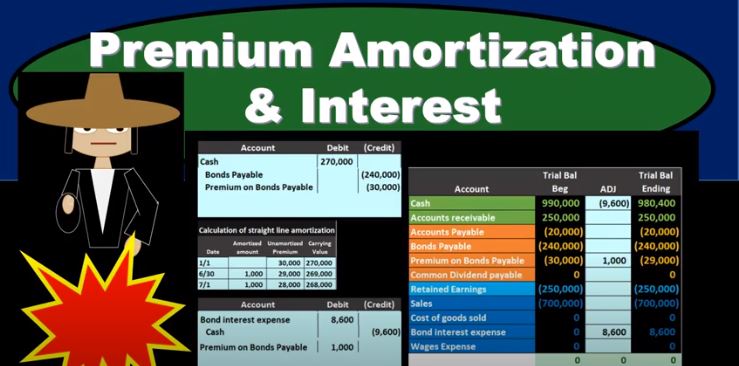

In this presentation, we will discuss the amortization of a bond premium and the recording of interest expense on bonds. This is going to be our starting point. This is the initial transaction in order to get the bonds on the books. Here’s our data down here we’ve got the number of years we’ve got the face amount of the bonds, we’ve got the issue price 270, we see that the interest on the market rate is different than the contract rate. The result then is that cash is going to be increased by the 217. The bonds payable went on the books for the face amount of the bond, the amount that’s on the bonds of the 240, which is a liability. And then we have the premium being the difference increasing the premium here by the 30. The 240 plus 230 is going to be equal to the 270,000 carrying amount book value of the bonds. Now we’re going to go through the process of recording the interest we can see that this is going to have 15 years bonds, we’re going to pay the bonds semi annually. So we’re going to have to record the interest on them. And we’re gonna have to reduce this premium in some way as well. Remember, at the end of the bonds, we’re not going to pay back the 270. We’re only going to pay back 240. So how are we going to get rid of that the premium on the bond and why are we going to do it in the way we will. We’ll start off by amortize in the premium using a straight line the method. Note that the effective method is the preferred method for amortize in a premium for generally accepted accounting principles, but the straight line method will be appropriate in some cases, if the difference is going to be a non material. And the straight line method is a simplified method and it’s easy for us to see what is going on. So we’ll start off with the straight line method.

01:48

Later we’ll talk about the effective method. Note what is happening here is we have the premium was a result in essence of this difference between the Interest rates. Now, in many problems, this is hard to really understand because oftentimes, what’s given to us when we record this initial transaction is the face amount being different than the price we receive, resulting in the premium when we make the journal entry. But we will do the calculation, which is a bit more complex to see what that difference is, why does this happen? How would we actually negotiate the issue price being different from the face amount, and the cause of it, of course, is the fact that the market rate is different from the contract rate. So in essence, then this premium is a result of interest. It’s really an interest difference here, we need to get rid of it throughout the life of the loan, we’re not going to pay it back at the end of the loan. What we’re going to do is reduce it throughout the loan at the same point in time that we make interest payments, which in this case is semi annual eight or two times a year. So we’re going to allocate this interest out to interest expense during that time period, because it really is kind of a result of the of the interest rates being different.

03:07

So we’re going to allocate it out to the income statement account interest expense as we go. You can think of this as being similar to depreciation because we’re going to amortize it. And that’s why the straight line method is a, it’s a nice place to start. So remember, when we have depreciation on equipment, what we typically do for the simplified, easy method to allocate the cost of equipment is to take the cost of equipment divided by the number of periods, typically the number of years or months and allocate the cost over that time period. Same thing we’re going to do here, we’re just going to take this premium and allocate it over the time period 15 years, but semi annual payments. So for example, on January 1, when we start we’ve got the premium of 30,000. That means that the carrying value is the 270 thousand, which is the 241 on the books for plus the 30,000. That’s what’s currently a liability on the books, as of the beginning of this process, we’re going to pay the interest on this bond semi monthly. Now here, we’re not calculated the amount we’re going to pay, we’re going to calculate the amount that we’re going to allocate of the premium.

04:20

So of the premium, we have 30,000 here 30,000. And we’re just going to divide this by not 15. But 30, because we’re gonna, there’s gonna be 30 time periods, meaning we have 15 years, semi annually twice a year. So we’re going to take that and divide by 30 time periods. The other way you can think about it is if you had the premium of 30,000 divided by the number of years 15, it would be 2000. And then it’s twice a year divided by two, or 1000. So that means that we’re going to take this premium, and we’re going to reduce it by 1000 each time period for 30 time periods. Which is 15 years times two semi semi annual pay periods times 15 years. And then at the end of that, then we’ll reduce down to zero. So we’re gonna have 1000, it’s going to take the unamortized peer premium from 30 down by 1000 to 29,000. Carrying value now is going to be the 240,000 plus the 29,000. And then we’re going to just keep doing this process the next, the next time period that we pay six months later, another 1000, it’s going to be straight. So notice we’re using straight line so the amount amortized will be the same 29,000 minus the 28,000. And that leaves us with the carrying value, which again goes down by the 1000, which is now the 240,000 bond payable plus the bond premium of the 28,000.

05:53

Now we’re going to record our journal entry to record the interest and to record the reduction of the premium on the bonds. We record it here, we’re going to post it to our trial balance. Our trial balance is currently in balance because the debits are non bracketed credits are bracketed debits minus the credits equals zero. Currently net income of 700,000, which is the sales of 700. No expenses at this time. When we calculate the interest, remember that we have 15 years bonds here, we’re going to pay the interest at the contract rate of 8%. How much that’s how much cash is actually going to be leaving the company. So that’s where we should start. We’re going to say, well, cash is affected. Cash is a debit balance, we’re going to make it go down. So we know that’s going to be the case. Question is, how much will it go down by? We’re going to take the face amount, not the issue price, the face amount, we’re talking about what’s actually physically on the bond here. That’s the promise that’s on the bond, which is the 240,000. And then the amount of the interest rates that are on the bond is the one on the bond with a contract rate now The market rate. So we’re going to take this times point 08. That’s the actual contract. That’s the actual bond, the 19. Two is what we would pay if it was paid each year, then we’re going to take that and divide it by two, that’s going to be the 9600. So this is how I would think of the interest rate.

07:18

Now there’s a couple of different ways you can think of that calculation, I typically think of it of the face amount, the amount of on 240,000, multiplied times the rate on the bond, which note that remember, any rate is really a yearly rate unless stated, stated otherwise. So if we say something’s 8%, we usually mean 8% a year your mortgage rate if we say 8%, we mean 8% a year. So if I multiply this times point, eight 8%, I’m going to get 19 two, which is 19. to how much interest we would pay in a year, it’s only six months, so we could break it down to a monthly total. We could do that by saying divided by 12 1600 A month, times six months. Or we could just divide it by two. Note, the other way you can do it, which is useful for Excel is to say, Okay, well if point oh A is the yearly rate, what’s the six months rate, we could say every six months is half a year or take that and divide it by 2.04 must be the monthly rate times the 240,000. To give us that same amount. So a couple different ways to think about it, just get an idea. And remember to know what the interest rate means. It means for a year typically, now the bond premium that we’re going to have to reduce here, we already calculated on our amortization table 1000 per time period, meaning it’s on the books as a credit, and we have to know that it’s helpful to know that if we have a trial balance because we can see it’s a credit, we need to make it go down. So we’re going to do the opposite thing to it to decrease it.

08:57

So we’re just going to kind of like plug this in there. into our journal entry. So I know that the cash is going to be paid here and I know we’re going to reduce the premium to kind of straight line it down to zero towards the end. And then the difference then is going to be the interest, which will be the 9006 minus the 1000, or the debit that we need in order to finish this process. So note that the debits here are not an order debits and then credits I kind of built this in in order to be able to see how things are going to be put together. So you could rearrange it to put the debits on top. Or you can keep it like this. It’s not quite as proper, but whatever way it helps you to see how the thing was constructed. That’s the way I would put it together. So note what happened here is the interest expense is only 8600 even though we’re paying cash, which is interest on the bond of 9600. Why? Because the difference between those two is really, in essence bringing the interest rate that’s on the bond down to the market rate. Cuz we’re not really paying 8% on the 240,000, because we really got 270,000. And we’re only paying interest on the 240,000. So that difference is what we’re trying to account for, as we as we kind of net out this interest payment.

10:18

If we record this, then we’re going to say that the bond, interest expense is going to go from zero up by 8600 to 8600. The cash is going to go from 990,000, down by 9600, because we’re paying the interest. And then the premium is going to go from 30,000 down by that 1000 to 29,000. That now matching our unamortized Premium amount on our amortization table, if we would take this amount and this amount that’s going to match our carrying amount per the amortization. The effect here on net income of course is to decrease net income by the expense, the expense being Lower in this case than the actual cash we paid because of the reduction of the premium, which is a result of the differences in interest rates market versus contract rate. If we do this, again, we’re just going to jump forward in time to the next interest payment, which is on 12, one another six months later. And that’s how these bond problems work, we typically have to kind of jump forward in time.

11:23

So now we’re going to say we record the same thing, it’s going to be the same transaction and we’re going to say, cash is going to go down by that 9600, which is calculated in terms of our the amount we’re actually going to pay face amount 240,000 times the yearly rate point oh eight, the rate on the bond, not the market rate. And then we’re going to take that would be a year divided by two because it’s semi annual. So that’s what we’re actually going to pay for cash. We’re going to reduce the premium by the 1000. Just like we were going it’s just like if it was equipment that we’re advertising And then the difference, of course is going to go to the bond interest expense. So if we go through that, again, we’re going to say that the bond interest is going to go up again, by 217 thousand 200. We’ve got the cash going down, and we’ve got the premium going down. So now the premiums at 28 that should match what’s on our table as unamortized. And our interest expense has increased which brings net income down