny. So always going to be an issue and we’ll have to deal with it no matter how we structure the information.

09:33

So here we go. We’re going to say that the interest was 145. What happens when we get paid then at the end of the loan period, so now we’re at the point where they’re going to pay us we loaned originally 6200. We’re going to get that back plus interest of 145. So the note receivable is going to have to go off the books. Here’s the note receivable. It’s easiest to see this when we have a trial balance because we can see hey, there’s note receivable, we got paid on it. Now that needs to go to zero, it has a debit balance, we need to make it go down. Therefore we’ll do the opposite thing to it a credit to make it go down. We’re also going to have the interest revenue. That’s this revenue that we generated. It’s not included here we’re going to get cash not a 6200, but 6200 plus the 145. Because of the time value of money, the interest that we’ve earned, that’s going to be interest revenue with an income account income is going up. Revenue has a credit balance, we’re going to increase it by doing the same thing to it another credit, so we’ll increase our revenue increase the net income.

10:40

Note that this revenue is not going up because we made a sale. But because we loaned money we loaned money and time value passed. Therefore we generate revenue from it. The debit to cash then will be the 6200 plus the 145 or the 6003 45. If we post this out Then we’re going to say that cash went up. So here’s cash here, we’re going to post that here, it started at 39 429, it’s going to go up in the debit direction by 6003 45 to 39,004 29. Accounts Receivable started at this 6200. It’s going off the books now, and this is a check figure that we should have, it should go to zero. And that should be intuitively the case that it should go to zero because no longer they no longer owe us money. If we have the trial balance, this becomes much easier for us to think through, construct the journal entry, and then post it and see if it does what we think it should do. A nice worksheet format is a good way to see this rather than having the GL and posting to the GL because this gives us a quick view of these accounts allows us to stay in balance after we record it and see what happened here very quickly and easily.

11:55

Then the interest revenue we’re going to say interest revenue is a revenue account. It was that 146 prior to this, it’s going to go up in the credit direction where we’re posting this 145 interest revenue by 145 to 291. If we take a look at all the accounts, then we can see that the cash is going to end up here we got the notes receivable is down, and the effect on net income then is going up by that 145. We’re recording this entire 145. At the point in time we received the cash because we earned revenue, not at that point in time, but throughout the time period throughout the 120 days. So instead of us recording the revenue that we’re earning for loaning money out for the interest each day, as it accumulates, we’re waiting until the end of the term. And then we’ve recorded this at one time at the point in time that we receive the money at the end. So just be aware that under the accrual method, this revenue didn’t happen at one point in time. It happened over 120 days. It’s just easy for us to reach At the end of the term when we get paid. Now, if the term goes over the the adjusting entry date the end of the month or year, we may have to then do an adjusting entry to recognize the fact that we did earn revenue over time, not at this one point in time at the end of the time period. And we’ll see an example of that shortly.

13:22

What would happen if at the end of the time period, they dishonored the note, we didn’t get paid? We’d have a similar journal entry, but of course, we wouldn’t get cash then we’re saying they didn’t they didn’t pay us. So we would say that the notes receivable is still going down. We still have to take it off the books. So it’s at 6200. We didn’t get paid, it needs to go down to zero, this is a debit we’ll do the opposite a credit to make it go down. We’re still going to earn the interest revenue. It’s not like we didn’t earn the money even though we haven’t gotten paid on it. We haven’t given up on it yet. We’re not going to debit cash yet. We’re going to debit instead accounts receivable representing the fact that they was the money putting it back into account that we can then track them and be able to see if we can have collection action on it within accounts receivable. So this the only difference here of course being not cash but accounts receivable, accounts receivable beam up going up. It started at 35 345 going up by 6003 45 to 41,006 88. The note receivable started at 6200.

14:26

It’s going down by 6200 to zero, and then the income would still be going up. It had revenue of 146. It’s going up by 145. Two, that’s 291. We also need to record down here in the subsidiary ledger, we increased the receivable we need to record that here in in my company on the subsidiary ledger, increasing the fact that it’s not at the principal now 6200 put the principal plus the interest that is owed to us back in receivable. Now this is an area that We can further track how much is owed further go through collection process and see if we can collect on the amount owed. Once again, if we if we see all of the accounts, we can see that there is an effect effect on net income, even though we didn’t get paid cash, it’s going up by the interest revenue recorded here. Remember, this is the income statement part. So we had 20,000 revenue plus this 145 increasing and this game down here for revenue. We’re not showing any expenses right now because it’s a simplified financial statement. So we don’t have any expenses at this time. Now, what would happen if we had an adjusting entry note that we recorded this 145 as of the end of the time period?

15:44

What if we had an adjusting entry for example, what if we made this loan term as of the middle of the month, there’s 15 days left in the month, let’s say the month of December, there’s 15 days left in the month, and we need to record then the fact that we generally Revenue over that 15 days interest revenue, even though we’re not going to get the money till next year, next month after the cutoff date. So we’ll have to do an adjusting entry in that case. So we’ll have the principal amount, we’re going to calculate the interest now for that 15 day time period. So we can do the adjusting entry. Principle 6200. interest is to 7%. The same for 34. We did prior to this calculation. But now we’re going to divide it once again by the number of days in a year, 360 12 months times 30 days. That’ll give us about $1 and 21 cents interest per day. And now we just need to multiply times the number of days this is where we differ rather than having 120 days. We’re just going to multiply times the 10 the 15 days that have passed for this current month that we’re in, so 15 days, which will give us at $10 and eight cents, and we’re going to round it to $18. So if we did this with a calculator, we’d say okay, there’s 6200 times point oh, seven 7%.

17:11

That gives us the 434 interest. If it was for an entire year, we only have 15 days that we’re looking for. So we’ll break it out into a daily total, divided by the number of days in a year rounding, not 365. But we’re going to use 360 12 times 30 divided by 360 gives us 1.2 0.5 1.20555, about 1.21. We’ll take this number, the unrounded number, times 15. And that’ll give us 1808. We’re going to round it to $18 for our calculate for our journal entry. So then we’ll do the journal entry here and we’d have to say okay, well as of the end of the cutoff date for our adjusting entry, we’ve got interest receivable of 18. We’re not going to put it into the loan amount. We’ve got 6200, we could you could think, Well, why don’t we debit the loan, they always now, not 6200. But they owe us 6218. But typically, we’ll record it separately and say, Hey, this is the principal. And then we’ll record all the interest that we’ve generated in the receivable amount here, and then the credits going to go to interest revenue. So even though we have not yet gotten paid, we have been generating revenue.

18:30

Note under a perfect accrual system, you might be saying, well, we should be recording revenue each day each second each minute, that time passes because that’s when we earn it. But clearly that that’s that’s not practical. That’s why we’re only going to record the revenue that happened over this hundred and 20 days at the end of the loan date typically, or we’ll record it at the end of the financial statement date at the point in time that we make the financial statements and therefore want them to be as correct as possible for presentation purposes. So recording this out, we’ve had interest receivable and asset accounts going up in the debit direction started at zero by 18, debit to 18 debit, then we’ve got the interest revenue starting at 146. Here it’s going up by the 18 to 164. Okay, and then if we see all the accounts, then of course, revenue is increasing. Even though we haven’t received the money, we do not we do need to recognize revenue, and this may look in material right now, it’s not very material, meaning it’s not going to affect decision making too much in this example, but if there were a lot of notes, receivables or if the dollar amount was larger, this could be something that would affect decision making be material to financial statements.

19:45

So we’re going to recognize the revenue that has been earned during that time period on the income statement side, increasing net income even though we have not yet generated the cash because we have earned revenue over that 15 day time period and we’re going to recognize the receipt That is owed to us as of the cutoff date, that $18 we’re not going to get paid until the end of the time period 120 days, and we’re going to accumulate more receivable as that time passes for the days that passed, but at this point in time, we’ve accumulated 18 more dollars on the original 6200. That is due to us.