Hello in this lecture we will discuss the accounting building blocks and the double entry accounting system. At the end of this we will be able to define and describe the double entry accounting system, write down the accounting equation and define each individual part of it, define and describe debits and credits, define a balance sheet and list its parts define an income statement list its parts and explain the relationship between the balance sheet and the income statement. Okay, so starting off every business and accounting software uses the double entry accounting system. So the double entry accounting system, it’s kind of like the math behind the calculator, every software is going to use it. In order to understand what the system is doing, we need to understand the double entry accounting system.

Posts with the financial statements tag

Accounting Cycle Steps in the Accounting Process

Hello, in this presentation, we’re going to be talking about the accounting cycle or the accounting process, that process that the accounting department will go through on a systematic basis over and over and over again, typically thought of as a monthly process. Although it could be thought of as a yearly process or some other process in terms of the amount of time that will pass. But these are going to be the steps that we’ll be going through in terms of the accounting process, always keeping in mind that in goal of financial accounting, which are the financial statements, some texts will have more steps than five as we have here. Some texts will have less than five steps. But the goal here is to really have a broad picture big picture, so that when we think about the accounting process, we can break down that that big picture view, five is a pretty good number for us to be able to memorize and keep in our mind if we have more than that, it can start to kind of muddy the picture.

Statement of Cash Flows Introduction

In this presentation, we will introduce the financial statement of statement of cash flows. When thinking about the statement of cash flows, we want to compare and contrast the reasons for it to what the other financial statements are providing us what information in other words, are we going to get from the statement of cash flows that’s not on the other financial statements, those being the balance sheet, the income statement, the statement of equity, we’re mainly comparing against the income statement, because the statement of cash flows going to give us some similar information. It’s going to give us information over time, what’s happening over time, unlike the balance sheet, which is going to have a point in time. So we’re still looking at at timing what is what is going on over time. That’s typically our income statement, which measures performance. The major goal of the income statement is to measure performance, how have we done how much work have we done, revenue minus expenses, revenue being recognized when we earn the work when we’ve done the job expenses when we We’ve incurred something in order to help generate in the same time period. And that’s going to be the net income. What that doesn’t do, however, is measure cash flow. And when we first learn about the income statement, that’s going to be a real big distinction we want to look at, we want to say, okay, the income statements on an accrual basis.

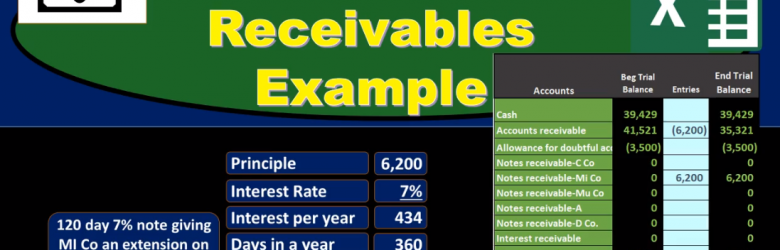

Note Receivable Example

In this presentation we will discuss notes receivable, giving some examples of journal entries related to notes receivable and a trial balance so we can see the effect and impact on the accounts as well as the effect on net income of these transactions. first transaction, we’re gonna have 120 day 7% note giving the company EMI and extension on past due AR or accounts receivable of 6200. When considering book problems and real life problems, one of our challenges is to interpret what is actually happening what is going on, which party are we in this transaction in? Therefore, how are we going to record this transaction when we’re looking at notes receivable? A common problem with notes receivable is the conversion of an accounts receivable to a notes receivable. So in this case, that’s what we have. We have an accounts receivable here that includes an amount of Due to us by this particular company in AI so these are our books, we have a receivable people owing us money for prior transactions goods or services provided in the past and they owe us in total, all customers owe us 41,521 this customer in particular owes us 6200 of this amount in the receivable that could be found not in the general ledger which would give backup of transactions by date.

Receivables Introduction

In this presentation we will take a look at receivables. The major two types of receivables and the ones we will be concentrating on here are accounts receivable and notes receivable. There are other types of receivables we may see on the financial statements or trial balance or Chart of Accounts, including receivables, such as rent receivable, and interest receivable. Anything that has a receivable, it basically means that someone owes us something in the future. We’re going to start off talking about accounts receivable that’s going to be the most common most familiar most used type of receivable and that means something someone, some person some company, some customer typically owes us money for a transaction happening in the past, typically some type of sales transaction. So if we record the sales transaction, that would typically be the way accounts receivable would start within the financial statements, meaning If we made a sale, we would credit the revenue account, we’ll call it sales. If we sell inventory, it would be called sales. If we sold something else, it might be called fees earned, or just revenue or just income, increasing income with a credit, and then the debit not going to cash. But going to accounts receivable.

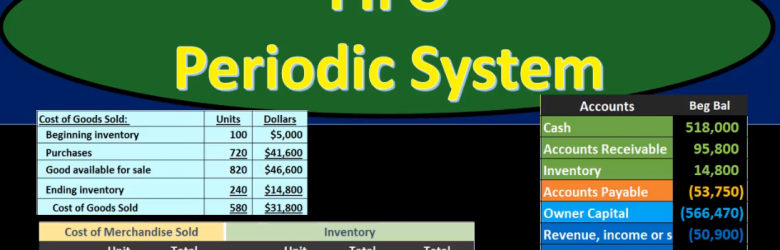

First In First Out (FIFO) Periodic System

In this presentation we will discuss first in first out or FIFO using a periodic system as compared to a perpetual system. As we go through this, we want to keep that in mind all the time that been that we are using first in first out as opposed to some other systems lastin first out, for example, or average cost, and we’re doing so using a periodic system rather than a perpetual system. Best way to demonstrate is with examples. So we’ll go through an example problem. We’re going to be using this worksheet for our example problem. It looks like an extended worksheet or large worksheet, but it really is the best worksheet to go through in order to figure out all the components of problems that deal with these cost flow assumptions, including a first in first out lastin first out, or an average method, and using a periodic or perpetual for any of them.

Lower of Cost or Market

In this presentation we will discuss the concept of lower of cost or market. We will define this concept first and then see it and talk about how it would apply to inventory. The definition of lower of cost or market according to fundamental accounting principles, while 22nd edition is required method to report inventory at market replacement cost when that market cost is lower than recorded cost. So, what we’re saying here is we have we’re talking about the inventory, of course, and we’re saying that we have to record it at the replacement cost. When that replacement cost that market cost is lower than the recorded cost, what we actually purchased it for. So this looks like a confusing type of definition. However, it’s pretty straightforward. What we’re applying here is going to be the conservative principle meaning that if our inventory has declined in value, we have to record it at the lower cost. We don’t want to be overstating our income mentoree obviously regulations are very concerned about us overstating something, when we’re talking about an asset, and making the financial statements look better than they would rather than understating it.

Consistency Concept

In this presentation we will discuss the consistency principle as it relates to inventory and inventory assumptions. First, we’re going to define the consistency principle and then apply it to an assumption such as the flow assumption such as do we use something like a first out last In First Out average inventory system, the definition of consistency principle according to fundamental accounting principles, while 22nd edition is a principle that prescribes use of the same accounting method methods over time so that financial statements are comparable across periods. So, here we’re considering the assumptions that we’re making with the flow of inventory those being either first in first out last in first out or the average method typically for the cost flow assumptions, because those are assumptions.

Special Journals Subsidiary Ledgers 2

In this presentation, we’re going to talk about special journals and subsidiary ledgers. First, we’re going to list out the special journals and talk about when we would use them, why we would use them and how they fit into the accounting system. The special journals are basically going to group types of transactions. So when we think about all the transactions that happened during the month, we typically see them in order of when they happen in the accounting system, we’re going to record transactions in other words, by date as they occur. But if we are able to group those transactions into special journals that can simplify the process.

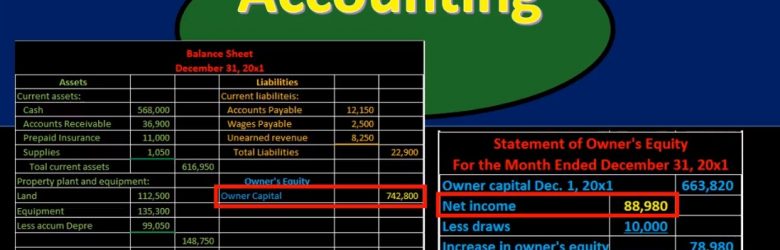

Financial Statement Relationships 18

Hello in this presentation we’re going to take a look at financial statement relationships. In other words, how do these financial statements fit together? How do these financial statements represent the double entry accounting system in the format of the accounting equation that have assets equal liabilities plus equity? First, we’ll take a look at the balance sheet. Note that most textbooks will talk about this relationship and constructing the financial statements by first saying to construct the income statement, then the statement of equity and then the balance sheet. If you’re constructing things by hand with a paper and pencil, that does reduce the number of calculations that you would need to do, however, if you’re using something like Excel, then it’s a lot easier to sum up columns of numbers and it might be useful to take a look at the balance sheet. In any case, the relationships will be the same when we consider the relationships between the financial statements.