Advanced financial accounting PowerPoint presentation. In this presentation we will discuss a situation where we have a consolidation process and in the period of consolidation the parent sells subsidiary shares to a non affiliated entity. In other words, we have a consolidation process we have a parent subsidiary relationship parent owning a controlling interest over 51% of subsidiary. The parent then in that period sells some of the shares that they own in the subsidiary to a party that’s not affiliated in the consolidation, what will be the effect in the consolidation process of that get ready to account with advanced financial accounting?

Posts with the subsidiary tag

Consolidation & Preferred Stock

Advanced financial accounting PowerPoint presentation. In this presentation we will discuss the consolidation process when there is a preferred stock involved, get ready to account with advanced financial accounting. We’re talking about a situation here where we have preferred stock in the subsidiary and a consolidation process we’re doing the consolidation subsidiary has some preferred stock, you’ll recall that the characteristics of preferred stock generally means that in general, they have preference with regards to dividends and distribution of acids in liquidation over common shareholders. So therefore, when when a distribution happens if there’s going to be dividend distributions, for example, the preferred stockholders will typically get paid first, and we got to consider how that will be impacted or affected within our consolidation process.

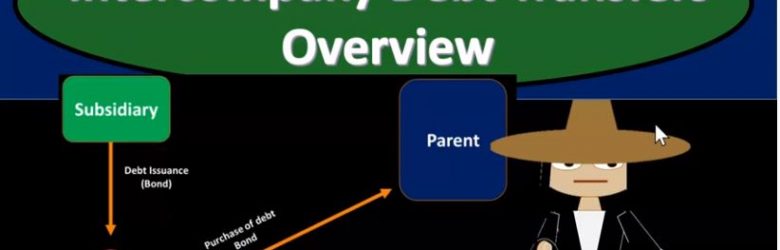

Intercompany Debt Transfers Overview

Advanced financial accounting PowerPoint presentation. In this presentation we will give an overview of intercompany debt transfers. In other words within the concept of our consolidation process where we have parent subsidiary relationships we have intercompany debt debt going from one entity to the other, from parent to the subsidiary or subsidiary to the parent could be in the form of, of notes payable or in the form of bonds payable, get ready to account with advanced financial accounting. When we think of intercompany debt, we can break it out basically into two categories intercompany debt the debt from one to the other from parent to subsidiary or subsidiary to parent, two categories, one direct intercompany debt transfer and the other is the indirect intercompany debt transfer.

Depreciable Asset Transfer

Advanced financial accounting PowerPoint presentation. In this presentation we will discuss the depreciable asset transfer. In other words, a transfer intercompany transfer with the context of our consolidation process. In essence, a transfer from parent to subsidiary or subsidiary to parent get ready to account with advanced financial accounting. In prior presentations, we talked about the transfer of land and we talked about the transfer of inventory. So the depreciable assets are going to be similar to the transfer of land but now we’ve got that added depreciation we’re going to have to deal with so it’s going to be similar to the transfer of land except that depreciation adds a level of complexity because we are now dealing with an asset that has a change in value over time.

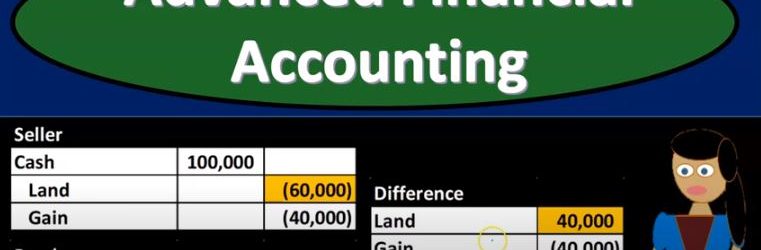

Equity Method and Land Transfer

Advanced financial accounting PowerPoint presentation. In this presentation we’ll take a look at the equity method and land transfer get ready to account with advanced financial accounting, land transfer intercompany. Within the context of our consolidation, then we’re talking about situations where land is transferred from subsidiary to parent like a sale from subsidiary to parent or from parent to subsidiary. That resulting in basically an intercompany type of transaction we’re going to have to deal with with the consolidation process and possibly with the recording of the equity method by the parent as they reflect their investment in the subsidiary. We talked a little bit last time about the land transfer being similar to the inventory transfer because typically you’ll have like a gain that will be involved in it and your physical inventory that is changing hands. It does not have the added complexity as the property plant and equipment type of transfer. That would be depreciable assets with regards to accumulated appreciation and appreciation.

Transfer of Long-Term Assets & Services Overview

Advanced financial accounting PowerPoint presentation. In this presentation we’re going to take a look at an overview of the transfer of long term assets and services. In other words transfers between related entities. If we’re thinking about a consolidation process then transfers that we will have to deal with with the consolidation process with consolidating or eliminating journal entries, you’re ready to account with advanced financial accounts. intercompany transactions need to be removed in the consolidation process.

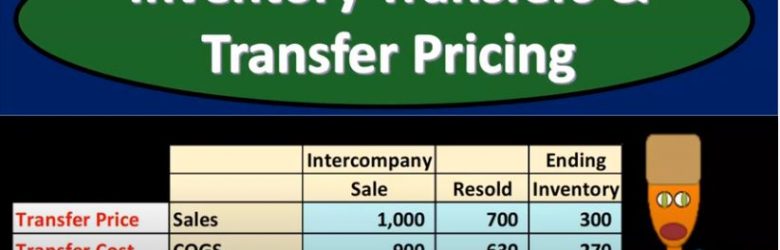

Inventory Transfers & Transfer Pricing

Advanced financial accounting. In this presentation we will discuss inventory transfers and transfer pricing. Our objective will be to get an idea of what inventory transfers are what will be the effect of inventory transfers and how to account for inventory transfers when considering a consolidation process, get ready to account with advanced financial accounting, inventory transfers and transfer pricing. So in essence, we’re talking about the inventory going from one organization to another, we can think about this in terms of parent subsidiary type of relationships.

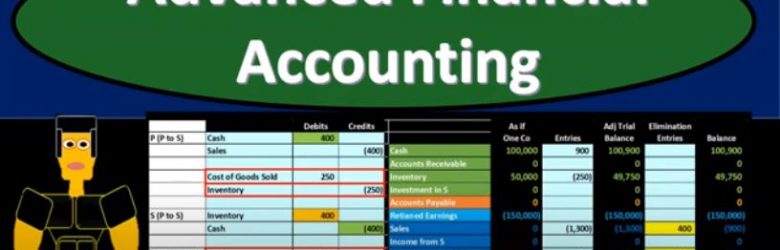

Parent Sale to Sub & Sub Resold

Advanced financial accounting. In this presentation we’re going to discuss an intercompany transaction where a parent makes a sale to a subsidiary and then the subsidiary resells it. In other words, we have this intercompany transaction, we want to think about how that is constructed. And then how we can do the reversing entry for it or a consolidation entry in the case of a consolidation of a parent and subsidiary in a consolidated financial statements, get ready to account with advanced financial accounting. So within a situation where we have a sale from P to s, and then S sells it to an outsider remember that as it goes to the outsider, that’s going to be the legitimate type of so that’s the arm’s length transaction, the sale from PETA is not so and therefore we kind of have to eliminate that. Now if it’s been sold to an outsider, then we have a situation where the inventory is still gone. There has been a sale being taken place. And so we so that’s good, but we still have to do the reversal of part of that intercompany transfer and it’s gonna boil down At the end of the day, basically debiting, the revenue account reversing revenue, and reversing the cost of goods sold. So this is the boiled down version. Now if you think about it, you might say what happy because if p sales to s, then you’re going to like debit cash credit, you know, you’re going to credit the sales, and then you debit cost of goods sold, and credit inventory and then asked is going to be recorded cash, and then they’re gonna be recording, then the other side go into inventory, and then right, there’s more, and then they made the sale to the outsider. So how do we boil this down? How does the intercompany boil down to just this right? We kind of kind of have an idea of that in our mind.

Eliminating Intercompany Transactions

Advanced financial accounting. In this presentation we will discuss eliminating intercompany transactions, the objective will be to have an overview of the intercompany transactions, the types of intercompany transactions and the basic elimination entry for those intercompany transactions get ready to account with advanced financial accounting intercompany transactions, we’re going to start off by listing the intercompany transactions as we list them. Remember, our objective is in essence to remove the intercompany transactions.

Consolidations Less Than 100% Owned Subsidiary

Advanced financial accounting. In this presentation we’re going to discuss the consolidation process for less than 100% owned subsidiary. In other words at the end of this, we’ll be able to understand some of the major differences in the consolidation process from a company that was 100% owned. In other words, the parent owns 100% of the subsidiary and one in which the parent owns some other percent some stock share and percent other than 100%. Get ready to account with advanced financial accounting when there is a controlling interest but less than 100% owned interest in a subsidiary. In other words, the parent company owns something other than 100% of the common stock something over 51% still having a controlling interest still makes sense to do consolidated financial statements, because it’s useful to see the assets minus the liabilities, the net assets that the parent has control over, even if they don’t have claim over them. The performance based on you know, the net assets that they have control over.