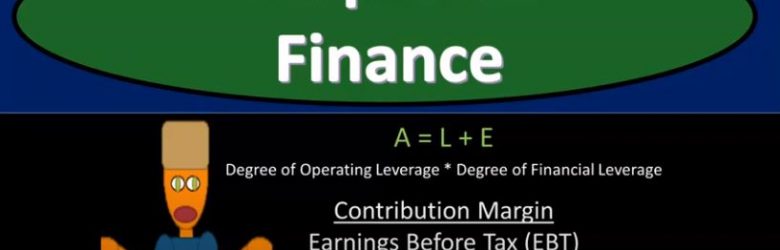

Corporate Finance PowerPoint presentation. In this presentation, we will discuss combined leverage, get ready, it’s time to take your chance with corporate finance, combined leverage. Remember when we’re thinking about the term leverage, there’s typically two types of leverage that come into our minds. One is going to be the financial leverage the others the operating leverage the financial leverage, probably the one that pops into most people’s mind, if they’re familiar with leverage that being related to the debt in the organization and the risk and reward related to different levels of debt depending on the circumstances. And then we have the operating leverage, which has to do with the mix between the variable costs and the costs and the in the fixed costs.

Posts with the calculation tag

Degree of Operating Leverage 515

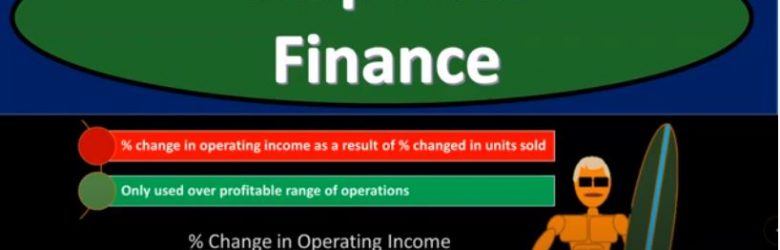

Corporate Finance PowerPoint presentation. In this presentation, we will discuss the degree of operating leverage, get ready, it’s time to take your chance with corporate finance, degree of operating leverage. Now remember, when you hear this term leverage, there’s two things that pop into your mind that generally categories of leverage. The first one is probably related to debt debt leverage or financial leverage. And the other related to the cost structure, the one that we’re going to be focusing in on here, the structure between variable costs and fixed costs. So what’s going to be the structure of the variable cost fixed costs, that’s kind of what we’re measuring here, with the degree of operating leverage the fixed costs being the thing that’s going to have more leverage related to it.

Consolidation With Difference Simple Example

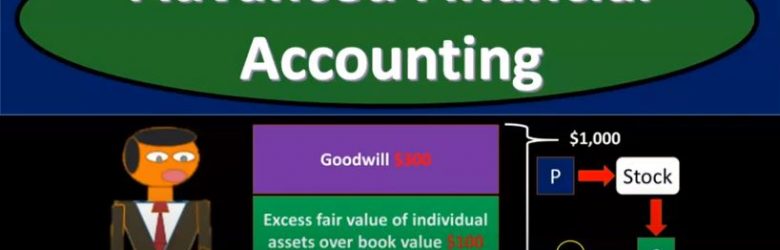

Advanced financial accounting. In this presentation we’re going to talk about the consolidation process with a differential we’re going to look at the component parts with a simple example a simple calculation, you’re ready to account with advanced financial accounting, consolidation with differential example. So here’s going to be the basic scenario for many of the practice problems we will be looking with. We have P and S, there’s going to be a parent subsidiary relationship in which we will be making consolidated financial statements. How did this situation take place what constituted this situation, we’re going to say that in this example, P is purchasing the stocks of S. So notice they’re purchasing the stocks of s and therefore negotiating the stock price, which we’re going to say is $1,000 here. Now to simplify this example, you first want to think about this as p purchasing 100% of the stock of s for $1,000. And then once they have control, anything over 51% would then be controlled.

Consolidation When There is a Book & Fair Value Difference

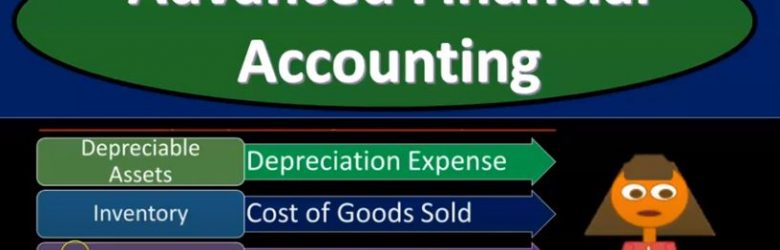

Advanced financial accounting. In this presentation we’re going to take a look at a consolidation process when there is a book and fair value difference. In other words, we’ll have a consolidation. We have two companies, we have a parent subsidiary type of relationship, and the parent has a controlling interest of the subsidiary. Therefore consolidation is what we’re going to be doing. That means we’re going to take two separate sets of books combine them together as if they were one. And we had some complications with the fact that when the purchase took place, there was a difference between the book value and the fair value, what will be the effect of that difference on the consolidation process, elimination entry example. So when we consider this difference, we want to think about what’s going on with the parents books and the subsidiaries books and then what would be the process to consolidate them and what type of problems would be caused if there was a difference between the book and fair value of the net assets so the parents books investment accounts starts out containing the acquisition costs at the fair market value of net assets and goodwill, so we have, that’s basically what’s going to be on the parents books, right. And we’re thinking here typically have an equity method being used. So we have the parents books, we have the subsidiary books that we’re gonna have to consolidate together, and then do our elimination entries. And on the parents books, you’re accounting for the subsidiaries.

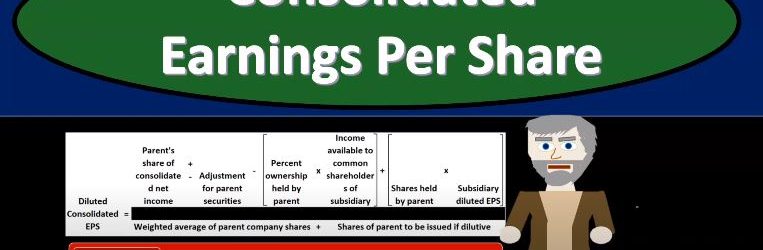

Consolidated Earnings Per Share

Advanced financial accounting PowerPoint presentation. In this presentation we will discuss consolidated earnings per share, get ready to account with advanced financial accounting, consolidated earnings per share, how do we calculate the earnings per share for a consolidated entity, the basic calculation for the earnings per share will in essence be the same as for a single Corporation. So there’s not too much difference between the consolidated earnings per share calculations and the basic earnings per share for one entity one Corporation. So the basic earnings per share is is computed by deducting income to the non controlling interest and any preferred dividend requirement of the parent from the consolidated net income. So we’re going to take the net income and then we’re going to deduct income to the non controlling the non controlling interest and any preferred dividend requirement. In other words, we’re going to take the consolidated net income and then remove or deduct income to the non controlling interest and and in preferred dividend requirement, then we’re going to take that number, the amount resulting is divided by the weighted average number of the parents common shares outstanding during the period covered. So it’s a pretty straightforward calculation for the basic earnings per share, we do have practice problems on it. However, if you want to brush up on calculating the basic earnings per share, we have that there. diluted consolidated earnings per share is going to be a more complex calculation.

Notes Payable Introduction

In this presentation, we will introduce the concept of notes payable as a way to finance a business. Most people are more familiar with notes payable than bonds payable, the note payable basically just being a loan from the bank. Typically, the bond payable is a little more confusing just because we don’t see it as often, especially as a financing option. From the business perspective, we often see it more as an investing or type of investment. But from a loan perspective, it’s very similar in that we’re going to receive money to finance the business if we were to issue a bond, or if we’re taking a loan from the bank. And then of course, we’re going to pay back that money. The difference between the note and the bond is that one the note is something we typically take from the bank. Whereas a bond is something we can issue to individuals so a bond we could have more options in terms of issuing the bonds than we do for a loan. Typically when we have a loan, we typically are Gonna have less resources, we can take a loan from the bank. When we pay back the bond, we often think of the bond as two separate things. And we set it up as two separate things, meaning we have the principal of the bond that we’re going to pay back at the end. And then we have the interest payments, which are kind of like the rent on the money that we’re getting, we’re getting this money, we’re gonna have to pay rent on it, just like we would pay rent if we had got the use of any physical thing.

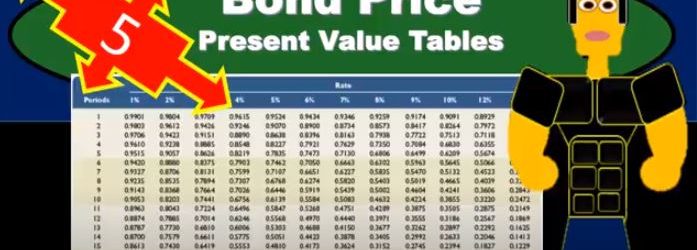

Bond Price Present Value Tables

In this presentation, we will calculate the bond price using present value tables. Remember that the bonds is going to be a great tool for understanding the time value of money. Because of those two cash flow streams we have when with relation to bonds, meaning we’re going to pay the bond back the face amount of the bond, and we’re going to have the income stream. And those are going to be perfect for us to think about time value of money, how to calculate time value of money, our goal being to get a present value of those two streams. So we’re going to think of those two streams separately generally, and present value each of them to find out what the present value of the bond will be. We can do that at least three or four different ways. We can do that with a formula actually doing the math on it. We can do it now, which is probably more popular. Now. Do it with a calculator or with tables in Excel, I would prefer Excel or we can use just tables pre formatted tables. The goal here the point is to really understand what we’re doing in terms of what what is happening, what can it tell it? What can it tell us, and then understand that these different methods are all doing the same thing.

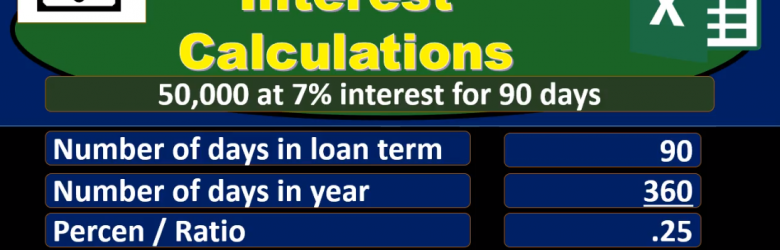

Interest Calculations

In this presentation, we will take a look at how to calculate simple interest a few different ways. As we look at this, you may ask yourself, why are we going over this a few different ways, why not just go over it one way, the best way. And let us learn that well and be able to apply it in each situation. While one way does work in most situations. In other words, we will probably learn one way have a favorite way to calculate the simple interest and apply that in every circumstance. It’s also the case that when we look at other people’s calculations or technical calculation, they may have some different form of the calculation. For example, I prefer away when I think about the calculation of simple interest to have some subtotals in the calculation and have more of a vertical type of calculation the way we would see if done in something like a calculator. If we see a type of equation in a book, then the idea there is that Have the most simple type of equation expressed in as short a way as possible. And that typically is going to be some type of formula. And that formula will often not be showing the subtotal.

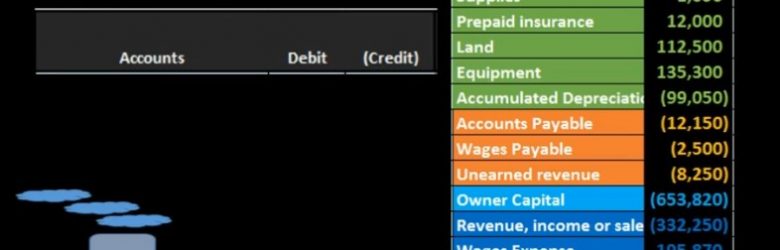

Adjusting Entry Insurance 9

Hello in this lecture, we’re going to record the adjusting entry related to insurance, we’re going to record the transaction up here on the left hand side and then post that to the trial balance on the right hand side, the trial balance being in the format of assets in green liabilities in orange. Then we have the equity section in light blue and the income statement, including revenue and expenses in the darker blue. We will start off by just identifying the accounts that will be affected and then talk about why they will be affected. So we know that we have the adjusting entries. Remember that adjusting entries should be kept separate in your head in that they do have the same characteristics of having debits and credits in at least two accounts affected however, they’re also all as of the end of the time period, either the end of the month or the end of the year.

Statement of Owner’s Equity 131

Hello in this presentation we will describe the statement of equity objectives, we will be able to at the end of this describe the statement of owner’s equity, list the components of the statement of owner’s equity and explain the reasons for a statement of owner’s equity. When we consider the statement of owner’s equity, we are like the income statement and unlike the balance sheet, talking about a timeframe, meaning we have a beginning and end point, unlike the income statement, the beginning point is not zero meaning we are going to start at the beginning point of the net value or the equity section of the prior balance.