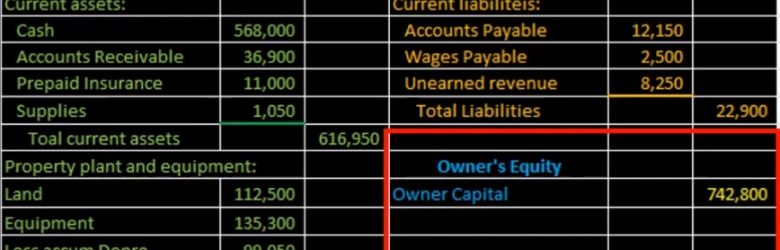

Hello in this lecture we’re going to be creating the equity section of the balance sheet. In prior lectures, we have taken a look at the current assets section, the property plant and equipment section and then the liability section. This will be rounding out the balance sheet where we will finally get to total assets being equal to total liabilities and equity represent in the double entry accounting system. In terms of the balance sheet in terms of the accounting equation, we of course, are pulling these numbers from the adjusted trial balance. the adjusted trial balance also represents the double entry accounting system. However, it represents that double entry accounting system in the format of the building blocks of debits and credits. All we’re doing is taking those building blocks in terms of debits and credits, rearranging them to the accounting equation, so that readers who don’t understand debits and credits can then read them. Now when we look at the equity section, this is a bit confusing when we convert from the trial balance to the equity section.

Posts with the Income Statement tag

Adjusting Entry Depreciation 10

Hello in this lecture, we’re going to record the adjusting entry related to depreciation were recorded on the left hand side, that’s where the journal entry will go. And then we’ll post that to the trial balance on the right hand side trial balance being in the format of assets in green liabilities in the orange. Then we have the equity section in the light blue and the income statement, including revenue and expenses in the darker blue. We’ll first talk about what accounts are affected and then we’ll go back and explain why this is the case. So first, we know that it’s an adjusting entry. So that’s going to have some added rules, you want to keep the adjusting entry separate in your head from just normal journal entries. all entries have at least two accounts and an equal number of debits and credits as well as adjusting entries. But adjusting entries are all made of as of the cutoff date, we’re gonna say 1231 in this case, and they generally have one account above this equity line above the capital meaning a balance sheet account and one account below that line meaning an income statement accounts.

Adjusting Entry Wages Payable 7

Hello, in this lecture, we’re going to record the adjusting entry related to payroll, we’re going to record the journal entry up here on the left hand side and post that post that to the trial balance over on the right hand side trial balance in terms of assets and liabilities, then equity and the income statement, including revenue and expenses, all blue accounts, including the income statement being part of equity, we’re first going to go through and see if we can find the accounts that will be related to a payroll adjusting entry. And then we’ll go explain why we are going through this process. So just if we have the trial balance, and we know it’s an adjusting entry related to payroll, we know that there’s going to be at least two accounts affected. And we know that because it’s an adjusting entry, it will be as of the end of the time period. In this case, let’s say it’s the end of the year 1231.

Debits & Credits 205

Hello in this presentation we will discuss debits and credits. Objectives at the end of this we will be able to define debits and credits list account normal balances and explain how debits and credits work. First we want to take a look at the double entry accounting system and recognize that the double entry accounting system can be represented in multiple different ways including as we have seen before the accounting equation meaning that assets equal liabilities plus equity, we can record transactions using this accounting equation as we have done in the past. That accounting equation is the basis behind the balance sheet where we have the assets liabilities and equity representing the fact that the balance sheet then would be in balance.

Income Statement 130

Hello in this presentation we will discuss the income statement objectives. At the end of this presentation, we will be able to describe what an income statement is list the parts of the income statement and explain the reasons for an income statement. First, we’ll start off with a question will which will explain the timing of the income statement or introduce us to an explanation of the timing of the income statement? And that is the question of asking somebody, how much do you make when we were to if we were to ask somebody how much they make, they would mentally make some type of assumption in order to answer that question, or they would ask you the question if they chose to answer at all.

Balance Sheet 120

Hello in this presentation that we will discuss the balance sheet objectives at the end of this presentation that we will be able to describe the balance sheet, list the components of the balance sheet and define and explain each component of the balance sheet. When considering the balance sheet, we will be looking at components equivalent to those in the accounting equation. the accounting equation as we have seen in a prior presentation is assets equal liabilities plus equity, these will be the components of the balance sheet.

Budgeted Profit and Loss-Data Input 11.10

This presentation and we will take a look at how to create a budgeted Profit and Loss report or budgeted income statement report. Let’s get into it with Intuit QuickBooks Online. Here we are in our get great guitars file. Before we open up the process of doing the data input for a budgeted profit loss. Let’s first take a look at a profit and loss. We’re going to go down to the reports on the left hand side, we’re going to be opening up the P and L the profit and loss the income statement, this is going to be the poor performance report.

Journal Report & Financial Statements 10.57

This presentation and we’re going to take a look at our reports our financial statement reports and journal entry reports. After we have entered the adjusting entries, we’ll take a look at the familiar balance sheet and income statement. We’ll also take a look at a journal entry report. That’s going to be a very useful report when we enter adjusting journal entries because it will reflect those adjusting journal entries. Let’s get into it with Intuit QuickBooks Online.

Prepaid Insurance Adjusting Entry 10.40

In this presentation and we’re going to enter an adjusting entry related to insurance recording prepaid insurance and insurance expense. Let’s get into it with Intuit QuickBooks Online. Here we are in our get great guitars file, we’re going to be opening up our reports. First, we’re going to go down to the reports on the bottom left. So we’re going to be opening up our favorite report that being the balance sheet report changing the dates up top from a one on one to zero, this time to our cutoff date at Oh to 29 to zero.

Bank Reconciliation Second Month Part 3 9.17

This presentation we’ll continue on with our bank reconciliation process for the second month of operations, this time finalizing the bank reconciliation process and reviewing the bank reconciliation report. Let’s get into it with Intuit QuickBooks Online. Here we are with our get great guitars file, we’re going to start off with our reports down below. So I’m going to go to the to the reports and we’re going to go to the reports on the bottom left. Let’s open up that balance sheet report.