In this presentation we will talk about the cash receipts journal. The cash receipts journal will be used when we have cash receipts when using a more of a manual system or a data input system that we will be doing by hand as opposed to an automated system. It’s still useful to know the cash receipts journal if using an automated system for a few different reasons. One is that we might want to generate reports from an automated system, similar to what we would be creating in a manual system for a cash receipts journal. And to it’s just a good idea to have different types of systems in mind, so we can see what’s the same and what is different between different accounting systems. The cash receipts journal will be used for every time we have a cash receipts. So the thing that transaction triggering a cash receipt will be when cash is being used. And we’re going to have a little bit more complex complexity in a cash receipts journal than something like a sales journal because we may be receiving cash for multiple different things.

01:02

Note that the main thing we will be receiving cash for most of the time is going to be something like sales. If we make sales consistently for cash rather than on account, then that would be a great use of the cash receipts journal because we can have just two line items and record those to record those two out here and then sum them up at the end of the month. Or the other common transaction would be to receive cash on account the other side then being accounts payable. But there are other types of things that we can be dealing with with cash and those things we’re typically going to put into the other category. When dealing with those items, breaking them out then at the end of the month, when we do the adjusting over the journal entry at the end of the month. And we’ll total these up in order to then record the journal entry at the end of the month. Note that the cash receipts journal is most effective when we have many transactions that are much the same. We would record all those transactions for the time period, whether that be the day, the week or the month.

02:05

In our case, it will be the month and then sum them up and record the one journal entry for them at the end of the time period. So we’re going to have the cash receipts journal once done with the cash receipts journal, we will then do the general journal, a general journal entry, which may seem like more work because we’re doing a cash receipts journal and a journal entry. But we are only doing one journal entry rather than a bunch of different journal entries here throughout the time period, just one journal entry, one debit and credit, or it’s going to be more than a debit and credit for this transaction, but one journal entry as opposed to many, in order to record the entire periods worth of data, in our case, a month’s worth of data, then we would post that to the general ledger. And then the general ledger will be used to create the trial balance.

02:50

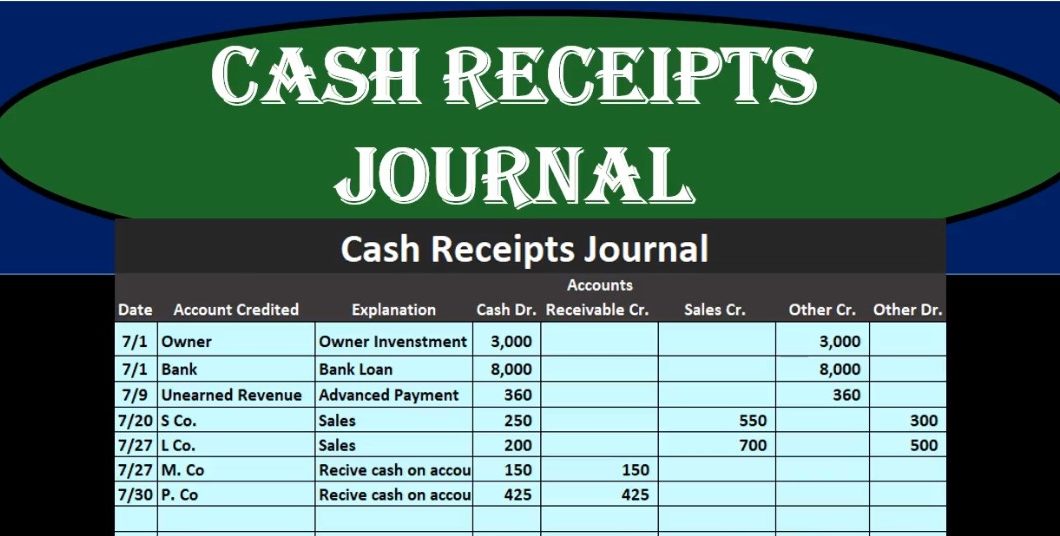

So let’s go through some transactions. We’re going to say on seven one we’ve got the owner deposited money into the business bank account at $3,000. So seven, one We’re going to say the owner is going to be the account credited. And then we’re going to have the explanation is going to be the owner investment. So this will give us some explanation. If there is a vendor involved or in this case, a customer involved will typically have the customer here. The cash then we’re going to say is 3000, we will always have this column here being a debit, because it’s the cash receipts, journal, anything where we got cash, we’ll have a debit in the cash receipts journal to cash the other side, then we’re going to put into other credit, it’s going to be an other credit, because it’s not going to be a normal type of thing that we will have an owner investment probably is not going to happen many times throughout the time period app throughout the month.

03:41

Hopefully not that many times that the owner has to put money in to the business they want to be taking the money out, and therefore we will put it into the other breaking that out at the end using this account category here to do so. Next item we’re going to say borrowed from the bank that happened on seven one. We’re just going to save up Bank for the account credited. And then we’re going to have the explanation, it’s going to be a bank loan. Once again, we will have a credit to cash because we were always going to I mean, I’m debit to cash because we’re always going to be increasing cash here because it’s the cash receipts journal, the other side, then it’s going to go to other again, because once again, we don’t think we’re going to have too many bank loans. Hopefully, that’s not the reason we’re getting cashed most of the time. And hopefully, most of the time we’re making sales or getting money on account for sales made in the past.

04:31

So we’re going to put that into other breaking it out at the point in time that we make the journal entry at the end of the time period, in this case, the end of the month. Next transaction on seven nine received Cash for Work that will be done in the future. So we’re going to say unearned revenue is going to be the account that we will be dealing with, because remember our journal entries here we’d have to kind of know our journal entries to figure this one out. If you know, we got cash and then we can’t credit we debit cash and we can’t credit the revenue account. We’re going have to credit something else. The reason we can’t credit revenue is because we have not yet earned it and therefore can’t record it until we earn it under the revenue recognition principle, therefore, that credit will then go to the unearned revenue a liability, it’s going to be an advanced payment, so the customer paid us in advance. In other words, it will be an increase of cash as always the 360.

05:21

If this were a normal sale, it would then go to the sales column, which we would break out into a normal column. But because it’s not a normal sale for us, we got paid before we’re going to put it into other breaking it out at the end of the time period to on earned revenue. Now if we were a type of company that always had unearned revenue, in other words, if we did something like newspaper subscriptions, and we always got paid before we did the work delivering the newspapers in that case, then we would have another column of unearned revenue and that would be our normal transaction. But for most companies, we do the work before we get paid or at the same time. Therefore this transaction would be somewhat unusual. Next transaction 720 completed job for s company received 250 will receive at a later date 300. So we did work and we got some money, but not all the money. This is going to be a confusing transaction. Because even if we just said, we did work and got cash, even if it wasn’t broken out between these two, it’s often something that we will get wrong in terms of what journalists will go into.

06:29

Because clearly we made a sale, we completed a job we basically made a sale in that case, and you would think it would go in the sales journal. But the sales journal is only there when we have something on account. And in this case, we got cash. So anytime you get cash, even if it’s for a sale, it’s going to go into the cash receipts journal rather than the sales journal. So we’re going to say the S company is going to be the company we want to list out the company here so that we can know what the subsidiary Count will be. And we don’t need to have the account credited here because the account will be in the sales column for this case, what we do want to do is is break out who we’re selling to, so that the accounts receivable component will be their explanation will be sales. And then we’re going to say the amount going up is the 250. So when we got 250, out of the total 550 that we did work for the other side then is going to go well then we’re going to have sales going up by 550. That being the 300 plus the 250. That’s what we did to work for but we only got 250 cash, therefore 550 minus 250 is the 300 the 300 going over here into the other debit and that’s going to be a bit confusing because you might say hey, we got an accounts receivable right here, why don’t we record it to the accounts receivable because that’s what this is going to be representing.

07:52

That’s what we are owed from we sold 550 only got 250 therefore accounts receivable is going up by 300. But this time column represents a credit to accounts receivable, the normal transaction we would expect when we are dealing with the cash receipts journal because if we got cash related to accounts receivable, it’s because accounts receivable is then going down, someone pays off therefore not owing us money any longer. So this is going to be an accounts receivable but it’s going to be a debit increase in accounts receivable, not very normal for a cash receipts journal. Therefore, we’re going to put it into the others category here. Next transaction, we’re going to say that completed a job for L company, invoice 700 received 200 account to be received in the future should be amounted 500. So now we’re going to say that this is going to be the same type of transaction, probably one of the more difficult types of transaction.

08:43

Although we made a sale, it’s not going to go in the sale journal, because we got cash and we should be recording the cash received. So we’re going to put it into L company here and that’s going to be so that we can record this to the subsidiary ledger, then we’re going to be having In the sales is going to be the explanation of what happened, we got cash of 200 we sold something worth 700 or services worth 700 got 200 of it, then we’re going to say that sales went up by that 700. The difference 700 sales minus the 200 is the increase in accounts receivable. Once again not going into accounts receivable here because this is going to be the credit to accounts receivable it’s going into accounts receivable here into an other account because it’s kind of an unusual type of transaction. Note that the transactions that have more than one account of course are going to be more complex type of accounts here as well as anytime we’re recording transactions with more than two accounts. Then we have on 727 received cash from in company for work done in the past.

09:49

So 727 we’re going to label this in company. Okay, we received work for we received cash for work done in the past. We’re going to call that received cash on account Count so we got money basically on account meaning we did work in the past and we’re going to get paid now we’re going to say that the cash is going to go up by the 150 to the debit to the cash, the other side is now going to go to the accounts receivable as we would normally expect accounts receivable to behave when looking at a cash receipts journal. So the accounts receivable would go down if someone paid us and then the cash side would go up next transaction and we’re going to say receive cash from the company for work done in the past so same type of idea we’re gonna say in 730. We’ve got p company is paying us we want to label that so we can record it in the subsidiary ledger. We’re going to receive on account received cash on account received cash for work done in the past and in companies owing us for that work done in the past.

10:47

We’re going to say it’s going to go up to cash of 425 the amount of received always debit in the cash in the cash receipts journal, the other side then go into the accounts receivable decrease in the accounts receivable this In a really normal transaction, so if we’re in a type of industry where we make sales on account, and then we collect on those accounts, this cash receipts journal would probably be filled with pretty much mostly these transactions all the way down. If on the other hand, we make sales on account, then the cash receipts journal would be filled with mostly this column here. And these other columns are ones we really want to practice, because those are the confusing ones in test and in practice, but ones that are more rare or not the norm or not the transactions made 90% of the time. Then we’re going to total this stuff up. So we’re going to total everything up and the cash side we got the 3000 cash the 8000, the 360, the 250, the 200 plus the 150 plus two fourths 25, giving us a total of 12,003 85 accounts receivable 150 plus 425 gives us a total of 575 in the sales 550 plus 700 gives us a total of 1215. And the other credit 3000 plus 8000 plus 360 gives us a total of 11,360. And other debit 300 plus the 500 gives us the 800.

12:10

We’re going to use these totals then to post one time instead of 1234567 separate journal entries to the general journal, and then use that to create the general ledger. So here’s our information up top, here’s our totals, we’re going to create our general journal just one time this time instead of multiple times. That’s what’s saving us time. So we’re going to say first we’ve got the checking account. So here’s the cash in the checking account, we will be debiting. The checking account, it’s going up cash is a debit balance, we’re going to do the same thing to it which is an increase or a debit. The other side it’s going to go to the accounts receivable here’s the 575 go into accounts receivable, accounts receivable being an asset and then having a debit balance. We’re going to make it go down doing the opposite thing to it a credit. Then we’ve got the sales so here’s going to be the sales item. We’re going to call it revenue here.

12:59

Sales is typical. typically used for a merchandising company, and revenue or, or fees earned or something for a service company, we will use the sales term here because it’s often used in the journals. When we have a sale journal, we typically call the sales journal rather than a revenue journal. So we’ll keep that term and we will look briefly at a merchandising company as well. Then we’re going to have the other which we have to break out note, we can’t just use this 11,003 60 because we don’t know which account it goes to. That’s the point of putting it into other we don’t know where it goes. So we’re gonna have to look over here and say, Okay, this went to the owner owner investment, that means it’s going to be the capital capitals got to be increasing. That’s what represents the owner investing money in a sole proprietor, therefore we’re going to increase capital capital has a credit balance, we’re going to increase it crease it, as it says here with a credit.

13:51

So we’re increased the capital then we have the bank. So the bank loan another other transaction in the credit, note, we debit it, of course. For these, both of these, the debit is already included here in the 12,003 85. We already got that, we just need the credit side related to this amount. So the totals already there, we need the credit side. So in this case it’s going to be a bank loan. So that’s going to be something like a notes payable that will record this too. That’s a liability account, we need to make it go up so we’ll do the same thing to it. Another credit has is indicated here. Then we have the unearned revenue. So unearned revenue here again, the debit the cash is already included in this 12,003 85 right there. Now we need to include the other side in this case go into unearned revenue, a liability account liabilities have any credit balance, we’re going to increase it doing the same thing to it another credit. Then we’ve got the others being a 300 and the 500, adding up to 800. And that’s going to go into the accounts receivable.

14:53

And note we can sum this up because these two weeks see we can see they’re doing the same thing. It’s both going to be the sales and it went As company therefore, it’s going to go into accounts receivable and we can just put that into the accounts payable one time and increase the accounts receivable here. Then we’re going to take this information as journal entry and post that to the general journal. So we’ll just list out the general journal, our general ledger general ledger accounts that we have. So the cash is going to be here started at zero we’re increasing it 12,003 85 to 12,003 85. By this amount of the entry, then we’ve got this 575 to the accounts receivable bringing the 2070 balance down by 575 to the 1004 95. Then we’ve got the revenue here going from zero up by 3000 to 3000. Then we’ve got the notes payable going from zero up by 8000 to 8000. Then we’ve got the unearned revenue going from zero up by 360 to 360. And finally, once again, the counts receivable being here 1004 95 and then we’ve got the debit of 800 and bring it up to 2002 95.

16:10

These ending balances then can be found and used to generate the trial balance. Note Of course, this isn’t all the accounts have a general ledger, it’s just the ones that we’re considering here. So here’s the 12,003 85 12,003 85 counts receivable 2002 95 is here 2002 95 we’ve got the notes payable 8000. Here’s the notes payable and the liability Count 1000 there, we’ve got the unearned revenue on the general ledger here. It’s going to be on the trial balance there. And finally, the capital accounts here on the general journal or the general ledger. And here it is on the trial balance. And then the revenue account looks like I’m not sure if I skipped the revenue account, but here’s the 1001 50. So it’s gone from 2017 up by 1001 50 to 3003 20. That To hear is on the trial balance and of course trial balances in balance debits equal in the credits. net income now is including just this revenue that we recorded in net income.

17:12

Finally, we’re going to take a look at the accounts receivable subsidiary ledger because you’ll note that these items here are dealing with customers and we want to break out more than just this item here. We know how much people owe us but we need to know who owes us money so that we can collect on that money more easily. To do that we do the accounts receivable subsidiary ledger. So we’re basically taking our cash receipts journal looking at these items here to break out this number. So this number that we recorded, that’s our Indian accounts receivable. Here’s the activity that we did in summary, during the time period, and now we’re going to have to break out that activity by customer So first, we’ve got the 300 here.

17:56

That’s where the accounts receivable for this transaction for s company So s company made a sale, and we have it, we didn’t collect 300 of it and therefore s company owes us 300. Bringing the balance from 425 up by 300 to 725. Same thing for L company, they still owe us 500 for a transaction, bring the balance up from zero by 500 to 500. And then we have the accounts receivable here going down for m company we got paid and therefore decrease the accounts receivable. So here we’ve got the the five 500 going down by 150 to 350. And then the 425 same concept we got the 1001 45 going down by the 425 to the 7720. So then if we add up all the accounts receivable we should tie out then to the accounts receivable in the general ledger breaking that out by who owes us the money.