Advanced financial accounting PowerPoint presentation. In this presentation we will take a look at interim financial reporting or rules get ready to account with advanced financial accounting. Interim financial reporting rules started off with interim report. So interim reports they will cover a time period of less than a single year. So when we’re thinking about the interim reports, when we’re thinking about interim information, we have the year in information when we think about financial statements, we often what pops into most people’s head most of the time are going to be for the year ended financial statements income statement covering January through December balance sheet covering the year end. If it’s a fiscal year calendar year in interim, then we’re going to be talking about the financial statements at some interim period typically quarterly, quarterly meaning first, second, third quarter and then you got the yearly information for the fourth quarter. Therefore, the interim reports they will cover a time period of less than a single year. The goal is to provide timely information about the company’s options. Throughout the year, so obviously more information is nice. We want timely information for the decision makers, we got the year end reports, it would be nice if we have the quarterly reports, which we have now, to give us more timely information as the year goes by. quarterly reports are required to be published for publicly held companies. So if you’re a publicly held company, that company’s stock is being traded on stock exchanges and whatnot, then people need current information. The market needs current information. Therefore, it’s a requirement to have the quarterly reporting for that timely information. The quarterly reports can generally be thought of as smaller versions of the annual report. So when we think about the annual reporting, what’s going to be included in it, the quarterly reports is, as you would kind of expect, right a smaller version of that as we’re doing the reporting for a timeframe that’s going to be less than the entire year. Here some type of interim reporting requirements form q 10 q or form 10 q sec s quarterly report.

01:58

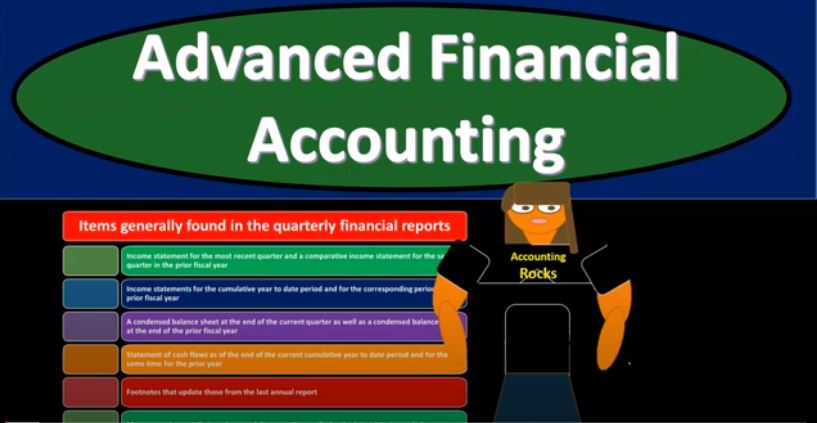

So this is the standard sec. C’s quarterly report, typically for publicly traded companies generally must file a 10 q within 40 days after the end of each of the first three quarters. So this will happen at the end of the quarter. So January, February, March, at the end of March 40 days after the end of March, you’re gonna expect to see the form 10 Q. And then April, May, June, at the 40 days after June, you would expect to see another July, August, September at the end of September, and then October, November, December. Why not there because that’s the end of the year. So you would expect to see the full thing at the end of the year. In terms of the Year End reporting the requirement the requirement is related to publicly owned companies. So we’re talking about once again, companies that are trading on the stock exchange, that’s typically when the SEC is going to be influencing companies because they’re regulating the trading that’s happening on publicly traded companies. And that means that if you’re trading to the public, that you have some necessities for the benefit of being able to do that to be in a publicly traded company and have that benefit, then you gotta have some more requirements, which is gonna be including these items here. So an audit is not required for the quarterly financial statements. So if you’re talking about publicly traded companies generally if you’re talking about the yearly financial statements, audits required audits are very time and cost a lot of time intensive, right. So the quarterly reports typically don’t have the audit for the quarterly reports and then you’re going to have the audit for pop the generally the annual reports, items generally found in the quarterly financial reports include income statement for the most recent quarter and a comparative income statement for the same quarter in the prior year in the prior fiscal year. So you got the income statement for this quarter, and then the corresponding income statement for the same time period prior year income statement for the cumulative year to date period and for the corresponding period for the prior fiscal year.

03:56

So say you’re talking about quarter to q2 gets a little bit complicated because then you’re saying, All right, I want the three month’s income statement, the three month ended the income statement for the current quarter, because that’s what we’re talking about. And we want to compare that to the three months of last year. For the same quarter q2, however, we also have the information that has happened up until this point in time, meaning January through June. So the whole, you know, first and second quarter could be included on the income statement. And we would want that to so we would want the full cumulative year to date, January in February, if it’s at the end of q2 for this year, and the comparative for the prior year, a condensed balance sheet at the end of the current quarter, as well as a condensed balance sheet at the end of the prior fiscal year. So notice here we’re talking about the balance sheet, which is a point in time so it’s a little bit easier in some ways, because now we just need the balance sheet as of the end of the time period. So if it’s quarter two, quarter two, we don’t need to combine it to quarter one or anything like that because the balance sheet is in As of a point in time, we’re going to look at the last time period, we’re not going to go back to the balance sheet. For like last year, quarter two, we’re going to go to the balance sheet the last balance sheet for the last fiscal year, typically as well to show that statement of cash flows as of the end of the current cumulative year to date period. And for the same time period for the prior year on the statement of cash flows. Remember, the statement of cash flows is going to be a timing statement as well, not a point in time, but a timing statement, footnotes that update to those from the last annual report. So we want the footnotes for any updates that are going to be necessary since the last annual report management report that analyzes and discusses the results for the last interim period, pronouncements and interim reporting. We have the ASC 270 standardizes, the preparation and reporting of interim income statements so there’s some standardization within ASC 270. You can check that out for more detail within it. sc 740 discusses the issue of measuring the tax provision for interim reports, when the tax expense is based on the annual income, we’ll have a couple practice problems on this so you can get an idea of what’s happening here. It’s a problem, of course, because when you’re talking about taxes, the taxes have a progressive tax rates.

06:19

So the tax rate, you know, can generally go up and it’s going to be applied to the year the yearly income. And so when you when you and and it’s based on taxable income, as opposed to financial income, and it has credits that are involved, that’s going to make it a little bit more difficult in the just the calculation of taxes. So how are we going to how are we going to go through the task of taking the annual tax calculation and quarter you know, doing it on a quarterly basis? And so we’re gonna have to build some questions to that. So we’ll think about how to go through that process. I recommend taking a look at some example problems just to get an idea of how that process works in your mind. International Financial Reporting standard words for interim reporting this is the international ay ay ay ay ay. Ay ay ay ay ay S. 34 outlines the minimum content for an interim financial report, similar to us generally accepted accounting principles. So we got the US generally accountants Accepted Accounting Principles, and the International Financial Reporting Standards, Interim reporting, they’re going to be similar. Remember that these the goal for a lot of people, of course, is to try to get these these two things on the same basis, so that you don’t have these different reporting for different areas if you’re working in different exchanges and whatnot. And they’ve worked somewhat towards that. So they should be in alignment for many places, but sometimes, they’re not always in alignment. So that so it is what it is at this point in case expresses the more estimates expresses that more estimates can be used in determining interim amounts, then for a measurement of the annual financial information. So in other words, if you’re doing the quarterly report So you’re going to probably be using more estimates, as you do so than you would if you did the annual financial reporting. materiality tests will be made based on the relation to the interim period information, not on estimated annual information. And then the year to date disclosures are required in addition to specific interim period disclosures revenue, the same measurement basis used for the full fiscal year will be used to determine revenue for the interim period. So we want consistency with the basis on which revenue would be measured, which is a standard accounting principle what you would expect revenue needs to be recognized and reported in the period it is earned. It cannot be deferred in order to show a more stable revenue stream, which again is what you would typically expect, right?

08:48

You know, from a corporate standpoint, what they what they like to see is a nice even up slope of revenue. And that’s what they have pressure to show for, you know, stock trading. and whatnot. But clearly what you what you want from us from an honest reporting standpoint would be that you’re going to recognize the revenue on an accrual basis when it is earned. And that’s going to be a revenue recognition principle that needs to hold better so seasonable seasonal business revenue cannot be adjusted to eliminate seasonal trends. So seasonal businesses often have, you know, spikes in their revenue due to the season that they are in. And they don’t really like those spikes. They would like to show it as a nice, easy, even trend upwards. But you can’t do that because it’s that’s dishonest. It’s not right. That’s not how it happened. That’s not what happened in terms of revenue recognition, so you can’t smooth out. You shouldn’t be able to smooth out the seasonal trend. The point of the quarterly reports is to see what is actually happening. So you want to consistency with the revenue reporting, inventory and cost of goods sold. In general the interim Cost of Goods Sold needs to be computed with the direct and allocated cost components on the same basis as used to compute the annual cost of goods sold. So once again, we have that concept of consistency, which of course, we would expect to see and desire permitted, permitted modifications to the general rule. So here’s going to be kind of some exceptions, modifications to the general rule can use estimated gross profit rates, lower of cost or market valuations and standard cost systems, then we have other expenses and costs, other expenses and costs in general expenses and costs will be charged to the interim income in the interim period they are incurred. That’s the matching principle or the expense recognition principle, and that it’s an accrual principle. So you would think that that would hold as well that should be a consistent principle. However, some expenses and costs will be allocated among the interim periods based on estimate of time used, so we might have some estimates that need to be used to see when they’re going to be used estimate of the benefit. received and activity level of the interim report. So we’re trying to, you know, do our best to recognize on an accrual basis, basically with the expenses in the proper period when they were incurred in accordance with the matching principle or expense recognition, principle taxes and interim period, estimating the effect of annual tax rate.

11:19

Those are things that are not going to reverse out. Therefore permanent, temporary differences example. So here are some examples of temporary differences. differences of the depreciation expense is probably one of the most common differences so if we’re using tax depreciation, you got to use exactly what the tax code says there might be some different kind of acceleration methods that can be used 179 deduction or something, you know, other depreciation methods that might be input implemented on the tax code. And on the books you might be using some other method such as straight line method or something like that. And that means that the depreciation will be the same over the same timeframe depreciation will be expensed over over the life or the useful life of the asset, the cost of the asset is going to be applied out, however, the times that are being applied to will differ, and therefore, you’ll have these temporary differences which will wash out in the long run, but you’re going to have the temporary differences going forward. Estimated expenses and losses that are reported on books when accrued but on taxes when paid. So you might have some some expenses or losses on the books that we said, Hey, we accrued it to be there in accordance with the accrual principle, the matching principle, the expense recognition principle, but the IRS is saying, hey, that particular thing, you can’t deduct it until you until you actually pay it, because you could see why the IRS would be a little skeptical on something so they might, you know, want to see a cash payment for certain things. Well, that’s going to be just a timing difference, because it’s just a timing difference as to when we record the expenses. When we think the accrual should be on there or when the actual amount was paid, so rent collected in advance reported on tax return, in period collected and on books in the period earned.

11:19

So on the revenue side, for example, we might be collecting rent on, we might be collecting rent for like a year in advance or something like that. And it might be a situation where where we from an accrual standpoint wouldn’t be recording the revenue because the person hasn’t lived in the place for that entire year, we got the rent before. But for tax purposes, the tax code might just they want to record it when you get the money in that case. So they’re going to deviate the tax code deviates, possibly in that case, because they’re going to say you got the money, you have the ability to pay at that point, maybe what the just whatever justification they have, then then you would then we’ll have to pay it at that point, but again, over the life of the year, you It should wash itself out because on an accrual basis, the revenue will be recognized over the point in time. But it has been incurred. And on the cash basis it would have been if you got the revenue in advance it would have already been recorded at the at the front end. So it’s just a timing difference.

11:27

So here’s our problem. This is one of the bigger kind of is kind of a, you know, a big problem is that how do we calculate the tax rate on interim taxes when the tax rate is based on annual taxable income, and it has differences between the tax and the book and, you know, tax credits that are going to be involved and whatnot. So what are we going to do on that estimated the effective annual tax rate, we need to find the effective annual tax rate so we can use it to compute the interim income tax provision. So we need to figure out the the provision for taxes in the current time period using some kind of effective annual tax rate. The estimated annual tax tax rate will include anticipated tax credits, state income taxes, foreign income taxes, capital gains taxes and other tax planning expected for the entire fiscal year, the estimate will be updated each interim period and the interim tax provision or benefit will be determined, we will have some problems with relation to this, I recommend going through the problems to get an idea of this. But the general the general idea is you’re saying okay, if you have the tax rate for the entire year, first you got to kind of determine the tax rate which could change based on your income level possibly. And then you got to figure out we want all of income taxes. So we want to take all of the income tax which includes state and federal possibly income taxes that we may owe. And then we would like to come up with one effective rate that we can use to apply to basically the quarterly net income as opposed to having to to pull out on a quarterly basis you know, tax and book differences and and having to deal with credit It’s being done differently, or at the at the end of the equation. So we want to come up with a rate then that includes those things all in one rate, basically, so that we can apply that one that one rate to figure out the tax for the current quarter or the interim time period. Now, we’re also going to have to do that quarterly, and the rates will change based on our differences in estimates.

13:22

So we’ll have to take into consideration for example, in quarter two, what happened in quarter one, what were the estimates that were made for taxes in quarter one, as we consider the effect on the current financials are differences between book and tax income, we have permanent differences, and we have the temporary differences. The permanent differences will not be included when determining the amount of taxable income for a period because we’re gonna basically reverse them out. So permanent differences are, you know, things that are permanently not

13:50

included in the taxable income. Maybe they’re on books income, but they’re not on taxable income or if we’re talking about permanent expenses that are on the books that aren’t included in tax. Those would be, you know, they are what they are, then the temporary differences would result in deferred taxes. These are things that are going to reverse themselves out over time differences in estimating methods such as the depreciation method different differentiating between books and taxes, permanent differences example. So here are our some examples of permanent differences, certain fines or penalties that are not tax deductible. So if something is is on the books, there’s a finer penalty, it’s part of a business expense might be deductible for business purposes, but may not be deductible for taxes, it’s not going to change that’s not going to reverse out. So it’s going to be a permanent difference. We could have proceeds of life insurance collected that are not taxable. So we might have certain types of life insurance. That is not taxable. We might have collected on certain types of life insurance. In other words, we might have income on the book side of things, but for taxes, maybe it’s not going to be something that would be included in income, life insurance premiums paid by the company on executive policies where the company is the beneficiary are not tax deductible. So we might have life insurance where we we put money the company puts money into the policy and it’s deductible, possibly for books, but maybe it’s not deductible for taxes, again, not going to reverse out there for permanent interest income or state or local government bonds that are not taxable. So we might have income, like interest income from bonds or something like that, that’s gonna be on the book side of things included in income but not in revenue for the tax side of things because it’s not taxable.