Corporate Finance PowerPoint presentation. In this presentation, we will discuss combined leverage, get ready, it’s time to take your chance with corporate finance, combined leverage. Remember when we’re thinking about the term leverage, there’s typically two types of leverage that come into our minds. One is going to be the financial leverage the others the operating leverage the financial leverage, probably the one that pops into most people’s mind, if they’re familiar with leverage that being related to the debt in the organization and the risk and reward related to different levels of debt depending on the circumstances. And then we have the operating leverage, which has to do with the mix between the variable costs and the costs and the in the fixed costs.

Posts with the debt tag

Financial Leverage 520

Corporate Finance PowerPoint presentation. In this presentation, we will discuss financial leverage, get ready, it’s time to take your chance with corporate finance, financial leverage. Now remember, when you hear the term leverage, you’re typically thinking of two different categories, that being financial leverage. And then the operating leverage the financial leverage, usually the one that most people think of when they think of leverage having to do with the leverage related to the debt, the operating leverage having to do with their leverage related to the cost structure between the variable cost and the fixed cost, the operating leverage having the leverage component when you have the in the fixed costs.

Leverage Overview 505

Corporate Finance PowerPoint presentation. In this presentation, we will give an overview and an introduction to the concept of leverage. Get ready, it’s time to take your chance with corporate finance, leverage what is leverage use of special forces or effects to magnify outcomes given certain conditions. Let’s break that down a little bit more detail use of Special Forces sounds kind of mystical here. But there’s a couple different things that we think about with leverage. And we typically break it down into operating leverage and financial leverage. Most people when they think about leverage, they’re thinking about debt, they’re thinking about the leverage related to the debt will also have leverage related to operating leverage, which has to do with the mix between fixed costs and variable costs. So on so we have these special forces or effects have magnify outcomes. So that could magnify outcomes.

DuPont System of Analysis 315

Corporate Finance PowerPoint presentation. In this presentation, we will discuss the DuPont system of analysis Get ready, it’s time to take your chance with corporate finance, the DuPont system of analysis, the DuPont system of analysis is going to be focusing in on a key financial ratio, that being the return on equity or our OE, the ROI he is calculated most simply as net income divided by equity, what we’re going to do is take this return on equity and break it out into components, those components drilling down on areas in the business, allowing us a better analysis in those areas and given us some opportunities to improve different components of the business. So it allows us to basically drill down and get more detail on the return on equity.

Ratio Analysis Introduction 305

Corporate Finance PowerPoint presentation. In this presentation, we will give an introduction to ratio analysis. Get ready, it’s time to take your chance with corporate finance, Introduction to ratio analysis. So once we have the financial statements, then we want to think about how best to use those financial statements for decision making purposes. So remember, then the two primary financial statements being the balance sheet and the income statement, we can think of them answering primary questions that a user of the financial statements may have, such as an investor or someone who’s thinking about investing into the company may want to know where the company stands as of a point in time, that once again, is the balance sheet.

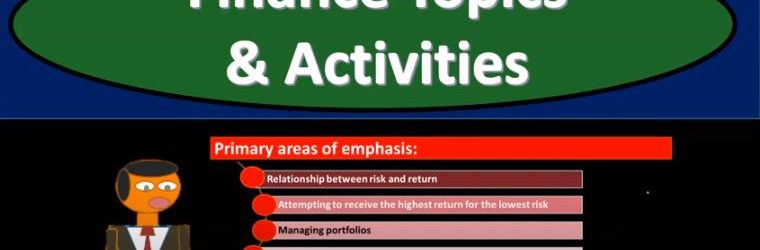

Finance Topics & Activities 115

Corporate finance a PowerPoint presentation. In this presentation, we will discuss finance topics and activities going over some of the historical emphasis in the field of finance to get some context of where we’re coming from and where the current emphasis is. And we’ll be in corporate finance, get ready, it’s time to take your chance with corporate finance, finance topics and activities, we’re going to go over some of the emphasis in corporate finance in the past up into the present day to get some focus in on in context of what we will be talking about within corporate finance. So in the 1930s, what’s the emphasis in corporate finance in the 1930s, we have capital preservation.

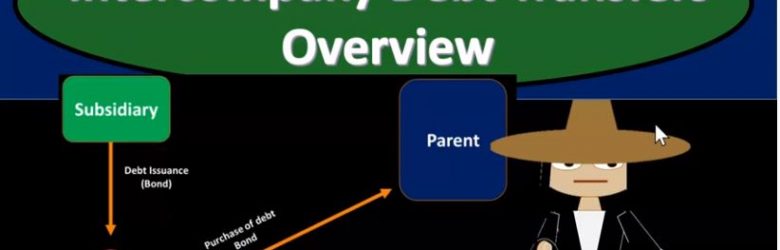

Intercompany Debt Transfers Overview

Advanced financial accounting PowerPoint presentation. In this presentation we will give an overview of intercompany debt transfers. In other words within the concept of our consolidation process where we have parent subsidiary relationships we have intercompany debt debt going from one entity to the other, from parent to the subsidiary or subsidiary to the parent could be in the form of, of notes payable or in the form of bonds payable, get ready to account with advanced financial accounting. When we think of intercompany debt, we can break it out basically into two categories intercompany debt the debt from one to the other from parent to subsidiary or subsidiary to parent, two categories, one direct intercompany debt transfer and the other is the indirect intercompany debt transfer.

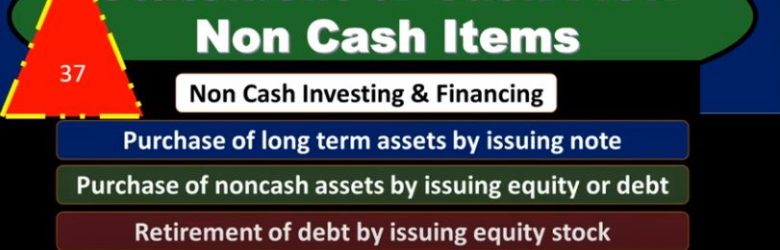

Statement of Cash Flow Non Cash Items

In this presentation, we will take a look at the statement of cash flows non cash items. First question, why would we be looking at non cash items when considering a statement of cash flows? We’re gonna go through a list of non cash items first and see if you can recognize a trend in these and why we might be linking them to a statement of cash flows discussion, then we will explain more fully on the idea of looking at non cash items when considering a statement of cash flows. So, some examples of non cash items would be the purchase of long term assets by issuing a note the purchase of non cash assets by issuing equity or debt, the retirement of debt by issuing equity stock, lease of assets in a capital lease transaction and exchange non cash asset for other non cash asset. Consider these examples and note some of the common features including the deal with investing and financing activities. and think through why we might be linking them to a statement of cash flows. We’ll go more fully through this by giving an example of the purchase of long term assets by issuing a note, an example that we can then apply out to the rest of these items. So what are we going to do with these non cash items, we’re going to report them at the bottom of the statement of cash flows or report them in a note related to the statement of cash flows. So we’re going to have to say in some format, or other, hey, look, these are some non cash items that we’re linking to, for some reason, the statement of cash flows.

Allowance Method % Accounts Receivable vs % Sales Method

In this presentation, we will be taking a look at the allowance method for accounts receivable focusing in on the calculation of the allowance for doubtful accounts. There are two methods that can be used in order to calculate the allowance for doubtful accounts accounts. One being the percentage of accounts receivable, the other is the percentage of sales, we will take a look at them both and look at the pros and cons of them. First, we’re going to look at the accounts receivable method. We’re going to start off with the percentage of accounts receivable method for a few different reasons. One, it’s the one that’s most often tested. And two is the one that may be most often used in practice often making the most sense to people that are looking at the two methods. It’s also a bit more complicated. So when we’re looking at test questions, they typically would focus on this method in order to have a bit more complicated process to do the calculation.

Allowance Method VS Direct Write Off Method

In this presentation, we will take a look at a comparison between the allowance method and the direct write off method. When considering both the allowance method and the direct write off method, we are considering the accounts receivable account. Remember that the accounts receivable account represents some money that is owed to the company, typically from sales made in the past, on account haven’t yet received the funds for sales made in the past and therefore, the company is owed money. We see this amount on the trial balance in this case 1,000,001 91. We then want to know information about that, including who owes us that money. We can’t find that typically in the GL as we have a GL for every account the GL only giving us the information by date. Typically, we want to see that information also broken out in the subsidiary ledger saying who owes us this money.