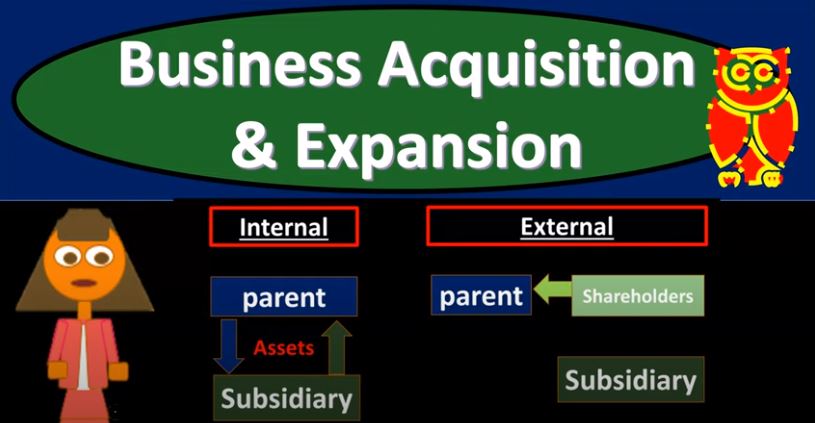

In this presentation, we’re going to discuss an Introduction to Business acquisition and expansion, get ready to act, because it’s time to account with business, Advanced Accounting, advanced financial accounting will have to do with the concept of expansion and the accounting related to it. So first we need to know well, what is expansion? What are the types of expansion that can take place? What are the problems with regards to the accounting for it? And then what type of accounting principles can we apply in order to deal with the accounting related to those problems? So when we think about expansion in general of a business, we’re thinking about the growth of a business, typically, you have either internal expansion or external expansion. So those are two categories of expansion. We want to start to visualize in our mind and we got our mind our mind is visualizing a business that is trying to expand how are they going to do that? Are they going to do it with some type of internal growth or some type of external growth? Then we want to think about the legal structure of the of the expansion for example, an expansion often results in a parent subsidiary type of relationship. So, we have different legal entities that are associated in some way shape or form.

01:13

So, with an internal type of expansion, you can think of a concept where we have one company the company is growing, how could they grow, they can either create more divisions to grow from just a logistic standpoint and and be working under the same overall company or they can create subsidiaries and many large companies, most large companies will have some type of subsidiary type of structure within their business structure. So we have a parent subsidiary type of relationship that could have been growing up or start from an internal type of relationship in that the parent basically gives assets or and or liabilities to the subsidiary and then has a subsidiary relationship. We can also think of external expansion. External expansion is the case where Have two entities, two companies, two organizations that will merge or combine in some type of way. And the easiest way to consider that or think about this, and we’ll think about other different ways or how that external combination can take place and the accounting related to it. But the most straightforward concept or idea of it is that say we have the parents company, possibly purchasing the shares from the shareholders of the subsidiary. And if they get a controlling interest, which will typically be over 50% of those shares, well, then you’re you’re left with once again a parent subsidiary type of relationship. So instead of the parent than creating the subsidiary and expanding internally, there’s going to be some kind of combination of entities resulting oftentimes in a parent subsidiary relationship.

02:50

Now note in this external expansion method, at some point in time, if there was a full purchase of a subsidiary company, you still have the question as to whether The parent wants to, to purchase in some way or combine with another company in some way, and then dissolve in some way the other company, resulting in just single one single company that now has multiple divisions, or which is often the case, do we want to keep the relationship as a parent subsidiary type of relationship? So those are the two general categories that you want to be thinking of company needs to grow or a company is growing, how are they going to do that? Are they going to do it internally or externally? And then the concept of what is going to be the the structure in terms of legal entities, what type of legal entities will be involved? And obviously, when we’re thinking about a parent subsidiary type of relationship, if you think of a relationship, such as a parent subsidiary like this, the question then is, well, how are we going to account for that? Because we have one entity which is a separate legal entity because this is typically a corporation we’re talking about here, which files their own tax return pays their own taxes that owns a new Other legal entity or has control of another legal entity? So how do we deal with the accounting? related to that? How do we deal with the financial statements that are going to be related to that type of situation? Why expand what’s going to be the reason for the expansion? Knowing the reasoning for the expansions? It’s going to be really important so that we can understand what type of expansion should be taking place, how many entities Do we want, what do we want in terms of the relationship of legal entities and so on and so forth, as we implement the expansion process.

04:31

And then once it has been implemented, then of course, we need to follow the accounting regulations to to move forward to make sure that we are reporting this information properly with regards to an accounting standpoint. So one reason of course for management is going to be diversification. Now, this is a managerial type of decision making process, whether they want to expand or grow into different areas or segments, which could help with diversification. Obviously, from an investment standpoint, we’ve all heard of the idea of defense. versification. And it’s going to be a risk management type of strategy, oftentimes, because if there’s a problem with one particular area, if one particular area has a problem, then we can rely on another area. And we have some kind of risk management for protection. In that case, obviously, there’s going to be some pros and cons. Because when we think about a business setting, most of the time the business is in a particular industry, because they’re good at that industry. They’re specializing in that particular industry. So from a manager from a managerial standpoint, you got to think about well, is it worthwhile for us to go into some other industry where we will have or some other area or some other expansion further than what we’re currently doing? Does it fit in with what we’re currently doing? Because we’re going to get some benefits from the diversification with it. But we’re also expanding beyond what our specialty typically is.

05:52

So those are, you know, the pros and cons that would kind of be considered with regards to the managerial decision of diversification there Got the new earnings potential. Obviously, if we go into different industries, we have, you know, different revenue, making potentials in different different industries that we can expand into, as we get different earning potentials and different revenue sources that will help us with that diversification as well as economies of scales will benefit. So if we are in an economy of scale, that means that certain economies, certain type of industries do better when they’re large, because you get the benefit of the overhead per unit actually going down. So if you’re in the type of energy industry that actually benefits from from growth, because the overhead per unit would go down, then of course, the expansion in some ways will benefit those type of industries. And you can kind of see some of those types of industries. If you look at some of the industries that have that they grow and possibly get broken up by something like even government regulation, and you’ll see that they tend to merge back together again, that’s probably because that type of industry benefits From the scale the size, so some businesses do quite well with the scaling. And other industries don’t have as much of a benefit. Obviously, when you think about conglomerates or going into different industries simply to be large, that doesn’t, that doesn’t always work out as well.

07:19

However, if you’re going into expansion, because of it’s in your related industry, oftentimes and you’re going to be benefiting from the the economies of scale, then that can be a very beneficial type of situation. So in other words, bigger, bigger, it turns out isn’t always better, you’re not always going to get those economies that benefit of scale. But in those industries, where you are getting that benefit of scale, it can be a beneficial idea or beneficial thing. So that’s another reason and then we have the greater perceived value of larger company size. And this is this is often kind of the illusion or something that that managers need to be careful Have because obviously if you’re if you’re managing a large corporation, and it’s growing there’s there’s pressure all the time to say, hey, you need to be expanded and expand and you should be, you know, expanding in every possible way, including revenue and other other kind of areas of influence, which may or may not be the wisest decision. It’s not always the wisest decision again to do something like diversify into a conglomerate or expand past your area of expertise, not always a wise thing to do if you’re making good revenue in where you are at and you and you can bet and you can solidify, put your time and effort better solidifying the hole that you have in the area you are in. So you want to make sure that you’re not overreaching from a from a managerial standpoint just to look good in terms of in terms of growth, the people that may not really understand your industry or market they just see that size is more prestigious or the idea of diversification beyond the fact that You’re diversifying past the point that you have, you know, done well and specialized in. But those are going to be some of the reasons why the expansion would take place.

09:09

Obviously, we’ve gone through periods of very large expansion in terms of both companies growing and expanding, as well as mergers of companies in the past. So one of the major concepts we want to be understanding is the idea of a parents company and the subsidiary company. So this relationship will often be the case with some type of expansion, whether it be internal or external will often end up with a situation where we have a parent subsidiary relationship from an accounting standpoint, the question then is how do we set that system up? You know, why would we want to set it up from from a business standpoint? Then how do we set it up? logistically? How do we do the accounting for it once set up? How do we do the accounting for it when you have that parent subsidiary relationship? How do we report that information on the financial statements? So the subsidiary Corporation controlled by another Corporation And obviously the parent is the controlling entity has some form of control over the subsidiary typically, meaning they’re going to have more than 50% of the shares and therefore have a controlling interest and be able to say in essence, what management is going to do or be able to hire, you know, management have have influence, major influence or control over the organization, can lower parent company risk due to the subsidiary being a separate legal entity. So note whether we’re talking about internal expansion or external expansion.

10:34

Oftentimes, the terms could be set up where the subsidiary would be absorbed into the parent. So if you’re talking about internal expansion, the question is, do we want to have a separate division under the under the one corporation which is completely possible? Or do we want to set up that separate division as a subsidiary company as separate legal entity? And when you think about a separate legal entity, I kind of envisioned like a separate like person in that legal entities have rights in some way his kind of like people do, meaning they owe taxes, they pay taxes, they’re responsible, you can think of the entity itself as basically being responsible for the liabilities of that entity. And that’s going to be that liability protection. Meaning if you’re suing the subsidiary, you’re suing the subsidiary and not the parent, the idea being that there’s some type of shield or some type of shield between the subsidiaries assets and the parent assets with regard to liability on that. So that’s one of the key kind of components that you want to think of is this as well. This is a separate legal entity. Now, that happens to be completely under the control of the parent in some way, shape, or form. So how do we deal with that from a legal perspective? In our case, we’re mainly concerned with the accounting perspective. So what are the problems with the subsidiaries type of relationship? Now when we think of problems, we’re thinking from an accounting perspective, from an accounting perspective, from a perspective of how do we make the financial statements Be in a in a way that’s, that’s going to be transparent. So notice, obviously the perspective when you think of problems and good things and bad things.

12:09

It depends on your perspective. We’re basically thinking here, from the perspective of of transparency, like the regulatory agency, the AI CPA, how can they what what problems do they have with regards to making this thing transparent? Obviously, when you’re thinking about this from a managerial standpoint, then you may have you know, you may have some different type of objectives because your objective there might be to, you know, increase, increase the perceived value of the organization, but you should still want transparency, but obviously, here we’re thinking about what are the problems from transparency from, from a regulatory standpoint, when you have these subsidiary type of relationships, so subsidiaries can be used to borrow money without showing the liability on the balance sheet. So that’s one thing that could be could be a problem. If you have the parents care type of relationship. You know, you want everything to be as transparent as possible if the subsidiary it’s possible to borrow money and have it not showing up on the balance sheet of the parent then then that could be a problem with regards to the transparency. And this of course results from the complexity of having having this parent subsidiary type of relationship. Subsidiaries can lead to intentional distortion of financial data due to the added complexity. So it’s possible for management even within the rules without basically in quotes doing something illegal possibly to simply through the complexity of the subsidiaries distort the financial statements in some such a way that that the financial statements typically would look better from, from a business perspective.

13:41

Why because that would increase the perceived value, and that could increase the investment into the company or organization. So from a from a legislative standpoint, from the AI CPA or from an investment standpoint, and accounting standpoint, transparency standpoint That complexity is is kind of a problem. And we want to make sure that there’s standardization so that the users of the financial statements, even though there is this complexity, have transparency can understand exactly you know, what they’re what they’re reading here. And then acquisition and mergers can lead to a distortion of financial data to due to the added complexity. So again, when you when you actually do the merger, if you have two different companies and they’re merging together, there’s an acquisition, we have two entities that are merging and possibly resulting in a parent subsidiary type of relationship. Then there’s complexity with that merging process. And, you know, there’s been termed like creative accounting or creative merger accounting, where you’re you could be revaluing type of things. We’ll talk about the accounting relating to the mergers, but we want to make sure that that merger takes place in such a way that people that are reading the financial statements can see what can see what’s happened and get an accurate you know, portrayal of the final position before during and after, before and after at least the merger takes place. So we need some kind of standardization of course from the reporting standpoint, so that so that people that are reading the financial statements have have that transparency and are able to know what to expect with regards to the financial statements even with some of these more complex type of situations, such as a merger or acquisition.