QuickBooks Online 2021 products and services list or item list, let’s get into it with Intuit QuickBooks Online 2021. Here we are in the free QuickBooks Online test drive file, which you can find by typing into your favorite browser, QuickBooks Online test drive, we’re in Craig’s design and landscaping services. So we’re looking at the another item that can be classified under the category of lists. So one way to get there would be go to the cog up top. And then under the lists, here, we’re looking at the products and services. So that’s one way you can get into this particular list. fairly quick way to get into it, I think more often, or at least more often for me,

Posts with the typically tag

Setup Sales Tax 6.65

QuickBooks Online 2021 setup sales tax. Let’s get into it with Intuit QuickBooks Online 2021. Here we are in our get great guitars practice file we’re going to be discussing turning on and setting up the sales tax. Before we do, let’s just recap the sales tax and how it will be working so that the setup will make more sense as we go through it. When we apply the sales tax, it’ll be on a sale.

Enter Service Items 6.50

QuickBooks Online 2021, enter service items. Let’s get into it with Intuit QuickBooks Online 2021. Here we are in our get great guitars practice file, we’re not going to be thinking about entering items into the system. Now remember, as we’re entering these items into the system are keeping in mind these beginning balances that we’re going to be entering into the system as well, the beginning balances that are going to be related to items would be the inventory items.

Statement of Cash Flows 4.05

QuickBooks Online 2021 that statement of cash flows. Let’s get into it with Intuit QuickBooks Online 2021. Here we are in our QuickBooks Online test drive file, which you can find by searching in your favorite browser for QuickBooks Online test drive or in Craig’s design and landscaping services, we’re going to go down to the reports down below, opening up the other report, that’s going to be a financial statement report, but not really our two favorite ones, the two favorites being the balance sheet and income statement, the other financial report being the statement of cash flows, so we’re going to be opening up the statement of cash flows, I’m going to right click on the statement of cash flows.

Pay Bills Form 1.22

QuickBooks Online 2021 pay bills form. Let’s get into it with Intuit QuickBooks Online 2021. Here we are in our Google search page, we’re going to be searching for QuickBooks Online test drive. And then we’re going to be selecting QuickBooks Online test drive from Intuit. It’s then going to be verifying that we are not a robot, which I don’t think is very fair. It’s like they’re saying my good buddy see, threepio is not allowed in the QuickBooks establishment.

Balance Sheet Report Overview 2.10

QuickBooks Online 2021 that balance sheet report overview. Let’s get into it with Intuit QuickBooks Online 2021. Here we are in our free QuickBooks Online test drive file, which you can find by searching in your favorite browser for QuickBooks Online at test drive are in Craig’s design and landscaping services practice file, we’re going to go down to the balance sheet by going to the reports down below, the balance sheet should be one of your favorite reports one of two favorite reports, not a matter of opinion, if it’s not one of your favorite reports, then your favorite thing is wrong, because it should be one of them. So we’re going to be opening up the balance sheet.

Degree of Operating Leverage 515

Corporate Finance PowerPoint presentation. In this presentation, we will discuss the degree of operating leverage, get ready, it’s time to take your chance with corporate finance, degree of operating leverage. Now remember, when you hear this term leverage, there’s two things that pop into your mind that generally categories of leverage. The first one is probably related to debt debt leverage or financial leverage. And the other related to the cost structure, the one that we’re going to be focusing in on here, the structure between variable costs and fixed costs. So what’s going to be the structure of the variable cost fixed costs, that’s kind of what we’re measuring here, with the degree of operating leverage the fixed costs being the thing that’s going to have more leverage related to it.

Break Even Analysis 510

Corporate Finance PowerPoint presentation. In this presentation, we will discuss breakeven analysis, get ready, it’s time to take your chance with corporate finance. Break Even analysis includes our fundamental tools for making projections and predictions into the future. Now note, when we think about breakeven analysis, the fundamental calculation within a breakeven analysis will be the break even point. But when we hear breakeven analysis in general, you can think of it that as a more broad kind of perspective, to use some of these tools in order to think about projections into the future. So when you hear breakeven analysis, you’re typically thinking kind of projections, budgeting, future based analysis, as opposed to some financial accounting, which is typically going to be based on the past prior performance.

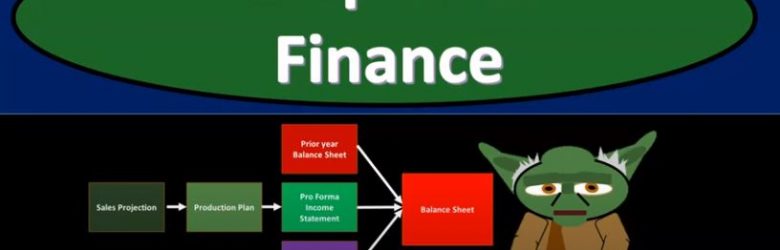

Pro Forma Income Statement 410

Corporate Finance PowerPoint presentation. In this presentation, we will discuss the pro forma income statement, get ready, it’s time to take your chance with corporate finance pro forma income statement. Let’s first take a step back and think about the pro forma financial statements in general, remembering the fact that we got to do them in some type of order in order to do them in a logical fashion. And that would mean that we would first need the sales projection information, the production plan, we can use those in order to create the pro forma income statement.

Forecasting Objectives 405

Corporate Finance PowerPoint presentation. In this presentation, we will discuss forecasting objectives Get ready, it’s time to take your chance with corporate finance, forecasting objectives. When thinking about forecasting, we’re thinking about into the future, we’re thinking about kind of like a budgeting or projection type of process, we want to plan ahead making changes in strategy as needed. So we’re going to think about what we think will happen into the future. So we can strategize now, and do what we need. Now, in order to accommodate what we believe will be happening in the future. Based on our best guesses based on our forecasts, we’re going to construct a financial plan to support the growth.