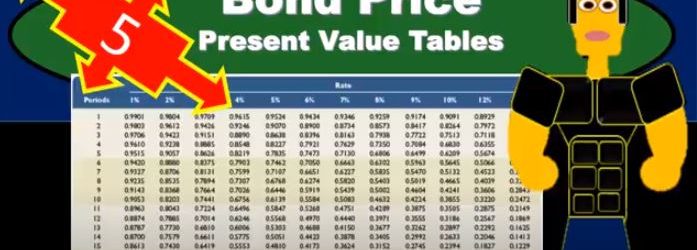

In this presentation, we will calculate the bond price using present value tables. Remember that the bonds is going to be a great tool for understanding the time value of money. Because of those two cash flow streams we have when with relation to bonds, meaning we’re going to pay the bond back the face amount of the bond, and we’re going to have the income stream. And those are going to be perfect for us to think about time value of money, how to calculate time value of money, our goal being to get a present value of those two streams. So we’re going to think of those two streams separately generally, and present value each of them to find out what the present value of the bond will be. We can do that at least three or four different ways. We can do that with a formula actually doing the math on it. We can do it now, which is probably more popular. Now. Do it with a calculator or with tables in Excel, I would prefer Excel or we can use just tables pre formatted tables. The goal here the point is to really understand what we’re doing in terms of what what is happening, what can it tell it? What can it tell us, and then understand that these different methods are all doing the same thing.

Posts with the amount tag

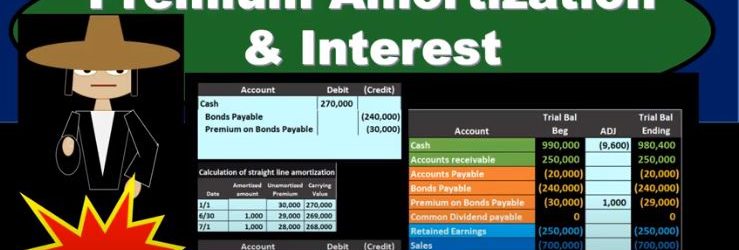

Premium Amortization & Interest

In this presentation, we will discuss the amortization of a bond premium and the recording of interest expense on bonds. This is going to be our starting point. This is the initial transaction in order to get the bonds on the books. Here’s our data down here we’ve got the number of years we’ve got the face amount of the bonds, we’ve got the issue price 270, we see that the interest on the market rate is different than the contract rate. The result then is that cash is going to be increased by the 217. The bonds payable went on the books for the face amount of the bond, the amount that’s on the bonds of the 240, which is a liability. And then we have the premium being the difference increasing the premium here by the 30. The 240 plus 230 is going to be equal to the 270,000 carrying amount book value of the bonds. Now we’re going to go through the process of recording the interest we can see that this is going to have 15 years bonds, we’re going to pay the bonds semi annually. So we’re going to have to record the interest on them. And we’re gonna have to reduce this premium in some way as well. Remember, at the end of the bonds, we’re not going to pay back the 270. We’re only going to pay back 240. So how are we going to get rid of that the premium on the bond and why are we going to do it in the way we will. We’ll start off by amortize in the premium using a straight line the method. Note that the effective method is the preferred method for amortize in a premium for generally accepted accounting principles, but the straight line method will be appropriate in some cases, if the difference is going to be a non material. And the straight line method is a simplified method and it’s easy for us to see what is going on. So we’ll start off with the straight line method.

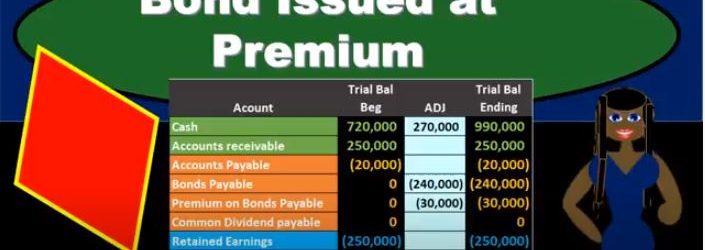

Bond Issued at Premium

In this presentation, we will take a look at the journal entries related to issuing a bond at a premium. When considering the journal entry for a bond, remember what can change and what is the same for a bond. When we think about a bond, it’s already been printed, we know the amount of the bond, the interest on the bond, the maturity date of the bond, these are already set. So if we’re making a negotiation with the bond after it had already been printed, then we can’t change the face amount. We can’t change the interest due dates. What can we change in order to negotiate and make a sales price on the bond, we can change the amount that we issue it for. So keep that in mind. Whenever you think about these bond problems. That’s the thing that’s going to differ from a bond to a note. The thing that changes when we want to loan is the interest rate. The thing that changes when we want to issue a bond that’s already been made is going to be the amount we receive For the bond being different than the face amount of the bond if there’s a difference in the market rate and the contract rate. So in this example, we’re saying that we issued a bond. Now note that when we think about the issuance of the bond, just like a note, we often have more information than we really need. And that can be a little bit confusing for us.

Last In First Out LIFO Inventory Method Explained

Hello in this lecture we’re gonna be talking about the lastin first out inventory method, we will once again be selling our coffee mugs. Here, we will not be specifically identifying the coffee mugs that we sell, but rather using a cost flow method, that method been a lastin. First out this time, whenever doing a cost flow method, I do recommend setting up a worksheet such as this with three parts to it having the purchases, the cost of the merchandise and the ending inventory, and then calculating the units that we’re going to sell the unit cost and the total cost for those particular categories. As we will do here. This will answer the most amount of questions in any format that those questions could be asked. What we are trying to do here is of course, say that the inventory that is reported on the trial balance needs to be backed up in terms of a worksheet Why? Because on the trial balance, it’s reported in terms of dollars.

Statement of Owner’s Equity 131

Hello in this presentation we will describe the statement of equity objectives, we will be able to at the end of this describe the statement of owner’s equity, list the components of the statement of owner’s equity and explain the reasons for a statement of owner’s equity. When we consider the statement of owner’s equity, we are like the income statement and unlike the balance sheet, talking about a timeframe, meaning we have a beginning and end point, unlike the income statement, the beginning point is not zero meaning we are going to start at the beginning point of the net value or the equity section of the prior balance.

Apply Credit Or Advanced Payment to Invoice 8.35

This presentation and we’re going to apply a credit or an advanced payment to an invoice. In other words, we got paid in advance by a customer recorded that into the system. Now we’re going to create an invoice and apply that event advanced payment to it. Let’s get into it with Intuit QuickBooks Online. Here we are in our get great guitars file, we’re first going to take a look at our flowchart in the desktop version.

Sales Receipts & Deposit 8.25

This presentation and we’re going to record a sales receipt and deposit. In other words, we’re going to imagine there’s a sale that takes place, we’re going to make that sale, record that sale with the sales receipt and then go to the bank with that deposit, deposit that into the bank and record that deposit as well into our system. Let’s get into it with Intuit QuickBooks Online.