In this presentation, we will take a look at the statement of cash flows non cash items. First question, why would we be looking at non cash items when considering a statement of cash flows? We’re gonna go through a list of non cash items first and see if you can recognize a trend in these and why we might be linking them to a statement of cash flows discussion, then we will explain more fully on the idea of looking at non cash items when considering a statement of cash flows. So, some examples of non cash items would be the purchase of long term assets by issuing a note the purchase of non cash assets by issuing equity or debt, the retirement of debt by issuing equity stock, lease of assets in a capital lease transaction and exchange non cash asset for other non cash asset. Consider these examples and note some of the common features including the deal with investing and financing activities. and think through why we might be linking them to a statement of cash flows. We’ll go more fully through this by giving an example of the purchase of long term assets by issuing a note, an example that we can then apply out to the rest of these items. So what are we going to do with these non cash items, we’re going to report them at the bottom of the statement of cash flows or report them in a note related to the statement of cash flows. So we’re going to have to say in some format, or other, hey, look, these are some non cash items that we’re linking to, for some reason, the statement of cash flows.

Posts with the note tag

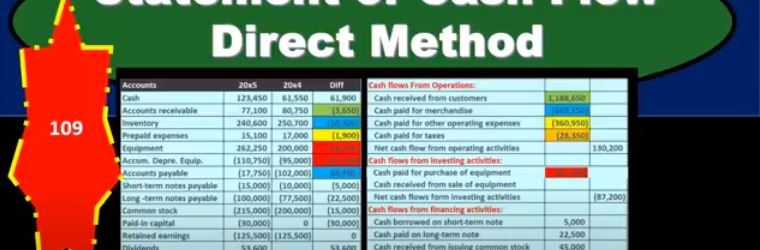

Statement of Cash Flow Direct Method

In this presentation, we will take a look at the statement of cash flows using the direct method. Here’s going to be our information we got the comparative balance sheet, the income statement and some additional information. And we will use this information to put together our worksheet which will be the primary source used to create the statement of cash flows using the direct method. This is going to be our worksheet. Now most of this worksheet will be similar to what we have done for the indirect method, in that we took the difference in the balance sheet accounts. So we’re taking the current year and the prior year, the current period, the prior period, all the balance sheet accounts, we’ve got cashed down to the retained earnings for the balance sheet accounts. But we’re also in this case going to give us the income statement accounts for the current period. So in other words, we’re going to break out the retained earnings the amount to its component parts, meaning we’ve got net income being broken out on the income statement. We’ve got sales cost of goods sold, the income statement accounts. So it’s going to be our same kind of worksheet here, we’re going to be in balance, we’ve converted it from a plus and minus format, we’ve removed all of the subtitles as we did under the indirect method.

Post Closing Trial Balance & financial statements

Hello in this presentation we will discuss the post closing trial balance and financial statements. When considering the financial statement relationship to the trial balance, we typically think of the adjusted trial balance that being used to create the financial statement. It’s important to note, however, that any trial balance that we use can be generated into financial statements. It’s just that the adjusted trial balance is the one that we have totally completed and prepared and ready. In order to create the financial statements to be as correct as possible as of the date we want them, which is usually the end of the month or the end of the year. Note that the names of the unadjusted trial balance the adjusted trial balance and the post closing trial balance are really a convention they’re all basically trial balances.

Classification of Cash Flows

In this presentation, we will take a look at classifications of cash flows on the statement of cash flows, there’s going to be three major categories on the statement of cash flows. Those will be operating activities, investing activities, and financing activities. So our goal here, when we go through the statement of cash flow as we work through the statement of cash flows is going to be in part to decide which area these cash flows should go, should they go into operating, investing or financing. It’s going to be common questions and common problems and really just information we need to know when reading the statement of cash flows. So we’ll start off with the operating activities. We’re just going to look at the major components of the cash flows within the operating activities. So we’ll talk about inflows and outflows. Remember what we’re talking about here is cash. So when we’re talking about the statement of cash flows, we’re talking about cash flows, the cash that goes into the company, they cashed out goes out to the company. We’re going to talk about inflows and outflows here related to operating activities. Before we go into the list of inflows and outflows related to operating activities, we want to know first, that operating activities is going to be similar to us thinking about the income statement on a cash basis. So when we think about the operating activities were really thinking or one way to think about it would be that if we were to have the income statement on a cash basis, then what would the inflows and outflows be that’ll basically be what are in the operating activities when we get to the thought process in terms of how to determine operating investing and financing activities.

Notes Payable Introduction

In this presentation, we will introduce the concept of notes payable as a way to finance a business. Most people are more familiar with notes payable than bonds payable, the note payable basically just being a loan from the bank. Typically, the bond payable is a little more confusing just because we don’t see it as often, especially as a financing option. From the business perspective, we often see it more as an investing or type of investment. But from a loan perspective, it’s very similar in that we’re going to receive money to finance the business if we were to issue a bond, or if we’re taking a loan from the bank. And then of course, we’re going to pay back that money. The difference between the note and the bond is that one the note is something we typically take from the bank. Whereas a bond is something we can issue to individuals so a bond we could have more options in terms of issuing the bonds than we do for a loan. Typically when we have a loan, we typically are Gonna have less resources, we can take a loan from the bank. When we pay back the bond, we often think of the bond as two separate things. And we set it up as two separate things, meaning we have the principal of the bond that we’re going to pay back at the end. And then we have the interest payments, which are kind of like the rent on the money that we’re getting, we’re getting this money, we’re gonna have to pay rent on it, just like we would pay rent if we had got the use of any physical thing.

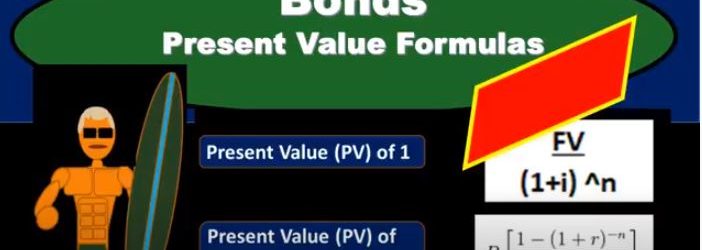

Bonds Present Value Formulas

In this presentation, we will take a look at present value formulas related to bonds. One of the reasons bonds is so important to accounting and finance is because they’re a good example of the term of present value of money. We’re trying to look for an equal measure of money, when we think of bonds and bonds is going to have this relationship between market rates and the stated rate, which helps us to kind of look through and figure out these types of concepts. So even if we don’t work with bonds, in other words, if we’re not planning on issuing bonds, or buying bonds, or knowing anything about bonds not being important to us, the time value of money is a very important concept and bonds is going to be a major tool to help us with that. Why is bonds so useful for learning time value of money, because there’s two types of cash flows with bonds meaning at the end of the time period, we typically are going to get the face amount of the bond that 100,000 similar to a note and then we’ve got the interest payments that are going to happen on a periodic To basis, and therefore we have these two different types of cash flows, that we can use two different formulas for, to think about how to equalize.

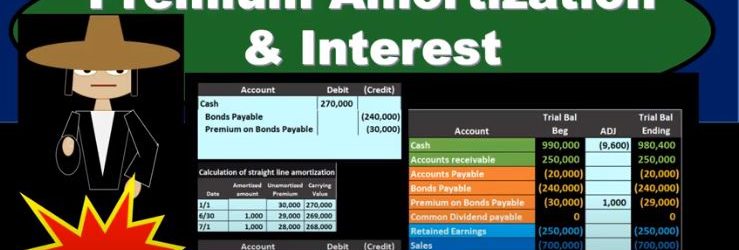

Premium Amortization & Interest

In this presentation, we will discuss the amortization of a bond premium and the recording of interest expense on bonds. This is going to be our starting point. This is the initial transaction in order to get the bonds on the books. Here’s our data down here we’ve got the number of years we’ve got the face amount of the bonds, we’ve got the issue price 270, we see that the interest on the market rate is different than the contract rate. The result then is that cash is going to be increased by the 217. The bonds payable went on the books for the face amount of the bond, the amount that’s on the bonds of the 240, which is a liability. And then we have the premium being the difference increasing the premium here by the 30. The 240 plus 230 is going to be equal to the 270,000 carrying amount book value of the bonds. Now we’re going to go through the process of recording the interest we can see that this is going to have 15 years bonds, we’re going to pay the bonds semi annually. So we’re going to have to record the interest on them. And we’re gonna have to reduce this premium in some way as well. Remember, at the end of the bonds, we’re not going to pay back the 270. We’re only going to pay back 240. So how are we going to get rid of that the premium on the bond and why are we going to do it in the way we will. We’ll start off by amortize in the premium using a straight line the method. Note that the effective method is the preferred method for amortize in a premium for generally accepted accounting principles, but the straight line method will be appropriate in some cases, if the difference is going to be a non material. And the straight line method is a simplified method and it’s easy for us to see what is going on. So we’ll start off with the straight line method.

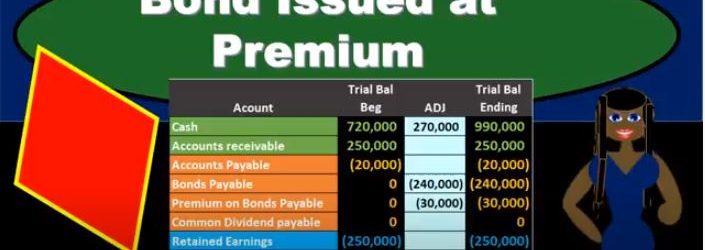

Bond Issued at Premium

In this presentation, we will take a look at the journal entries related to issuing a bond at a premium. When considering the journal entry for a bond, remember what can change and what is the same for a bond. When we think about a bond, it’s already been printed, we know the amount of the bond, the interest on the bond, the maturity date of the bond, these are already set. So if we’re making a negotiation with the bond after it had already been printed, then we can’t change the face amount. We can’t change the interest due dates. What can we change in order to negotiate and make a sales price on the bond, we can change the amount that we issue it for. So keep that in mind. Whenever you think about these bond problems. That’s the thing that’s going to differ from a bond to a note. The thing that changes when we want to loan is the interest rate. The thing that changes when we want to issue a bond that’s already been made is going to be the amount we receive For the bond being different than the face amount of the bond if there’s a difference in the market rate and the contract rate. So in this example, we’re saying that we issued a bond. Now note that when we think about the issuance of the bond, just like a note, we often have more information than we really need. And that can be a little bit confusing for us.

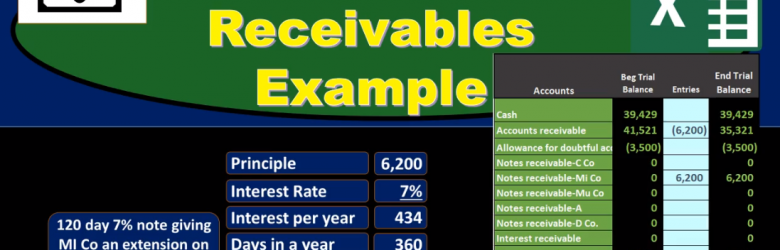

Note Receivable Example

In this presentation we will discuss notes receivable, giving some examples of journal entries related to notes receivable and a trial balance so we can see the effect and impact on the accounts as well as the effect on net income of these transactions. first transaction, we’re gonna have 120 day 7% note giving the company EMI and extension on past due AR or accounts receivable of 6200. When considering book problems and real life problems, one of our challenges is to interpret what is actually happening what is going on, which party are we in this transaction in? Therefore, how are we going to record this transaction when we’re looking at notes receivable? A common problem with notes receivable is the conversion of an accounts receivable to a notes receivable. So in this case, that’s what we have. We have an accounts receivable here that includes an amount of Due to us by this particular company in AI so these are our books, we have a receivable people owing us money for prior transactions goods or services provided in the past and they owe us in total, all customers owe us 41,521 this customer in particular owes us 6200 of this amount in the receivable that could be found not in the general ledger which would give backup of transactions by date.

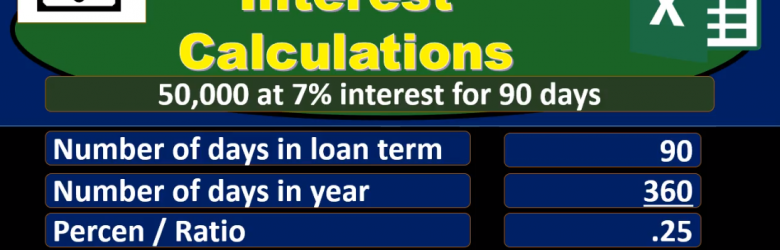

Interest Calculations

In this presentation, we will take a look at how to calculate simple interest a few different ways. As we look at this, you may ask yourself, why are we going over this a few different ways, why not just go over it one way, the best way. And let us learn that well and be able to apply it in each situation. While one way does work in most situations. In other words, we will probably learn one way have a favorite way to calculate the simple interest and apply that in every circumstance. It’s also the case that when we look at other people’s calculations or technical calculation, they may have some different form of the calculation. For example, I prefer away when I think about the calculation of simple interest to have some subtotals in the calculation and have more of a vertical type of calculation the way we would see if done in something like a calculator. If we see a type of equation in a book, then the idea there is that Have the most simple type of equation expressed in as short a way as possible. And that typically is going to be some type of formula. And that formula will often not be showing the subtotal.