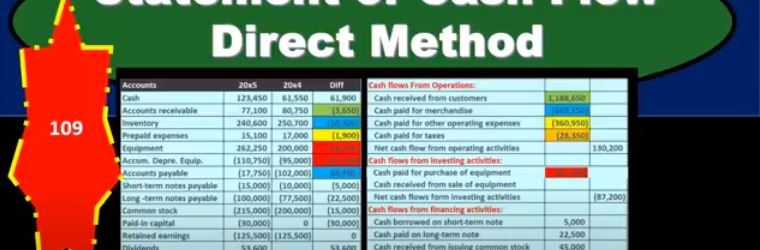

In this presentation, we will take a look at the statement of cash flows using the direct method. Here’s going to be our information we got the comparative balance sheet, the income statement and some additional information. And we will use this information to put together our worksheet which will be the primary source used to create the statement of cash flows using the direct method. This is going to be our worksheet. Now most of this worksheet will be similar to what we have done for the indirect method, in that we took the difference in the balance sheet accounts. So we’re taking the current year and the prior year, the current period, the prior period, all the balance sheet accounts, we’ve got cashed down to the retained earnings for the balance sheet accounts. But we’re also in this case going to give us the income statement accounts for the current period. So in other words, we’re going to break out the retained earnings the amount to its component parts, meaning we’ve got net income being broken out on the income statement. We’ve got sales cost of goods sold, the income statement accounts. So it’s going to be our same kind of worksheet here, we’re going to be in balance, we’ve converted it from a plus and minus format, we’ve removed all of the subtitles as we did under the indirect method.

Posts with the Cash tag

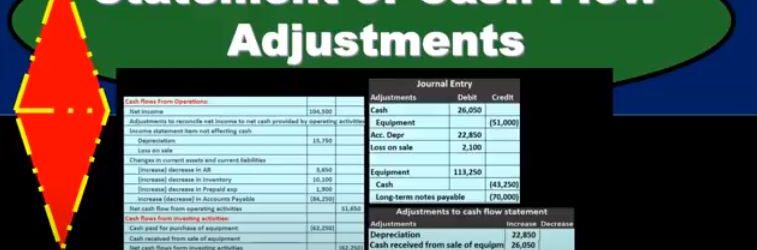

Statement of Cash Flow Adjustments

This presentation we will continue on with our statement of cash flows, we’re not going to enter the final adjustments that we will need to finalize the statement of cash flows to bring those last few numbers to the correct balances. In order to do that, we’re going to use this information we’ve got our comparative balance sheet, our income statement and additional information. We put together most of our information so far with the comparative balance sheet, which we made into a worksheet. Now we’re going to use some of these other resources, the income statement, the additional resources to make those final adjustments, those fine tunings that are needed to get those few numbers that we have left and noted into balance. And this is going to be part of the normal practice where once we get this information set up, we can then make some comparisons such as net income does it tie out, such as depreciation does it tie out on the cash flow statement to what we see here on the income statement, then we can have this other information which will be given in both problems in practice, of course, we’ll just go to the gym. General Ledger. And we’ll get this information in a book problem, we don’t want to give all the detail of a general ledger or just when we’re going over an example.

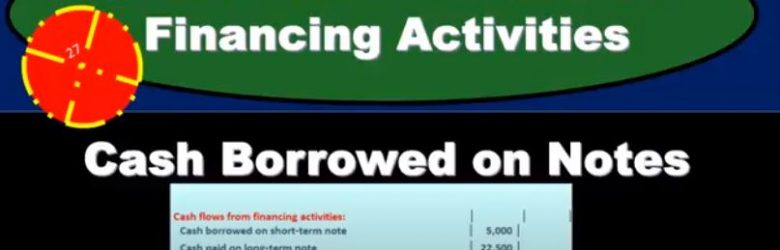

Statement of Cash Flow Financing Activities Cash Borrowed on Notes

In this presentation, we will continue on with the statement of cash flows. Looking at the financing activities looking at cash borrowed on notes, we’re going to be using the information with our comparative balance sheet, the income statement and the additional information focusing on the comparative balance sheet. First, it will be used to create this worksheet, we have going through this worksheet looking for all the differences and finding a home for them starting Of course, with cash down here, and then we kind of skipped around to pick up all of the cash flows from operating activities. And that’s really how people usually start this thing out. And rather than going just from top to bottom, picking out the operating activities, then we went back and we picked up the cash flows from investing activities. Now we’re going to go down and pick up the financing activities. And those deal with notes payable here. So we have the notes payable, and we have this common stock issuance. So those are going to be things that are typically going to be in the final financing. And you might think of as well, how would I know this? What? Why would I know that’s going through? Well, if we go through these, remember that the cash is obviously down here, that’s where we started. And then the current assets versus current liabilities, most of them are going to be up here. And that’s going to be the accounts receivable, the inventory, prepaid expenses, and then equipment.

Statement of Cash Flow Investing Activities Cash Paid for Purchase of Equipment

In this presentation, we will continue on with our statement of cash flows. Taking a look at the investing activities, specifically the purchase of equipment, we’re going to be using the comparative balance sheet, the income statement and additional information focusing here on the comparative balance sheet, which we use to make this worksheet. So this worksheet is our comparative balance sheet. We’ve been going through this worksheet and really looking for the differences. We’re finding a home for all the differences. Once we do that, we’re feeling pretty good. We have done this all the way through the operating activities. So are the cash flows from operations. So we’ve gone through here we’ve kind of picked and choose the items that are going to be cash flows from operations, which is probably the way most people approach this. But just note that as we’ve done that, we’ve tried to pick up the exact differences here. We haven’t gone to the income statement and thought about it separately outside of this worksheet, and then we’re going to go back and make adjustments. So we found a home for the difference in cash because that’s Kind of like our bottom line. And then we’ve got accounts receivable, inventory prepaid expenses, and then we skipped equipment and went down to accounts payable.

Statement of Cash Flow Indirect Method Change In Accounts Payable

In this presentation, we will continue on with our statement of cash flows using the indirect method looking in on the change in accounts payable, we’re going to be using this information or a comparative balance sheet income statement and other information focusing primarily on comparative balance sheet creating a worksheet with it, looking like this. This basically being the comparative balance sheet. But in a post closing trial balance format, we have our two periods and the difference between those periods here. Our goal is to find a home for all of these differences. Once we do so we’ll end up with basically the change in cash. That being our bottom line that we’re looking for. We’ve gone through this information in terms of the cash flows from operations. We’re currently looking through the current assets, and now we’re moving on to the current liabilities. So we’ve looked at the accounts receivable, the inventory, prepaid expenses, we have these here. We’re moving on now to a liability and notice when we do that, when we’re working From the worksheet, we’re kind of skipping over some things here.

Statement of Cash Flow Indirect Method Change in Prepaid Expense

In this presentation, we will continue with the statement of cash flows indirect method looking at the change in prepaid expenses, we’re going to be using this information, we’ve got the comparative balance sheet, we’ve got the income statement and some additional information, we will be working primarily with the difference in the comparative balance sheet with the use of a worksheet taking this information to create this worksheet. So this is just basically a comparative balance sheet that has been condensed down to something that looks like a post closing trial balance. We are constructing our cash flows from operations from it, we have all of our differences. We’re basically just finding a home for these differences. We know if we do so that if we find a home for all of these differences, then it’ll add up to that difference, the difference in cash, which is basically the bottom line of our cash flow statement, or that’s what we want to get to in terms of adding up the cash flows. So we’ve gotten so far We’re working on the cash flows from operations. And we’ve done the cash flows in terms of the accounts receivable, inventory. Now we’re on prepaid expenses. We’re just going through these.

Statement of Cash Flow Indirect Method Change In Inventory

In this presentation, we will continue putting together our statement of cash flows using the indirect method. Now taking a look at the change in inventory, we’re going to be using our materials here with a comparative balance sheet, the income statement and some added information, working primarily at this time from a worksheet that was made from the comparative balance sheet. So here is our worksheet. Here’s what we have. So far, we basically have a comparative balance sheet in a trial balance type format, where we have the current year, the prior year, and then the difference. Our goal is to find a home for all of these differences are in number that we’re looking for, is basically the 61 900 change in cash. So we’ve gone through this, from top to bottom, we’re working through basically the operating cash flows from operating First, the indirect method. So we started off with the net income, then we made our adjustments. And then now we’re going through basically The accounts receivable to inventory. Now once we get into the current assets, we’re going to group those into this change in current assets under the cash flows from operations. Once we know the theme here on what’s going to happen with these current assets, it’s it’s always going to be the same.

Statement of Cash Flow Indirect Method Change In Accounts Receivable

In this presentation, we will continue putting together the statement of cash flows using the indirect method focusing here on the change in accounts receivable. The information will be a comparative balance sheet, the income statement and some added information we will be focusing in on a worksheet that was composed from the comparative balance sheet. So here is our worksheet. So our worksheet that we can pay that we made from the comparative balance sheet, current period, prior period change. So we have all of our balances here for the current period, the prior period and the change, we have put in this change. And this is really the column that we are focusing in on we’re trying to get to this change in cash by finding a home for all other changes. Once we find a home for all other changes. We will get to this change in cash the bottom line here 61,900. The major thing we’re looking for is right here. We’ve already taken a look at the change in the retained earnings. And the change in the accumulated depreciation. Now we’re going to look at the changes in current assets and current liabilities.

Statement of Cash Flow Indirect Method Adjustments to Reconcile Net Income to Net Cash Provided

In this presentation, we will continue putting together a statement of cash flows using the indirect method focusing in on adjustments to reconcile net income to net cash provided by operating activities. So this is going to be the information we will be using, we have the comparative balance sheet, the income statement added information, we took this comparative balance sheet to create our worksheet. So here is our worksheet for two time periods. This is the difference we’re basically looking to find a home for all of these differences we have done so with cash, and we’ve done so with a difference in retained earnings. So here’s cash, here’s net income, the difference in retained earnings, we will have to adjust net income shortly or at the end of the problem. We’ll we’ll take a look at that we’ll make an adjustment for it. We’re going to now find the difference for all the rest of these. Also note that of course cash is going to be the change in cash will be our bottom line. Never we’re going to recalculate this But it’s nice to know where we are ending up at. So this is kind of like even though it’s at the top of our worksheet, that’s where we want to end up by finding a home for everything else. So now we’re going to take a look at the adjustments to reconcile net income to net cash provided by operating activities. So these are going to be those types of things that we look at the income statement, and we’re going to say that these are non cash activities, meaning income is calculated as revenue minus expenses. And the cash flow.

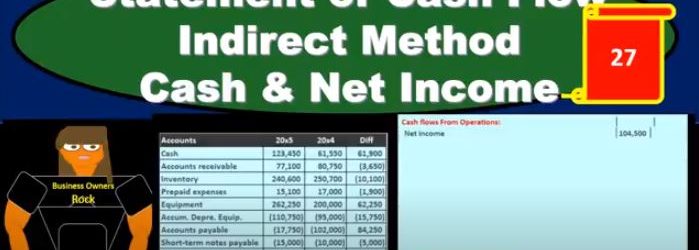

Statement of Cash Flow Indirect Method Cash & Net Income

This presentation, we will start to construct the statement of cash flows using the indirect method focusing in on cash and net income. This is going to be the resources we will have, we’ll have that comparative balance sheet, the income statement, and we’re gonna have some added information. In order to construct the statement of cash flows, we’re mainly going to be working with a worksheet that we’ve put together from a comparative balance sheet. That’s where we will start. So we’re going to find a home, this is going to be our worksheet. We have the two periods. So we have the current year, we’ve got the prior year, and we’ve got the difference between those activities. Now our goal here is to basically just find a home for every component on this difference section. So that’s going to be our home. Why? Well, we can first start thinking about cash. What are we going to do with cash? That’s the main thing. This is a statement of cash flows here. So where are we going to put cash? that’s actually going to start at the bottom, we’re going to say that’s going to be our in numbers. In number we know it’s going to be cached. Now, we’re going to recalculate it. But it’s useful for us to just know and we might just want to put there, hey, that’s where we’re going to end up. That’s where we are looking to get. And now what we really want is the change.