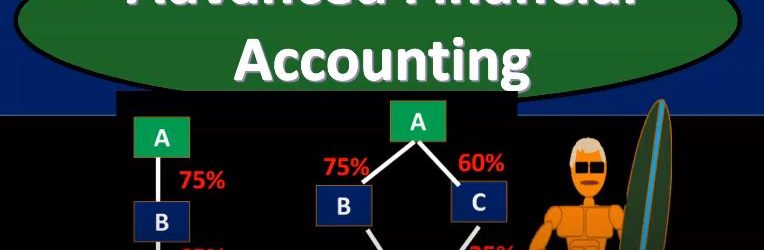

Advanced financial accounting. In this presentation we’re going to talk about the concepts of direct and indirect control. If you’re ready to account with advanced financial accounting, we want to consider these concepts within the context of financial statements and consolidation. So you’ll recall that when we have consolidated financial statements, the idea is to put two financial statements together when one company has basically control over another company that being defined typically by having more than 51% interest because if you have more than 51%, then you have basically a voting share for you to vote on anything, then of course, you would win the vote at that point in time. So let’s consider then direct control and indirect control direct control when one company has a majority of another company’s stock common stock. So that would be a situation where you got a and b, one company has a majority interest over 51% control is pretty easy to see at that point. When you start to get into indirect control. This can get more complicated things can get more confusing here. So indirect control, one company’s common stock is owned by one or more other companies that are under common control. So this can get a lot more detailed structure in terms of what is going to constitute control. So for example, if we have direct control, then you have just simply a parent subsidiary type of relationship. And, you know, the parent has more than 51% of the subsidiary, interest common stock. So and that could happen if we have to, we could still have a little bit more complexity here, where we have two subsidiaries, right. But they’re both going to be consolidated in this case, because there’s 75% over 51% direct control is parent over as one direct control over as to here because it’s over the 51%. So both of these cases would be direct control.