In this presentation, we’re going to discuss an Introduction to Business acquisition and expansion, get ready to act, because it’s time to account with business, Advanced Accounting, advanced financial accounting will have to do with the concept of expansion and the accounting related to it. So first we need to know well, what is expansion? What are the types of expansion that can take place? What are the problems with regards to the accounting for it? And then what type of accounting principles can we apply in order to deal with the accounting related to those problems? So when we think about expansion in general of a business, we’re thinking about the growth of a business, typically, you have either internal expansion or external expansion. So those are two categories of expansion. We want to start to visualize in our mind and we got our mind our mind is visualizing a business that is trying to expand how are they going to do that? Are they going to do it with some type of internal growth or some type of external growth? Then we want to think about the legal structure of the of the expansion for example, an expansion often results in a parent subsidiary type of relationship. So, we have different legal entities that are associated in some way shape or form.

Posts in the Accounting Instruction category:

Accounting Related to Ownership & Control

In this presentation, we will take a look at accounting methods which will relate to and depend on ownership and control, get ready to account with advanced financial accounting. Accounting related to ownership and control methods used to account for investments in common stock will depend on the extent of influence or control, the investor can exercise over the investi. So in other words, we’re gonna have different methods depending on the level of control. Now, if we’re going to use different methods, we need to have some kind of definition we need to have some lines in terms of when we’re going to apply these different methods. What does it mean to have different levels of control? And then how do we apply those in practice so we can have some kind of standardization for that.

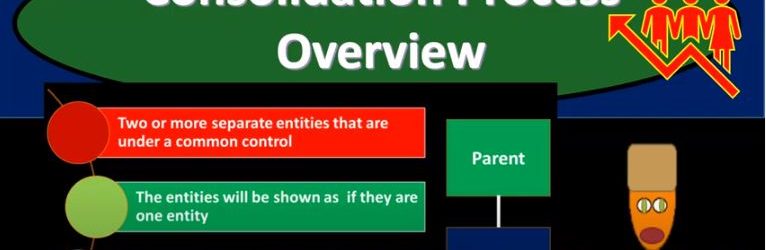

Consolidation Process Overview

In this presentation, we will take a look at an overview of the consolidation process, get ready to account with advanced financial accounting, consolidation process overview we’re talking about a situation where we have two or more separate entities that are under a common control. So the basic kind of format of that you’re imagining here, then you have a parent and a subsidiary, these are going to be connected in some way shape or form because the parent has control over the subsidiary, we can imagine more complex situations, for example, having one parent and multiple subsidiaries as well. The entities will be showing as if they are one entity. So if we have a situation like this, if there’s a control type of situation, it’s quite possible then we’re going to have the the subsidiary and the parent These are two separate companies have a consolidated basically a financial statement. So the financial statement the idea of that being we’re going to take these two financials and represent them as if these two separate entities in this case, two or more can be more than two are one entity. This means two or more sets of books are merged into one set of financial statements. So obviously, what does that look like from a practical standpoint, we have the parent company, we have this subsidiary company, they have two sets of books, we’re gonna have to take those two sets of books and put them together for the financial statements. Here is an example of a slightly more complex situation where we still have parent subsidiary relationships but multiple pole subsidiaries in this case, so we have the parent subsidiary one where there’s a 75% ownership. So we’re over we have a controlling interest, we’re over that 51, we’re going to say there’s a controlling interest here, therefore there’s going to be a consolidation. So we’re gonna have a consolidation subsidiary to is owned 52%. So we’re still over the 51.

Measurement Period and Contingent Considerations

In this presentation, we will discuss measurement period and contingent considerations within an acquisition process, get ready to account with advanced financial accounting. At this point with the discussion of the acquisition process, you’re probably thinking, Okay, I kind of see how this fits together. I’ve see how this works. But logistically, it could still be a little bit tough. If you were to apply this in practice, you’re probably saying, Hey, there could be some problems. In practice. If we were to apply this out. For example, if we’re saying, okay, we’re going to revalue the assets and the liabilities. And we’re going to value the consideration we’re going to make a comparison of the value of the assets and liabilities to the consideration that’s being given for the company that in essence is being acquired in the acquisition process. Well, then what about that valuation process? That’s going to be difficult because how do we revalue the assets and liabilities because normally, when you value something, you value it from a market perspective, which means there’s actually a transaction a sale that’s taking place. So note obviously that valuation process is going to be somewhat of a tedious process for us to go through and revalue. And how long do we have for that to take? I mean, if this isn’t happening basically instantly with regards to this process, this is going to be taking some time.

Financial Reporting After a Business Combination

In this presentation, we will discuss financial reporting, after a business combination, get ready to account with advanced financial accounting, financial reporting, after a business combination, show the combined entity starting on the date of combination and going forward. So in other words, we probably when we’re imagining this type of scenario, we’re going to say, Okay, I see how this all works out here. And then we imagine this happening if we have a calendar year in a calendar, fiscal year, January through December, we say, Alright, the purchase happens, it will just apply it to January out through December. But obviously, that’s not always the case here. What happens when we have that interim kind of transaction where the purchase happened sometime in the middle of the of the fiscal year then that adds some bit of a complication. So you want to think about this in terms of a clean, you know, year, if it happened at the beginning of the fiscal year in combination, and then you know, what would happen if it did not happen at the beginning of the fiscal year, so if a combination of During a fiscal period, revenue earned by the acquire II before the combination is not reported in revenue for that combined enterprise. So you can see that can add a bit of complication with regards to that reporting

Other Intangibles

In this presentation we can continue on discussing acquisitions, this time talking about other intangibles other intangibles other than goodwill, get ready to account with advanced financial accounting. We are talking here about intangibles that must be recognized separately. So in prior presentations, we talked about an acquisition process and the recording of goodwill and the calculation of goodwill. Through that process, you’ll remember that we talked about the revaluation we had to reevaluate the assets and liability of the company that’s been acquired to their their value and then consider that or compare that, to the consideration that’s being given we can think about goodwill. Now in that process, however, we might have some other intangibles that need to be valued at that time as well, other than just simply the goodwill. So for example, we might have marketing related intangibles things like Internet domains and trademarks. So instead of just basically lumping everything into goodwill, we got to say okay, all right. They’re going to be marketing related intangibles like the internet domains and the trademarks that we need to apply some of that intangible amounts to we need to value in essence, those things as well breaking them out from just basically a kind of a lump sum valuation of goodwill.

Acquisition Accounting Bargain Purchase

This presentation we’re going to continue on with our discussion of acquisition accounting, and this time focusing in on a bargain purchase, get ready to account with advanced financial accounting. First off, we can basically think of the bargain purchase as the opposite of goodwill. So in a prior presentation, we talked about the concept of goodwill within an acquisition, which would be resulting if the fair market value of the amount that was given like basically the purchasing price was greater than the fair market value of the net assets. So in other words, we take we look at the books of the company that’s being acquired, we’ve revalue their assets and liabilities to be on a fair market value, then assets minus liabilities, the equity section, the net assets now at a fair market value, we take a look at that. And if there’s a consideration that’s given that is greater than that amount, that then would result in goodwill. Now goodwill is quite common, because it’s unlikely even if you even if you re assess all the assets and liabilities to their fair value. Then you would typically think that the price would either be that that would be given the the amount that would be exchanged, the fair market value of the consideration would be the same as the assets minus the liabilities at fair market value, or more, because there’s some type of goodwill, that’s going to be that’s going to be in the organization. Now, you might be thinking, Well, what what if it was the opposite? What if you took the fair market value of the net assets, and the amount that was given the exchange amount was less than the fair market value? Now that could happen, but just note that that’s a lot more unusual.

Acquisition Accounting Goodwill

In this presentation, we’re going to continue on with our discussion of acquisition accounting, this time focusing in on the concept of goodwill. Get ready, because it’s time to account with advanced financial accounting. First question is, what is goodwill. So it’s an intangible factors that allow a business to earn above average profits. So the way you might want to think about that is the first thing about a business that isn’t being purchased and sold. If you just got one business that started from scratch, they just started doing business, they started earning revenue, then you can look at their financial statements, they got the they got the balance sheet, assets minus liabilities is the book value of the company, and then the income statement, which is their performance. Now, if you were to say, Hey, is this company worth more than their equity than their assets minus the liabilities than their net assets? In other words, if it is, then you’re saying hey, there must be some intangible factor that’s not really on the balance sheet that would explain the reason why the you know the value of them because most likely through Profit generation, after the the perceived ability, the likely ability to earn profit in the future is greater than just what’s on the balance sheet assets minus liabilities. So you would think then that many companies, if a company is doing well, then there’s going to be some kind of intangible factor there. That’s not basically on the balance sheet that basically explains why the company is doing better than then just the value of the company being assets minus liabilities. So in other words, if we were to purchase the company, you would think that you would purchase it for their assets minus the liabilities, that’s what they consist of, that’s breaking them down to their parts.

Accounting Related to Ownership & Control

In this presentation, we will take a look at accounting methods which will relate to and depend on ownership and control, get ready to account with advanced financial accounting. Accounting related to ownership and control methods used to account for investments in common stock will depend on the extent of influence or control, the investor can exercise over the investi. So in other words, we’re gonna have different methods depending on the level of control. Now, if we’re going to use different methods, we need to have some kind of definition we need to have some lines in terms of when we’re going to apply these different methods. What does it mean to have different levels of control? And then how do we apply those in practice so we can have some kind of standardization for that.

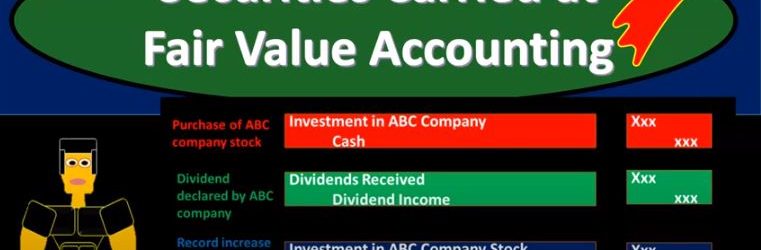

Securities Carried at Fair Value Accounting

In this presentation, we’re going to focus in on situations where we have securities carried at fair value using fair value accounting, this will typically be the case if one company is investing in another company, and they do not own above the 20%. That’s going to be basically the general rule. In other words, they don’t have significant influence, and therefore, we’re going to be using the fair value accounting method for them get ready to account with advanced financial accounting. In a prior presentation, we discussed in general different accounting methods we were going to use depending on the level of control or influence that one company has on another company we set what can be kind of arbitrary kind of points, which means zero to 20%. We’re going to use one method that they carried value 20% to 50%, the equity method and then 51 through to 100. We might be having a consolidation at that point. So now let’s break that down and concentrate on each of these in a little bit more detail This time, let’s focus in on this first category. Now this would be the category where typically most of the time you would be you would be accounting for something as in most cases, if you’re just investing if one company is just investing like a normal type of investment, just like an individual’s investing, they don’t expect to have really influence over the decision making process, because they have, they don’t have a controlling interest in order to do so it’s just a normal type of investment type of situation, that’s going to be the norm kind of here. And then once once the ownership gets over to a certain percentage 20% 20% being quite large, I mean, if you think about the number of shares that are out there for a large company or something like that, like apple or something like that, you would need a lot of shares to basically be constituting 20% ownership.