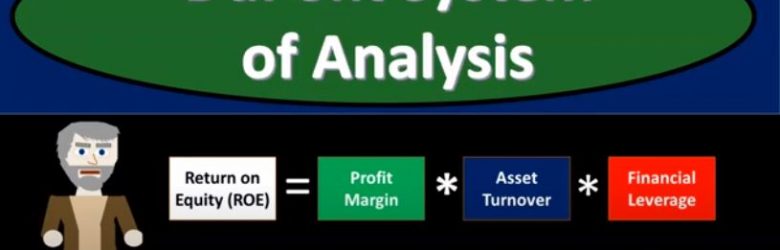

Corporate Finance PowerPoint presentation. In this presentation, we will discuss the DuPont system of analysis Get ready, it’s time to take your chance with corporate finance, the DuPont system of analysis, the DuPont system of analysis is going to be focusing in on a key financial ratio, that being the return on equity or our OE, the ROI he is calculated most simply as net income divided by equity, what we’re going to do is take this return on equity and break it out into components, those components drilling down on areas in the business, allowing us a better analysis in those areas and given us some opportunities to improve different components of the business. So it allows us to basically drill down and get more detail on the return on equity.

Posts with the assets tag

Ratio Analysis Introduction 305

Corporate Finance PowerPoint presentation. In this presentation, we will give an introduction to ratio analysis. Get ready, it’s time to take your chance with corporate finance, Introduction to ratio analysis. So once we have the financial statements, then we want to think about how best to use those financial statements for decision making purposes. So remember, then the two primary financial statements being the balance sheet and the income statement, we can think of them answering primary questions that a user of the financial statements may have, such as an investor or someone who’s thinking about investing into the company may want to know where the company stands as of a point in time, that once again, is the balance sheet.

Balance Sheet Continued 215

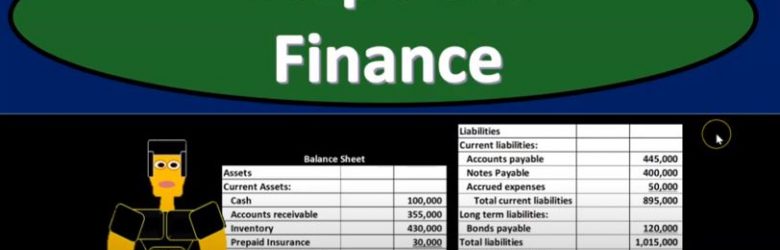

Corporate Finance PowerPoint presentation. In this presentation, we will go into more detail about the balance sheet. Get ready, it’s time to take your chance with corporate finance, balance sheet continued. Remember when we’re thinking about the financial statements, we can break them out to two separate objectives. If we’re considering this from an investor standpoint, that is, where does the company stand at a point in time, and what’s the likelihood or their earnings potential in the future, which we will typically based on past performance, therefore, you’re going to have the timing statement and the point in time type of statement. So when we think about the balance sheet, that’s going to be the point in time type of statements. So if you’re looking at the financial statements for the year ended December 31, the balance sheet will be as of the end of the period, in this case, December 31, as opposed to the timing statements, which are going to be the income statement being the primary statement that should come to mind measuring performance, which will be as of January through December 31 measure and how well we did for that range of time. So our focus over here is going to be on the balance sheet.

Financial Statements Overview 205

Corporate Finance PowerPoint presentation. In this presentation, we will give an overview of financial statements Get ready, it’s time to take your chance with corporate finance, financial statement overview, the financial statements will be the primary tool that will be used to value the company, the financial statements are going to be generated from the company.

Finance Topics & Activities 115

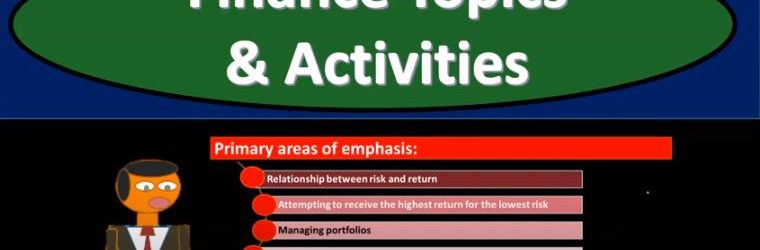

Corporate finance a PowerPoint presentation. In this presentation, we will discuss finance topics and activities going over some of the historical emphasis in the field of finance to get some context of where we’re coming from and where the current emphasis is. And we’ll be in corporate finance, get ready, it’s time to take your chance with corporate finance, finance topics and activities, we’re going to go over some of the emphasis in corporate finance in the past up into the present day to get some focus in on in context of what we will be talking about within corporate finance. So in the 1930s, what’s the emphasis in corporate finance in the 1930s, we have capital preservation.

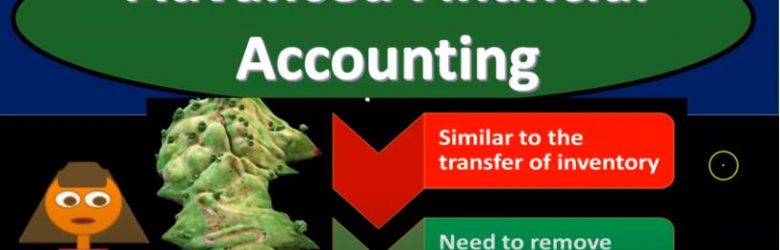

Equity Method and Land Transfer

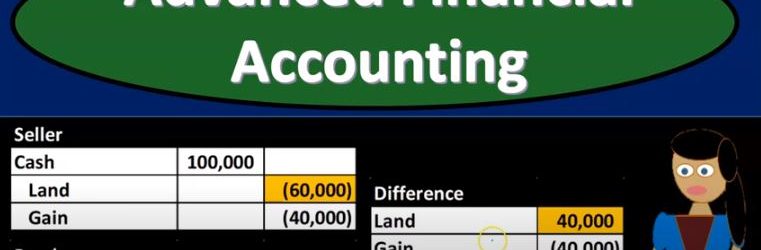

Advanced financial accounting PowerPoint presentation. In this presentation we’ll take a look at the equity method and land transfer get ready to account with advanced financial accounting, land transfer intercompany. Within the context of our consolidation, then we’re talking about situations where land is transferred from subsidiary to parent like a sale from subsidiary to parent or from parent to subsidiary. That resulting in basically an intercompany type of transaction we’re going to have to deal with with the consolidation process and possibly with the recording of the equity method by the parent as they reflect their investment in the subsidiary. We talked a little bit last time about the land transfer being similar to the inventory transfer because typically you’ll have like a gain that will be involved in it and your physical inventory that is changing hands. It does not have the added complexity as the property plant and equipment type of transfer. That would be depreciable assets with regards to accumulated appreciation and appreciation.

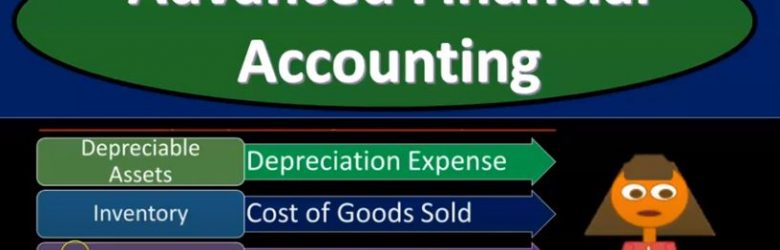

Transfer of Long-Term Assets & Services Overview

Advanced financial accounting PowerPoint presentation. In this presentation we’re going to take a look at an overview of the transfer of long term assets and services. In other words transfers between related entities. If we’re thinking about a consolidation process then transfers that we will have to deal with with the consolidation process with consolidating or eliminating journal entries, you’re ready to account with advanced financial accounts. intercompany transactions need to be removed in the consolidation process.

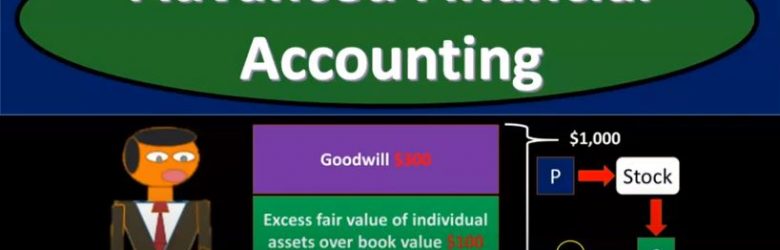

Consolidation With Difference Simple Example

Advanced financial accounting. In this presentation we’re going to talk about the consolidation process with a differential we’re going to look at the component parts with a simple example a simple calculation, you’re ready to account with advanced financial accounting, consolidation with differential example. So here’s going to be the basic scenario for many of the practice problems we will be looking with. We have P and S, there’s going to be a parent subsidiary relationship in which we will be making consolidated financial statements. How did this situation take place what constituted this situation, we’re going to say that in this example, P is purchasing the stocks of S. So notice they’re purchasing the stocks of s and therefore negotiating the stock price, which we’re going to say is $1,000 here. Now to simplify this example, you first want to think about this as p purchasing 100% of the stock of s for $1,000. And then once they have control, anything over 51% would then be controlled.

Consolidation When There is a Book & Fair Value Difference

Advanced financial accounting. In this presentation we’re going to take a look at a consolidation process when there is a book and fair value difference. In other words, we’ll have a consolidation. We have two companies, we have a parent subsidiary type of relationship, and the parent has a controlling interest of the subsidiary. Therefore consolidation is what we’re going to be doing. That means we’re going to take two separate sets of books combine them together as if they were one. And we had some complications with the fact that when the purchase took place, there was a difference between the book value and the fair value, what will be the effect of that difference on the consolidation process, elimination entry example. So when we consider this difference, we want to think about what’s going on with the parents books and the subsidiaries books and then what would be the process to consolidate them and what type of problems would be caused if there was a difference between the book and fair value of the net assets so the parents books investment accounts starts out containing the acquisition costs at the fair market value of net assets and goodwill, so we have, that’s basically what’s going to be on the parents books, right. And we’re thinking here typically have an equity method being used. So we have the parents books, we have the subsidiary books that we’re gonna have to consolidate together, and then do our elimination entries. And on the parents books, you’re accounting for the subsidiaries.

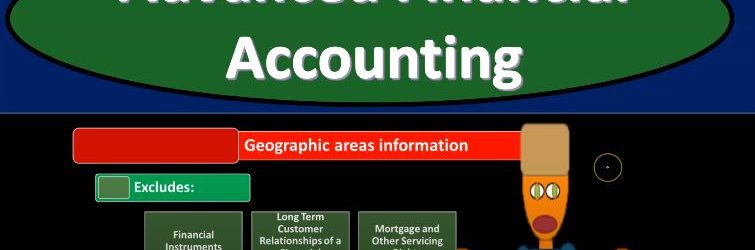

Enterprisewide Disclosures

Advanced financial accounting a PowerPoint presentation. In this presentation we will discuss enterprise wide disclosure, get ready to account with advanced financial accounting. enterprise wide disclosures established by ASC 280 standards provide users more information about the company’s risks generally made in a footnote to the financial statements. First category of required information to include under ASC 280 is information about products and services so information about products and services disclosure related to them. Companies are generally required to report revenues from external customers for each major product and service or each group of similar products and services. Unless doing so is not practical. primary reason for this is that the company could have organized its operating segments on a different basis from the organization of the entities product lines. So we’ve got then again, companies are generally required to report revenues and external customers for each major product and service. You might be saying, hey, well, they already have the segment’s reporting. But it’s possible that those two things don’t exactly line up in the way they put the segment reporting together and therefore, you know, you have this requirement. second category of required information to include under ASC 280 is going to be related to geographic areas information. The following needs to be reported unless it would be impractical to do so. revenues from external customers attributed to the company’s home country of domiciled revenue from external customers attributed to all foreign countries in which the enterprise generates revenues.