Corporate finance a PowerPoint presentation. In this presentation, we will discuss finance topics and activities going over some of the historical emphasis in the field of finance to get some context of where we’re coming from and where the current emphasis is. And we’ll be in corporate finance, get ready, it’s time to take your chance with corporate finance, finance topics and activities, we’re going to go over some of the emphasis in corporate finance in the past up into the present day to get some focus in on in context of what we will be talking about within corporate finance. So in the 1930s, what’s the emphasis in corporate finance in the 1930s, we have capital preservation.

Posts in the Accounting Instruction category:

Finance, Accounting, & Economics 110

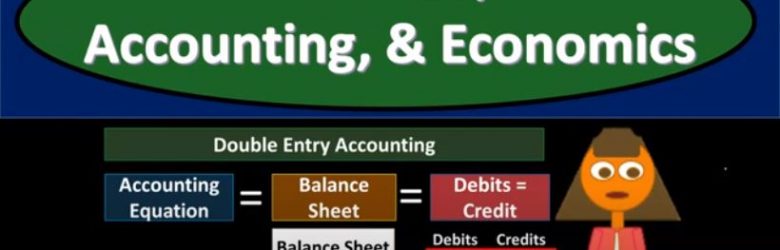

Corporate Finance PowerPoint presentation. And this presentation we will discuss the differences between finance, accounting and economics, the differences between the fields of finance, accounting and economics Get ready, it’s time to take your chance with corporate finance, there’s a lot of overlap and differences between the fields of finance, accounting and economics, what we want to do is think about those differences. And where that overlap is, as we do so we will do so from the perspective of corporate finance, because that’s the objective of our viewpoint here for this particular course.

Consolidation Parent Sale of Subsidiary Shares

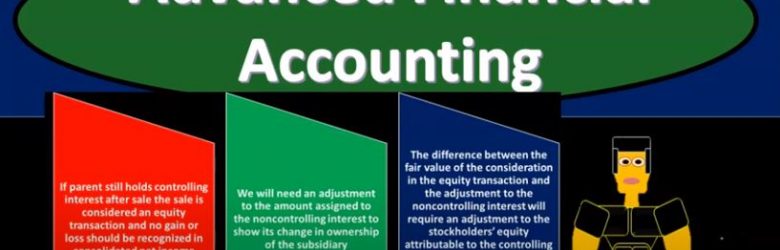

Advanced financial accounting PowerPoint presentation. In this presentation we will discuss a situation where we have a consolidation process and in the period of consolidation the parent sells subsidiary shares to a non affiliated entity. In other words, we have a consolidation process we have a parent subsidiary relationship parent owning a controlling interest over 51% of subsidiary. The parent then in that period sells some of the shares that they own in the subsidiary to a party that’s not affiliated in the consolidation, what will be the effect in the consolidation process of that get ready to account with advanced financial accounting?

Consolidation & Preferred Stock

Advanced financial accounting PowerPoint presentation. In this presentation we will discuss the consolidation process when there is a preferred stock involved, get ready to account with advanced financial accounting. We’re talking about a situation here where we have preferred stock in the subsidiary and a consolidation process we’re doing the consolidation subsidiary has some preferred stock, you’ll recall that the characteristics of preferred stock generally means that in general, they have preference with regards to dividends and distribution of acids in liquidation over common shareholders. So therefore, when when a distribution happens if there’s going to be dividend distributions, for example, the preferred stockholders will typically get paid first, and we got to consider how that will be impacted or affected within our consolidation process.

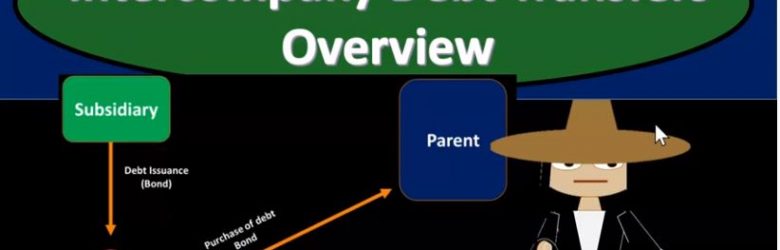

Intercompany Debt Transfers Overview

Advanced financial accounting PowerPoint presentation. In this presentation we will give an overview of intercompany debt transfers. In other words within the concept of our consolidation process where we have parent subsidiary relationships we have intercompany debt debt going from one entity to the other, from parent to the subsidiary or subsidiary to the parent could be in the form of, of notes payable or in the form of bonds payable, get ready to account with advanced financial accounting. When we think of intercompany debt, we can break it out basically into two categories intercompany debt the debt from one to the other from parent to subsidiary or subsidiary to parent, two categories, one direct intercompany debt transfer and the other is the indirect intercompany debt transfer.

Depreciable Asset Transfer

Advanced financial accounting PowerPoint presentation. In this presentation we will discuss the depreciable asset transfer. In other words, a transfer intercompany transfer with the context of our consolidation process. In essence, a transfer from parent to subsidiary or subsidiary to parent get ready to account with advanced financial accounting. In prior presentations, we talked about the transfer of land and we talked about the transfer of inventory. So the depreciable assets are going to be similar to the transfer of land but now we’ve got that added depreciation we’re going to have to deal with so it’s going to be similar to the transfer of land except that depreciation adds a level of complexity because we are now dealing with an asset that has a change in value over time.

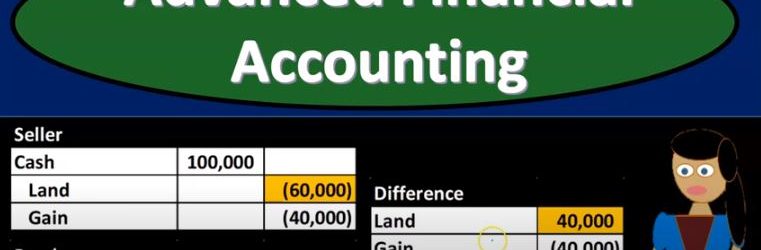

Equity Method and Land Transfer

Advanced financial accounting PowerPoint presentation. In this presentation we’ll take a look at the equity method and land transfer get ready to account with advanced financial accounting, land transfer intercompany. Within the context of our consolidation, then we’re talking about situations where land is transferred from subsidiary to parent like a sale from subsidiary to parent or from parent to subsidiary. That resulting in basically an intercompany type of transaction we’re going to have to deal with with the consolidation process and possibly with the recording of the equity method by the parent as they reflect their investment in the subsidiary. We talked a little bit last time about the land transfer being similar to the inventory transfer because typically you’ll have like a gain that will be involved in it and your physical inventory that is changing hands. It does not have the added complexity as the property plant and equipment type of transfer. That would be depreciable assets with regards to accumulated appreciation and appreciation.

Transfer of Long-Term Assets & Services Overview

Advanced financial accounting PowerPoint presentation. In this presentation we’re going to take a look at an overview of the transfer of long term assets and services. In other words transfers between related entities. If we’re thinking about a consolidation process then transfers that we will have to deal with with the consolidation process with consolidating or eliminating journal entries, you’re ready to account with advanced financial accounts. intercompany transactions need to be removed in the consolidation process.

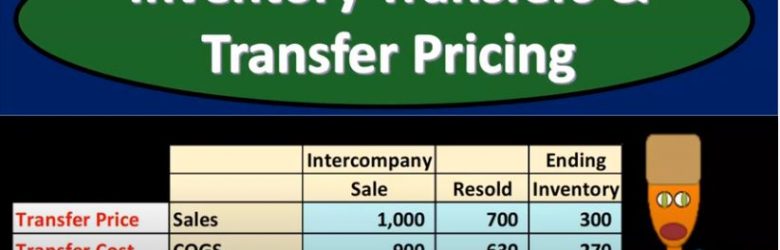

Inventory Transfers & Transfer Pricing

Advanced financial accounting. In this presentation we will discuss inventory transfers and transfer pricing. Our objective will be to get an idea of what inventory transfers are what will be the effect of inventory transfers and how to account for inventory transfers when considering a consolidation process, get ready to account with advanced financial accounting, inventory transfers and transfer pricing. So in essence, we’re talking about the inventory going from one organization to another, we can think about this in terms of parent subsidiary type of relationships.

Sale From Parent to Sub Sub Has Not Resold

Advanced financial accounting PowerPoint. In this presentation we will discuss a situation where there is a sale of inventory or transfer of inventory from parent to subsidiary, the subsidiary not having yet sold the inventory. So in that sense, we have an intercompany type of transfer. When we consider the parent and subsidiary as a whole with regard to a consolidation process, the parent sold to the subsidiary the inventory, the subsidiary still holding on to that inventory has not resold it externally at this point, get ready to account with advanced financial accounting. What we want to do now is think about the transaction on p side and then on SSIS, and then what the elimination entry will be. So there’s a couple ways you can think about this, you can kind of memorize what the elimination process will be what the elimination entry will be and put together worksheets to do that elimination process kind of by just routine by just filling out the worksheet. And then you also want to analyze the worksheet and think about it in detail in terms of what is actually happening.