Hello in this lecture we will discuss the accounting building blocks and the double entry accounting system. At the end of this we will be able to define and describe the double entry accounting system, write down the accounting equation and define each individual part of it, define and describe debits and credits, define a balance sheet and list its parts define an income statement list its parts and explain the relationship between the balance sheet and the income statement. Okay, so starting off every business and accounting software uses the double entry accounting system. So the double entry accounting system, it’s kind of like the math behind the calculator, every software is going to use it. In order to understand what the system is doing, we need to understand the double entry accounting system.

Posts with the system tag

Cash Disbursements Internal Controls

In this presentation, we’re going to talk about Cash Disbursements, internal controls. Now we’re going to talk about a voucher system for the payment process. But before we get too into the voucher system, note that the systems will change depending on the type of organization and what industry we’re in and how large the organization is. So if we just have a small organization, then we probably just want to have some internal controls for the owner of the company, the owner, being a key component of the internal control system and having a lot more oversight over many of the things that happened. For example, for the payments that happen, we may have someone that requests something on an employee that wants to request a payment may even you know, enter the payment into this system. However, we want to make sure that the owner still has some control over such as the cheque signing.

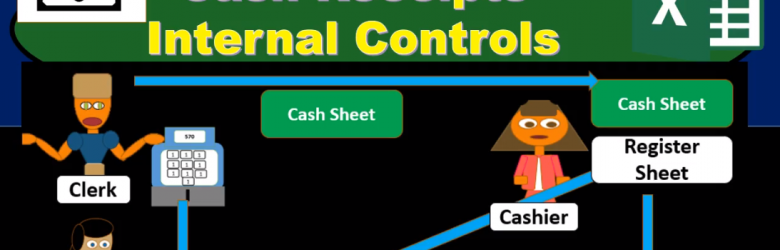

Cash Receipts Internal Controls

In this presentation, we will talk about cash receipts, internal controls. Now we’re going to talk about a voucher system for the payment process. But before we get too into the voucher system, note that the systems will change depending on the type of organization and what industry we’re in and how large the organization is. So if we just have a small organization, then we probably just want to have some internal controls for the owner of the company, the owner, being a key component of the internal control system and having a lot more oversight over many of the things that happen. For example, for the payments that happen, we may have someone that requests something on an employee that wants to request the payment may even you know, enter the payment into the system.

Internal Controls

In this presentation we will introduce the topic of internal controls. Internal Controls been policies within an organization in order to achieve certain objectives those objectives including the safeguarding of assets, having reliable accounting records, efficient operations, and company policy alignment. We’ll get further into what each of these categories mean in detail. However, first we want to discuss the fact that internal controls will change from organization to organization and industry to industry will have similar objectives between organization to organization industry to industry, however, the customization of the internal controls will differ in order to have an optimal amount depending on size of company and type of industry. For example, a small company often one run by one individual will have very much fewer internal controls for multiple reasons. One that that individual can really monitor A lot more of the transactions for a small company and have direct contact with the transactions that are taking place.

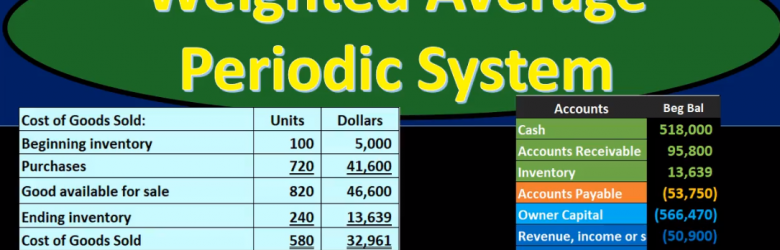

Weighted Average Periodic System

In this presentation we will discuss the weighted average inventory method using a periodic system. The weighted average method as opposed to a first in first out or last In First Out method, the periodic system as opposed to a perpetual system. We want to keep the other systems in mind as we work through this comparing and contrasting. We’re going to be working with this worksheet entering this information here. It’s important to note that this worksheet is a worksheet that can typically be used with any of these inventory flow type problems of which there are many. We have first out last in first out the average method. And then we have a perpetual and periodic system which can be used with any of those methods. It’s also possible for questions to ask for just one component such as cost of goods sold or Indian inventory, and therefore it can seem like there’s more types of problems that we can have in that format as well. If we set up everything in a standard way, even if that weighs a little bit longer for some types of problems, it may be easier because we can just memorize that one format to set things up, this would be a format to do that.

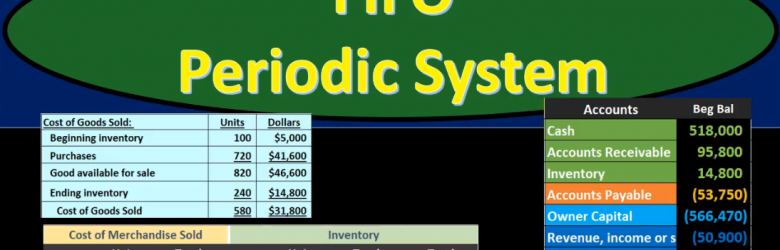

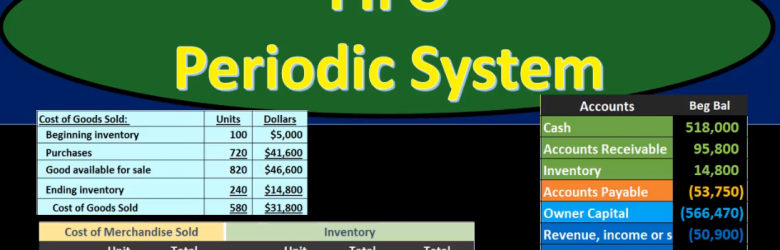

Last In First Out LIFO Periodic

In this presentation we will discuss the lastin first out inventory system on a periodic basis rather than a perpetual basis. As we go through this process, we want to always be comparing those to one, the LIFO or lastin first out system to other systems such as first in first out and average, as well as comparing the perpetual system to the periodic system. We’re going to go through this by looking at a problem the problem going into a worksheet such as this, I do recommend learning this worksheet. This worksheet should look repetitive if you seen the first in first out presentation as well as presentations for the perpetual system.

First In First Out (FIFO) Periodic System

In this presentation we will discuss first in first out or FIFO using a periodic system as compared to a perpetual system. As we go through this, we want to keep that in mind all the time that been that we are using first in first out as opposed to some other systems lastin first out, for example, or average cost, and we’re doing so using a periodic system rather than a perpetual system. Best way to demonstrate is with examples. So we’ll go through an example problem. We’re going to be using this worksheet for our example problem. It looks like an extended worksheet or large worksheet, but it really is the best worksheet to go through in order to figure out all the components of problems that deal with these cost flow assumptions, including a first in first out lastin first out, or an average method, and using a periodic or perpetual for any of them.

Perpetual & Periodic Inventory Systems

In this presentation, we will compare and contrast the perpetual and periodic inventory systems as we track inventory through the accounting process. First, we’re going to look at the perpetual system, the system we typically think of when recording transactions that deal with inventory. So if a transaction doesn’t say it’s using a periodic or perpetual system, you probably want to default to the perpetual system. We have here the owner, we have the customer, we’re saying that we’re selling this inventory this Inc for a cost of 8450. To the customer, the customer is not paying cash but pain, an IOU to the owner. Typically, under a perpetual system. We break this out into two components one, the IOU, or the accounts receivable or sales component. The component similar to what would be seen if we were not selling merchandise but a service company.

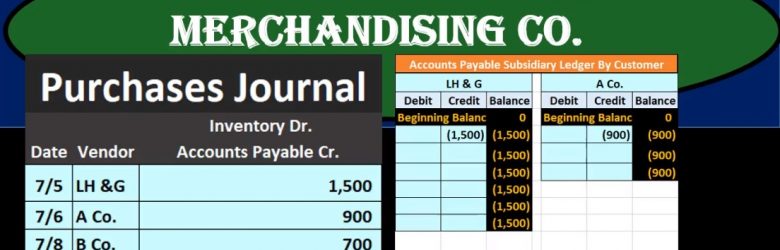

Purchase Journal Merchandising Co.

In this presentation we will take a look at the purchases journal for a merchandising company. Purchases journal will be used when we make purchases for a type of system that will typically more be more of a manual system as opposed to an automated system. However, it is useful to know this in order to have an automated system because the automated system will generate reports that will be similar to a purchase journal and because it’s good to know how different system works to know what are similar what’s different, so that we better understand whatever system we are using. The purchases journal may better be described as the purchase journal on account. So that’s going to be the major point meaning if we make purchases for something that in cash if we spent cash to make the purchase then it will not go in the purchases journal even though we made a purchase because it will go into cash payments journal. So this is really kind of a short name. The accounts payable journal might be a better name for it or the purchases journal on account, but purchases journal is typically the term that will be used.

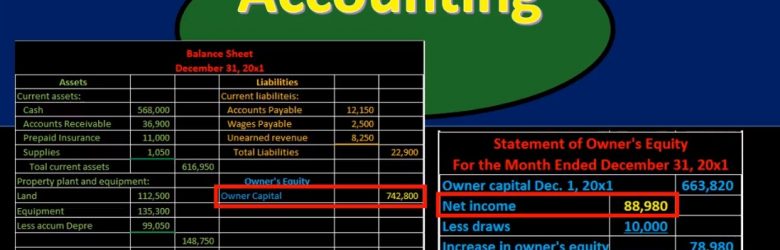

Financial Statement Relationships 18

Hello in this presentation we’re going to take a look at financial statement relationships. In other words, how do these financial statements fit together? How do these financial statements represent the double entry accounting system in the format of the accounting equation that have assets equal liabilities plus equity? First, we’ll take a look at the balance sheet. Note that most textbooks will talk about this relationship and constructing the financial statements by first saying to construct the income statement, then the statement of equity and then the balance sheet. If you’re constructing things by hand with a paper and pencil, that does reduce the number of calculations that you would need to do, however, if you’re using something like Excel, then it’s a lot easier to sum up columns of numbers and it might be useful to take a look at the balance sheet. In any case, the relationships will be the same when we consider the relationships between the financial statements.