In this presentation, we will take a look at a cash payments journal for a service company, the cash payment journal we’ll be dealing with transactions where we have cash payments, that’s going to be the factor that will be the same for all transactions with cash payments meaning this column here cash payments will always be affected wish they kept cash payments journal cash payments journal will be used when using more of a manual system rather than an automated system. However, it’s good to know what the cash payments journal is, even if using an automated system because it’s possible that we or it’s very likely that we would need to run reports that will be similar in format to a cash payments journal. And it’s useful to see this format or how different types of accounting structures can be built.

00:46

Different types of systems can be run because that will give us an idea of how some things will be the same and different and therefore how any system works. The cash payment journal will work best when we have to transactions that will be really the same throughout the time period, meaning, we know that there’s going to be a lot of things that we can spend cash on. And we’ll take a look at a lot of different factors that we spend cash on. But if we have transactions where we typically have the same thing that we spend cash on, in the case of a service company, it might be something like purchasing supplies, then this type of journal will be very effective, because we can have a similar transaction that we will record all the time throughout the that process. If we were always paying off something on account, then accounts payable is another typical type of transaction, we’re going to look at a lot of different transactions because obviously cash can be involved in many different areas within the cash pit when we record transactions, and the ones that are unnormal.

01:47

The ones that are not normal, are the ones that are typically more difficult in test taking situations and in practice. So we’ll take a look at an example of items where we don’t have the column laid out and we got to put to other over here, and then we’ll be dealing with that at the end of the process and how to break that out when recording it to our accounting system. So here’s going to be our cash payment journal. Once we’re done with all this, we’ll do this for the entire month and at the end of the month, then we’ll make one transaction that’s what’s going to simplify the process within our general journal, as opposed to having every transaction that we will enter into the payment journal be its own general journal that would then be posted out during or through the time period, in our case the month. Note it is possible to do this for different types of time periods for a month, a week a day. But the same process will be the same.

02:38

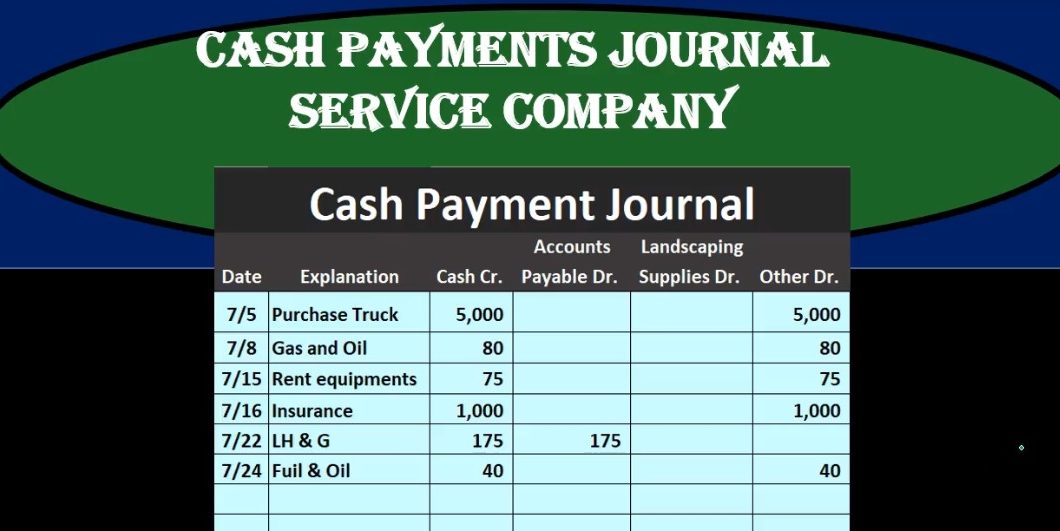

We’re going to enter the transactions into our journal, and then record the totals into the general journal making then the general ledger recording the general journal to the general ledger and then creating the trial balance from that. So here’s going to be our transactions. We’ll go through the transactions for the cash payments journal starting with the purchased a truck for cash. 5000. So we’ll just list this through here, we’re going to say the date is going to be seven, five, we’re going to say the purchase truck, we’re going to give some kind of explanation here. And it might, if we had a name of something that we purchased like a vendor, then that would be relevant there. We’re always going to have something in the cash column, because we’re dealing with the cash payments journal, and cash is going down, therefore, we’re just going to label it a credit. So rather than having the debit and credit column, we’re just going to say it’s going to be in one line item.

03:28

And then we’ll have the credit here. The other side of it’s going to be going to other in this case, and what we’re going to do is show all the types of transactions where cash goes out, instead of just the normal transactions, which would be typically buying something like landscaping supplies, if we were a landscaper, buy an inventory, possibly if we are merchandiser, or paying something off on account, the cash payment journal because there’s a lot of different things we pay with cash is one of the more confusing journals, and therefore we have more columns. We could have more columns, depending on how relevant a transaction is, if a transaction happens a lot, then we might add another column related to that specific transaction to deal with it there. And if it’s not, then if it’s a rare transaction, one that we don’t have happening all the time, we’re just going to list it into the other category. In this other category, then, once we do the journal entry, we will have to break out into its component pieces. Next transaction, we’re going to say pay cash for gas and oil $80.

04:28

We’re just gonna list that off, it deals with cash. So therefore it belongs in this journal. Anything that says paid cash will be in the cash payment journal. So Seven, eight, we’re going to say gas and oil, cash is always going down, we will always be crediting this column in the cash payment journal because cash will always be decreasing. The other side once again is going to go to the other over here because we’re going to say that the cash payment for gas and oil possibly is not the most common type of transaction. If it is, we would break out another column forward. If not, we’ll put it over here again. cash payment journal is most effective when we have a lot of similar transactions, such as purchasing landscaping or supplies or inventory, or paying off the accounts payable are going to be the typical to that the cash transactions going out would be for. Next we’re going to say in 715 paid cash to rent equipment needed for a job.

05:21

So we paid cash on 715, we’re going to say rent equipment in the descriptions. And once again, cash will be going down by the 75. And we’re looking for that other side of it. And we will be putting it into the other category, this being another type of expense. And we can’t really break out all the different types of expenses. Otherwise, we would have way too many columns in the cash payment journal. So we’re going to list out those expenses over here and just put those really relevant ones, the ones that happen all the time as their own journal entry. Then we’re going to have on 716 paid for a year’s worth of General Liability Insurance 1000. So that’s going to be on Seven, six We’re going to say insurance for the explanation, that’s going to be $1,000. The cash is going down as always in the cash payments, journal, other side once again, go into other, so we’ll be putting it to other it’s going to be going to this case prepaid insurance.

06:16

And we’re listing out basically the other account here, in essence, so when we said it’s going into other for a truck payment, if it’s a truck payment, the other is probably going to be something auto expense or something like that. In the explanation, gas and oil, it’s probably our truck. If it’s a purchase of a truck, it’s going to go into an auto not expense, but Otto as a fixed property, plant and equipment. If it’s oil and gas, that’s probably going to go into something like auto expense or something like that. Rent of equipment, probably a rental expense. insurance will probably go into prepaid insurance because we paid for it before we use the insurance. So this description will help us to basically find the account ones that we want to post this to. And in some cases, it just depends on how you want to record this, you could put the actual just account here and just label his account and put the account for the other items here. Description covers everything, it’ll cover whether we have an account there, or whether it’s in one of these accounts that are one of the columns. And we can just put a description. Next one 722 paid l, h and G for purchases in the past on account 700 and $175.

07:30

Cash will of course be going down by the 175 and the other side is going to go to the accounts payable, and that’s one of the transactions you would think would be more common in that the accounts payable is going down. That would be an account that if we have a type of business where we purchase something on account and then make payments to accounts payable, we would have a lot of this type of transactions cash going down the other side being to accounts payable. Next transaction pay for fuel and oil on 720 Before, we’re going to say fuel and oil, probably the same as gas and oil up here. And we’re going to say that it’s 440 dollars. And once again, we’re not going to list out all the expenses, we will just put it into the other category for the expenses breaking those out when we make the journal entry at the end, then on 730 owner draws out money for personal use $500, we’re going to call that owner draws, it’s going to bring down the cash once again, as always, we always have something credit in the cash in the cash payment journal, the other side then going to other this again, being something that doesn’t happen all the time we expected the draws will happen a few times once a month possibly for the owner withdraws.

08:40

Once we have everything there then we can total everything up so the totals are just going to total everything up. So on the cash side cash is going down 500 plus 80 plus 75 plus 1000, plus 175 plus 40 plus 500, or 6870. The 175 is going to be brought down, nothing’s in the landscaping supplies because we typically purchase those on occasion. But I want to list that here because for something like a landscaper, they might not purchase everything on account. And this may be their, you know, the biggest column that would be going to for that type of industry. And then the other the 5000 plus 80 plus 75 plus two 1000 plus 240 plus v 500 is 6006 95. Once we have that information, we can then record that to the general journal. So rather than recording each of these as a debit and credit to the general journal, and then posting it, we’re just going to wait till the end of the month and break this out. Now, this is going to be a more complex type of journal entry this way, because the cash payment journal involves different types of accounts, and we’re going to have to combine them all together.

09:47

We’ll start off with the cash going down. We’re going to start off then with a credit, which is unusual, but it’s helpful to see when doing a manual system because that’s the first account on our cash payments journal. So for formatting purposes, this Wouldn’t be the best way to do it. But for formatting in terms of understanding the process, then maybe we would want to do it this way. So we can go back and easily see how the form how this journal entry was created, then the next component will be the accounts payable. So here’s the accounts payable, it’s going to be debited. So remember, this transaction means that we paid cash that’s included with the cash credit here, and then we’re debiting accounts payable, making it go down accounts payable being a credit balance account, US bringing it down, and then we’re gonna have to break this out. Now, we can’t just debit this number because all of these accounts will be different.

10:37

We’re going to pull this from the description. So we’re going to say the explanation here says it’s purchased of a truck. So we’re going to put that into the fixed asset of auto and record the 5000 will be a debit increase in the truck. Next we’ve got the 80. And we’re combining here, the 80 here and the 40 because those will be the same amount. So the 80 and the 40 is the 120 That is going to be recorded here. So we’re checking this off, it’s going to go into auto expense. Next we have the equipment rental, so equipment rental from this description for this 75. Again, the cash is going down, and that’s included in this credit the debit side, then going to equipment rental, then we have the prepaid insurance. Once again, this is 1000 going down included in this number. And then the other side of it will be to prepaid insurance not insurance expense because we have not yet consumed the insurance in order to help us generate revenue, therefore putting it into prepaid insurance.

11:35

Lastly, we have the draws, so there’s going to be the draws. And we’re going to put that into the account of draws. If we add this up the 175 plus two 5000 plus two 120 plus 75, plus these 1000 plus the 500. That will add up to the credits of 6008 70. Therefore being in balance, we would then record this to the general ledger. So we will record this item to the General Ledger bringing the cash account from 12,003 85. In this case down by 6008 70 to 5005 15. We’ve got the accounts payable here. That is bringing the balance that it was at 2001 40 down by 175 to 1009 65. Then we have the auto so here’s the auto, it went from zero up by this 500 debit to 500. Then we have the auto expense, the expense side for the gas and oil. So here’s the 120, bringing it from zero up by 120 to 120. Then we have equipment rental. So here’s the equipment rental going from zero up by 75 to 75. And then we have the prepaid insurance prepaid insurance as an asset account going from zero up by 1000 to 1000. And finally, the drawings here that’s going to be an equity account going from zero up in the debit direction to 500.

13:02

Once we post this just like we would for most normal transactions, we would then take this and use it to generate the trial balance. So we can see these same numbers here in the trial balance being used to generate the trial balance, there’s the cash. Here’s the prepaid insurance. Here’s the auto, it’s going to be an asset. Notice these are all in the asset section. And then we’ve got the the liability account for the accounts payable, the drawings, the auto expense, so the auto expense and equipment rental expense, and so there is the process.