In this presentation we’re going to talk about valuation of business entities when there’s going to be an external expansion. In other words, a merger or consolidation, get ready to act because it’s time to account with advanced financial accounting. We’re continuing on with our discussion of external expansion. That means we’re have two separate entities that are going to be combining in some way shape or form. The two types that we want to keep in mind at this point is the acquisition of assets and the acquisition of stocks. So if the acquisition of assets we have one company acquired another assets using negotiation with management, so that means you have two separate entities and one entity is basically going to be purchasing the assets of the other entity versus the acquisition of stock, where we have a majority of outstanding voting shares is generally required, unless other factors result in the gaining of control. So in other words, you have two entities, one entity in essence buying a controlling share or controlling ownership over 50% typically 51 and above. Have another entity. So from an accounting perspective, then the question is, well, how are we going to value the assets and liabilities. Now when we think about the assets and liabilities, we may have to use an appraisal oftentimes, in order to do so because remember, if you’re talking about some assets, they might may be on a fair value method, because you might be talking about cash or something like that, or possibly stocks or investments in that way, that may be easy to value with a market method. However, if you’re talking about things like property, plant and equipment, then it’s going to be more difficult to know what the value is. That’s the problem because there hasn’t been a market transaction for that exact same piece of equipment for some time.

01:39

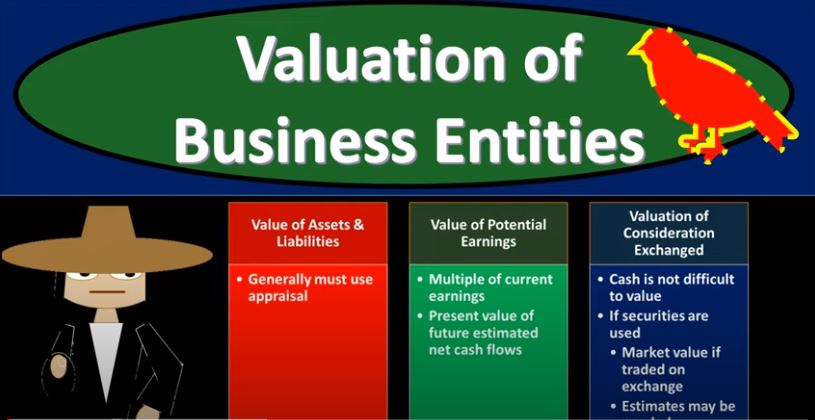

And therefore, you’re going to have to use some type of appraisal method for something like property, plant and equipment typically. So if you think about this type of transaction, you’re going to be saying, hey, well, there is some consideration happening between the two transactions. If you got company a and Company B, some negotiation between the two, then obviously there’s going to be some kind of payment that happens. So your mind should be saying, okay, there’s going to be a market transaction, I know in total, then that the total value should be equivalent to whatever consideration generally is given. And however, then, of course, we got to think about how to put those individual assets on the books, how do we put the individual assets on the books? Well, typically, we’re going to have to go through the valuation. Now normally, of course, if you have two companies that are going through this negotiation, they’re going to have some type of valuation process happening, that’s how they’re going to determine what the negotiation or market price they come to is, but you’re going to have to think about, Okay, I need the total price of that this transaction took place in and I’m going to have to break out, you know, line by line asset by asset, what is the value of these particular assets that we’re gonna have to put on, on the books for for that process. So value of potential earnings, so multiple of current earnings and present value of future estimated net cash flows. So again, if you’re thinking about a negotiation, if you’re thinking about what Company buying another company, then you’re going to be thinking, Well, whatever consideration whatever payment if you’re thinking of, if it was just cash payment, like an easy type of transaction where they just paid cash, we know the value of cash, then you’re thinking, Well, whatever the cash payment was, then that’s the total value, you would think.

03:18

But then we’re gonna have to break it out, like we said to the individual assets and liabilities to put them on the books appropriately, which we would need a valuation for. And then we got to think, well, what if there is a payment made that was higher than basically, even that net assets minus liabilities, even if we put the assets and liabilities at their fair value, and then consideration was paid for that was over and above that amount? Well, then you would think that you would have something like we call like goodwill. And what is goodwill? I mean, if we were to value kind of think about what goodwill is, it could be some multiple of current earnings. It could be present value of the future estimated net cash flows. So what’s the value of the potential earnings and that’s of course What’s part of being the purchase price? Part of what’s being purchased here is future earnings because there’s current payments happening for future earnings. There’s a merger happening, one company in essence buying the assets or somehow this type of transaction is happening, due to the fact that there is potential for the future earnings. How do we value that? valuation of consideration exchanged? So the consideration exchange then you can think about like the payment. So if it was just obviously if it was just cash, if we were saying there’s going to be this transaction and there was a there was cash consideration given within the transaction? Well, that’s pretty straightforward. Cash is cash, we can value cash, not a problem. If securities are used, then we have to think of Alright, well, what if they What if they gave stocks basically, well, then if there’s if they’re traded on the market, if they have a market basis, well, we can value those because we know the market transactions there because they’re being traded at any given time. And so we can get an estimate of that if they’re not publicly traded stocks. However, then we’re going to have to use some type of estimate to value those factors as well. So in other words, the consideration given the payment given typically might be cash, it might be the stocks.

05:11

And, and but it could be anything. And it could be, it could be assets, it could be property, plant and equipment or whatever that’s given within the exchange, anything other than cash gets a little bit more confusing to value, what the value of the consideration given was for the trade, or the or the deal or the transaction that took place factors to consider. buyer will, will generally not want to assume responsibility for the new companies, unrecorded liabilities, contingent liabilities such as outstanding litigation. So if you’re thinking about two companies that are coming together, obviously one of the consideration factors of the company they might say, hey, look, I really like this. I like you know, these assets that you have, what I really don’t like is this contract that you have with these people that you know, I don’t think you can get out of or something like that. Don’t like these contingent liabilities. I don’t like the fact that you have this lawsuit hanging over hanging over your head that I really don’t want to assume with it with regards to this merger process. And that’s and that’s part of the process where you got to consider Well, what’s going to be the merger format that you’re going to set up so that you so that the the controlling company needs to take that into consideration, what’s going to be the easiest process to do on the merger side of things or the or the consolidation side of things? And and how can we do this consolidation, if there’s going to be large factors that you do not want to be to be taking on? Then how can you that’s going to influence of course, how you might structure that consolidation. So tax considerations need to be taken into account as well.

06:42

So obviously, there could note that we no longer we’re not thinking of a pooling type of method, where there’s where you don’t have to, to adjust the value of, of the assets, just transfer the book value over now we’re talking basically as an acquisition type of method. So so that means there’s going to be a revaluation when there’s going to be a revaluation, then you could have to recognize gains and losses. And depending obviously, the the buyer and seller in this case, the seller and the buyer have conflicting desires for the for the tax implications in terms of the valuations of things. So, from a market standpoint, that’s kind of good, because now you can think, well, now there’s going to be some market negotiation between this process which hopefully would result in a process that would be in the middle somewhere more that you might consider a fair consideration in terms of evaluation with regard to this negotiation over over the tax treatment, but tax obviously, will will confuse the issue. And, and so you got to take the tax constituents consideration into consideration when when thinking about this process as well. Acquiring common stock is generally much easier in this regard to acquiring assets. So in other words, if you do the common stock aquas If you’re not doing this kind of like negotiation for the individual type of assets, where you were you, you’re going to run into this conflict, more and more. So again, if you talk about if you’re thinking about logistically to to, you know, controllers of to owners or controllers or management of organizations going line by line through assets, and basically thinking about what’s going to be the appropriate price and how to value these things, and so on and so forth. That could be a long process, the purchase of the of the common stock is generally going to going to be easier. But of course, again, there’s pros and cons to either method. So the pros and cons, we’re talking about acquiring assets, so acquiring the assets, versus the just purchasing other stock.

08:46

What are the pros and cons? Well, if again, you’re thinking about this is where you’re thinking about two companies. One company is basically buying the other one, and they’re saying, hey, let’s just go let’s just go look at the assets and whatnot and see what appropriate and appropriate price would be to be preferred. Purchasing out the assets. So Pros will not take on the new company’s contingent liabilities. So that’s again, huge factor. Because Because oftentimes if you’re looking at another company and say, Look, this company would be doing great. If it wasn’t for the fact that you had, you know, this lawsuit hanging over your head or something like that. Well, what you want to do then is take it, pick out the stuff that they would be doing great with and remove that huge contingent liability that’s causing them a problem. So that’s the acquiring acquiring of the assets can help with that method can be beneficial, will not take on new company, labor unions and other contracts. And other things that the company you might be saying this company would be doing great, they got so many good things, but this labor union is kind of dragging them down a bit or some other contract that they don’t that could be, you know, cumbersome to the company, then it might be the case where another company would say, hey, I’d love to, you know, pick up your assets. I think you’re you know, you’d be doing great here but you have these contracts that are out there that are that we see as as being something that’s making you not profitable. Can we do this in some way shape or form? So we could pick up the assets and not be picking up the those kinds of of obligations.

10:11

So then we have the cons, what are the problems with this? Well, transfers that assets can be time consuming, it can be a time consuming process, because again, you could you could think about these two companies sitting down to think about line by line, you know, value of the assets, maybe difficult or impossible to transfer contracts. So, there may be some contracts that you want to transfer their their value, they’re going to be an asset, possibly intangible assets that one company has, and there might just be no way that if you’re another company acquiring the assets, they might not be able to assign the rights to good contracts, the contracts that they want over to another company, because the contract might say, Hey, we got it, we’ve got a contract with you. You can’t just sell the rights of the contract that we have with you to the Other company, and so that that could be a problem with just the acquiring of the assets. Whereas if you acquired the entire company, then you still have the company, there’s basically a subsidiary and you would think then that the contracts that they then had for that company would still be valid. Now, let’s think about the other side of things. So now if we go to the acquiring common stocks, so we’re acquiring just the common stock, as opposed to the assets of one company wants to buy the other one, they’re not going to go in and buy all the assets, they’re not just going to clean out the company. Instead, they’re going to actually buy the company creating a subsidiary type relationship by buying a controlling interest 51% or more typically, of the stock. So the pros of that then are going to be that we have the transfer is typically going to be easier. So it’s usually an easier process for the transfer because you’re just basically going to be buying the common stock until you have the controlling interest.

11:56

The contracts will transfer So again, the good contracts, the Once you want if you’re buying, the fact that they have these contracts that are that are long lasting contracts, and you want to keep those contracts, you want to keep that in place, then if you actually purchase the entire company, then those contracts should come with the company. The cons, however, being could take could take on contingent liabilities and labor union contracts. So the cons, of course, being that if they have those contingent liabilities, they got lawsuits hanging over their head, you might be assuming those lawsuits, and then if they have contracts that you don’t want, including labor using contracts, which typically the company doesn’t want, then you may be taken on those as well. And then could take on facilities or units that are not wanted. So in other words, we talked about the concept of a spin off before we were they were they said, Hey, I want to concentrate on this particular thing. This is the thing I want. And they and they basically spun off the assets that weren’t, they weren’t part of that. Well, the same thing can be true when you’re acquiring another country. accompany you might say they might be, you might be looking at another company and they’ve kind of made a conglomerate of themselves or something like that. And you’re saying, hey, look, I like this, your core unit, I like that. But all this other stuff that you that you kind of expanded doesn’t seem to us to fit in your, your core, your core unit of what we think you can do better, the best and what aligns with us. So we would like to just purchase, you know, what your core factors, and these other facilities aren’t in alignment with us? Well, if you’re just picking and choosing the assets that you’re purchasing, you can do that more easily. Whereas if you’re just purchasing the common stock, you’re going to get, you’re going to get everything. So if that were the case, then of course, you could think about purchasing the entire company and then doing a spin off or something like that. So that could be a workaround, but again, pros and cons to the methods that you would be choosing