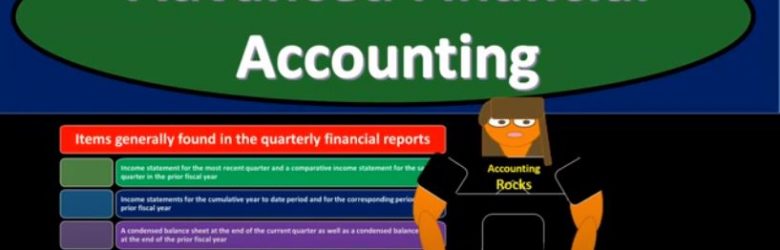

Advanced financial accounting PowerPoint presentation. In this presentation we will take a look at interim financial reporting or rules get ready to account with advanced financial accounting. Interim financial reporting rules started off with interim report. So interim reports they will cover a time period of less than a single year. So when we’re thinking about the interim reports, when we’re thinking about interim information, we have the year in information when we think about financial statements, we often what pops into most people’s head most of the time are going to be for the year ended financial statements income statement covering January through December balance sheet covering the year end. If it’s a fiscal year calendar year in interim, then we’re going to be talking about the financial statements at some interim period typically quarterly, quarterly meaning first, second, third quarter and then you got the yearly information for the fourth quarter. Therefore, the interim reports they will cover a time period of less than a single year. The goal is to provide timely information about the company’s options. Throughout the year, so obviously more information is nice. We want timely information for the decision makers, we got the year end reports, it would be nice if we have the quarterly reports, which we have now, to give us more timely information as the year goes by. quarterly reports are required to be published for publicly held companies. So if you’re a publicly held company, that company’s stock is being traded on stock exchanges and whatnot, then people need current information. The market needs current information. Therefore, it’s a requirement to have the quarterly reporting for that timely information. The quarterly reports can generally be thought of as smaller versions of the annual report. So when we think about the annual reporting, what’s going to be included in it, the quarterly reports is, as you would kind of expect, right a smaller version of that as we’re doing the reporting for a timeframe that’s going to be less than the entire year. Here some type of interim reporting requirements form q 10 q or form 10 q sec s quarterly report.

Posts in the Accounting Instruction category:

Enterprisewide Disclosures

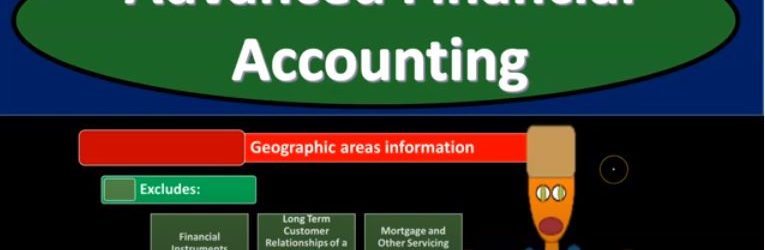

Advanced financial accounting a PowerPoint presentation. In this presentation we will discuss enterprise wide disclosure, get ready to account with advanced financial accounting. enterprise wide disclosures established by ASC 280 standards provide users more information about the company’s risks generally made in a footnote to the financial statements. First category of required information to include under ASC 280 is information about products and services so information about products and services disclosure related to them. Companies are generally required to report revenues from external customers for each major product and service or each group of similar products and services. Unless doing so is not practical. primary reason for this is that the company could have organized its operating segments on a different basis from the organization of the entities product lines. So we’ve got then again, companies are generally required to report revenues and external customers for each major product and service. You might be saying, hey, well, they already have the segment’s reporting. But it’s possible that those two things don’t exactly line up in the way they put the segment reporting together and therefore, you know, you have this requirement. second category of required information to include under ASC 280 is going to be related to geographic areas information. The following needs to be reported unless it would be impractical to do so. revenues from external customers attributed to the company’s home country of domiciled revenue from external customers attributed to all foreign countries in which the enterprise generates revenues.

Threshold Tests for Segment Reporting

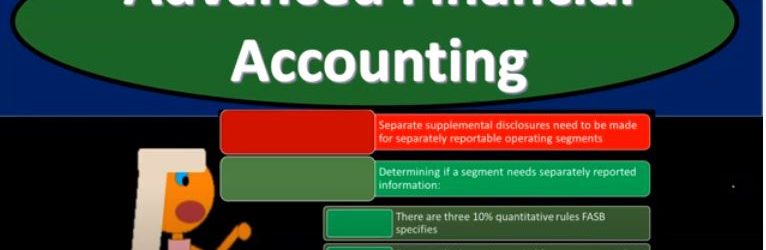

Advanced financial accounting PowerPoint presentation. In this presentation we will discuss threshold tests for segments reporting, get ready to account with advanced financial accounting threshold tests for segment reporting separate supplemental disclosures that need to be made for separately reportable operating segments. So we’ve got these separately reportable operating segments, we have to then determine what type of reporting needs to be taking place for them. determining if a segment needs separately reported information. There are 310 percent quantitative rules FA SB specifies separate disclosure is needed for any segment that meets at least one of the three tests that follow. So we have the segment we got to think about Okay, do we need separate disclosure for this segment, and in order to determine that we’re going to use these 310 percent tests, they only need to meet one of these tests in order for the separate disclosure to be necessary that being 10% revenue test 10% profit or loss test and 10% assets tests. We’re going to go into more detail on each of these tests. Now some we’re going next slides we’ll be focusing in on these three items. So we’re going to start of course with the 10% revenue test. If an operating segments revenue, including both external sales and intersegment sales or transfers is 10% or more of total revenues from external sales plus intersegment. transactions of all operating segments, then segment is separately reported and supplemental disclosures must be provided for it in the annual report so that we have the 10% of revenue basically top line of course on the income statement to determine if the segment is separately reportable. Then we have the 10% of profit and loss. So now the next test now looking at the bottom line, of the income statement, as opposed to The top line if the absolute value of the segments profit or loss or absolute value, so, if we have a income or loss is 10% or more of the higher in absolute value of a the total profit of all operating segments that did not report a loss or be total loss of all operating segments that did report a loss, then the segment is separately reportable and supplementary disclosures must be provided for it in the annual report. So, you can think about these tests you got the 10% of the top line of the income statement, the revenue, basically 10% of the bottom line, profit or loss on the income statement. Now, we’re looking at the balance sheet 10% of assets tests. If these segments assets are 10% or more of the total assets of all operating segments, then the segment is separately reportable and supplementary disclosures must be provided for it in the annual report.

Segment Reporting Overview

Advanced financial accounting PowerPoint presentation. In this presentation, we will give an overview of segment reporting, get ready to account with advanced financial accounting, overview segment reporting. So when we think about segment reporting, we’re thinking about a company breaking that company into the segments. And when we think about the segments, two questions we want to consider are what is a segment? How does one qualify or how does a segment qualify as a segment and once qualifying for a segment, then what are going to be the financial reporting that needs to be done for the segment? So three characteristics of an operating segment, the component units, business activities, generate revenue and incur expenses. So the component unit that unit you can think about like a separate unit incurs revenue and has expenses including any revenue or expenses in transactions with other business units of the company? So we’re including the transactions if you’re thinking about it as a different segment, a different unit? You’re thinking okay, they have revenue and expenses with In the revenue worth, we’re also including any revenue or expenses, in transactions with other business units of the company. So you’re kind of thinking about a segment as being somewhat autonomous in and of itself here, and therefore having its own basically revenue and expenses, although it can be connected to other segments, the component units, operating results are regularly reviewed by the entities Chief Operating mark, operating decision maker.

Valuation of Business Entities

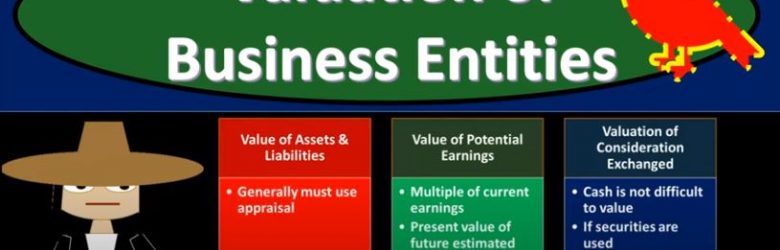

In this presentation we’re going to talk about valuation of business entities when there’s going to be an external expansion. In other words, a merger or consolidation, get ready to act because it’s time to account with advanced financial accounting. We’re continuing on with our discussion of external expansion. That means we’re have two separate entities that are going to be combining in some way shape or form. The two types that we want to keep in mind at this point is the acquisition of assets and the acquisition of stocks. So if the acquisition of assets we have one company acquired another assets using negotiation with management, so that means you have two separate entities and one entity is basically going to be purchasing the assets of the other entity versus the acquisition of stock, where we have a majority of outstanding voting shares is generally required, unless other factors result in the gaining of control. So in other words, you have two entities, one entity in essence buying a controlling share or controlling ownership over 50% typically 51 and above. Have another entity. So from an accounting perspective, then the question is, well, how are we going to value the assets and liabilities. Now when we think about the assets and liabilities, we may have to use an appraisal oftentimes, in order to do so because remember, if you’re talking about some assets, they might may be on a fair value method, because you might be talking about cash or something like that, or possibly stocks or investments in that way, that may be easy to value with a market method. However, if you’re talking about things like property, plant and equipment, then it’s going to be more difficult to know what the value is. That’s the problem because there hasn’t been a market transaction for that exact same piece of equipment for some time.

Forms of Business Combinations

This presentation we’re going to talk about forms of business combinations, which is basically external expansion, two types of entities that are going to be related in some way, shape or form, get ready to act because it’s time to account with advanced financial accounting, forms of business combinations. Now remember, we’re talking about expansion. Here, we’re thinking about expansion. We’ve got the two categories, we’ve got the internal expansion and external expansion. We’re considering here, the external expansion, we have an organization that now wants to expand and they’re going to be consolidated in some way or have two separate entities that will be combining. So now we’re talking about two separate legal entities typically separate legal entities that are now going to be combined in some way shape or forms. The forms of business combinations can be the statutory merger, the statutory consolidation, and the stock acquisition. So if you think about, in other words to separate legal entities and say, Alright, well how can these two separate legal entities be combined in some type of way, you can imagine some different Kind of scenarios in which that could take place. So and when you’re imagining those different types of scenarios, you’re going to be thinking about, okay, well, what’s going to be the key factor here, it’s going to be the controlling interest. So what’s going to be a situation where you had two separate legal entities, and now they’re they’re going to be have some controlling relationship, which could be that they’re combined together under one entity at some point or they are having a parent subsidiary type of relationship, in which case the control would be over the 50%. So that control concept is what you want to keep in mind here.

Internal Expansion Accounting

In this presentation, we will expand on the logistics of internal expansion, get ready to act, because it’s time to account with advanced financial accounting. We’re going to take a look now at the steps of the internal expansion. So note we have the two categories of expansion, the internal expansion and the external expansion, internal expansion with a company growing, we’re imagining the company growing, they can either grow internally make it another sub subsidiary, possibly, that would be owned by the parent company creating a parent subsidiary relationship internally, or has some kind of external expansion where we have two separate entities that are going to be together in some way, shape or form. So here, we’re talking about the internal expansion. So we have one company that is then thinking about expanding how are they going to put that expansion together? We’re thinking about the setting up then in this case of another legal entity such as a subsidiary, what steps for that? Well, first, you’re going to have a sub sub subsidiary B. created. So you get the parent company is going to be creating the subsidiary, then we have assets and liabilities are transferred to the new entity. So we’re imagining we have one company that wants to expand possibly have another division or another location that they will be expanding into. They make this subsidiary so they another legal entity created, we typically will think of another corporation that is owned by the prior Corporation, parent subsidiary relationship, the assets and liabilities that are going to be controlled or be part of that new segment are going to be transferred from the parent company now to the subsidiary company. And the key point here is that it’s going to be transferred at book value. And you might be thinking after looking at the external expansion, where you have two separate entities that are coming together and the need for us to then use the basically the acquisition method treat it basically like a sale happening.

Business Combinations Methods

In this presentation, we will take a look at business combination accounting methods, both historic methods and the current methods get ready to act, because it’s time to account with advanced financial accounting. We’re going to start off with business combinations from the past, these are not the current method that we’re going to be using. However, it’s good to have some historical context so that if you hear these methods, you know what you’re talking about. We also want to think about these concepts in terms of just a logistical standpoint. If you were to make these laws, then how would you do it? What are some of the challenges that have happened? And by looking through the historical process, you can kind of think about, okay, these are what were put in place, I see why those were put in place here that changes that are happening, we could see why the changes are happening, therefore have a better understanding of what we are doing, and how the current process is being put in place and why the decisions were made to put it in place. So in the past, we had combinations methods that included the purchase method and the pooling of interest. method. So they then what happened is the pooling of interest method was taken away by faz B. So faz B said, Hey, we’re not going to allow anymore, the pooling of interest method, and then the purchase method has been replaced with the acquisition method. So if you hear the purchase method, that in essence is what we’re currently doing. However, we changed the name from the purchase method to the acquisition method.

Allocate Expenses to Classes

This presentation we’re going to take a closer look at external business expansion, which includes things like mergers and business combinations, get ready to act, because it’s time to account with advanced financial accounting. Before we move into the external expansion, you want to give a review and keep your mind on what our focus is we’re talking about a business that is expanding. When we think of it about expansion, we can break that expansion into internal and external expansion. So we have a business expanding into new areas do segments, we can think of it as an internal or external expansion. In a prior presentation, we talked a little bit more on the internal expansion, in which case you might have a situation where a parent creates a subsidiary or a parent basically just creates another division possibly, and expands in that format. Now we’re going to be going to the external expansion, in which case we’re talking about two entities. So we have two separate legal entities that in some or two separate entities in some case in some way, shape reform are coming together. So now we’re going to have an expansion where we have an external expansion. So if we’re thinking of thinking about this, from the from the standpoint of one company, we’re thinking about ourselves as one company and we are expanding, then we’re thinking about the expansion externally, that we are going to be combining in some way shape or form with another company. Now, the format and form in which that combination can take place can be various we can have various forms of that combination, it could result in a parent subsidiary type of relationship, or it could result in the parent basically consuming that another company and bringing them into the overarching parent company.

Internal Business Expansion

In this presentation, we’ll take a closer look at internal business expansion, get ready to act because it’s time to account with advanced financial accounting. In our previous presentation, we talked about the types of expansion that a company can take. And we broke those out into the general categories of internal expansion and external expansion. The internal expansion, meaning we have a corporation or a company that needs to expand wants to do so internally might result in other divisions or might result in a creation of a subsidiary, the external expansion meaning we have two entities that are separate and somehow come together, which still could result in something like a parent subsidiary type relationship, or some type of division. So we’re going to be considered here the internal ideas the internal concept or internal expansion. So we have one organization, the organization wants to grow and expand possibly into a different sections or segments are different industry, and therefore they’re going to expand in some way shape. shape or form. Typically, we’re thinking of the creation in this case of a subsidiary type of relationship, in which case, they might create a separate legal entity. And that would be the giving of the assets and possibly liabilities to a separate legal entity that would be created. In other words, the parents company, setting up a subsidiary in some way, shape or form. And then given the subsidiary some assets and the liabilities that were formerly the parents organization, and then having a parent subsidiary type relationship with that subsidiary unit, us from an accounting standpoint, then having to think about how are we going to account for that with regards to financial accounting with that parent subsidiary type of relationships. So types of business entities that could be involved with this, we could have a subsidiary company and that’s the one you’d probably most be considering.