In this presentation, we will compare and contrast the perpetual and periodic inventory systems as we track inventory through the accounting process. First, we’re going to look at the perpetual system, the system we typically think of when recording transactions that deal with inventory. So if a transaction doesn’t say it’s using a periodic or perpetual system, you probably want to default to the perpetual system. We have here the owner, we have the customer, we’re saying that we’re selling this inventory this Inc for a cost of 8450. To the customer, the customer is not paying cash but pain, an IOU to the owner. Typically, under a perpetual system. We break this out into two components one, the IOU, or the accounts receivable or sales component. The component similar to what would be seen if we were not selling merchandise but a service company.

Posts with the Revenue tag

Cash Receipts Journal 40

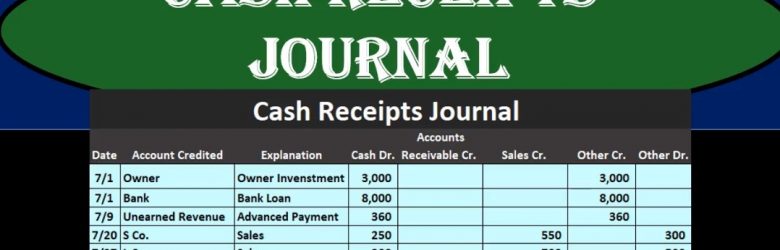

In this presentation we will talk about the cash receipts journal. The cash receipts journal will be used when we have cash receipts when using a more of a manual system or a data input system that we will be doing by hand as opposed to an automated system. It’s still useful to know the cash receipts journal if using an automated system for a few different reasons. One is that we might want to generate reports from an automated system, similar to what we would be creating in a manual system for a cash receipts journal. And to it’s just a good idea to have different types of systems in mind, so we can see what’s the same and what is different between different accounting systems. The cash receipts journal will be used for every time we have a cash receipts. So the thing that transaction triggering a cash receipt will be when cash is being used. And we’re going to have a little bit more complex complexity in a cash receipts journal than something like a sales journal because we may be receiving cash for multiple different things.

Sales Journal Service Company 10

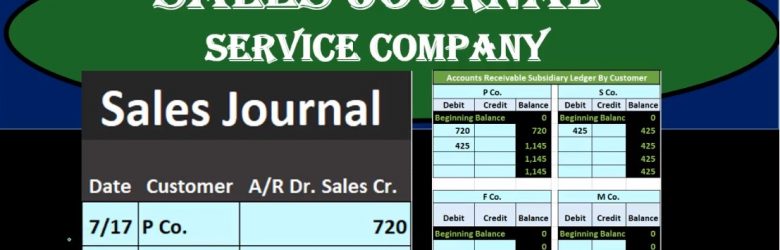

In this presentation, we will take a look at the sales journal for a service company. We’ll use the sales journal in a manual system or a system we do by hand. When we make sales. However, it’s a little bit more complicated than that because if sales journal really means sales that we make on account, meaning we’re not receiving cash at the point in time we make the sale. If we do receive cash at the point in time we make sale even though we have sales being recorded or revenue accounts being recorded. It should be going into the cash receipts journal, because that’s the journal we use whenever we get cash. So the better term for this journal may be something like accounts receivable, or more specifically, sales made on accounts or sales and accounts receivable, but it’s typically called the sales journal. So don’t let that confuse you.

Income Statement from Trial Balance 16

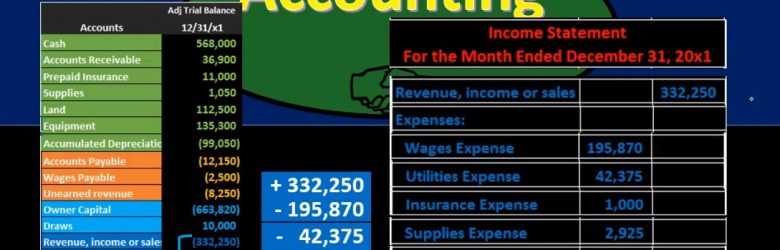

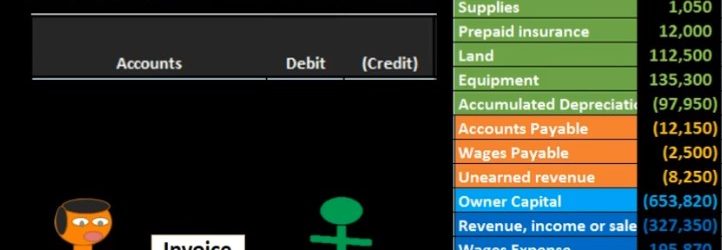

Hello in this presentation we’re going to take a look at the creation of the income statement from the trial balance. First, we want to take a look at the trial balance and consider where the income statement accounts will be. When looking at the trial balance, it will be in order we have the assets in green, the liabilities in orange, the equity in light blue, and then the income statement accounts including revenue and expenses. That’s what we are concentrating here we’re looking at those income statement accounts. And that is what will be used in order to create the financial statements to create the income statement. Note that all the blue accounts represents the equity section. So the income statement really is going to be part of total equity. If we consider that on the balance sheet, then we’re really looking at a component of this capital account.

Adjusting Entry Accounts Receivable 8

Hello in this lecture, we’re going to record an adjusting transaction related to accounts receivable. We’re going to record the journal entry over here on the left hand side and then post it to the trial balance on the right hand side trial balance and format of assets in green liabilities in orange equity in the light blue and the income statement in the darker blue including revenue and expenses, we’ll first walk through which accounts will be affected and then explain why that is the case. So we know that it is an adjusting entry and knowing that it’s an adjusting entry means it’s slightly different than a normal journal entry in that it does have two accounts like normal journal entries, but it also generally has one income statement account below the blue line and one balance sheet account above the blue line the light blue line, so it’s going to be one account above owner’s equity, one account below owner’s equity.

General Ledger 245

Hello, in this presentation we will discuss the general ledger. At the end of this, we will be able to define what the general ledger is. We’ll list components of the general ledger and explain how the general ledger is used. When looking at transactions in terms of journal entries and posting those journal entries in track prior presentations, we were posting those journal entries mainly to a worksheet in order to see a quick computation over the beginning balance and what is happening to that balance, posting it to a format of a trial balance than an adjusting column and then an adjusted trial balance. Note, however, that we typically think of the journal entries being posted to a general ledger. The general ledger can be very complex when we look at it which is why it is often useful to not look at it when we first start posting the transactions but to see that how those transactions affect interest Visual accounts.

Accounts Receivable Journal Entries 230

Hello in this presentation we will be recording that journal entries for business transactions related to accounts receivable otherwise known as the revenue cycle. We will be recording these using debits and credits. At the end of this we will be able to list transactions involving accounts receivable record transactions involving accounts receivable using debits and credits and explain the effect of transactions on assets liabilities, equity, revenue, expenses and net income. We’re going to be recording these transactions up here on the left hand side constructing those journal entries in accordance with our thought process our list of questions to most efficiently construct the journal entries.

Cash Journal Entries with Cash 225

Hello in this presentation we are going to record business transactions involving cash using debits and credits. At the end of this, we will be able to list transactions involving cash record transactions involving cash using debits and credits and explain the effect of transactions on assets, liabilities, equity, revenue, expenses and net income. We’re going to record these transactions on the left hand side in accordance with our thought process. We’re then going to post them to a worksheet format, not necessarily or in this case, not a general ledger. But in a similar way, we will post it to this worksheet in order to see what is happening to each of these accounts individually as well as the groups of accounts in terms of assets, liabilities, equity, revenue and expenses, notes the order of the trial balance, always in the order of acids in this case in green liabilities in orange, and then we have the equity and revenue and expenses, the income statement accounts and net income at the bottom calculated as revenue minus expenses.

Rules for Using Debits & Credits 210

Hello. In this presentation we’re going to discuss rules for debits and credits, how to make accounts go up and down using debits and credits. objectives, we will be able to at the end of this define rules to make accounts go up and down, apply rules to make accounts go up and down and explain how rules are used to construct journal entries. When considering these rules that will be applied, the rule will be very simple to apply once we understand the normal balances or have memorized or are using a cheat sheet in order to know what those normal balances are. There’s no getting around just memorizing the normal balances. That’s where most of the time will take place. Once we know what those normal balances are, we’re going to want to do things to those normal balances. We’re going to want to be increasing or decreasing those normal balances in some way.

Debits & Credits 205

Hello in this presentation we will discuss debits and credits. Objectives at the end of this we will be able to define debits and credits list account normal balances and explain how debits and credits work. First we want to take a look at the double entry accounting system and recognize that the double entry accounting system can be represented in multiple different ways including as we have seen before the accounting equation meaning that assets equal liabilities plus equity, we can record transactions using this accounting equation as we have done in the past. That accounting equation is the basis behind the balance sheet where we have the assets liabilities and equity representing the fact that the balance sheet then would be in balance.