Corporate Finance PowerPoint presentation. In this presentation, we will discuss financial leverage, get ready, it’s time to take your chance with corporate finance, financial leverage. Now remember, when you hear the term leverage, you’re typically thinking of two different categories, that being financial leverage. And then the operating leverage the financial leverage, usually the one that most people think of when they think of leverage having to do with the leverage related to the debt, the operating leverage having to do with their leverage related to the cost structure between the variable cost and the fixed cost, the operating leverage having the leverage component when you have the in the fixed costs.

Posts in the Accounting Instruction category:

Degree of Operating Leverage 515

Corporate Finance PowerPoint presentation. In this presentation, we will discuss the degree of operating leverage, get ready, it’s time to take your chance with corporate finance, degree of operating leverage. Now remember, when you hear this term leverage, there’s two things that pop into your mind that generally categories of leverage. The first one is probably related to debt debt leverage or financial leverage. And the other related to the cost structure, the one that we’re going to be focusing in on here, the structure between variable costs and fixed costs. So what’s going to be the structure of the variable cost fixed costs, that’s kind of what we’re measuring here, with the degree of operating leverage the fixed costs being the thing that’s going to have more leverage related to it.

Break Even Analysis 510

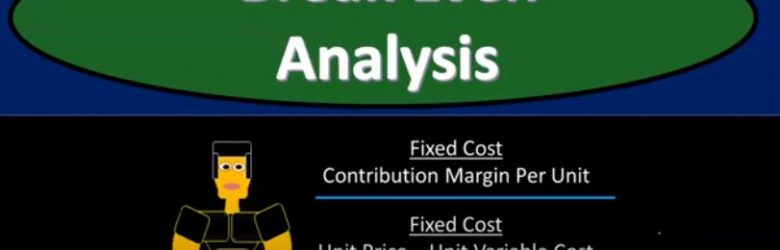

Corporate Finance PowerPoint presentation. In this presentation, we will discuss breakeven analysis, get ready, it’s time to take your chance with corporate finance. Break Even analysis includes our fundamental tools for making projections and predictions into the future. Now note, when we think about breakeven analysis, the fundamental calculation within a breakeven analysis will be the break even point. But when we hear breakeven analysis in general, you can think of it that as a more broad kind of perspective, to use some of these tools in order to think about projections into the future. So when you hear breakeven analysis, you’re typically thinking kind of projections, budgeting, future based analysis, as opposed to some financial accounting, which is typically going to be based on the past prior performance.

Leverage Overview 505

Corporate Finance PowerPoint presentation. In this presentation, we will give an overview and an introduction to the concept of leverage. Get ready, it’s time to take your chance with corporate finance, leverage what is leverage use of special forces or effects to magnify outcomes given certain conditions. Let’s break that down a little bit more detail use of Special Forces sounds kind of mystical here. But there’s a couple different things that we think about with leverage. And we typically break it down into operating leverage and financial leverage. Most people when they think about leverage, they’re thinking about debt, they’re thinking about the leverage related to the debt will also have leverage related to operating leverage, which has to do with the mix between fixed costs and variable costs. So on so we have these special forces or effects have magnify outcomes. So that could magnify outcomes.

Percent of Sales Method 425

Corporate Finance PowerPoint presentation. In this presentation we will discuss the percent of sales method, the percent of sales method been a tool that can help us with our projections out into the future help us to think about where we will stand, think about what our balance sheet accounts will be in the future. If we, if we estimate some type of growth into the future also help us to determine whether or not we may need additional funding to support our growth plans that we have set in place. Get ready, it’s time to take your chance with corporate finance percent of sales method. Now this method can be a little bit confusing when you first look at it in the calculation or formula for it can be a little bit intimidating as well, I highly recommend to get a better understanding of this formula and how to apply it to go through the practice problems, we will have practice problems related to this formula in terms of Excel problems, as well as working through the practice problems and presentations in one note.

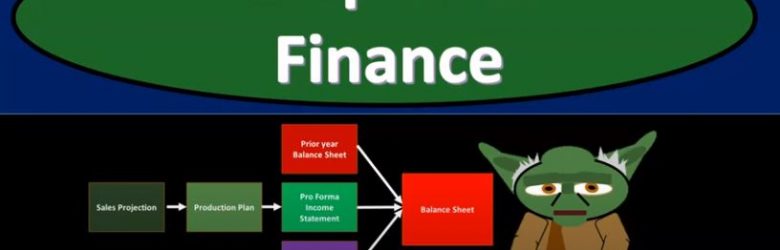

Pro Forma Balance Sheet 420

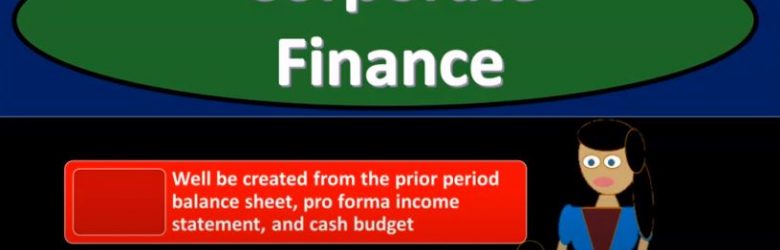

Corporate Finance PowerPoint presentation. In this presentation we will discuss a pro forma balance sheet or budgeted balance sheet. Get ready, it’s time to take your chance with corporate finance pro forma balance sheet. As we think about the pro forma or budgeted balance sheet, let’s take a step back and see where it fits in with our projections with our pro forma statements, you’ll recall that the place we need to start then is going to be the sales projections, we need the sales projection, we’re first going to think about how far we’re going basically the activity type of statement. And then we’ll take that change that activity statement how far we went, like miles driven in and our income statement, and then we’ll tack on the beginning balance where the odometer was at at the beginning to get to the ending point, which is going to be the ending balance sheet.

Cash Budget 415

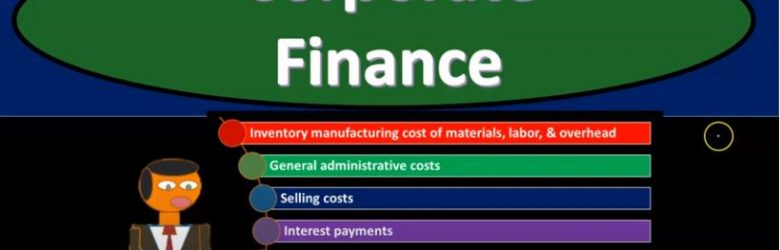

Corporate Finance PowerPoint presentation. In this presentation, we will be discussing the cash budget Get ready, it’s time to take your chance with corporate finance, cash budget, as we consider the cash budget, let’s take a step back and think about the budgeting process. So we can think about where the cash budget will fit in it. So we got to start off with the sales projection, that’s going to be our first step. So we can think about the production plan if we manufacture inventory, or we think about the purchasing plan. If we purchase and sell inventory, then we can think about the pro forma income statement. Now the pro forma income statement is going to be on an accrual basis. But we also want to be considering the cash budget. So obviously, once we have once we start to construct the income statement, on an accrual basis, we can also think about what the cash flows will be.

Pro Forma Income Statement 410

Corporate Finance PowerPoint presentation. In this presentation, we will discuss the pro forma income statement, get ready, it’s time to take your chance with corporate finance pro forma income statement. Let’s first take a step back and think about the pro forma financial statements in general, remembering the fact that we got to do them in some type of order in order to do them in a logical fashion. And that would mean that we would first need the sales projection information, the production plan, we can use those in order to create the pro forma income statement.

Forecasting Objectives 405

Corporate Finance PowerPoint presentation. In this presentation, we will discuss forecasting objectives Get ready, it’s time to take your chance with corporate finance, forecasting objectives. When thinking about forecasting, we’re thinking about into the future, we’re thinking about kind of like a budgeting or projection type of process, we want to plan ahead making changes in strategy as needed. So we’re going to think about what we think will happen into the future. So we can strategize now, and do what we need. Now, in order to accommodate what we believe will be happening in the future. Based on our best guesses based on our forecasts, we’re going to construct a financial plan to support the growth.

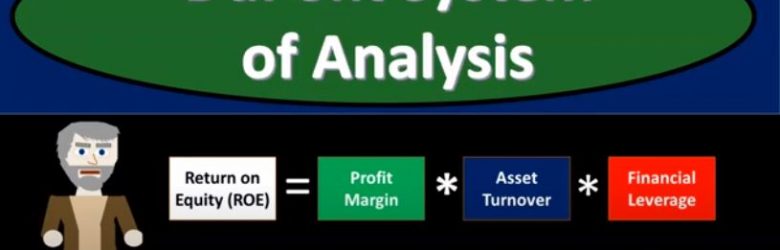

DuPont System of Analysis 315

Corporate Finance PowerPoint presentation. In this presentation, we will discuss the DuPont system of analysis Get ready, it’s time to take your chance with corporate finance, the DuPont system of analysis, the DuPont system of analysis is going to be focusing in on a key financial ratio, that being the return on equity or our OE, the ROI he is calculated most simply as net income divided by equity, what we’re going to do is take this return on equity and break it out into components, those components drilling down on areas in the business, allowing us a better analysis in those areas and given us some opportunities to improve different components of the business. So it allows us to basically drill down and get more detail on the return on equity.