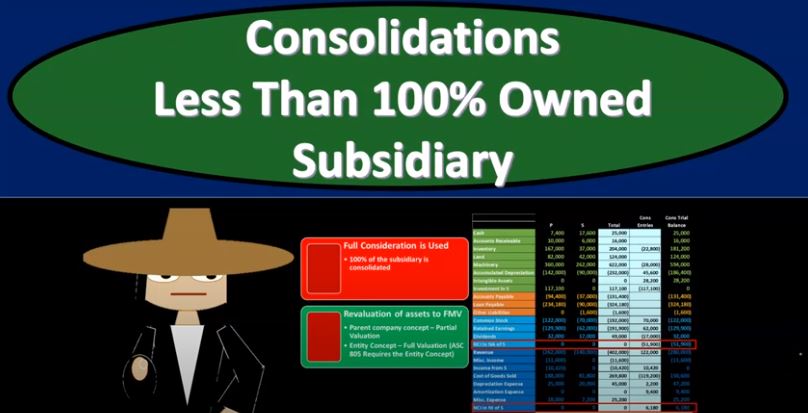

Advanced financial accounting. In this presentation we’re going to discuss the consolidation process for less than 100% owned subsidiary. In other words at the end of this, we’ll be able to understand some of the major differences in the consolidation process from a company that was 100% owned. In other words, the parent owns 100% of the subsidiary and one in which the parent owns some other percent some stock share and percent other than 100%. Get ready to account with advanced financial accounting when there is a controlling interest but less than 100% owned interest in a subsidiary. In other words, the parent company owns something other than 100% of the common stock something over 51% still having a controlling interest still makes sense to do consolidated financial statements, because it’s useful to see the assets minus the liabilities, the net assets that the parent has control over, even if they don’t have claim over them. The performance based on you know, the net assets that they have control over.

However, if they don’t own 100%, we got to, we got to account for the claims of a non controlling interest, the basically the net assets that would have claimed to In other words, you can think of it kind of like if there was a liquidation, then part of the subsidiary wouldn’t be going right, the non controlling interest, part of it would be going to the non controlling interest of shareholders who aren’t the parent company, and that needs to be accounted for in some way. Now, we’ve discussed this briefly in the past, you can think of a couple different ways where you might adjust the consolidation worksheet itself. Meaning you might say, well, maybe within the consolidation, if the parent only owns 70%, maybe we’ll just take on, you know, the 70% as the consolidation, in other words, the assets and the liabilities we value at 70%. But that’s not typically what we’re going to do. We want to put the whole amount on the books so that we can combine them together and then show because that will show you What the parent company has control over even if even if they don’t have claim to it. So we want to put the full amount on there and then still be able to represent the non controlling interest in some way. So that means we’re going to use the full consolidation is going to be what’s typically used meaning 100% of the subsidiary is consolidated.

02:19

So if we have, for example, the parent and the subsidiary, this would be the subsidiaries books with 100% of the subsidiaries books we’re not taking say like 70% of it, if parent owns 70%, and then adding only, you know, the 70% together here to get to the end results. These are the net. These are the accounts for 100% for the subsidiary that we’re going to be adding together to get this total, which now includes the parent and the subsidiary, total amounts. And that’s useful because that again will give us a current consolidation numbers that will show us the full amount as if they were basically one entity and that shows us the the numbers that basically, the parent has control over if not the claim to. Now, we can also think about the revaluation of the assets to the fair market value. So in other words, you might think, Well, what about a situation where, for example, we have the machinery and the equipment, or like an intangible asset or something like that, and we’re putting those on on the books. Do we put those on the books as if they were the fair market value, the full fair market value at the point in time that the consolidation took place? Or are we going to put those on the books as if they were only the revaluation for the purchase? Because that’s what you know, you can think of it like it would kind of make sense you would think, well, maybe I should just put the portion of it that would be for the purchase, meaning the fair value versus the book value for that because that there’s been an exchange that kind of took place for that amount, whereas the amount that wasn’t purchased the non controlling interest portion You might think that there was no market transaction because there was no market exchange for it. But again, in that case, we’re typically going to take the full amount again. In other words, if there was a revaluation for the machinery to the fair value, we’re going to revalue for the full revaluation and then and then break out the the non controlling interest portion. So that would be the parent company concept would be like partial revaluation. But we’re typically using the entity concept, which is the full revaluation meaning we’re going to basically adjust the fair market value of the machinery and equipment of as as of the point in time of purchase to the full fair market value at that point in time. Now, how are we going to then account for the non controlling interest here? Well, we’re typically going to have two accounts here, a balance sheet account and an income statement account that’s going to reflect the non controlling interest. So we’re going to reflect the non controlling interest, in essence with just one line item here on on the balance sheet. So we’re going to then be able to say on the balance sheet side of things, here’s the total assets, total liabilities 100% of s been included.

05:08

And then here’s the one line item representing the portion of the assets minus liabilities, the net assets to N A, in this case that is allocated to, to the non controlling interest here, which is going to be 51, nine, it just this example here. And then we’re going to do the same thing for the the net income, we’re going to say, hey, look, this is the revenue and the expenses for the full, you know, ss all of us, you know, and then we’re going to be pulling out the amount that we’re going to be allocating to the non controlling interest for it. So that’s in this case, the 6001 80 and show that basically as one line item, so that’s going to be the general process. So what’s the general journal entries going to look like? I mean, what’s going to be the change that we need to do the added complication that’s going to happen? Well, when we think about our first journal entry that we typically are going to be putting into place ways, which deals with like the equity section over here for as basically removing as typically, then we’re going to add another component to it. And that’s going to be the non controlling interest in the net assets and the non controlling interest in in the net income. So we’re going to see these two items to kind of be a more complication a bit more of a complication in the first journal entry that we’re going to be putting into place. And you can kind of think of it as a similar similar type of fashion here where we got basically this being the equity section, and then the net income kind of equity. And then we’re going to be allocating the net assets, which is going to be this this this this this all added together and breaking it out between the non controlling interest and controlling interest portion of kind of like a balance sheet side of things the non controlling interest in a in the investment in s. This will of course, make a lot more sense when we work through a practice problems. So you know, I highly recommend going through the practice problems. Do you have the Excel worksheet to work through this in Excel, just putting it down on paper will help out a lot. And then when we do a transaction such as this, for example, putting the building, if we’re reevaluating the building, putting the building on the books at the fair market value, as of the point in time that the purchase took place, then we’re going to be we’re going to be allocating the other side, rather than just going to the investment in s account, that’s going to be for the controlling interest, we’re also going to be breaking this out to the non controlling interest in a so we’re gonna have to break that out as we do in entries such as this one, right breaking out the non controlling and controlling interest. So notice that when we need to do that, on the balance sheet side of things, basically we’re going to be breaking out between the non controlling interest and in a in a net assets and the investment in s. And when we’re on the income statement side of things. We’re going to be breaking out between the the income from S, which is which is where P put, you know the parent put the equity accounts for the Income here and the other side go into the non controlling interest in net income of s inventory related differential. So what if there’s a differential in inventory? It’d be a little bit confusing when you think about the inventory because we thought about the building and the goodwill that we could have on their accumulated depreciate, if you think about the building, you got to deal with the accumulated depreciation. If you deal with something like if there was a difference in the the inventory, then you got to think about Okay, is the inventory still on the books, as of the end of the year, if there was a difference between the inventory value for s as of the point in time of purchase, fair value versus the book value?

08:41

We need to account for that and then think about, okay, what are we going to do with that differential over time? So inventory related differential allocated to inventory as long as the subsidiary has inventory units. So obviously, if they don’t sell the inventory units yet, then we would just be applying that inventory differential to the inventory. The inventory related differential is assigned to cost of goods sold in the period the units are sold. So obviously then what we have to do is think about when that inventory differential when the units related to that differential and inventory between fair value and the book value were sold. And at the point of sale, then we’re gonna have to allocate to cost of goods sold. The period the differential cost of goods sold is recognized depends on the inventory method used by the subsidiary. So you might think of, well how do I know when that particular unit is sold? Well, we’re going to look at the inventory method that’s used and assign the same kind of flow assumptions such as FIFO LIFO average