Hello in this presentation we will discuss the post closing trial balance and financial statements. When considering the financial statement relationship to the trial balance, we typically think of the adjusted trial balance that being used to create the financial statement. It’s important to note, however, that any trial balance that we use can be generated into financial statements. It’s just that the adjusted trial balance is the one that we have totally completed and prepared and ready. In order to create the financial statements to be as correct as possible as of the date we want them, which is usually the end of the month or the end of the year. Note that the names of the unadjusted trial balance the adjusted trial balance and the post closing trial balance are really a convention they’re all basically trial balances.

Posts with the net income tag

Closing Process Step 4 of 4 Closing Journal Entry Draws or Withdraws

Hello in this lecture we’re going to continue on with the closing process with step four, the final step of the process which will be to close out the draws. Remember that the objective is to have the adjusted trial balance be converted to the post closing trial balance. adjusted trial balance is what we use to create the financial statements. And the difference between the adjusted trial balance and the post closing trial balance will be that we want to have all temporary accounts including draws revenue and expense accounts to be converted to zero and have all that be in the owner capital account meaning the owner capital account will now be including all these accounts underneath it crunched into basically one number, we’re going to do that with a four step process.

Closing Entries Journal Entry 3 of 4 Step 3 Income summary

Hello in this lecture, we’re going to talk about the closing process step three of the four step closing process, which will include the close of the income summary to the capital account. Remember that our objective is to close out all the temporary accounts, which are all the accounts below capital, including drawers, and the income statement accounts of revenue and expenses. So we want the adjusted trial balance to be converted to the post, post closing trial balance, which means that everything from capital on down will be zero. The way we do that is the four steps and that includes step one we did in a prior video closeout income to the income summary. Step two was to close out expenses to the income summary. Step three is what we’re going to do now close out the income summary now having net income in it to the capital account, then we’re finally going to close out the draws to the capital account.

Closing Step 2 of 4 – Journal Entry 2 of 4

Hello in this lecture, we’re going to talk about the closing process. Step two of the four step process being closing the expense accounts to the income summary. Remember that the goal of the closing process is to close out the temporary accounts that would include the drawers as well as all the income statement accounts, including revenue and expenses to the capital account. So we want our adjusted trial balance to thing we used to make our financial statements to look like the post closing trial balance with all the zeros from the capital accounts down. How do we do that? Last time we did the first step step one, which was to close out income to the income summary. This time we’re going to close out expenses to the income summary. Next time we’re going to close out the income summary to the capital account. And finally closeout draws to the capital account.

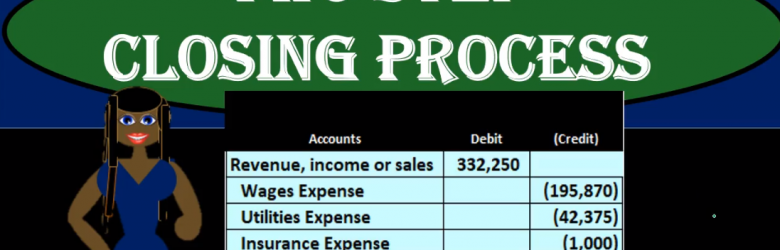

Closing Process Step 1 of 4 – Journal Entry 1 of 4

Hello, in this lecture, we’re going to talk about the closing process step one of the step four process. Last time, we talked about the objectives of the closing process, which in essence was to close out the temporary accounts, all the accounts from the draws, and the revenue and expenses on down to zero. Putting that balance into the capital account, we talked about how we were going to do that, we’re going to do a four step process, including closeout, the income to the income summary, and then close out the expenses to the income summary. And then we’re going to close out the entire income summary to the capital account. And finally closeout draws to the capital account. We’re going to start off with step one of those four step processes. In order to do this. We are adding this new account you’ve probably been wondering, income summary account, what is that? Where did it come from? Why is it there? The income summary can be called a clearing account, meaning it’s going to start at zero and it’s going to end at zero right when we’re done with this four step process which we’re going to do basically at the same point. Time.

Two Step Closing Process

Hello in this presentation we will take a look at a two step closing process. In other words, we will perform the closing process using two journal entries. There’s a couple different ways we can see the closing process, each of them having a pros and cons. The two step process is nice because it allows us to see net income broken out and being closed out directly to the capital account, followed by draws, which is similar to what we see when we actually do the statement of equity, meaning that when we do the statement of owner’s equity, we start with beginning balance and then we increase it by net income and decrease it by drawers or dividends. Because this process is similar to that process, it’s often easy to remember it’s the easiest for me to remember in any case, so we will take a look at the two step closing process.

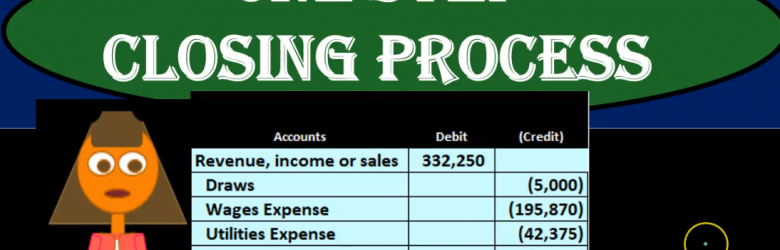

One Step Closing Process

Hello in this presentation, we will be looking at a one step closing process. In other words, we will be closing out temporary accounts using one journal entry. There’s a few different ways that we can perform the closing process. And there’s benefits and cons to each way of doing it. The one step closing process is the simplest way to do it. And it’s also a way that we can imagine what is happening within the closing process as easily as possible a skill useful when considering what’s happening from time period to time period, and how the financial statements are working. So here we’re going to look at a one step closing process. Remember what the closing process is, it’s going to be a process at the end of the time period that we will be performing.

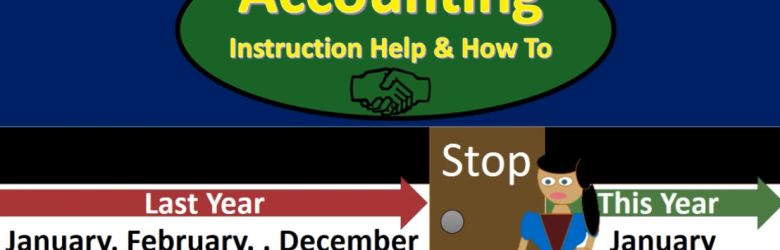

Closing Process Explained

Hello in this lecture we’re going to talk about the objectives of the closing process the closing process will happen after the financial statements have been created. So we will have done the journal entries where we will have compiled those journal entries into a trial balance, and then we will have made the financial statements. And then as of the end of the period in this case, we’re going to say as of December, when we move into the next time period, January, what we need to do is close out some of the temporary accounts those accounts including the income statement and the draws account so that we can start the new period from start in a similar way as if we were trying to see how many miles we could drive say in a month. If we wanted to Vince in December, and then see how many miles we’re going to drive in January of next year.

Statement of Cash Flow Indirect Method Change In Inventory

In this presentation, we will continue putting together our statement of cash flows using the indirect method. Now taking a look at the change in inventory, we’re going to be using our materials here with a comparative balance sheet, the income statement and some added information, working primarily at this time from a worksheet that was made from the comparative balance sheet. So here is our worksheet. Here’s what we have. So far, we basically have a comparative balance sheet in a trial balance type format, where we have the current year, the prior year, and then the difference. Our goal is to find a home for all of these differences are in number that we’re looking for, is basically the 61 900 change in cash. So we’ve gone through this, from top to bottom, we’re working through basically the operating cash flows from operating First, the indirect method. So we started off with the net income, then we made our adjustments. And then now we’re going through basically The accounts receivable to inventory. Now once we get into the current assets, we’re going to group those into this change in current assets under the cash flows from operations. Once we know the theme here on what’s going to happen with these current assets, it’s it’s always going to be the same.

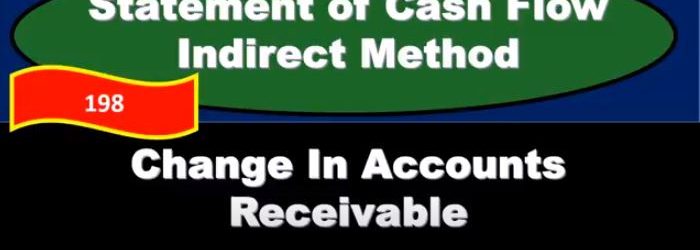

Statement of Cash Flow Indirect Method Change In Accounts Receivable

In this presentation, we will continue putting together the statement of cash flows using the indirect method focusing here on the change in accounts receivable. The information will be a comparative balance sheet, the income statement and some added information we will be focusing in on a worksheet that was composed from the comparative balance sheet. So here is our worksheet. So our worksheet that we can pay that we made from the comparative balance sheet, current period, prior period change. So we have all of our balances here for the current period, the prior period and the change, we have put in this change. And this is really the column that we are focusing in on we’re trying to get to this change in cash by finding a home for all other changes. Once we find a home for all other changes. We will get to this change in cash the bottom line here 61,900. The major thing we’re looking for is right here. We’ve already taken a look at the change in the retained earnings. And the change in the accumulated depreciation. Now we’re going to look at the changes in current assets and current liabilities.