Corporate Finance PowerPoint presentation. In this presentation, we will discuss the statement of retained earnings Get ready, it’s time to take your chance with corporate finance statement of retained earnings. So remember that as we think about the financial statements in total, the financial statements are basically answering questions that users of the financial statements would have. So for example, if we were thinking about investing into a company, the financial statements would help us answer the question as to how does the company stand at this point in time? How does the company look from a financial standpoint at this point, that is the balance sheet, the balance sheet gives you the assets, liabilities, equity, assets minus liabilities, being basically the book value being basically where the company stands at a point in time.

00:48

Therefore, if you look at the financial statements, and total for the year ended for the prior year, let me look at last year’s financial statements for the year ended December 31. The balance sheet is as of the end of the day, the last point of that period, December 31. The timing statements then are indicated to tell the performance so remember, when we’re thinking timing statements, the other question we want to know is how well will this company do in the future? How much income will they make, that will be hopefully allocated to me as the owner of the corporation if I have stocks in the corporation? So how can we know that we can’t tell the future? Obviously, we do that based on past performance? We say well, how did they do last year in terms of a performance measure, that we can then project out into the future and make some estimates about their performance in the future.

01:36

So that’s going to be something like the income statement should be the primary statement that we think of as the performance statement, the income statement represents how someone did in the past how the company did in the past, how they got to, or at least one year’s worth of data, to tell how they got to the point in time that’s represented at the end of the timeframe, which is the balance sheet. Therefore, the income statement represents the beginning to the end January through December, whereas the balance sheet represents where we got to or where we are now, at, as of the end of the timeframe being December. How are these things related? How is the balance sheet related to the income statement, we’re gonna have the statement of retained earnings, which will be our focus here, that’s basically tying these two things together. Now, this is a timing statement.

02:23

But unlike the income statement, which is basically like a clock, you can think of the income statement starting at zero, and just going up every account on the income statement starts at zero goes up, just like if you were trying to see how many miles a car can go within an hour, you just start the thing at zero miles. And then you drive for an hour until you know the hours up and then you count how many miles they drove. That’s what the income statement does, it starts at January zero in revenue and all expense accounts and then it goes up from zero up until the end of the year, if we’re talking about a year end income statement, and then we stop. But the statement of retained earnings does not start at zero, because what it’s doing it’s tying together last period, and this period. So that would be like if your odometer already had something on it, when you start driving the car, then you have to start with that beginning balance, then drive for an hour. And then look at the Indian balance there.

03:20

The difference being how many times how far you drove, you drove in that particular hour, that’s what the statement of retained earnings is going to do. It’s going to take the balance sheet number basically as of last period, meaning assets minus liabilities, or the equity number book value of the balance sheet last period, take a look at the book value this period. That’s how far we drove. If you subtract the two out, that’s where we were last year. This is where we’re at this year, the difference, the main part of the difference is the income statement. And that’s and then the statement of retained earnings is going to tie those two together because you need it because the income statement isn’t the only difference typically, because there could be dividends as well. So then the statement of retained earnings is going to tie out it’s going to be a timing statement. But it’s not going to start at zero the there’s already something on the odometer. In this case, they’re always there’s already something in retained earnings, if it’s a continuing business.

04:14

And then we’re simply going to record the activity that has happened to show us how we got from the beginning point to the ending point. So then we’re going to have the statement of cash flows, which we’ll talk about in a future presentation. Also a timing statement. However, you want to think about it as a little bit different because you want to think of these three statements. Basically, as connected all as part of the same kind of accounting concept, the accrual accounting concept. These three statements will be done first, if you were thinking about putting these statements together before doing the statement of cash flows, which would then be taking these statements converting them from basically an accrual statement to a cash flow statement.

04:55

So here’s the statements that we have. We’ve looked at these financial statements. We’ve got the balance sheet assets equal liabilities plus equity. So the balance sheet isn’t balanced because the assets equal liabilities plus equity. That is the accounting equation way of saying it what the way accountants would typically look at this when they’re building the statement. When we think about finance, we’re often think about thinking about the equation as assets minus liabilities are going to equal the equity here, the equity. Now, when you break down the equity, note that it’s broken down between the amount of money that the investors have invested into the company, that being up here, that being the preferred stock, the common stock, and the paid in capital, that means those are those are representative of the company issuing stock, the owners, then paying the company.

05:44

So the owners are putting the money directly into the company, through the purchase of stocks from the company. And then the the other point that we’re going to look at the other piece that we break out in a corporate equity section is the retained earnings, we want to keep those things separate, because we want to say, hey, look, this is the amount of money that we got in the company from an investment from the owners through the issuance of stock versus the earnings that have accumulated over time, the earnings of the company, which have gone up of which we have not paid out yet to the owners, meaning we haven’t given it back to the owners in the form of dividends, which would be similar to draws for a sole proprietorship.

06:26

So the retained earnings is when we give money back to the owners in the form of dividends. In other words, we typically want to make sure that we’re taking it out of the retained earnings first, right, we want to distribute any dividends out of what we consider to be the retained earnings. That’s why we’re going to keep those two things separate. So when we think about the income statement, then note the income statement is the timing statement. It’s revenue minus expenses, we took take a look at it before we get to the net income, otherwise known as earnings after taxes, net income or earnings after taxes. Now, if there’s preferred stock, as we talked about in the income statement, they get paid first. So if we subtract out the preferred stock, the obligation we have to the preferred stock, we would get the earnings available to the common shareholders.

07:12

Now, this is going to be the item that’s going to be tied to help us figure out how the balance sheet is related to the income statement. So note, if you look at if you look at the balance sheet, you can say well, these, these two things don’t tie out why because the income statement just starts at zero, like we said, the odometer just starts at zero and goes up from that point in time. And the balance sheet doesn’t start at zero, because this 600,000 down here is where we’re concentrating started at wherever we were prior to the beginning prior to January at the end of last period, because this isn’t the first year of operations. So this is just basically where we drove in our analogy and where we drove. This is what we did for the last hour drive how far up the odometer went in telling us how many miles we drove.

07:56

But over here, this is showing us on the balance sheet. This is showing us basically the lifetime of retained earnings, which includes more than just one hour of driving or one year of income statement information. So we need the statement of cash or the statement of retained earnings to tie this thing out. The statement of retained earnings then is going to give us that beginning balance. The beginning balance is not on the balance sheet, where does the beginning balance come from comes from last year’s balance sheet But prior periods balance sheet, because the ending balance of the prior period is the beginning balance of this period meaning in other words, in our analogy, the ending point that we drove our our truck to before is where the odometer was at before we started testing the new hour worth of driving, right. So if this is how far we got in terms of the income statement in terms of performance, similar to how many miles we drove, then if we already had something on the odometer.

08:53

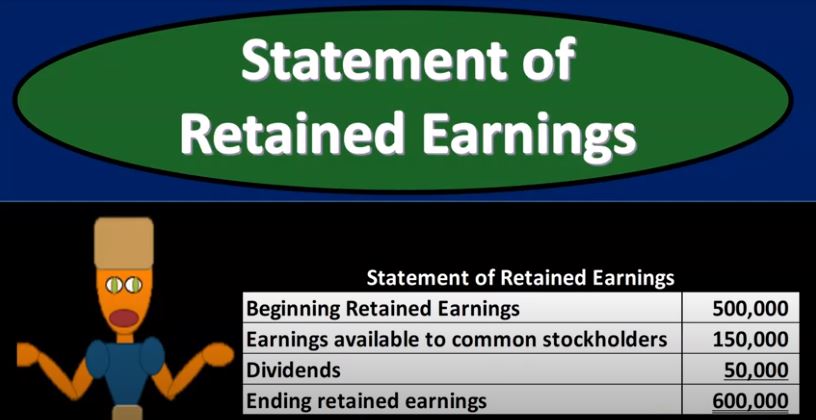

In our case, in our analogy, in our case we had on the odometer 500,000, prior to doing this test prior to increase in it by this 150 then we got to add that beginning balance to it. So now we got the 500,000 beginning point plus the 150. That comes from the income statement that we kind of like drove or that’s the performance we did this time period. And then we also have to add the point that we decreased by and we decreased by dividends meaning dividends is the amount of money that we take from the company and we’re going to be paying it back to the owners. So it’s a it’s nice to be able to compare this to a sole proprietorship, if you had your own company, your sole proprietorship you would put money in possibly at the beginning to get the business going. Once the business is generating revenue, then as the revenue accumulates, you’re going to be taking money out of the business hopefully in the form of draws.

09:48

So the money goes up, and then you take the money out so that you could spend it on personal use. That would be a draw for for a sole proprietorship for a corporation. We call the similar kind of activity a dividend. So a dividend means that the corporation is taking some of its earnings that it’s had over the lifetime. So we’ve had earnings prior to this time period of 500,000, that had been accumulated that hadn’t been paid out, we had earnings, this time after taking into account preferred stocks, dividends, of the 150,000. So and then we’re going to pay out 50,000 of dividends. So dividends are like the draws. But just remember, they’re the reason the reason they’re different. The thing that’s different about dividends than draws is that the owner because we have equal ownership for all shares of stocks cannot simply just say, Hey, I own three shares of stock of Apple, could you give me my portion of the dividend, you can’t do that.

10:46

Because to make them standardized, Apple has to give dividends to everybody evenly. So unlike a partnership, where different partners can take money out, draw money out at different component at different rates, you can’t do that with a corporation, if the company declares a dividend, then all stocks have to receive an equal amount of dividends in order for the stocks to be equal in nature. So that means that management and the board of directors are the ones that decide whether or not they’re going to hold on to the to the money retain it, meaning it’s going to be building up in retained earnings. And therefore the assets and liabilities that have accumulated up top that are mirrored down here in the equity section will be in the company and hopefully used in order to help generate revenue in the future help us perform better on the performance statements in the future would be the goal of that or they take that money retained earnings, and they pay it back out.

11:41

Now that’s going to give us two. So if I take the beginning balance, plus the net income or earnings available to the common stockholders, minus the dividends, then that’s going to give us our ending point that’s going to tie out to the balance sheet. So the point is that the balance sheet and the income statement are tied together by the statement of retained earnings, which is just basically summarizing what’s on the income statement, tying it to the prior period balance sheet, tying last year’s balance sheet point in time to this year’s balance sheet point in time, and then taking into consideration the one factor that’s not on the income statement, but which is a timing deal timing issue, meaning how much did we pay out in dividends. So the statement of retained earnings reconciles prior period retained earning balance to the current period retained earnings balance components include the beginning retained earnings, the net income or earnings available to common stockholders, and then the dividends and that’s going to give us the ending retained earnings. So with the statement of retained earnings, you just want to kind of memorize that that formula, right? It’s just going to tie out last periods balance sheet to this period balance sheet.

12:51

So when I say beginning retained earnings, that’s where do I get beginning retained earnings? Well, I get it from last periods balance sheet the balance sheet before the balance sheet for the current time period that we’re working on. Because the ending period retained earnings for last year is the beginning retained earnings for this year, then we’re going to increase it generally by net income. But if there’s preferred stock, then it’s going to be earnings available to the common stockholder, that will be on the income statement, then we’re going to decrease it by dividends. That being the component that is nowhere else on the financial statements, most likely, that’s the component that’s not on the balance sheet. It’s not on the income statement, because the money that was distributed back out in the form of dividends is not an expense, it’s us giving money back to the owners.

13:37

Therefore, although it’s a timing thing, it happens over time, as opposed to something being a point in time like a balance sheet, it won’t be on the timing statement, the primary timing statement of the income statement, because the income statement is measuring performance in terms of how much revenue was generated, and how much expense was having to be consumed in order to generate it. And the dividends don’t have anything to do with performance. The dividends have to do with whether or not you’re going to take the money that was generated through performance and feed it and pay it back out to the owners in the form of dividends or retain it in retained earnings to hopefully increase future performance. So if we recap this one more time, you’re looking at the statement of retained earnings.

14:21

These are the three statements that are going to be the primary financial statements, then you can kind of think of the statement of cash flows as being tacked on or once again, these three statements being done first. And then you have the statement of cash flows, which is going to be a reformatting of this information from an accrual basis to a cash basis. So when you think about the financial statements, the first two statements that really should come to mind should be the balance sheet and the income statement. I typically think of the balance sheet first, because I think of the balance sheet as where the company stands. And then I think about the performance related to the balance sheet is really kind of the overarching double entry accounting system because it is the assets liabilities and equity gives the whole accounting equation is the balance sheet, the income statement, then giving the support given the story as to what happened to get to that balance sheet number.

15:10

So those are the two statements you want to think of with the financial statements point in time balance sheet, and then the story, how did you get their income statement, then you’ve got the statement of retained earnings, which is that link between the two, it’s going to tie the two out because these two statements are related, meaning the balance sheet is the double entry accounting system assets equal liabilities plus equity, the income statement is not separate from the double entry accounting system, it fits into the double entry accounting system, it does so because you can think of it basically as part of equity section, as part of the retained earnings, it’s part of the story to see how we got to the point in time that we are at to the book value of the company where we are at, which is assets minus liabilities equals equity, or stockholders equity. So the stockholders equity is the book value of the company at the 1,220,000. And remember, when you think about the 1,220,000, in a corporation, we break that out by what was invested into the company, versus what was accumulated through the business of the company, what was accumulated through business and retained, the earnings that we have earned throughout the life of the company and have retained, in other words have not yet distributed out to the owners in the form of dividends.

16:28

So all this stuff up top that has to do with a common stock and the preferred stock. Those are the investments from the owners, those don’t change a lot, right, because the company doesn’t issue stocks all the time, the stocks are trading all the time, it’s a publicly traded company on a stock exchange. But the trades have nothing to do with the company, the company is not getting the money from those trades, they’re trading amongst themselves. So these things once the stock is issued, once they then they don’t, they’re not going to change much, what will change every year is going to be the retained earnings, the retained earnings are the things that are going to change because that’s going to change in accordance to the activity, the business activity that is happening, we see that change happening within the income statement. And the income statement is starting at zero going up from zero. So it’s kind of like we’re driving the car, it starts at zero, and then it goes up as if we have the odometer at zero. But in reality, the odometer is not at zero.

17:25

When we start testing how many miles we’re going to drive. In other words, when we start testing how much revenue and expenses are going to go up in that period of time. The odometer actually at this point was at 500,000. That’s where the odometer really was right? So once we look at the income statement, imagining it at zero and counting upwards, then we got to get back to the point where we weren’t at zero, we were at retained earnings that had been accumulated before that point in time, and had not yet been distributed out in the form of dividends of 500,000. And then if we add what was increased this time, this driving period or this period of earning money, 150,000. That’s how the income statement ties out. And then again, we’re adding that one piece that’s not on the income statement, although a performance measure. So this dividends note again, this is the money going out to the owners. And you might ask why isn’t it up here? Why, you know, the money went out? And you know why? Why isn’t it it’s part of the business, isn’t it? Why wouldn’t I put it up here as an expense decreasing the net income up top?

18:31

Because it’s not a performance measure of the company? It doesn’t it doesn’t it does it? We didn’t give out the dividends in order to generate revenue. We another what we did is we said now we’ve got the revenue that has been generated, and of that revenue that has been generated, do we want to retain it in the company and invested possibly and like assets or something like that? Or do we want to give it to the owners in the form of dividends. So that’s why it can’t go into the income statement up here, although it’s a timing statement. And that’ll give us the ending retained earnings, which will tie out to the stockholders equity, it’ll always tie out to the retained earnings portion of the stockholders equity, because the other portion will not change all that often. So you want to basically memorize this kind of formula, right? You want to say okay, the beginning balance, plus the net income or the earnings to the common stockholders, minus the dividends is going to give us the ending retained earnings. And then you’re going to say,

19:28

Well, where do I get this number, I don’t even see it anywhere. Well, you get it from the prior year balance sheet, you’d have to have the prior year balance sheet in order to pick up that number because that’s where the beginning balance will start from. So these things should tie out, of course over time, as well as tie out amongst themselves with the assets equaling the liabilities and the equity, the income statement tying into the statement of retained earnings, and then the retained earnings tying into the balance sheet. And then of course of the beginning retained earnings on this periods balance sheet should tie in to the ending retained earnings last year.